1. The Holdings

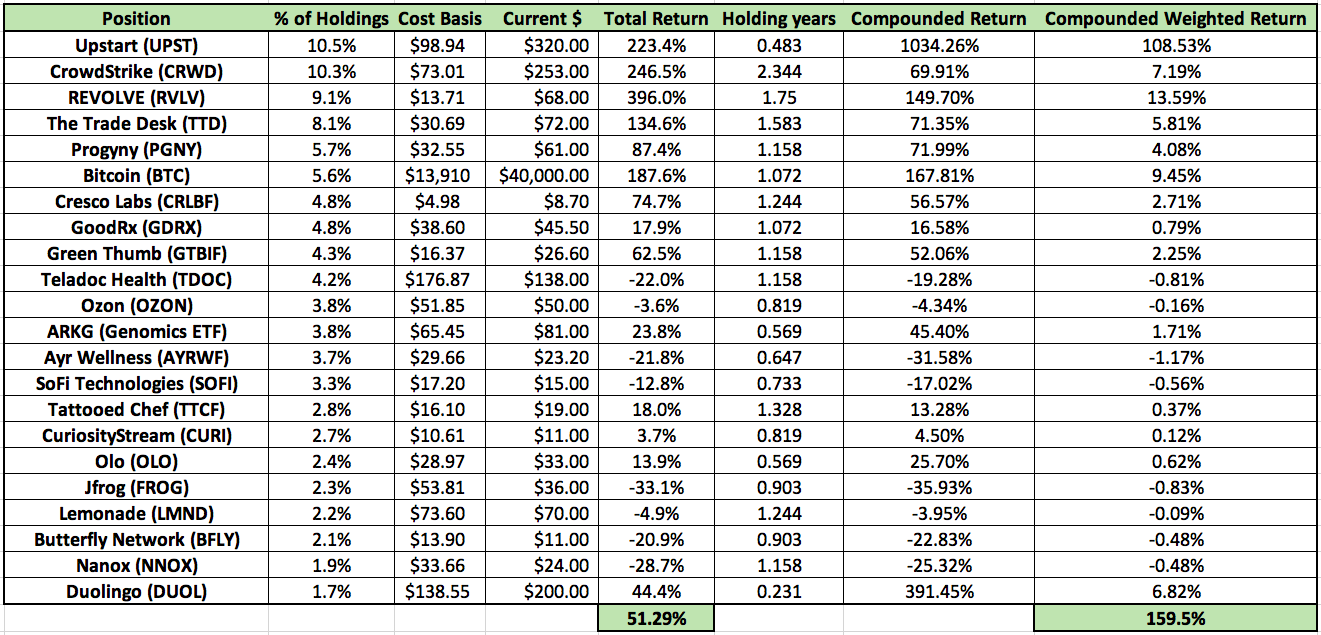

a. High Growth Disruptor Portfolio

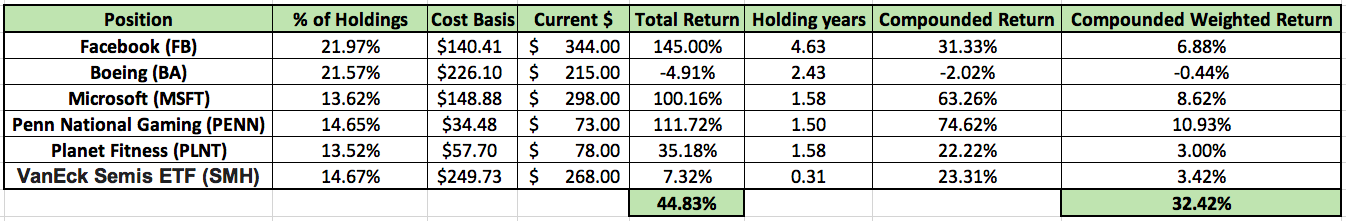

b. Mature Value Portfolio

c. Summary

The 81% from “all equity” represents the total ownership from both equity portfolios depicted above. I consider my 15.9% cash position available for accumulating shares in both of my equity buckets. It is not split into different groups but accounted for as one cash position.

