Intro:

Palantir is a software company that helps customers get the most out of their structured and unstructured data. Like many others, it pulls from years of AI/ML work to automate insight-gleaning. It utilizes complex neural networks to power anomaly detection, trend forecasting and natural language processing too. Overall, it frees clients to conjoin disparate data sources, while utilizing its software to uncover ideas that manual analytics and legacy competition cannot match. It gives customers a birds-eye view of their operations with detailed suggestions to help optimize products and workflows.

Revenue is neatly split into two buckets – “government” and “commercial.” Government clients predominantly use its Gotham product platform while commercial clients mainly use its Foundry product platform. With Gotham, Palantir routinely builds custom use cases for individual government clients. Foundry was built to be more malleable with far more pre-built app integrations available. That diminishes the need to conduct custom builds for every single private enterprise.

It has also seamlessly leveraged the commercial platform to cater to industry-specific needs. By-industry large language models (LLMs) are intuitively named “micro-models.” These boast sector-specific use cases with granular, relevant regulatory compliance help. A financial services model from Palantir, for example, may specialize in assessing credit risk or fraud detection.

Palantir Apollo is its software suite, which provides continuous integration and continuous delivery (CI/CD) to automate software package building and deployment. It’s a foundational piece of the firm’s ability to collect, utilize and drive value from broad data ingestion. Apollo ties very closely into Foundry and Gotham as a software enabler for both platforms.

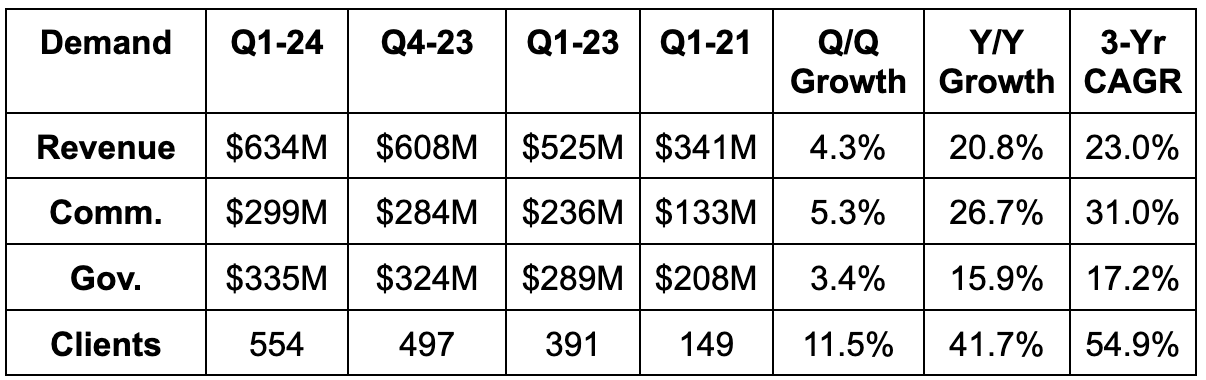

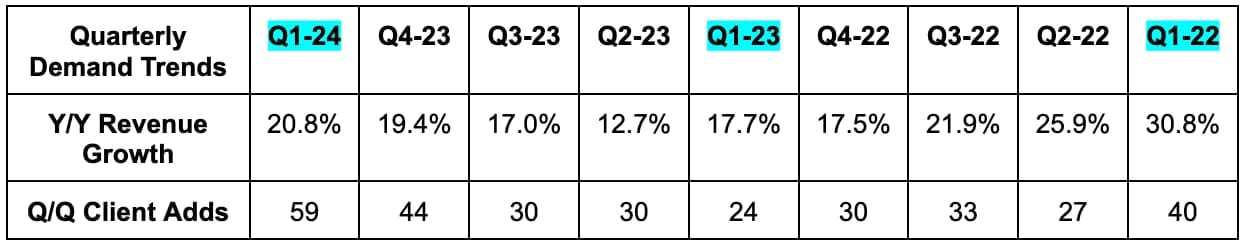

1. Demand

Palantir beat revenue estimates by 2.8% & beat revenue guidance by 3.3%. Excluding SPAC-related revenue, overall growth would have been 24% Y/Y. Revenue from its top 20 customers rose 9% Y/Y to $55 million on average; Net Revenue Retention (NRR) improved to 111% vs. 108% last quarter; it closed 15 $10 million+ deals vs. 21 Q/Q. Remaining performance obligations (RPO) rose 38% Y/Y to $1.3 billion. This is a key forward-looking demand metric, which looks quite strong at the moment.

