Section 1 -- The Basics

1.1 A Brief Story on the Beginnings of PayPal

PayPal’s journey to digital payment ubiquity commenced in 1998 when it was created under the name “Confinity”. Confinity -- founded by Max Levchin and Peter Thiel among others -- was a software-based security program for hand-held devices and struggled to find any success. Perhaps ahead of their time, in 1999 the founding team subsequently evolved the focus to electronic payments. The new product concocted was called “PayPal."

Luckily, Confinity was founded with a security core. This fostered cutting edge payments innovation pertaining to privacy and data encryption and enabled it to find early success. The company quickly caught the eye of X.com, a new digital bank, and its charismatic founder Elon Musk. Soon after, the two merged at the turn of the century and PayPal went public at the tail end of the dot-com bubble in 2002. Early employees of PayPal formed what was called the “PayPal Mafia” and included a wildly impressive roster of talent including those already mentioned plus Reid Hoffman, David Sacks and the co-founders of YouTube.

Just months after PayPal’s IPO and strong success, it was purchased by eBay. From 2002-2014, under eBay’s wing, PayPal blossomed as the platform’s default payment option and achieved dominant market share in the process thanks to its preferential placement. But PayPal had ambitions well beyond a checkout button on eBay. Five years into the journey, PayPal secured a partnership with MasterCard and other financial institutions which freed it to vastly expand its merchant availability. At this time (around 2008), it was generating 150% of what eBay paid for it in annual revenue -- quite the purchase.

By 2011, PayPal’s product suite was morphing from checkout into a broader host of services including brick and mortar shopping, peer-to-peer (P2P) payment solutions and other M&A-based project. And from there, PayPal grew like wildfire; its future was as bright as ever and its revenue base had surpassed its parent company’s. Unfortunately, eBay’s future wasn’t so bright with the rapid advancement of Amazon and other competition. Identifying this, legend Carl Icahn pressured the combined entity to spin off PayPal in 2015. This is also when current PayPal CEO Dan Schulman stepped in to manage the next evolution.

From 2015-2020, a continued operating agreement between the two firms kept things largely unchanged and placid. The companies were separated, but continued to work closely during that 5-year period. That changed in 2018 when eBay announced it would not renew the operating agreement and would instead let it expire in 2020. That move meant PayPal would lose preferential checkout button placement on eBay’s page and would no longer be eBay’s processor -- its competitor Adyen securing that new contract. PayPal had been the preferred button AND the processor up until this point -- but no longer.

Over the last 24 years, PayPal’s colorful history has seen it transform from a single-product payment provider into an entity striving to build super-apps to power the financial lives of consumers. In the process, it successfully democratized access to financial services, achieved spectacularly consistent growth and established a market-leading niche within the crowded financial services landscape. Here, we will explore how it has been able to prosper in the past, and if it can overcome a competitive landscape that gets more difficult with each passing month.

1.2 Payment Ecosystem 101

a) The Digital Transaction Process and Players

Before going into how PayPal creates value, it’s imperative to understand the digital payments value chain, the process, its players and how PayPal fits into the full equation. PayPal’s online checkout offering is described by management as its “past, present and future” and it is intertwined throughout this ecosystem. So, we’ll explore this world from the point of view of PayPal. As we’ll see later on, it is aggressively expanding into new segments, but all of the other launches are dependent on the strength of the central checkout system.

Checkout begins when a customer has finished filling their online goods/services basket and is ready to pay for their selections. The customer can enter in credit/debit card information manually, or can use a payments provider like PayPal and login to have the data auto-populated once an account has been created. After a payment method is selected and the data is entered, the card information and all other identifiable account information is encrypted (AKA tokenized) by what’s called a gateway service. This can effectively be considered a digital point of sale (POS) system or a high-tech, digital cash register during the checkout process.

- Tokenization definition: Process of anonymizing sensitive card data by converting it to a string of continuously generated numbers called a token. This is very similar to encryption and the two terms are often used interchangeably. PayPal has tokenization partnerships with all card rails like Visa and Mastercard.

A Gateway offers many of the essential software connections to the rest of the landscape. It plugs a merchant’s site into online payment processors, integrates into card networks and connects to digital wallets to power consumer payment optionality. It’s needed for any online sales presence. Gateways also provide payment vaulting databases which serve as encrypted storage systems of consumer information. That is what enables the auto-populating services that payment providers such as PayPal feature.

Post-gateway data collection and encryption, this information is sent to a payment processor which does most of the transaction authenticating to ensure its legitimacy and legality. It’s the work horse of the equation and the second required merchant connection -- this time between gateways and the merchant’s bank. A processor moves the transaction funds through its network and back again, facilitates the settlement of funds and authenticates.

- Payment processor examples: Adyen, Stripe, PayPal, Braintree etc.

Authentication concludes with a request sent from the processor to the customer’s card issuer.

- Issuer examples: Bank of America issues a consumer debit card on top of a card network (rail) like MasterCard.

The issuer is the party ultimately responsible for approving the transaction -- it will do so largely based on account balance data. Processors authenticate and issuers authorize all in a few seconds. If approved by the issuer, it will then directly fund the transaction and communicate its decision to the rest of the ecosystem. Issuer funds will be sent through the processing network, back to the gateway and ultimately into a merchant bank’s (frequently called a merchant acquirer) deposits.

This merchant acquirer maintains and services merchant accounts within their deposits ecosystem. Post fund settlement, the acquirer immediately credits the merchant account for the sale amount. Settlement usually takes a day or two, and commonly, the role of merchant acquirer and processor are done by the same entity (such as Wells Fargo). Merchants must have one of these accounts in order to accept online payments through a licensed financial institution.

Finally, to compensate the consumer issuer for its transaction funding role, it directly debits the shopper’s approved account by the amount of the purchase. It’s worth noting that none of this process is visible to the front-end customer, but instead facilitated all through the back-end to ensure a slick, delightful experience. All a shopper sees is a receipt post-approval or a notice of rejection from the gateway.

b) Fees

Every party mentioned above that touches the transaction requires a fee for their participation:

- The interchange fee is paid to the customer’s issuing bank as a percentage of every sale. This is usually around 2% of the sale + ~$0.10.

- The assessment fee is paid to the credit card association (card rails such as Visa or AmEx). This is often combined with the interchange fee and quoted as one value, but alone it is typically around 0.1% of the sale + ~$0.10.

- The markup fee is paid to any other party involved in the transaction -- such as the merchant acquirer. This is usually around 0.25% of sales + ~$0.10 on its own.