2. Summing Up Earnings Season

Another earnings season has now come and gone. Detailed commentary on all 25 reports can be found on my Substack feed. After reading through the reports of all 25 positions, here are the key takeaways:

a. The Stand Out

Upstart delivered a remarkable beat and raise in every metric imaginable — just like it did in its previous two quarterly reports. Click here for my overview of the results. All three quarters since Upstart went public have been phenomenal.

To put things into perspective, in this quarter Upstart earned in profit what analysts were expecting for the entire year and raised its 2021 revenue outlook by another 25%. When it went public, expectations were for the company to generate roughly $350 million in 2021 revenue — it now expects $750 million. Go team Upstart.

b. The Good

The following companies modestly exceeded expectations while also raising guidance:

High growth disruptor portfolio:

CrowdStrike

SoFi Technologies (maintained revenue guidance despite an unforeseen $52 million headwind)

The Trade Desk

REVOLVE

Ayr Wellness

Teladoc Health

Ozon

Olo

Lemonade

JFrog

Mature value portfolio:

Facebook

Microsoft

c. The Fine

The following companies reported results that exceeded expectations but offered no further material guidance raises:

High growth disruptor portfolio:

Green Thumb

Cresco Labs

GoodRx

Teladoc Health

Butterfly Network

CuriosityStream

Mature value portfolio:

Penn National Gaming

d. The bad

Tattooed Chef reduced its margin outlook and missed revenue forecasts. In its 3 quarters since going public, 2 out of the 3 reports have been bad. I have paused adding to the Tattooed Chef position until performance improves. I have not sold any shares.

Progyny reduced its revenue and profit outlook due to what it’s calling a “sector-wide anomaly” in utilization rate. It has already seen this metric make meaningful progress towards normalization. Still, a guidance reduction is never good.

e. The rest

Nanox is pre-revenue so has no expectations to meet. It didn’t announce any new production or distribution setbacks which was really all I was looking for. Chairman/Founder Ran Poliakine stepped down as CEO and will stay on as Chairman — something I had been hoping for.

Duolingo’s first public quarter was in line with expectations. The period featured an extremely difficult year over year comparison due to the pandemic and it still posted 47% revenue growth. It will be interesting to see what kind of impact China banning all for-profit education apps has on Duolingo’s business. The company has not mentioned it at all in any of its recent events.

Planet Fitness posted results that were largely as expected. Its revenue guidance for 2021 came in a touch under analyst forecasts but it had not yet offered annual guidance until this report. Considering how damaging the pandemic has been to its industry, I found it encouraging to see guidance established around where I was expecting it to be.

3. A Note on my Plan Going Forward

I frequently reiterate in my writing that I do not pass up on companies I’m passionate about owning because I perceive them as too expensive. When a company is particularly expensive — however — I make a smaller initial purchase and wait for more stock price pain than I normally would to begin slowly accumulating.

Here is the list of the companies I consider to be in that grouping:

Lemonade

Olo

Duolingo

I pause adding to names that are fundamentally underperforming to give the companies a chance to right the ship — I call this being on the hot seat like a coach in jeopardy of losing their job. If poor execution endures, I sell the position.

Here is the list of the companies I consider to be on the hot seat:

Tattooed Chef

Nanox

For more mature names in my portfolio, I usually reach a point where I consider my position full. At that time I stop accumulating shares into stock price pain and simply hold.

Here is the list of positions I consider to be full:

Boeing

Microsoft

Planet Fitness

Thank you for reading!

Admire your approach to investing, all the best Brad!

Congratulations on the great returns and thank you so much for sharing openly.

I have a question about the compounded weighted return. What is your intention when calculating it? I see you are use current value for each position as weight, what that would tell is what is the return that you will get in the future if you continue having in the future the same compounded return as you had in the past for each stock.

Would it make sense, though, to understand aggregated returns, to use invested amount for each position as the weight?