Introduction:

Fertility treatment coverage in the USA is broken. Sky-high costs, little guidance and poor outcomes are just a few of the realities plaguing this portion of healthcare. Progyny (PGNY) is a fertility benefits company born to remedy this stubbornly undesirable situation.

The organization began its journey in 2008 as “Fertility Authority” when it was founded by Gina Bartasi. 7 years later, Fertility Authority merged with Auxogyn (a fertility technology company) to create Progyny. Following the complete integration of the two companies, Bartasi stepped down with David Schlanger — the current CEO — replacing her.

Today, the company serves as the fertility benefits manager for large enterprises across the United States and has found notable success in doing so. This article will offer a detailed overview of Progyny’s industry, operations and prospects including:

The Issues with Fertility Treatment

Progyny’s Solutions

Quantifying Progyny’s Impact

Progyny’s Pre-Tax Edge

Progyny’s Reach and Market

The Business Model and Sales Cycle

What’s Next? (Optionality)

Management and Ownership

Financial Performance and Outlook

Balance Sheet

Risks

The Competitive Landscape

Valuation Table

My Approach

I also interviewed a Progyny Vice President as part of my research. The conversation was fascinating and quotes and insight from the talk are incorporated throughout the piece.

1. The Issues with Fertility Treatment

a. Fertility Coverage Issues

Despite infertility impacting 1 out of 8 couples in the United States today, the American Medical Association did not recognize it as a disease until 4 years ago. As a result, infertility insurance is extremely sporadic throughout the USA. Just 19 states have infertility insurance laws requiring some form of coverage, with 5 states having specific legislation pertaining to in vitro fertilization (IVF).

When private insurers do provide some form of fertility coverage, it’s usually inadequate, outdated and incomplete. How so?

Health insurance carriers (also known as managed care providers) commonly use “limited lifetime dollar maximums” which place a ceiling on how much fertility treatment coverage an insured individual has. This approach designed to cut cost by limiting utilization is embraced — in some form — by 88% of managed care providers according to survey data recently published by Mercer. The philosophy innately places cost over safety and outcome on the list of carrier priorities.

Furthermore, the maximums philosophy also leads to insurers fundamentally handcuffing fertility specialists via mandating step-therapy protocols to try and limit cost. No two people are identical — and their fertility treatment plans shouldn’t be either. This objective often precludes specialists from using the best treatment methods and technologies.

The median coverage of these maximums is $16,250 — roughly 25% of the average cost of a complete round of fertility treatment according to the Journal of American Medical Association (JAMA). The effect is that fertility programs are often halted in the middle of a course of treatment. This means that the $16,250 in cost is wasted for employers while employees realize poor outcomes.

Common mandated step-therapy protocol example: Insurers often require a member to undergo multiple cycles of intrauterine insemination (IUI). This comes with a 5-15% success rate and costs $4,000 each time (with a $16,250 average budget). There is rarely genetic testing done to determine if this is the correct course of action. IUIs also must be spaced out over several months and these protocols do not take into account a women’s biological clock. This resembles a guessing game and wastes precious time for many.

The pressure that maximums place on a mother needing to get pregnant on time and on budget inherently fosters poor choices. For example, IVF treatments are often selected without any preimplantation genetic testing conducted. The result of this is a sky-high miscarriage rate and therefore longer workplace absences, distressed employees, and a larger economic burden on the employer and insurer.

Another common problem stemming from dollar maximums is that patients often elect for multiple embryo transfers when undergoing an IVF treatment — thinking this boosts their odds of pregnancy. This has little impact on pregnancy odds and instead often leads to mothers who do get pregnant having twins, triplets and/or pre-term births. The increased odds of both multiple births and early births greatly raises the probability of health complications for the mother and the child and is a leading cause of neonatal intensive care unit (NICU) costs.

For context, according to the American Journal of Obstetrics and Gynecology, the mean cost of a single birth over the last 5 years was $36,000 compared to $153,000 for twins and $577,000 for triplets. Furthermore, pre-term births ALONE cost the United States $40 billion per year. Private employers often bear the bulk of these expenses in the form of higher employee coverage costs.