- The authorization fee is paid to the processor for their services and is generally ~$0.30 per transaction. This is charged for all transactions: sales, declines and returns.

- This is why a merchant bank/acquirer would ideally like to be the processor for every transaction as well -- they get a higher, margin-accretive fee. Still, these merchant banks readily plug into PayPal due to the vast digital distribution bump it fosters.

There are various methods for quoting these fees for merchants. Regardless of the method chosen, these costs are inherent in card-based commerce.

c) PayPal’s Role Within All of This

As briefly stated, PayPal is a payment provider. That classification means that it bundles the roles of checkout flow, gateway, processor and merchant account (through bank partnerships) all into one offering. It’s also now becoming a more prominent card issuer through its Venmo and PayPal revolving products. The gateway specifically is called “PayFlow Pro” which takes a $0.10 cut per transaction plus a $25 per month fee. This has largely replaced PayPal’s legacy offering called “PayFlow Link.” Please note that this payment provider niche does not include merchant bank or acquirer servicing. Instead, PayPal readily integrates with this piece of the ecosystem to provide end-to-end payment capabilities.

PayPal’s broad integrations and partnerships with the rest of the space mean that merchants can pick individual tools in an a-la-carte manner. It’s all about merchant choice, which is only possible with PayPal’s integrations that ensure reliable cross-vendor interoperability.

1.3 PayPal’s Product Philosophy

a) Build the 2-Sided Network

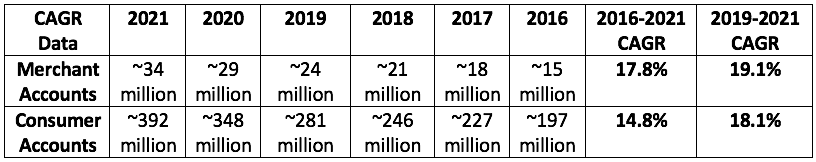

While PayPal started with a single service, it has built out a vast suite of utility-building products for both merchants and consumers. All of these products are aimed at supporting what PayPal calls its 2-Sided (consumer + merchant) Network scale. The wonderful thing about PayPal’s business model is that its success is intimately based on its stakeholders enjoying more payment volume through their networks, or convenience in their daily lives. It can only thrive by providing more value which eliminates conflict of interests. PayPal teamwork makes the dream work.

The Two-sided network creates a compelling flywheel:

- Happier merchants with more flexibility and options use PayPal more frequently.

- More merchant adoption means broader acceptance for consumers.

- This ultimately results in more successful merchants, more choice for consumers & greater revenue for PayPal.

- More merchants mean even happier consumers while the converse is also true. One side of the network directly augments the other.

The utility PayPal can provide to the consumer acts as a force multiplier for making PayPal more valuable to the merchant. It is with this singular focus that PayPal has rounded out its comprehensive product suite. This is how is wins: delight, delight and then delight some more. Many formidable competitors have addressed one of these sides, but none have achieved the satisfaction & scale duality that PayPal has built. This paves the way for PayPal to offer value that others simply can’t which we’ll explore in detail later on.

While PayPal has comprehensive solutions, it does divide its products into merchant-facing and consumer-facing. For consumers, this culminates in its two digital wallets while for merchants it takes the form of the “Commerce Platform” which integrates all of the enterprise utility PayPal provides into a unified B2B platform.

b) Revenue Generation

PayPal’s two revenue segments are labeled as transaction revenue (by far the largest) and “Other Value Add Services” (OVAS).

Transaction revenue is the compensation PayPal gets for operating its gateway, checkout, processing & merchant account services. It also includes other products like instant transfers of account balances and cross-border foreign currency conversions to facilitate international transactions. PayPal does not compete by undercutting competitor pricing, rather it does so through brand excellence (quantified later), checkout flow and scale.

As a result, PayPal’s all-in flat rate is 2.9% + $0.30 for the first $3,000 in monthly merchant sales. After that, it charges 2.5% + $0.30 until a merchant reaches $10,000 in monthly sales with 2.2% + $0.30 charged for all sales thereafter. For reference, Block’s flat fees are very similar with both having surcharges for use of non-traditional Alternative Payment Methods (APMs). Transaction revenue is consistently 91-93% of total PayPal revenue.

Key performance indicator (KPI) definitions pertaining to PayPal Transaction Activity:

- Active Account: Registered user within PayPal’s ecosystem (or an account registered through a platform access partner) who has completed a non-gateway-exclusive transaction in the last 12 months. One person can have multiple accounts meaning accounts and active users are two different things.

- Total Payments: Payments less Reversals through PayPal’s platform.

- Total Payments Volume (TPV): Total volume passing through PayPal’s platform or a platform access partner using PayPal.

The other 7-9% of revenue creation is via PayPal’s OVAS. This is all other revenue generated from things like partnerships, deal discovery, subscription fees, referral fees, PayPal’s merchant credit offerings and net interest income on select customer balances.

In terms of U.S. and international split, PayPal’s revenues are 53% domestic and about 47% international. This leaves PayPal vulnerable to currency fluctuations vs. the U.S. dollar which it actively hedges whenever possible. As a reminder, a stronger dollar means international revenue is worth less when converted back to dollars. Considering how rapidly the U.S. dollar has risen lately with it now roughly at parity with the Euro, PayPal’s hedging efficacy will be put to the test in 2022. But currencies always fluctuate and that won’t change; for this reason, all calculations done in this thesis are done on a spot rate basis without FX conversion rate adjustments. It’s just part of being a global entity.

c) Partner Frequently

PayPal’s ambitions are to offer essentially all basic financial services, but it extensively uses partnerships to bring this vision to life. Within categories such as checkout, payments and commerce where it’s able to deliver what it sees as tangible differentiation, it builds internally (or buys and integrates assets if it can’t). Conversely, for many financial services, it taps into financial institutions (FIs) to provide the licensing, usury exemptions and know-how to launch their products within PayPal’s environment.

As a standard rule of thumb, PayPal seeks out these partnerships within commoditized products like savings accounts. It takes these partner capabilities and laces its own interface throughout them to build use cases without creating disparate experiences within PayPal’s apps. The way to stand out here is via broader distribution. PayPal copiously provides that to these FIs to form a compelling win-win: Institutions gain coveted scale, and PayPal is able to offer more utility and revenue enhancing products.

