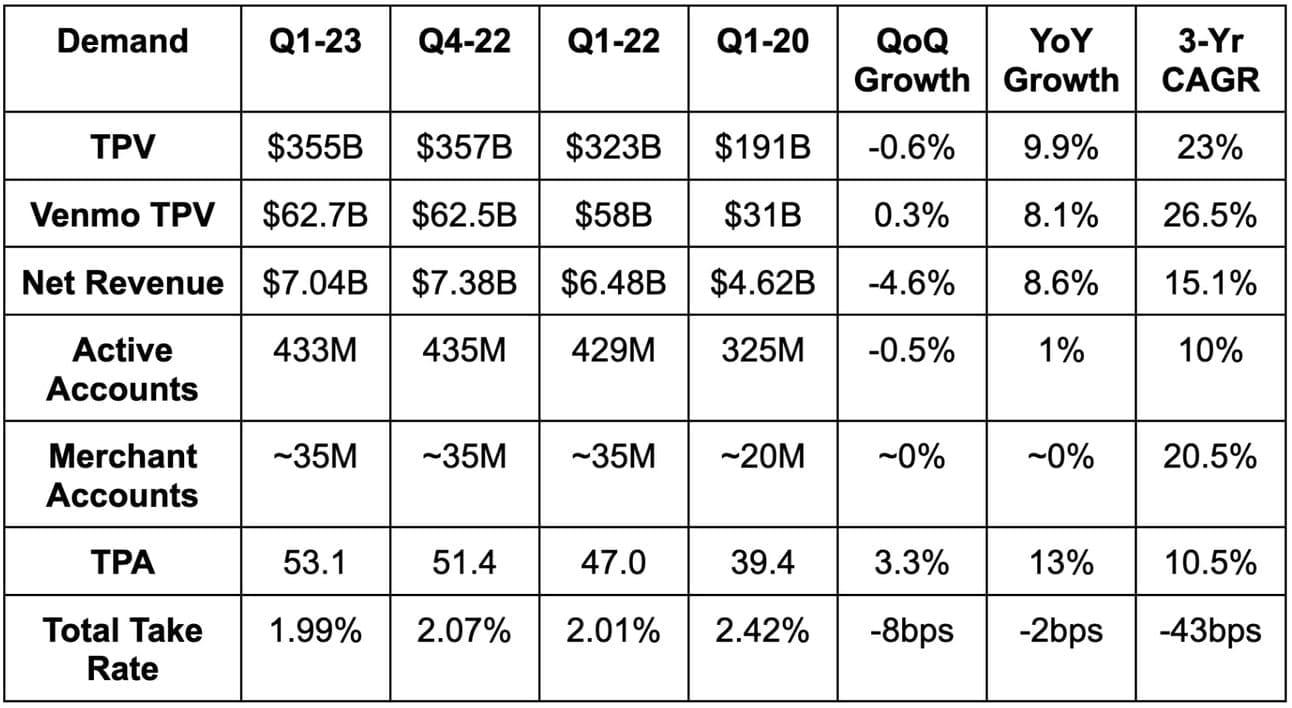

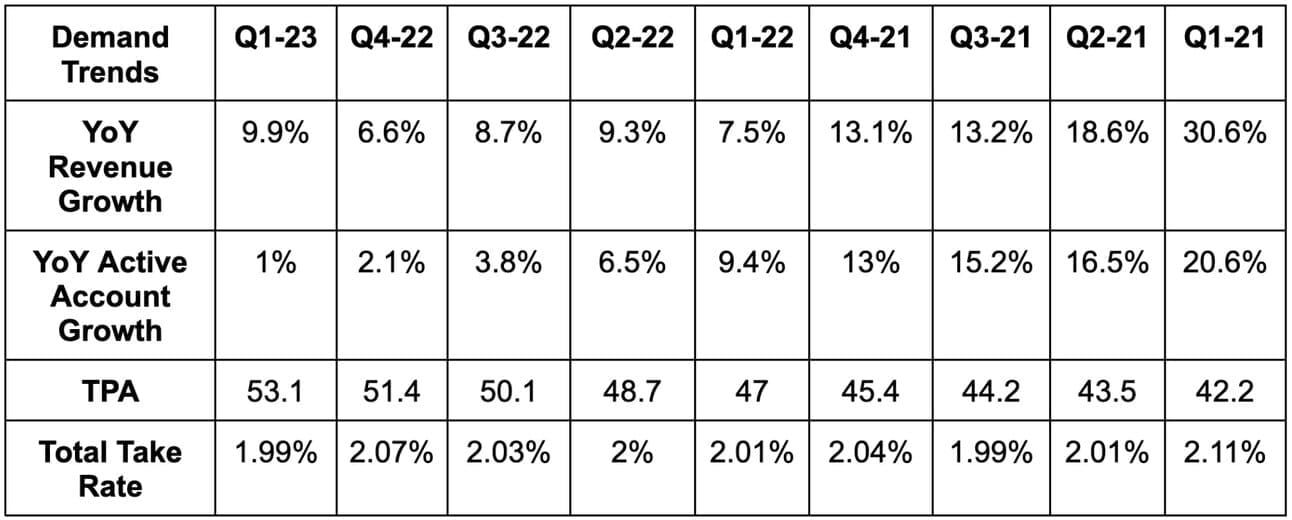

1. Demand

Revenue beat estimates by 0.7% and beat PayPal’s guide by 1%.

Demand Context:

- The 3-year revenue CAGR is 20% when excluding the impact from eBays’s migration.

- Revenue rose 10.4% YoY on an FX neutral (FXN) basis as currency headwinds continue to ease. This was vs. internal guidance calling for about 9% growth.

- Both branded and non-branded volume growth accelerated meaningfully from Q4.

- Venmo revenue rose double digits YoY despite some of its toughest comps ever. Volume growth for Venmo accelerated over 500 bps vs. last quarter.

- U.S. revenue rose 13% YoY and international rose 3% YoY (7% FX neutral).

- U.S. revenue is 59% of total vs. 57% of total YoY.

- Transaction revenue fell 5% QoQ and rose 6% YoY.

- Other value add services fell 1% QoQ and rose 39% YoY.

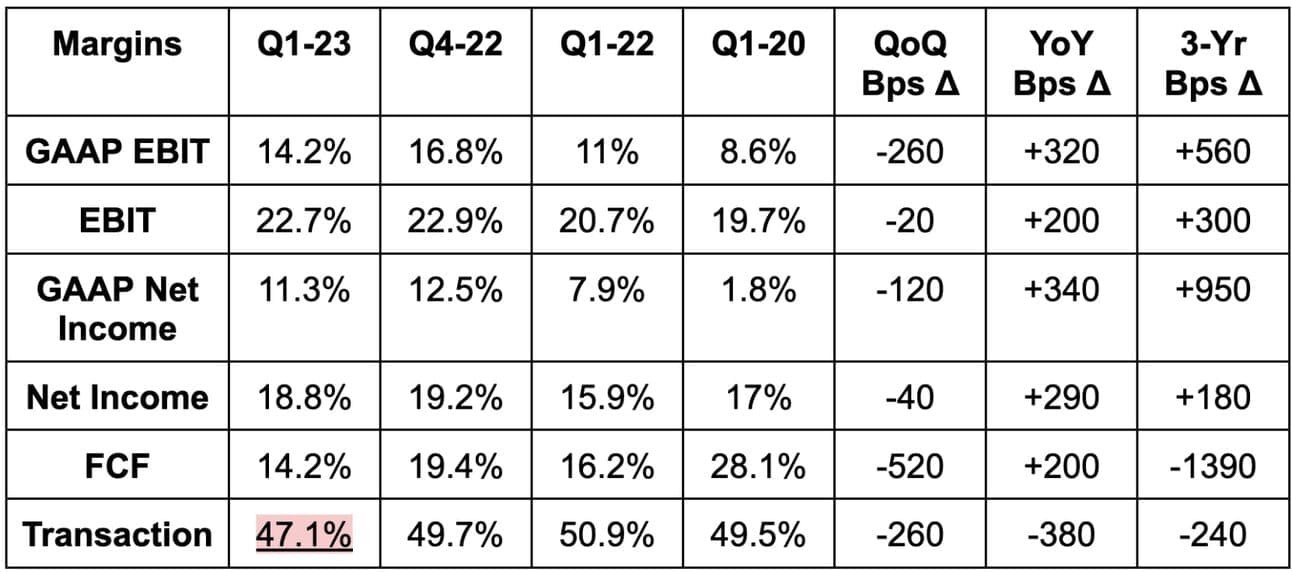

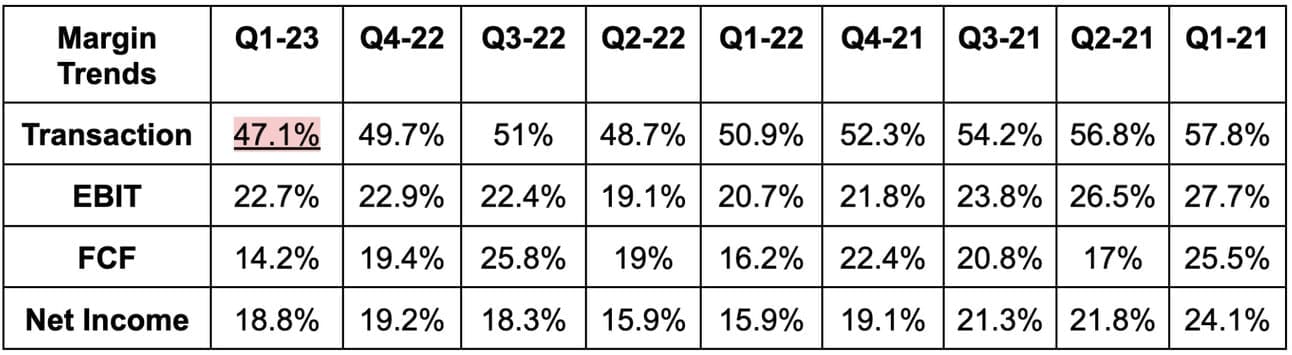

2. Margins

- EBIT beat estimates by 4.6% and beat PayPal’s guidance by 4.6% as well.

- EPS of $1.10 beat estimates by $0.07 and its guide by $0.08.

- GAAP EPS beat estimates by $0.03 and its guide by $0.07.

- Free cash flow missed expectations due to a unique item discussed below.

Margin Context:

Transaction margin is being pressured by non-branded Braintree revenue growth far exceeding the company’s expectations. This is also pressuring transaction take rate (1.80% vs. 1.85% YoY) and the company’s other margin lines. The negative trend is being temporarily amplified by it sunsetting PayPal white-label service to move those clients to PayPal Commerce Platform (PPCP). Pressure is expected to continue for a few quarters with transaction margin bottoming thereafter. PayPal is actively working on the margin profile here via the following objectives:

- PPCP debuting for smaller merchants with lower volumes and so higher margins.

- PPCP being integrated into PayPal’s largest selling channel partners to facilitate efficient growth.

- Expanding globally. Cross-border transactions carry a higher margin profile due to added complexity and FX services.

- Adding more value add services on top of the platform like risk as a service, open orchestration and Hyperwallet payouts. Hyperwallet is especially attractive to giant marketplaces needing to pay sellers in as flexible and expedient of a way as possible. That’s why Braintree has won Airbnb and Uber as clients recently (among many others).

Importantly, PayPal’s non-transaction operating expenses are being cut (fell 12% YoY) to counteract this pressure. That’s why EBIT and net income expanded meaningfully and why EBIT growth was faster than it has been in 2 years. Recovering cross-border volumes also helped here with YoY growth turning positive this quarter for the first time in a while.

Other headwinds that dampened the level of margin expansion in the period include:

- The continued normalization of credit usage following the stimulus-era debit shock.

- Lapping the start of the company’s most meaningful cost control objectives.

Somewhat notably, AI was a key theme of the call. CEO Dan Schulman sees generative AI as feeding more cost savings efforts over the next several quarters.