1. PayPal Demand

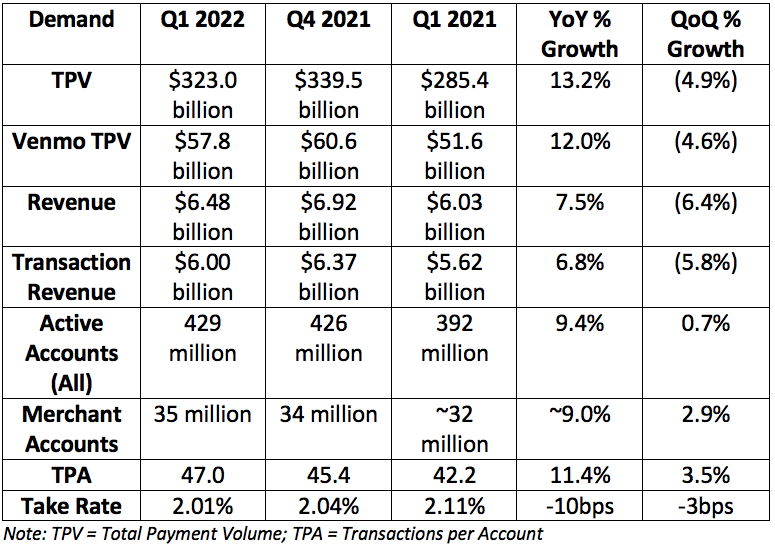

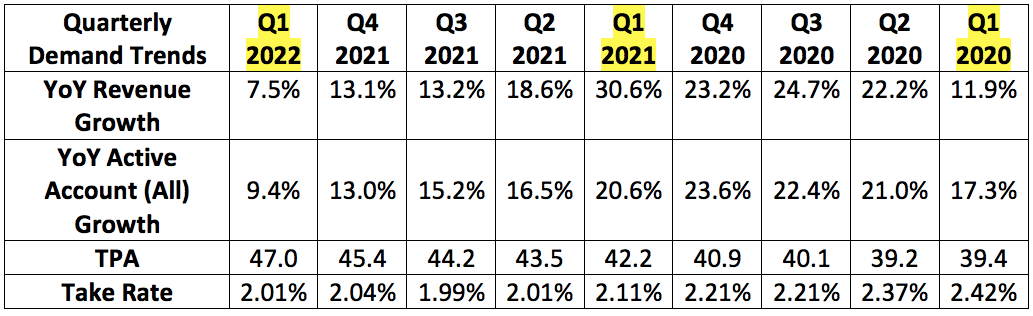

PayPal guided to roughly $6.40 billion in first quarter revenue with analysts expecting $6.41 billion. The company posted $6.48 billion, beating expectations by roughly 1%. This 7% revenue growth metric would have been 15% ex-eBay as PayPal continues to deal with the temporary headwind of eBay shifting to a managed payments system. We will be through this headwind by July of this year.

Ex-eBay spot rate growth:

17% total payments volume growth (13.2% including eBay)

24% total transaction growth (18% including eBay)

Also note that Q1 2021 was PayPal's best quarter, ever. During that period, it grew revenues by nearly 47% on an apples to apples basis as e-commerce adoption exploded higher. PayPal continues to take e-commerce payment marketshare meaning this slowing growth is a factor of macroeconomic turbulence that will eventually fade.

PayPal added 2.4 million net new active accounts during the quarter.

PayPal has been struggling to grow TPA by a double digit % for several quarters. This 11.4% growth was actually closer to 19.0% YoY when normalizing for eBay. To me, this is a clear sign of the super-app journey beginning to bear fruit.

2. PayPal Profitability

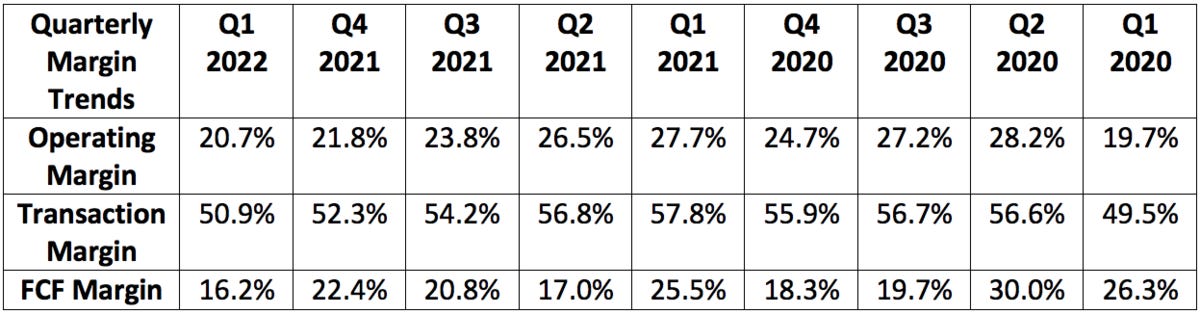

PayPal guided to $0.87 in earnings per share (EPS) with analysts expecting $0.88. It posted roughly in-line results of $0.88. This result is in light of $0.36 in headwinds via eBay, higher taxes, lapping credit reserves and ending Russian operations. Without these obstacles, PayPal would have earned $1.24 per share vs. $1.22 YoY. Keep in mind that we are comping vs. a historically great PayPal Q1 2021 in which its EPS growth was over 80% YoY.

More exogenous factors weighing on margins:

Cross Border volume as a % of total company TPV vs. 14% vs. 17% YoY in light of supply chain headaches and geopolitical tension. It collects higher fees on cross border sales due to its currency conversion service.

A shift back to credit from debit (post-stimulus checks) raised transaction expenses.

This prompted volume-based expenses to jump back from 42% of sales to 49% of sales YoY.