The reality of this situation is frustratingly ironic. The insurance carriers and employers fixated on minimizing cost rather than maximizing utility end up with higher costs incurred anyway. Higher costs & poor outcomes — not great. When instead focusing on happier, healthier mothers experiencing safer pregnancies, the costs naturally fall anyway.

b. Fertility Medication Issues

Adhering to fertility medication schedules is a dauntingly complex process. The mandated step-therapy protocol philosophy means a one-sized-fits-all approach to fertility vitamins and other prescriptions when each person’s needs are intrinsically unique. There’s also a several step authorization process because these medications are administered via specialty pharmacies and involve numerous parties in the fulfillment process.

This red tape delays the delivery of a vital scripts by 1-2 weeks on average. The timing of consuming a pill could make all the difference in the world for a woman getting pregnant — time consuming authorization jeopardizes that imperative schedule.

The medication issues only continue. There is little to no reliable literature on how to actually store or consume a given prescription. Some of these medications require very specific storage temperatures with others being injectable and thus somewhat difficult to administer. Despite these being two vital variables in the pregnancy equation, women are often left alone with adhering to medication schedules.

c. Fertility Specialist Issues

Yet another issue with this field is the lack of uniform access to high quality fertility specialists. A large portion of treatment seekers are left mainly on their own to research and grade doctors. Virtually none of us are experts in this field, yet the we are often required to know how to qualitatively analyze one potential specialist vs. another. Good luck.

Furthermore, insurance plans come with pre-set networks of healthcare practitioners; these networks don’t always include the most-preferred option of an individual patient — even if they have one. Finally, in the field of fertility especially, the specialists perceived to be the best are globally coveted by perspective mothers. Hefty demand for a select group of professionals makes appointment availability a logistical nightmare.

We also have to remember that fertility specialists and clinics are judged on their track record of outcomes. Because the fertility treatment status-quo offers a damaging headwind for those outcomes, the shortcomings of legacy coverage has a profoundly negative influence on a specialist’s business.

The culmination of all of these issues is a lose-lose-lose situation. Employers spend more on NICU costs due to poor treatment plans while suffering from discouraged and absent employees. Mothers find less success (and more danger) on their fertility and family planning journey. Fertility specialists aren’t able to maximize their success rates and therefore the reputation of their practice.

If this sounds like a frustrating reality, that’s because it is. The common practices in fertility treatment are simply not good enough. Thankfully, Progyny brought a disruptive solution to the market to turn that lose-lose-lose into a win-win-win.

2. Progyny’s Solutions

Progyny’s fix to the plethora of issues that the fertility industry faces is inherently business to business (b2b) in nature. It contracts with large enterprises and integrates its benefits into their existing employee coverage plans. These employees are referred to as “Covered Lives”.

Progyny’s benefits take the form of 2 core product offerings:

a. Fertility Benefits Solution

Progyny’s fertility benefits solution was launched 6 years ago as its first commercial product. The offering was developed from listening to a network of large enterprises consistently voice complaints about the shortcomings of existing fertility solutions. Progyny made it its mission to solve those pain points, and this product is the result.

How Patients win:

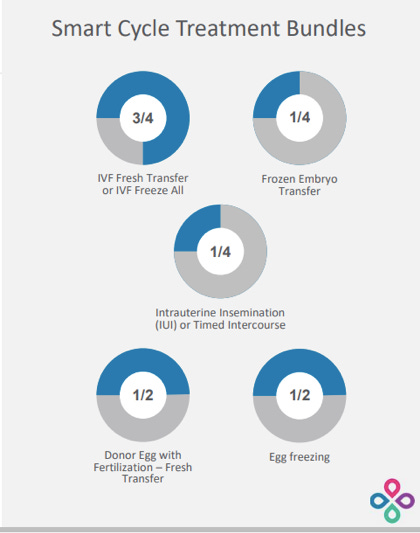

At the center of Progyny’s fertility benefits product is what it calls “Smart Cycles” — its take on assisted reproductive treatment (ART) cycles. Rather than mandating certain treatment practices be used, Progyny has created 19 different smart cycle bundles that can be mixed and matched to ensure the most customizable plans in the industry today. Progyny’s clients purchase 2-3 cycle units per employee on average.

These Smart Cycles include everything a perspective mother could possible want: diagnostic testing, access to the latest and greatest technologies, genetic testing for IVF and so much more. To ensure Progyny’s Smart Cycles are optimized for efficacy, the company’s advisory board — made up of world-renowned professionals in the industry — constantly reviews and upgrades the bundle options based on industry innovations.