On a Sequential Basis:

- 14% Q/Q U.S. commercial growth compares to 12% Q/Q last quarter.

- U.S. commercial growth was 40% Y/Y

- U.S. commercial revenue growth was 68% Y/Y ex-SPAC related revenue vs. 71% Y/Y last quarter.

- 5% Q/Q total commercial growth compares to 13% Q/Q last quarter.

- 8% Q/Q U.S. government growth compares to 3% Q/Q last quarter.

- U.S. government growth was 12% Y/Y.

- 3% Q/Q total government growth compares to 5% Q/Q last quarter.

Total growth lagged U.S. growth mainly due to Europe (16% of total business).

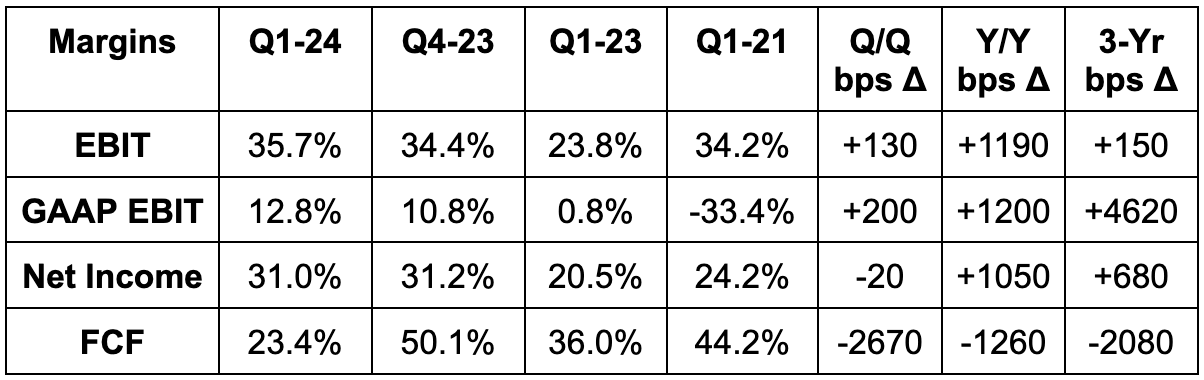

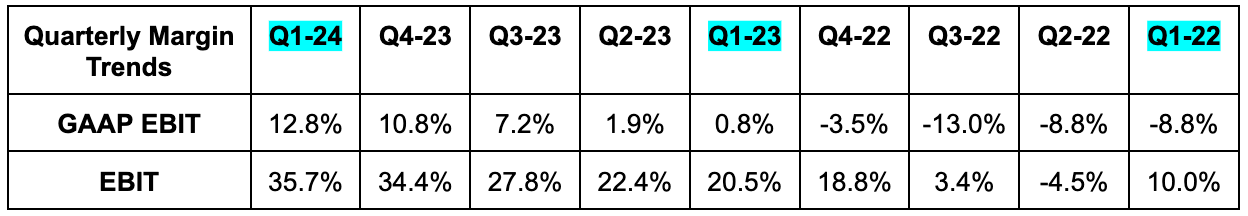

2. Profitability & Margins

- Beat EBIT estimates by 14.6% & beat EBIT guidance by 14.4%

- Met $0.08 EPS & $0.04 GAAP EPS estimates.

- Adjusted gross profit margin expanded from 81% to 83% Y/Y and was 100 basis point (bps; 1 bps = 0.01%) ahead of expectations.

This is Palantir’s 5th straight quarter of positive GAAP EBIT. Its rule of 40 score continued to rise to 57% vs. 54% Q/Q and 42% Y/Y.

3. Balance Sheet

- $3.9B in cash & equivalents.

- $500M in untapped credit revolver capacity.

- No debt

- Diluted shares rose 8.3% Y/Y; basic shares rose 5.0% Y/Y. It did repurchase 500,000 shares during the quarter, but that did not offset dilution.

The most negative part of this largely positive report is the consistently rapid dilution. A normal pace of share compounding for firms that use stock comp is 2%-3% ex-buybacks. 5%+ is too high. Importantly, last quarter management told us that it re-vamped comp structures to become more “aligned” with shareholders. That should hopefully mean this rate of increase slows considerably going forward. That progress was never going to begin this quickly. If we zoom out a year and growth is still this elevated, I think that would be a concern for bulls. Not my expectation… but pay attention to this trend.