“As PayPal launches products, our partnerships deepen. We’re one of the largest digital distribution channels for FIs and becoming an increasingly large piece of their growth. The new volume we create accrues to them.” — CEO Dan Schulman

This culture of openness has created a seamless path for joint go-to-market risk management and tokenization capabilities with Visa, Bank of America and others. PayPal also boasts a direct connection between its peer-to-peer (P2P) payment networks and AmEx’s while AmEx allows its card rewards to be used on PayPal and Venmo. This integration has been so successful for AmEx that it now advertises the capability to its vast user base. All other card rails offer integrated instant transfer capabilities with PayPal as well.

Furthermore, most major FIs including Bank of America and J.P. Morgan allow for card tokenization and linking into PayPal’s digital wallet. This isn’t unique to PayPal, but it’s a pre-requisite for any digital wallet’s success. Additionally, recall that PayPal’s expedited checkout process relies on its aforementioned gateway vaulting service to securely save and store needed information for future use. These institutions add more than a quarter trillion cards to the mix.

“Major FIs put their reward points in PayPal for customers to use them with any of our merchants, rather than redeeming them on an internal catalog with maybe 1-2 merchants. It’s a real value add for credit card issuers to offer rewards in more places.” — CEO Dan Schulman

The analyst community used to fear that credit card issuers or rails would be the death of PayPal. Not only has that proven to be inaccurate, but the opposite has been true. It has seen consistent renewals and partnership advancements from bellwethers like Citi. PayPal and FIs collaborate quite well together, and that’s the way it should be to create an aligned incentive environment that optimizes consumer value.

d) CEO Dan Schulman’s Two Transformative Priorities

PayPal’s most recent digital wallet upgrade and overhaul took 7 whole years. When embarking on my research in the company, that was one of the things that first stood out to me in a not-so-positive way. Most companies today are on continuous software release cycles which enable constant, interruption-less iterations.

Well, Schulman noticed this too when he took over in 2015 and made it his priority to make PayPal more innovative and nimbler within software advancement. This ambition took shape in two ways. First, he spent heavily on re-vamping the company’s technology to orchestrate more expedient and consistent software updates such as the external crypto transfers capability activated last month. The company had been leaning on dated, monolithic C++ code and spent hundreds of millions to transform that static backbone to one that is now exponentially more service-oriented, easy to use and utility-building. Specifically, the all-important digital wallet (covered extensively next section) will now be updated constantly.

As clear signs of these investments bearing fruit, PayPal has recently seen its software release cadence soar from a few hundred annually to tens of thousands while its bug rate simultaneously sank. Furthermore, the company’s up-time rate has risen from 99.99% to 99.999% this year. I know this doesn’t sound significant, but when you're processing trillions of dollars for hundreds of millions of accounts, it does matter a lot.

This modernization freed PayPal to tear down the walls of its product data silos so product teams can now work together with more data, more context and therefore more precision. The evidence of this collaboration bearing fruit comes in the form of rising authorization rates -- and for PayPal that rate has risen by a brisk 600 basis points since 2018 on top of the lead it already had vs. the industry (quantified later). If you know the customer better, you can typically authorize over 90% of transactions vs. around 75% for single-interaction companies -- and PayPal knows its customers as well or better than anyone else in the industry.

To power even more organizational agility, PayPal is finalizing a years-long process of creating digital twins or “evergreen systems” that enable its teams of software engineers to conduct constant split testing without ANY system downtime.

This makeover has had another interesting impact on the company’s approach to M&A. Previously, PayPal consistently guided to $1-$3 billion in annual acquisitions, which investors had long come to expect. It removed this piece of guidance as Schulman’s infrastructure reinvigoration changed the company’s view on what it can develop internally via R&D, and what must be bought. This is good news.

“Three years ago if we wanted a new product, we would have had to buy something for billions. Now, we feel we can do more organically.” — CEO Dan Schulman

The second item Schulman spent heavily on was compliance and risk management. Product release cadence -- especially in the highly regulated space of financial services -- relies on strong relationships with agencies and lawmakers. This is especially true if you want to expand internationally like PayPal has done. Regulators decide which services a vendor can provide and how they’re specifically able to be presented. Consequently, PayPal has been focused on cultivating strong governmental relationships since its inception, but Schulman has taken things a large step further.

Under Schulman’s leadership, the company’s risk management and compliance team soared from 120 in 2015 to over 4,000 today. This expansion has walked hand in hand with the technology modernization. A cutting edge software stack frees a company to be nimble while its regulatory prowess allows that nimbleness to actually be implemented and rewarded. PayPal brings both strengths to the table which is somewhat unique in FinTech. This edge allowed it to launch more products in 2021 vs. its entire history combined and enabled it to be the first foreign entity with a domestic Chinese payments license… ever.

“If you want to be a major financial services player, you have to be world-class at regulatory compliance… some thought regulation would slow us down, but no. We are better at this and it’s a foundational part of who we are.” — CEO Dan Schulman

e) The Market Opportunity

PayPal’s democratization vision is well-placed with 72% of Americans stressed about their finances. The firm estimates its current total digital transaction volume opportunity at a whopping $110 trillion which has grown 6-fold since 2018. Assuming a conservative 1% PayPal take rate, this implies that PayPal’s total addressable global revenue opportunity is north of $1 trillion dollars. PayPal thinks this revenue opportunity is closer to $2 trillion, but I think it’s good to lean pessimistic in market size calculations just to be safe (calculations are very subjective). And a $1 trillion market is still massive.

For global e-commerce growth specifically, estimates for 2022 are around 10-12% growth with modest acceleration expected in the future from vendors like GrandView as we distance ourselves from the pandemic shock. Much more on this later. The company fully expects to continue outpacing global e-commerce growth and gaining market share in the years to come.

The two tailwinds that will help drive its expansion are e-commerce penetration and cash displacement. With 70% of all global commerce via cash in brick & mortar settings as of 2021, the runway is long and full of opportunity for PayPal for years to come.

PayPal’s offline opportunity (retail brick & mortar) is lower margin, but it’s also an $8 trillion market. And the added brick and mortar use cases have also been shown to boost a PayPal user’s online engagement overall. PayPal’s rising offline entrenchment makes a user’s transition to the digital world happen more frequently with PayPal. To put it simply, offline is the bridge to more online volume.

Section 2 -- Checkout

2.1 PayPal Checkout for Merchants

a) Various Merchant Checkout Products

PayPal has a few different checkout products for merchants -- all of which handle payment card industry (PCI) compliance. Furthermore, each plan provides vaulting capabilities, thus eliminating the need to enter billing, shipping and delivery information for transactions after creating an account and linking a card. That’s largely how it expedites the transaction process and improves the user experience.