No longer will a mother be required to go through IUIs or a blind IVF but instead will be able to select a personal plan from Progyny’s vast treatment options based on ideal timing and needs. Progyny does provide extensive educational resources to teach the patient and to steer them towards the best option. Ultimately however, it’s always up to that patient to decide which bundle to select.

Imperatively, there are also are no dollar maximums applied to these Smart Cycles. Instead, full unit values are assigned to complete treatment courses with a patient always covered for the entire unit’s cost. This means a person will not run out of funding in the middle of their treatment, but will instead be able to see it through to the end.

Below are some examples from Progyny’s most recent investor presentation of how its members can customize Smart Cycle units:

Progyny’s refreshing approach fosters superior outcomes as patient treatment paths are crafted for the best efficacy — not the remaining coverage availability. For evidence of this, Progyny’s treatment approach has all but eliminated the multiple birth scenario. It’s now clear that this former expectation stemmed from financial pressure forcing patients into less-than-ideal treatment plans. With Progyny, the treated multiple birth rate is roughly the same as it is with natural pregnancy.

Multiple birth scenario/expectation: The previous assumption that fertility treatment heightens the odds of having multiple births.

Progyny collects all of the relevant data that its clinic network generates and the company then uses this data for its own constant improvement. A data driven approach vs. a guess and hope approach wins every time; according to CEO David Schlanger, no other competing program collects practice and outcome data in nearly as detailed a way as Progyny does. If its competitors are falling short (and they are), they likely don’t even know it.

Progyny does not expect consumers to be able to pick and adhere to the perfect fertility plan on their own. I already covered the educational resources it provides, but the company goes further in helping its patients. How? Progyny employs a team of Patient Care Advocates (PCAs) to provide administrative, strategic and emotional support every single step of the way. These PCAs communicate with each patient an average of 15 times per course of treatment which compares to 1 time per course of treatment for alternatives.

A PCA will help a member pick the best specialist, select the perfect Smart Cycle combination, schedule appointments, order prescriptions and answer any questions a person may have. With no dollar maximums to consider, these PCAs are free of any conflict of interest and can focus wholeheartedly on the best outcomes for their patients. It’s a true relationship and because PCAs are entrusted with so much responsibility, Progyny is quite selective in who it will hire to this position.

“We have babies named after our PCAs and you can’t find that elsewhere in our industry.” — CEO David Schlanger

Progyny’s PCAs come from fields like fertility, nursing, social work, psychology and endocrinology and boast years of relevant experience. Each PCA is also put through a training program before they can communicate with their first patient — all of this to guarantee Progyny’s consumers have the best experience possible. Generally speaking, the company’s hands-on, supportive approach also works to reduce the stress levels of hopeful mothers pursuing treatment. According to countless medical journals, there is a materially negative correlation between higher stress levels and higher rates of pregnancy.

How Participating Fertility Specialists Win:

Not only are the treatment plans superior and PCAs a wonderfully trusted ally, but Progyny also opens members up to its world-renowned network of fertility specialists. It calls this its “Center of Excellence.” The company’s network features 900 total specialists and 650 clinics across the United States including 46 out of the top 50 clinics in the nation. This makes confidently scheduling an appointment with an elite care provider an easier task — especially because a PCA does it for us.

Unsurprisingly, Progyny is extremely selective with the specialists it allows to enter its exclusive network. According to CEO David Schlanger, “providers consider it a privilege to be part of our network” which has allowed Progyny to aggregate a vast group of talented industry experts.

“When we started out 5 years ago, we had to beg doctors to be involved. Now doctors are begging us.” — CEO David Schlanger

Progyny boosts volumes for these participating clinics thanks to opening them up to its growing list of clients and members (covered below). It also improves its network’s overall treatment efficacy by providing the clinics with adequately covered patients. Because these patients can select the best treatment plan and always see it through to the end, Progyny frees its network of specialists to be at its best.

“Doctors don’t view us in the same boat that they view large commercial carriers and think working with us is easier and more beneficial to their practices.” — CEO David Schlanger

To add to the utility Progyny provides, the company eliminates administrative bloat and risk for its clinics and specialists. How? By paying them for the full value of the treatment directly. This means clinics have a far lower bad debt expense arising from consumers defaulting on expensive treatments.

Unlike its competition, