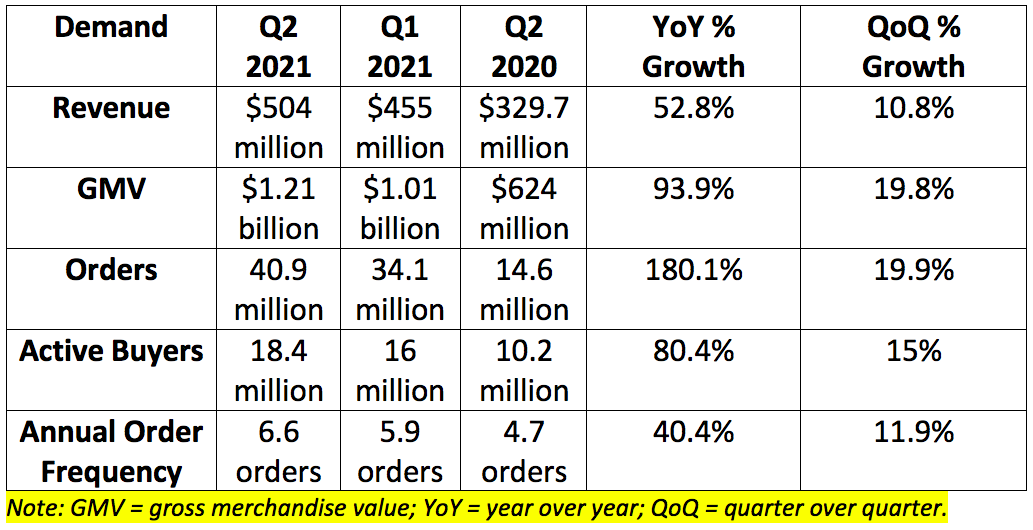

1. Demand

Reference Note on exchange rate utilized: 1 Russian Ruble = $0.014

Ozon was expected to generate approximately $459 million in quarterly revenue. Quarterly revenue came in at $504 million beating these expectations by 9.8%.

It’s important to note this quarter is comparing results to peak pandemic pain when Ozon’s business got a large demand boost. Despite this, it still produced rapid growth in all metrics.

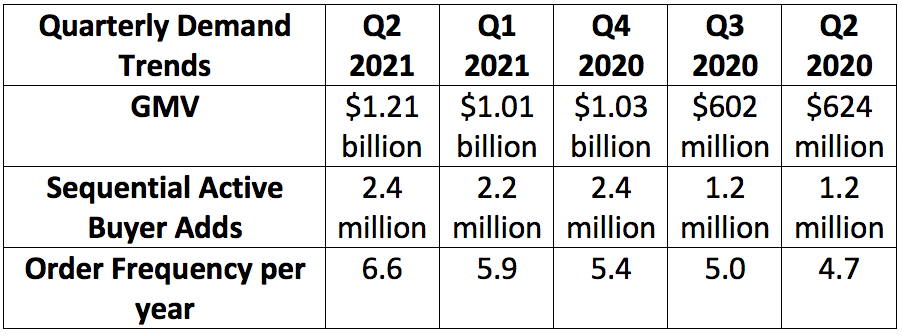

The accelerating order frequency amid an end to pandemic lockdowns is largely due to last mile logistics expansion and improvement.

Ozon’s seller footprint more than tripled year over year to pass 50,000. Roughly 1/3 of these sellers are already using Ozon’s tools for advertisers. Its marketplace now offers 27 million SKUs vs. 19 million sequentially.

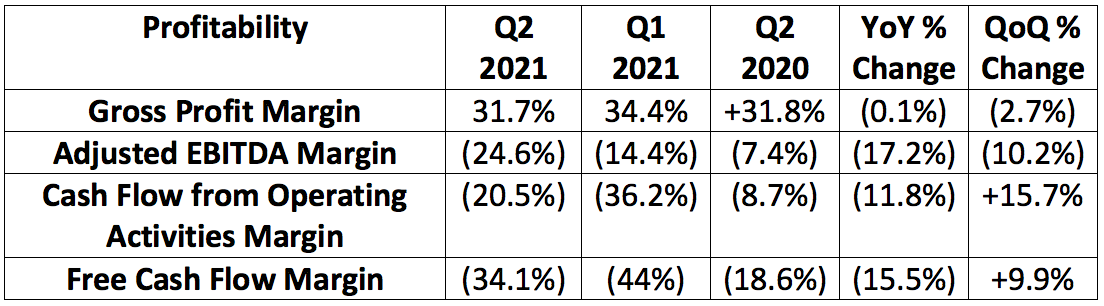

2. Profitability

Note that Ozon calculates margins using GMV as the denominator rather than using revenue like most do. I calculated margins using revenue as the denominator, not GMV as this is closer to typical accounting standards.

Falling EBITDA margin is mainly due to normalizing growth spend vs. the pandemic period. Still, marketing and general and administrative spend only saw modest increases as a percentage of total GMV year over year. The company will prioritize market share, growth and scale over short term profit margins.

The falling GPM was solely driven by Ozon lowering its seller commission to drive market share in the quarter (this worked better than planned). It does not expect to lower this commission any more going forward. The company anticipates that gross profit margin will move higher in the coming quarters as investments in growth come to fruition.

Competition is not driving the margin erosion. It is solely powered by the accelerating spend on growth and a lowered take-rate.

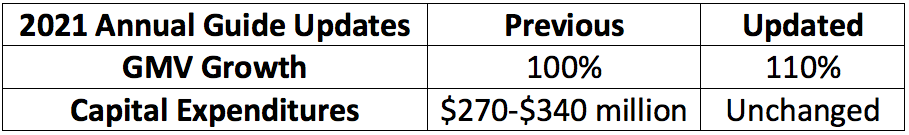

3. Guidance Updates

Ozon’s GMV growth guide was 90% as of the beginning of the year and despite the back-to-back raises it has maintained its capital expenditure outlook of between $270-$340 million. This is operating leverage in action.

4. Operational Highlights

Ozon maintained its 98% on-time delivery rate. This is stable sequentially and up from “95%+” at the time of its initial public offering (IPO).

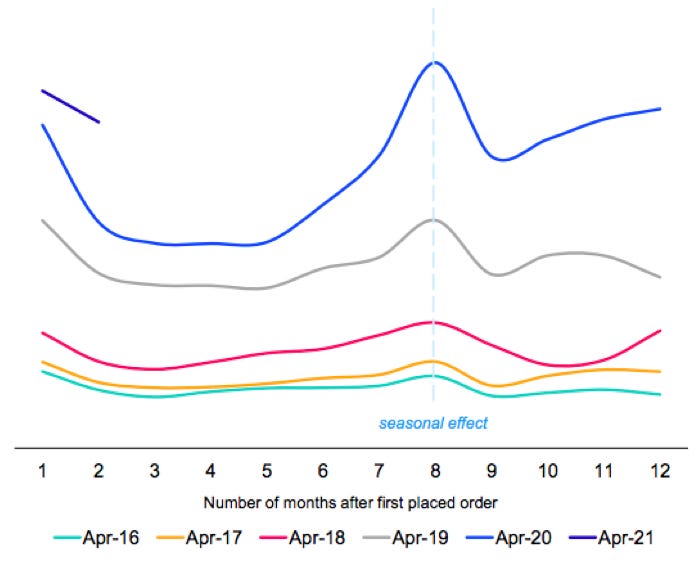

New customers continue to order more frequently than more seasoned Ozon users:

Despite the outsized growth, Russian e-commerce penetration remains at a low 9% compared to 24% for the United Kingdom and 14% for Brazil.

The company opened a robotics laboratory during the quarter to automate fulfillment processes. This will not contribute to top line growth but could drive meaningful longer term margin expansion.

Fin-tech highlights:

Ozon Cards issued rose to 1 million vs. 780,000 sequentially representing 28.2% QoQ growth. It has more than doubled from the beginning of the year.

Ozon announced plans to launch new lending products. It created a micro-finance company called “Ozon Credit” for merchants to finance their businesses and to match working capital needs. 2000 sellers use this service.

Ozon Card is now a top 3 most popular way to pay on Ozon.

Cardholders order 60% more frequently than non-holders — consistent with previous quarters.

Ozon is now offering buy-now-pay-later (BNPL) consumer loans.

Ozon Express (one hour delivery) highlights:

Express orders doubled sequentially.

Ozon Express now covers all of Moscow.

Ozon launched an internal private label line of SKUs with goods such as coffee and snack food to support this segment.

Ozon Express accounted for 1 in 5 Moscow grocery purchases in the quarter.

International Expansion highlights:

In its newly launched Belarus territory orders tripled sequentially and the company is building new logistics facilities in the nation to support that growth. Belarus makes up a very low % of the company’s total business for now.

Ozon plans to launch in Kazakhstan later this year.

These two successful entrances would raise Ozon’s population footprint by 19.5% to 172 million.

5. Conference Call Commentary

Founder and CEO Alexander Shulgin:

Growth heading into this current quarter has remained stable despite re-opening.

Russia’s untapped e-commerce market will be a strong enough tailwind to offset the headwind of normalization eroding some e-commerce demand globally.

The top 3 players in Ozon e-commerce still represent just 30% of the market. It’s very fragmented and ripe for dominance.

Ozon now ships 1 million goods per day with plans to double its fulfillment footprint again this year.

Ozon’s 2-year GMV growth rate accelerated sequentially from 124% to 136% depicting the company’s strong momentum when adjusted for the pandemic’s impact.

Every 7th Russian now uses the Ozon platform.

60% of active sellers are now outside of the Moscow region pointing to broader coverage of the nation as a whole.

Total Ozon Pick-up points quadrupled year over year.

60% of Russians can now access same-day delivery.

6. My Take

Growth remains lofty and new product launches continue to work well for Ozon. Despite difficult year over year comparisons, Ozon’s business kept shining while other e-commerce players faltered.

It has already demonstrated that it can be free cash flow positive, so prioritizing market share gains over today’s bottom line makes complete sense to me. Now is the time to take advantage of this compellingly untapped opportunity and that’s exactly what the organization is doing. I will continue to add to my position over time. Great quarter Ozon!

Thank you for reading! For my broad overview of Ozon’s business click here.