1. PayPal (PYPL) – Earnings Review

a. Demand

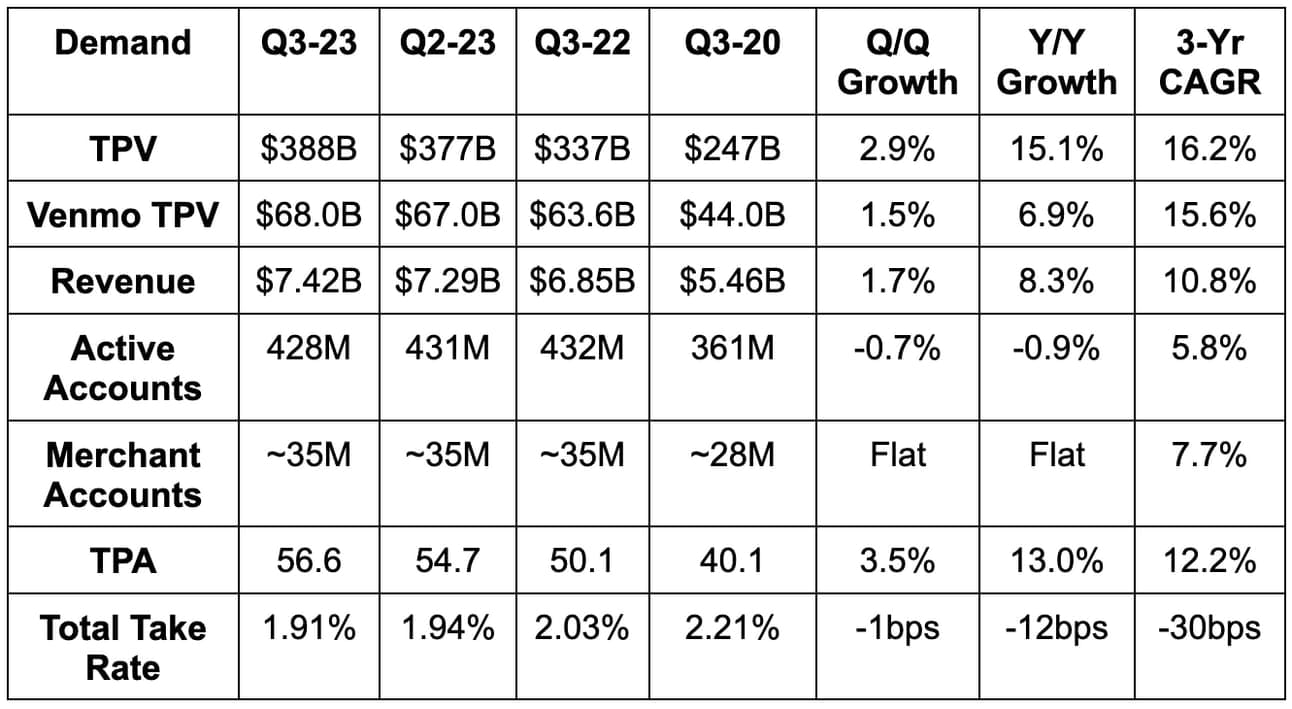

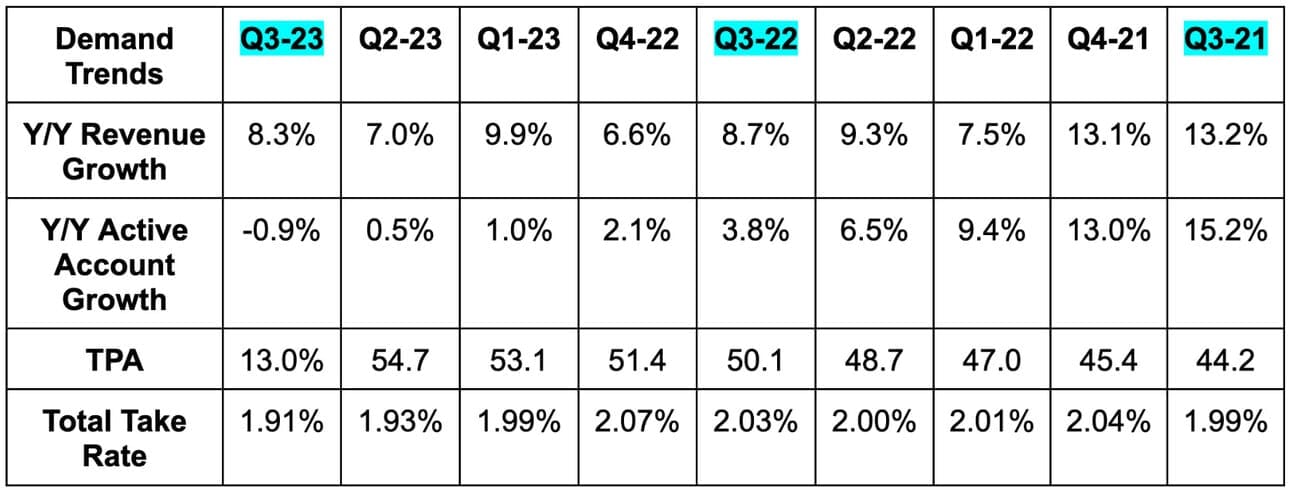

- PayPal beat revenue estimates by 0.5% and beat guidance by 0.2%.