“Nobody in the Western world has the amount of data and information that we do in our vaults to help merchants.” — CEO Dan Schulman

Here, the partner philosophy shines with its ubiquitous card integrations providing merchants and consumers with the broadest payment optionality.

PayPal is now using these vaults to eliminate logins, making purchases even easier with one-click checkout for customers. Easier means higher conversion rates and a deeper competitive advantage. That same data is even being leveraged to target customers with valuable promotions upon domain entrance.

The company’s basic checkout option is called PayPal Standard Checkout. This allows for PayPal and card acceptance through a merchant’s site or marketplaces with zero setup or termination fees. This is the famous PayPal checkout button in its simplest form and is free for all merchants to offer. PayPal handles checkout, gateway servicing, processing and the merchant account while the actual transaction is authorized and facilitated on a PayPal-hosted site. Post-authorization and issuer approval, the transaction is sent back to the merchant for completion.

This 3rd party hosting is somewhat limited for two reasons. First, it means that the merchant enjoys zero user experience (UX) customization capabilities in the checkout flow. Furthermore, Standard Checkout forces shoppers to work through multiple sites and interfaces -- they have to actually leave the site and come back. Both issues lower conversion rates.

The next option is called PayPal Advanced Checkout. Unlike Standard, Advanced requires heavy PayPal vetting as it provides merchants more power to transact on their customers’ behalf. Approved Advanced merchants can do things like add or tweak purchases on a bill so that the customer doesn’t have to do it themselves. This jurisdiction comes with great responsibility -- hence the vetting. Advanced Checkout still relies on a PayPal-hosted portal, but here that page is actually embedded directly into a merchant’s website. That allows for slightly more customization tools for merchants and higher conversion via the in-line flow.

Advanced offers more thorough payment processing capabilities than Standard and broader integrations into more card issuers. Importantly, it can also process manually entered card data for returning customers. Conversely, Standard offers an error message when someone tries to manually enter in the data of an already-linked card. Customers often forget their cards are linked.

Finally, PayPal offers PayPal Pro/Custom Checkout which starts at $360 per year and is generally for larger enterprises. It features vast scalability and is fully merchant hosted meaning granular UI/UX customization which allows a merchant to mirror the theme of its own site. PayPal is still powering the gateway, processing and merchant account, but does not host transactions under this plan. With Pro, merchants also receive native integrations to accept ApplePay, Google Pay, AmEx Checkout and more.

b) Cross-Border for Merchants

PayPal’s deep global regulatory relationships have created a seamless international expansion capability for merchants. Its broad integrations do things like allow buyers to transact with their favorite local payment methods (LPMs) while PayPal handles all of the currency settlement, tariff and duty compliance. It takes the headache out of manually setting up a new business and payments chain in every new market that a business enters.

PayPal also includes its merchant protection programs (more later) which allow merchants to avoid the approval vs. fraud/loss correlation trade-off inherent within global e-commerce. With PayPal, that’s not the case -- they get the higher approval rates but without the coinciding higher losses. As a result, at the end of 2021, 65% of small and medium businesses (SMBs) in the USA using PayPal had cross-border businesses as opposed to under 5% for all others.

c) BNPL for Merchants

We can’t talk about PayPal Checkout without talking about Buy Now, Pay Later (BNPL) -- an installment loan product gaining speedy momentum within commerce. PayPal debuted its BNPL product in the United States and has expanded quickly to other core markets like the U.K. and Germany. The company expects BNPL to be its largest credit product in the future, which is encouraging considering it’s less capital intensive than its other revolving credit products. PayPal has a range of options in the space -- based on payment schedule and transaction limits -- which are collectively referred to by the company as its “Pay Later” solutions.

Regardless of where you look, long term growth forecasts for the BNPL space are robust and range from 25%-46%. Younger generations do not like interest payments; PayPal Pay Later allows them to avoid that burden. In Australia where pay later products are more mature than any other nation, 8% of all digital checkout is funded via BNPL vs. rates of less than half that in all other developed nations. Worldpay sees this BNPL penetration rate globally rising to 13-14% by 2024: the runway here is quite long and PayPal is poised to dominate. Clearly, BNPL is becoming a more central piece of consumer checkout preferences which, obviously, means merchants are highly motivated to offer this solution to stay on-trend. PayPal makes that easy.

Existing PayPal Merchants aren’t required to do any integration or on-boarding work to offer PayPal Pay Later to its consumers. All they have to do is turn it on as an option. Merchants not only gain access to PayPal’s nearly 400 million consumer accounts, but they don’t even have to assume any balance sheet risk in the process. PayPal funds all of these transactions and stores the loans on its own balance sheet -- merchants are paid immediately. It assumes the credit risk for the merchant. All of this value must fetch a hefty price tag, right? Wrong. It’s actually free for merchants to use with PayPal charging its typical payment provider fees.

Rather than charging for access to this service, PayPal benefits from the added BNPL volume. The average merchant volume boost when the service was launched in 2020 was 15% and has grown to 21% since then. This incremental gain directly accrues to both PayPal and the merchants. It features an up to 82% merchant conversion rate boost while the overall traffic is 90% additive (not cannibalistic) for these merchants. How can this be? Interestingly, PayPal BNPL users have shown to lean on it for shorter-term and smaller buys while using its revolving products for their other purchases. To make things even more appealing, 70% of PayPal BNPL customers are repeat buyers within 6 months, which is much higher than typical repeat rates.

All of that value is likely why PayPal has been able to rapidly add 1.6 million BNPL merchant accounts. That metric is currently growing at 33% sequentially.

For merchants like Samsonite, simply adding a PayPal BNPL option raised the entire company’s AOV by 36% while yielding a 205% rise in overall Pay Later volume. Higher AOV means better margins and added revenue. As an aside, Samsonite also purchased PayPal’s inventory management which solved its frequent glut issues to offer a unique perk for PayPal to differentiate vs. other BNPL vendors.

When looking across other merchant case studies, the outcomes are similar. Jewelry Television enjoyed an 85% AOV spike while DXL used PayPal Pay Later to foster a 25% incremental rise in Gen Z customer reach in just 60 days. DXL also experienced a 3.5X lift to its overall revenue growth rate -- amazing results for a free product requiring no balance sheet risk.