Transaction margin is also being impacted by PayPal's rapidly growing Bill Pay product which comes with a lower take rate.

eBay was higher margin business than the rest of its operations.

The aforementioned lapping of credit reserve releases propping up Q1 2021 net income.

Also note that free cash flow contraction was predominately an unfavorable shift in working capital.

PayPal bought back $1.5 billion in stock year to date -- a notably accelerated pace vs. previous quarters.

3. Guidance

Q2 2022:

Analysts were looking for $7.09 billion in sales. PayPal guided to $6.8 billion, missing expectations by 4.1%.

Analysts were looking for $1.11 in EPS. PayPal guided to $0.86, missing expectations by $0.25.

2022:

Revenue growth of 12% at the midpoint vs. 16% previously expected.

EPS of $3.87 at the midpoint vs. $4.67 previously.

This is via a flow-through of previously mentioned demand headwinds.

"Over $5 billion" in free cash vs. $6 billion previously.

10 million net new active accounts vs. 15-20 million previously.

14% spot rate TPV growth (16% FX neutral) vs. 20.5% spot rate TPV growth (22% FX neutral) previously.

4. Investor Letter Highlights

Happy Returns (PayPal’s omni-channel returns program):

Doubled merchant adoption from 2020 to 2021

Includes wins like Levi’s, Revolve, GymShark and more.

Available to all PayPal merchants at no added cost.

In person returns through happy were up 4X YoY.

Revolve case study (Shout out):

Revolve added checkout with Venmo and PayPal and Braintree processing.

Revolve is now using Zettle terminals to offer Venmo QR/Debit/Credit at Revolve’s live events (Braintree exclusive processor).

Braintree:

Braintree's unbranded processing continued to rapidly grow at a rate of 61% YoY as clients like Airbnb, Tiktok and Uber grow their operations. Braintree is the exclusive unbranded processor for most of its larger clients.

5. CEO Dan Schulman Conference Call Notes

On lowered 2022 guidance and Macro:

"Shareholders expect more from us than our track record over the last few quarters. I take full responsibility. Navigating through this macro-environment has made visibility more challenging. But we need to do better and we will deliver on our commitments.” — CEO Dan Schulman

Geopolitical tension continues to weigh on its international results. For context, domestic volumes rose 20% YoY while international shrank 5% YoY. China and the United Kingdom continue to be "very challenging macroeconomic markets" for PayPal.

The company's 2022 guidance contemplated that "macro would improve" throughout the period. Its updated guidance now assumes that macro will worsen further throughout 2022. It seems that management got too excited with its forward outlook and I appreciate the level-setting of expectations to now provide upside risk to the guide rather than downside risk. Leadership was sure to make clear exactly how conservative it saw its new 2022 guide as being. This reminds me of GoodRx's Q4 2021.

“Make no mistake that we have strong conviction in our business’s growth potential and the creation of shareholder value. We will continue to grow faster than the rate of e-commerce. We now recognize the need to level set expectations in a dynamic environment.” — CEO Dan Schulman

“It’s been a tough few quarters to accurately forecast our business. I will say that over the last 5 years, we’ve consistently gained market share which was true in Q1. We need to re-think our philosophy around forecasting. There’s also a lot to be done to streamline operations further, but we’re beginning to make good progress with some metric green shoots. — CEO Dan Schulman

“At some point, these macro trends will again turn. When that happens is unclear so we’ll continue to invest in seizing those opportunities and to ensure we continue to grow in excess of e-commerce so when we do get positive change we’ll be prime beneficiaries. — CEO Dan Schulman

On BNPL:

"Continue to see persistent market share gains."

$3.6 billion in BNPL TPV rose 256% YoY (small base).

Over 80% of these transactions are done via debit meaning as this becomes a larger piece of total volume, transaction margin will benefit.

"We increased upstream presentment merchant penetration."

Venmo:

Despite volumes growing just 12% YoY due to extremely tough comps, revenue grew 60% YoY as monetization continued to dramatically accelerate.

Venmo now has over 85 million accounts vs. 83 million QoQ.

Set to launch Pay with Venmo on Amazon later this year.

PayPal reiterated its 50%+ revenue growth guidance for Venmo. Good news.

On the Digital Wallet:

PayPal's re-vamped wallet is now downloaded by over 50% of its total user base. These users:

Transact 25% more frequently.

Deliver double the average revenue.

Churn 25% less frequently.

On Competition:

“Checkout is a hard business. You’ve got to be able to scale it with perfection. Retailers depend completely on a checkout provider for sales. Our brand trust, track record and fraud/risk capabilities set us apart." — CEO Dan Schulman

PayPal can approve 6 more transactions per 100 with its checkout methodology vs. the average alternative. This is thanks to the massive amount of vaulted data PayPal has on all of its consumers. 6 is a large, large number.

60% of consumers select PayPal's digital wallet as their top choice for an online transaction with the next closest digital wallet at 8%.

PayPal customers are 2X more likely to shop when a PayPal button is visible.

On Partners:

PayPal renewed intimate partnerships with Citi Bank and American Express during the quarter.

M&A:

"Transformative acquisitions are not on our agenda at this time." (love to hear it) — CEO Dan Schulman

6. My take

In my mind, two things are true: this performance was underwhelming and my long term thesis remains firmly in-tact. The key here is that it continues to take e-commerce market share and find meaningful traction with new products to raise engagement and reduce churn. This is direct evidence of the weak results being a factor of a worsening macroeconomic backdrop vs. intensifying competition or a diminishing value proposition. There are a plethora of exogenous challenges (not just eBay) trying to hold down PayPal's structural long term momentum -- when these challenges eventually abate, I think PayPal will be poised to take full advantage.