- Transaction revenue rose by 7% Y/Y and other value added service revenue rose by 25% Y/Y. The 25% growth was powered by more interest income via soaring rates.

- Foreign exchange neutral (FXN) revenue growth was a bit over 9% Y/Y.

- Branded volume rose 6% Y/Y FXN vs. 5% Q/Q & 6.5% 2 quarters ago.

- Unbranded volume rose 32% FXN vs. 28% Q/Q & 30% 2 quarters ago.

- International FXN volume growth was 19% Y/Y vs. 14% Y/Y last quarter. U.S. volume growth was around 10% Y/Y.

b. Profitability

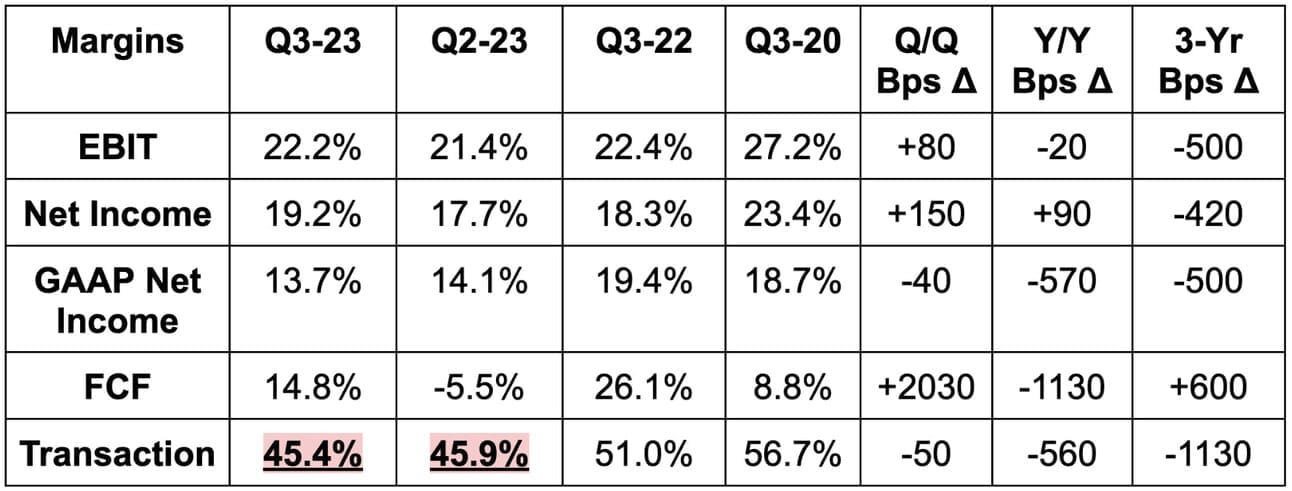

- Beat EBIT estimates by 1.7%.

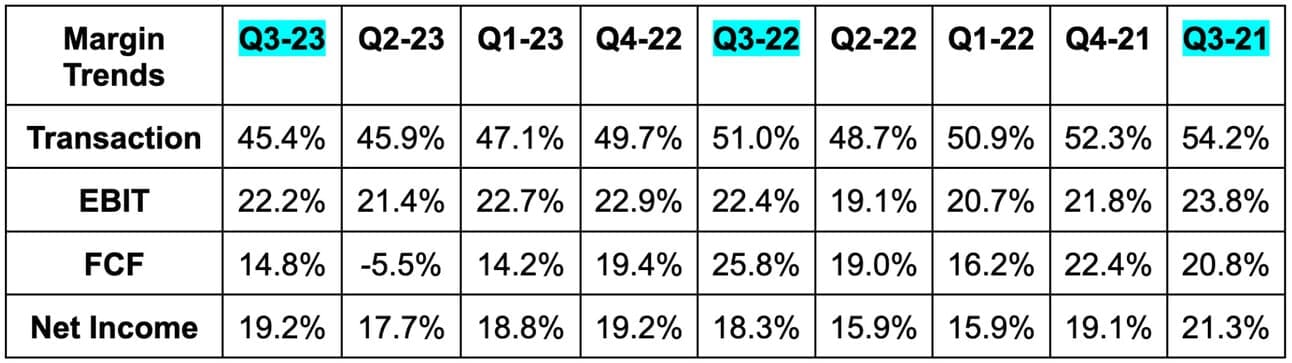

- Beat $1.23 earnings per share (EPS) estimates by $0.07 (same guide). EPS rose 20% Y/Y thanks to non-transaction operating expense cuts. As you can see below, transaction margin fell Q/Q as expected.

- Beat $0.87 GAAP EPS estimates by $0.06 (same guide).

c. Guidance

PayPal’s Q4 guidance was 1.4% light on revenue. This was mainly related to incremental FX headwinds that its currency hedging program can’t entirely eliminate. Its GAAP EPS guide beat $1.02 estimates by $0.18 and its non-GAAP EPS guide missed $1.40 estimates by $0.04 (raised for the full year).

For the full year, it lowered its revenue growth guidance from 8% to 7.5% and lowered FXN growth guidance from 9.5% to 8.5%. It lowered its EBIT margin expansion guidance from 100 bps Y/Y to 75 bps Y/Y. This is due to branded checkout slowing starting in July and through the end of Q3. Imperatively, that slowing stabilized quarter to date with growth in line with the first half of the year. That’s slightly worse than what we were told to expect on the last call. The guidance was called very prudent.

Conversely, it raised its full year EPS guidance from $4.95 to $4.98 thanks to the strong Q3 result. It lowered its FCF guidance from $5 billion to $4.6 billion.

Finally, for transaction dollars, the Q4 Y/Y decline will improve vs. Q3. This means better than -3% Y/Y transaction dollar growth. The margin will again contract Y/Y in Q4. Q4 is expected to represent a transaction dollar growth bottom with that turning positive (along with a resumption of margin expansion) in 2024. This is vital.

d. Balance Sheet

- $11.5 billion in cash & equivalents with another $3.9 billion in investments.

- $10.6 billion in debt.

- Share count fell 5.2% Y/Y via continued rapid buybacks. It will remain “opportunistic” with buybacks.

- It sold Happy Returns to UPS for $465 million in cash proceeds.

The 30% Y/Y decline in FCF is related to its buy now, pay later portfolio sale to KKR. The cash flow hit will be fully offset next quarter following the deal closing. FCF growth would have been 21% Y/Y without the transitory headwind.

e. Call & Release Highlights

Alex Chriss’s Priorities:

This was Alex Chriss’s first quarterly call as CEO of PayPal. Considering this, he spelled out his priorities for the company in detail. He did so while candidly sharing where the old team has done well… and where they’ve struggled. Let’s dig in.

“I speak plainly and transparently. I will not hesitate to call out where we are struggling.” – CEO Alex Chriss

First and foremost, the pace of innovation at PayPal needs to speed up. Considering the slow pace of large merchant onboarding to its latest checkout flow, I fully agree. To him, the firm has all of the assets in place (and then some) to drive profitable growth and strong shareholder returns. To get there, tighter focus on the core and better execution is dearly needed. This is not a matter of needing to seek out exciting new sources for growth. All of those sources are present and obvious. The foundation is strong, the opportunity is massive and the internal performance needs to improve. “It will” according to Chriss.

“We know exactly what needs to be done. We simply must execute.” – CEO Alex Chriss

Cost Base Priorities:

Chriss sees significant opportunity to cut operating expenses further. He thinks the cost base is bloated and redundant to a point of limiting to the firm’s pace of innovation and growth. Several acquisitions that were not properly integrated led to these issues. Cost cuts leading to accelerating growth would be a wonderful thing.

The company’s teams do not share work or communicate well. They operate parallel, redundant infrastructure that must be consolidated. This consolidation, again, will lower costs while also making PayPal better at launching products in a timely fashion.

Chriss is in the process of evaluating the highest return products that PayPal features. He will pull costs away from less appealing opportunities to ensure the firm has the needed financial capacity to invest where needed.

“The cost base remains too high and is slowing us down.” – CEO Alex Chriss

Consumer-Facing Priorities:

From a consumer perspective, Chriss’s priority is to revamp the digital wallet and checkout experiences. Apparently, the refresh conducted under Schulman did not cut it. It has wonderful products like the 3% cash back debit card, the first regulated stable coin and a rewards program used by 25 million consumers. It needs to package these disparate value creators in a more intuitive and obvious fashion to make the utility utterly clear. Today, it’s not clear. Product silos are abundant and interoperability is rare at PayPal. This new experience will fixate on pulling from PayPal’s quality assets to ensure customers get unique value every single time they choose PayPal.

Another key theme of the call was better leveraging the data advantage PayPal enjoys from its massive scale. This will entail more aggressively utilizing all of its merchant and consumer data to make PayPal a more intelligent. Doing so will allow it to improve product discovery, streamline checkout further, offer more affordable access to products, sharpen package tracking tools, market more effective etc. It will help everywhere. The firm has always had this massive data edge, yet hasn’t quite taken advantage. Chriss is determined to take advantage.