For yet another worthwhile merchant bonus, PayPal’s extensive customer transaction history means its approval rates are routinely above 90% just like for the rest of its operations. Conversely, competitors that are lacking transaction history data boast typical approval rates that are 1500+ basis points lower. This is precisely why it’s vital for BNPL to be just one tool in a tool kit like it is for PayPal -- rather than the entire offering like for many others.

“We’ve got higher pay later approval rates & lower loss rates than any other vendor in the industry… this is a good service, but not a company by itself” — CEO Dan Schulman

It’s good to intimately understand the customer via uniquely extensive and leverage-able profiles on each of them. All of PayPal’s products in aggregate are what help to build this lucrative awareness. That knowledge has freed PayPal’s BNPL credit delinquencies to be stable as recently as June 2022 while others have seen theirs precipitously rise.

“We see the articles around credit delinquencies, but we’re a bit unique. We’re not immune… but we feel good about our position. We have dense customer data… the vast majority of all our BNPL is with existing PayPal customers which is a different position than stand-alone BNPL firms trying to learn on a one-off transaction basis. This is a credit product and we said that from day 1 even when it wasn’t in vogue to do so. But it is a credit product and we take it responsibly.” — PayPal Head of Consumer Doug Bland

PayPal’s consumer Pay Later adoption has been strong per MoffettNathanson. It jumped from 0% to 5% penetration within the top 500 internet retailers in just a year. PayPal expects to lead this category over time with management telling us every single quarter that the product continues to “rapidly gain share” (as recently as May 2022) and that this was its “best organic product launch ever”. Its most recent Pay Later volume growth was 256% YoY, indicating continued strength.

I believe that growth and market share gains will accelerate going forward as much of PayPal’s competition here is -- as leadership calls it -- “VC-funded contra revenue for placement operations.” This type of firm should quickly fade away as the cost of capital rises and liquidity diminishes. To put it bluntly, macroeconomic volatility has a way of eliminating weaker competition.

Today, PayPal’s Pay Later products are for terms of up to 12 months and $10,000 -- both limits were just raised. In terms of what’s next for this segment, the firm’s overwhelming success is resulting in more of a focus on tools and perks being folded the BNPL umbrella.

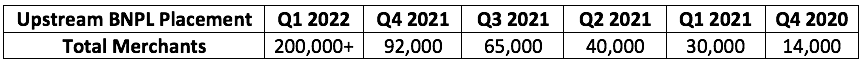

To me, the most exciting development here is something called “Upstream Presentment.” This simply means that PayPal’s BNPL and other checkout options are displayed sooner in the shopping process on the product page. That type of placement features the same one-touch checkout covered above and boasts PayPal’s highest conversion stats out of any other transaction format. This is the biggest reason why PayPal entered BNPL, not because it’s a great profit driver on its own (it isn’t), but because it’s a wonderful means for securing preferential checkout treatment. This drives even more volume which ultimately does drive its success.

“Upstream presentment placement is why we went so heavy into BNPL. It’s not the economics of BNPL alone.” — CEO Dan Schulman

Specifically, upstream placement alone raises PayPal’s share of branded checkout by a full 10%. For context, PayPal has roughly 25% checkout share with a partner like Shopify -- another 10% bump with some of its merchants is a massive boost. Younique (an e-commerce engine for female entrepreneurs) is a great example of the power of Pay Later upstream presentment: Post-implementation, it saw a 209% rise in overall Pay Later volume and PayPal commanded more than half of that share. Younique is so pleased with the results, that they promoted this tool to other organizations, for free:

“We hit the jackpot with PayPal Pay Later. We want to tell the field that this is available and why it is so important for engagement, volume, AOV and flexibility.” — Younique Finance Director David Serpa

This not an isolated incident but a bit of a cliché -- and a heartening one at that for PayPal. Omaha Steaks saw a 10% spike in AOV by implementing Pay Later upstream and saw its overall customer base become materially younger. That was something it had struggled with for years. Unsurprisingly, these trends have paved the way for rapid merchant upstream placement progress:

BNPL = More Profitable PayPal:

PayPal’s overall transaction margin benefits from BNPL as well. Yes, it gets the added volume which is quite important, but it gets more than that. BNPL funding sources are debit and ACH at an 85% clip and rising. These methods of funding are far cheaper for PayPal to facilitate as assessment and interchange fees are lower or non-existent in some cases. Accordingly, BNPL has a 16% lower transaction cost than all other funding options. As we’ll see later, PayPal’s take rate trend over the long term has been lower; this is one of the many ways it can become a more efficient company to counteract that pressing margin headwind.

Paidy:

While the bulk of PayPal’s Pay Later ambitions have been built internally, it did buy Paidy for $2.7 billion last year to enter the space in Japan. Japan is the 3rd largest e-commerce market in the world with Paidy providing instant access to the 10 largest marketplaces and all convenience store chains in that nation. PayPal mainly operated a cross-border business there pre-acquisition -- this opens the door to do FAR more. 70% of all transactions are conducted digitally in Japan, but ultimately settled in cash: The cash displacement runway there is longer than most other developed nations. These were the main reasons for the purchase while a few million net new active Pay Later users and 200 capable employees were bonuses.

Paidy offers several Pay Later products which can be settled in convenience stores (a central part of Japanese culture) or via bank transfer. The two companies had been close partners for years and PayPal was even a founding member of Paidy’s gateway service. The Japanese company’s founder and its CEO both stayed on and remain with PayPal post-transaction. Always a good sign.

d) Marketing (Honey, Store Cash etc.):

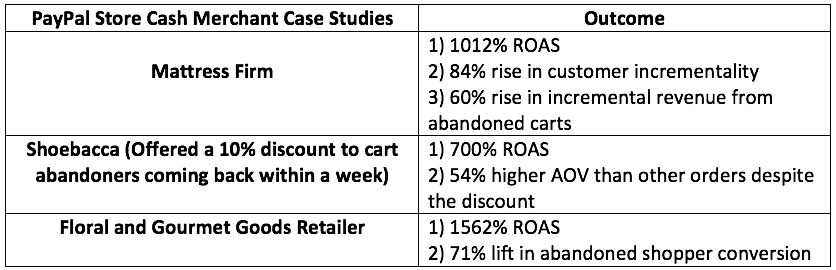

A key piece of PayPal’s merchant value within checkout comes from that aforementioned ability to provide extensive information on nearly 400 million consumer accounts. It offers the standard integrations into all relevant sales channels such as Google and Facebook, and uses its special consumer scale to go deeper than competitors can go.

For example, PayPal Store Cash is a program that identifies “almost-buyers” or those who started, but didn’t finish the checkout process from its a database of 392 million+ shoppers. Merchants get a curated list of these relevant and interested consumers to re-target with promotions to lure them back in. To boost accessibility for smaller merchants, PayPal solely charges for access to this service on a performance fee basis. It takes 8% of incremental sales generated from the merchant which nurtures some stellar return on ad spend (ROAS) metrics.

The key driver of advertising performance is targeting granularity. When you’re sending out messages to millions simultaneously over linear TV, that granularity is a pipe-dream. With PayPal’s almost 400 million consumer profiles and detailed, actionable information to target on a person by person basis -- that pipe dream morphs into a reality.

“PayPal is the best partner we’ve had in my experience. Store Cash was one of the strongest wins we’ve ever seen.” — Mattress Firm VP of Product Management Sumo Das

PayPal’s new and improved app -- with decades of machine learning algorithm built in -- is even nimble enough to offer dynamic merchant promotions display only to the highest intent app users. This newfound ability is pushing PayPal even further upstream from product page to site entrance, bolstering its command of the checkout process even further.

Beyond these programs, the Honey acquisition a few years ago entrenched PayPal deeply into deal discoverability. As we’ll explore in detail in section 3, this platform has generated services like “Wish Lists”. These effectively serve as a history of what a consumer has expressed interest in (through clicks & opens) to gauge concrete demand.

e) Merchant protection programs

Merchants using PayPal for checkout get access to its fraud and risk seller protection programs, free of charge. No other company does so for free and this is yet another PayPal competitive advantage. The company is doing everything possible to make its stakeholders happier to incent more volume passing through its ecosystem. It’s all about them. The merchant protection program relies on PayPal’s expertise in assessing each transaction with hundreds of factor-engineered variables to determine legitimacy -- in real time.

If a transaction is approved and a merchant sends the good or service in the condition promised, PayPal guarantees their payment no matter what. This, paired with PayPal’s buyer protection program (the reciprocal consumer equivalent), effectively makes it a clearing house for digital transaction participants. That’s a powerful tool for ensuring confidence from both parties to conduct and approve more transactions.

“These protection programs are generally much broader than similar protection provided by other payment industry participants.” — PayPal’s 10K every year since IPO

Simility:

PayPal bought Simility in 2018 to gain proficiency in fraud detection and subsequently re-branded it as PayPal Fraud Prevention Analysis (FPA). This is a key piece of PayPal’s industry-leading protection programs for merchants and buyers. PayPal wanted Simility for its Adaptive Decisioning Platform and infused that into its own “Risk-as-a-Service” (RaaS) feature. It also offers FPA on a standalone basis. Simility is a crucial piece of PayPal’s fraud detection and its edges in authorization and loss rates which, again, is a game-changer in the world of e-commerce.

It uses things like its behavior profiles to flag deviations from normal engagement by stitching available data into a singular birds-eye-view of each customer. It also helps PayPal provide promotion abuse protection by uncovering malicious new account creation. This results in more accurate transaction underwriting which improves overall loss rates and juices volumes -- quite the win-win.

f) PayPal’s Brand -- The True Merchant Prize

Merchants enjoy loyal PayPal customers:

While all of the perks above are great, simply the presence of the PayPal brand may bring the biggest statistical benefit of all. The following studies from independent 3rd parties reiterate that sentiment in an unbiased manner:

According to a Nielsen survey of 15,000 online shoppers, PayPal converts customers at a 28% higher clip when selected at Checkout vs. the average alternative. PayPal also delivers an aggregate 19% rise in unplanned purchases, 13% more repeat purchases and happier customers with an overall +8 impact on merchant net promoter scores (NPS). All this, just from adding PayPal Checkout.

PayPal’s risk management and checkout flow edges yield that aforementioned 6% higher authorization rate for merchants vs. industry standards without impacting loss or fraud rates. That advantage -- which is up from 4% as of 2020 -- means that merchants convert 6 more transactions per 100, while consumers are rejected and thus discouraged less frequently. This quarter, CEO Dan Schulman hinted that the lead is now closer to 8%. Regardless of which metric is accurate, it’s a massive impact. Again, PayPal provides the coveted holy grail in online payment: More approvals and lower loss rates.

And in an e-commerce world where cross-party reliability is imperative, PayPal delivers. A Morning Consult survey of 300,000 people revealed that PayPal is the 2nd most trusted brand in the entire World. Data from Netfluential mirrors this result with 53% of respondents trusting PayPal to keep their data safe vs. less than 4% for the other 6 financial service innovators in the study. When handling a consumer’s sensitive data and finances, trust is like gasoline to a combustible engine. You’re not going very far without it.

IPSOS (in conjunction with PayPal) ran a study a few years ago painting a similar positive theme of PayPal fostering more merchant success. They determined that customers are 54% more likely to complete checkout with a merchant if the PayPal button is present. Notably, tens of millions of PayPal surveyed consumers admitted to abandoning an online purchase because PayPal was not a payment option. If you were a merchant, would you implement PayPal’s checkout option with no on-boarding cost to get these tangible benefits? I certainly would.

When consumers trust you more than others, it gives you permission to sell them more and more things. As we’ll see in the next section on PayPal’s digital wallet, that’s the plan.

Governments love it:

Not only does the PayPal brand build consumer confidence, but it comes with tremendous global regulatory clout as well. The huge investment that PayPal infused into building the teams to massage these relationships was both tedious and cumbersome -- but the regulatory connections now serve as a deep moat against competitors. This is why PayPal has been so effective in providing cross-border services and why merchants can use PayPal for compliant global payment expansion. As a notable bi-product, the government affiliations also free PayPal consumers to pay in their preferred, comfortable local method regardless of location.

The clearest evidence of PayPal’s regulatory prowess comes from China. Again, it’s the only foreign company in that Nation with a Chinese Payments License -- and this took them just 6 months to secure. Considering how protective the Chinese government is of their consumers and economy, this was nothing short of amazing. The relationship came from PayPal’s outright purchase of GoPay and gives it complete access to the massive Chinese market.

With the license, PayPal can provide Chinese merchant checkout service to open them up to 392 million customer accounts globally. What’s even more exciting is that China’s nearly 1.5 billion people can now shop at PayPal’s 35 million merchants across the globe. PayPal can also now process Chinese taxes, customs and tariffs and can clear transactions in local RMB -- none of which it could do pre-license.

The license also freed PayPal to strike lucrative partnerships with multiple key players. Notably, it partnered with UnionPay to link the Chinese Giant’s 1 billion+ cards into PayPal’s ecosystem. PayPal will now be a payment method at all UnionPay merchants (so pretty much all Chinese merchants) and vice versa. Together, the two also offer PayPal QR codes, which can be used by tourists instead of requiring WeChat or Ant Pay downloads. Outside of China -- throughout APAC where UnionPay is prominent -- the tie-up permits PayPal to link UnionPay cards into its digital wallet in Australia, The Philippines and other countries. Finally, PayPal signed a contract with Alibaba allowing it’s customer to use PayPal for checkout globally.

This license was a big get for PayPal, but I don’t think the tailwind has yet been enjoyed. China is just now trying to come out of its latest pandemic supply port shut downs which have made global commerce a nightmare. These issues have been stubborn, but are also temporary. As the Chinese economy eventually re-opens (now with monetary stimulus to support it) PayPal should be one of the only American Fintechs positioned to materially gain.

In Europe, it was able to secure a banking license in Luxembourg to unlock many new services thanks to the coinciding lower cost of capital and new authority. This has allowed business segments such as its merchant credit facilities to explode in popularity in nations such as the U.K and has opened the door for new use cases in countries like Italy as well. The company was just added to Italy’s Public Administration App which enables PayPal to be used for bill, tuition and tax paying to the Italian Government. Another great sign.

In the United States -- where PayPal is regulated by the Consumer Financial Protection Bureau (CFPB) as a “money transmitter” (not a bank) -- the regulatory grip appears to be tightening. Very recently, this government agency has commenced research into things such as AI/ML and its impact on fostering bias within financial services. While this increased scrutiny will be tough to maneuver for some companies, PayPal has invested in the level of regulatory compliance needed to position it for success regardless.

“We think it’s great to see regulators imposing the right mandates and programs to protect consumers. We’re a partner in that process and have built a platform to enable us to do right by the customer always… there’s a myth that security and innovation can’t both be done. They can.” — PayPal CTO Sri Shivananda

Not only does seasoned regulatory expertise facilitate product launches, but it makes PayPal a prime initial integration candidate for Central Bank Digital Currencies (CBDCs). Central Banks will not give up total control of digital currencies and they are quickly working to digitizing their own fiat forms to stay modern. According to the Bank of International Settlements, Central banks representing 20% of the world’s population will have CBDCs issued by 2024 and PayPal is best positioned benefit.

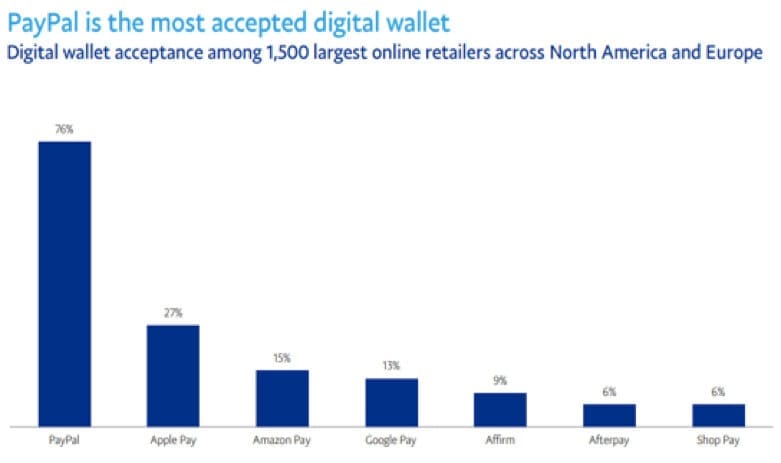

g) PayPal’s Market Share

If everything above in this section were the cause, market share would be the effect -- and for PayPal, signs are all positive. Its overall merchant checkout placement is 8X the next closest digital app with Apple Pay the only competitor materially closing that gap.

When the pandemic re-shuffled the competitive landscape, PayPal showed its effectiveness by taking another incremental 2% checkout share from the competition as leadership frequently reiterates. Amid chaos, it relatively outperformed. Today, it boasts a dominant market share lead with the largest global merchants and that lead has proven to be quite sticky over the last several years. Specifically, in the company’s most recent quarter, it lost share with 5 of its 55 largest customers, gained share with 17 of them and maintained share with the rest.

For now, the main point to make here is that PayPal’s checkout share continues to grow with concrete, quantifiable advantages paving the way. Slowing industry e-commerce growth as we lap pandemic comps is temporarily dampening the rewards from these market share gains, but once e-commerce growth re-accelerates, so will PayPal’s.

2.2 PayPal Checkout for Consumers

Merchant value creation is just one piece of the equation. That value skyrockets when complemented by a large cohort of customers like with PayPal. Who cares about accurately targeting promotions and conversion-juicing features if no consumers use the service? Short answer: not merchants. That’s why consumer value creation to encourage usage is imperative and that’s why PayPal is also keenly focused here.

a) Convenience, Security and Trust

In the checkout and “button wars” world where competition is fierce, it’s vital for PayPal to differentiate wherever it can. Checkout is largely commoditized at this point which makes differentiation difficult but immensely lucrative if attainable.

PayPal stands out here by minimizing clicks and time to checkout while maximizing security, authorization and privacy for the customer.

It accomplishes this in a few ways. First -- as briefly mentioned -- PayPal’s gateways encrypt and vault sensitive customer data so that users are guaranteed anonymity and also don’t have to manually enter in the information for each checkout. With PayPal -- after creating an account -- the data automatically populates, allowing consumers to breeze through. Easy and convenient.

With its newer One-Touch offering -- requiring no new integrations or installations for merchants -- consumers with a PayPal account can race through checkout even more quickly. After a card has been saved with PayPal and a consumer has logged into a certain device, they simply select PayPal, confirm the purchase and they’re done. For a large merchant like StubHub, this feature immediately delivered 50% more revenue per customer than its other checkout options combined and positive outcomes like this are common.

PayPal also offers the aforementioned consumer protection program alongside the merchant program; both are broader and stronger than most alternatives. With fraud and unscrupulous behavior as rampant as it is within e-commerce, this is a big deal to people as it works wonders in curbing the consumer losses incurred from this issue. It means PayPal is footing the fraud bill, but it’s a necessary cost to pay to stand-out in the crowded checkout field. All of this seems to be working based on the brand trust surveys covered above.

b) Global Adoption Ubiquity

Convenience and security are a great foundation, but that foundation blossoms into something so much more prized when it’s combined with leading merchant adoption. And with PayPal’s previously stated 8X placement rate lead and broad partnerships, it delivers in droves.

A turnkey cross-border service in 200+ countries helps drive this ubiquity too. As you can imagine, PayPal acceptance in more countries and its ability to offer more local payment methods (while competition can’t) are wonderful tools for it winning churned customers.

As an aside, if you’re noticing a theme of me using the terms “aforementioned” and “briefly stated” it’s because PayPal’s consumer and merchant utility is generally built in concert. The two sides of the network are intimately intertwined and each must be nurtured to support the other.

c) BNPL -- Summary of consumer BNPL utility:

- No late fees (unlike others) or interest rates on payments.

- Broader payment flexibility.

- Direct integration into the digital wallet.

- Omni-channel usability.

d) What’s Next?

Going forward, the focus will remain on reducing latency whenever possible -- it eliminated several seconds in 2021 -- and crafting delightful experiences. Updates like proactive card expiration notices along with making more of checkout in-line have been two of the many tweaks that delivered this positive result. And there’s still a long, long way to go. PayPal users still only select it as a direct option half the time that it’s available: there has been remarkable success to date, but the low hanging fruit remains abundant.

Finally, as briefly discussed, the company is actively phasing out login request prompts. Since forgotten information accounts for half of PayPal’s churn, successfully removing this piece of the checkout process would be a nice conversion tailwind. Shockingly, roughly 95% of that data is on the dark web anyway, so this is no longer a reliable assessment of identity verification and it will be replaced over time.

Section 3 – The PayPal Digital Wallet (Super-app)

3.1 The product suite for consumers:

a) Basis of the Launch

PayPal’s digital wallet, accessible via mobile app or desktop, is just another name for its product suite. As a reminder, the digital wallet launch last year marked the completion of a 7-year upgrade process, but updates will now be constant thanks to Schulman’s internal transformation. The update involved extensive split testing to observe data driven preferences and to refresh the app that management frequently referred to as “tired and “antiquated.”

This is leadership’s fix for that ailment and to become the consumer’s daily financial app. Some of these additional tools are value extenders for its traditional checkout flow while others create new use cases entirely with the aim to support consumer engagement and diminish churn. This has become an increasingly important aim for PayPal. Today, the digital wallet is rolled out to half of PayPal’s user base with plans to get that rate to 60% by 2023.

A key theme to keep in mind with this release is getting the most out of PayPal’s data treasure chest. With its nearly 400 million consumer accounts and extensive transaction histories, PayPal can use all of this data to create a more granular, personalized app experience. Now when a consumer doesn’t click on a certain icon enough times, that piece of the feed goes away. In the past, experiences were far more static and uniform as PayPal’s product teams had existed in isolation, and just didn’t work together to augment things like underwriting and UX. That’s no longer the case. Beyond getting more out of PayPal’s unique data scale, the team fixated on making more experiences native to the PayPal app to avoid having to ship consumers off to potential competition with an interface disruption. Let’s dive in.

b) The Consumer Options

The three main service categories for consumers are payments, financial services and commerce -- and it has dedicated app tabs for each of them.

Payments:

Payments is the original service. It comes with the same peer-to-peer payment features that the firm has been featuring for decades and ubiquitous card linking capabilities for checkout usage. Whether it’s account balances, cards, QR codes, internal or 3rd party rewards, bank transfers, gifts and more, you can use it in the wallet. This is why it’s called a digital wallet -- all physical cards and funds can be digitally stored in it to function as a virtual, comprehensive container for your financial livelihood.

Beyond payments, the app provides native bill pay flexibility with new auto-pay and reminders, as well as crypto and rewards available as funding tools. Through a partnership with the billing company Paymentus, billers and aggregators are able to display invoices directly in the PayPal app. Previously, bill pay happened largely outside of the PayPal ecosystem and this small update alone has powered a 200% spike in first time users. That spike not only means more revenue, but also affords PayPal a superb indirect benefit of infusing more data and accuracy into its credit issuance. Generally speaking, if I know you can pay back your bills on time, I can offer you cheaper and more frequent credit.

The partnership frees PayPal to use Paymentus’s processing network while offering a uniform UI/UX to augment the quality and consistency of the offering. This is a clear example of PayPal’s partnership bias when it comes to largely commoditized products. In addition, PayPal added a large cohort of billers and aggregators into its integration network ensuring that consumers can pay bills through the wallet regardless of who their vendor is. Consumer choice is key.

Financial Services:

Financial services is where we start to see some real changes. This app page offers customers a high yield savings account with a 0.85% APY (raised from 0.4% in early 2022) which is around 12X the national average. Companies like SoFi offer more yield, but PayPal thinks it can rely on its brand trust to thrive with a rate that’s high, but not the highest in the industry. This product features no fees or balance minimums and boasts extensive budgeting tools to guide users on a path to financial health. PayPal’s consumer credit card, with its 3% cash back for all transactions, is another piece of this product segment. The hefty rewards work to create healthier users capable of contributing more to merchant volumes -- simple enough.

Within Crypto, PayPal offers the standard buy/hold/sell products. Similarly to PayPal’s BNPL approach, this crypto debut was entirely organic and, within 60 days of launch, achieved results that shattered all management expectations. By then, 17% of PayPal’s hundreds of millions of users had already transacted Bitcoin through the platform -- per Mizuho. So far, Bitcoin, Ethereum, Bitcoin Cash, and Litecoin are the currencies offered with many more coming.

But PayPal takes digital currency adoption a step further. As of last year, the firm’s users can actually use virtual currencies to fund purchases at any PayPal merchant. To offer this unique perk, PayPal partners with Paxos for licensing, liquidity and custodial services and is working on securing integration partners to enable brick and mortar tap to pay with Crypto as well. While the crypto commerce tool sounds cool, it really hasn’t gained much traction to this point -- and PayPal expected that.

Schulman really sees crypto for transactions as a placeholder for when CBDCs are broadly available in the near-ish future. By having this ability in place -- coupled with the previously covered government relationships -- PayPal will be well-positioned to integrate these federal coins into their wallets. CBDCs and digital wallets are like peanut butter and jelly and PayPal is determined to be an intimate part of this.

“We’d like to see crypto evolve from price hype to the utility that blockchain can provide to the payments industry.” — CEO Dan Schulman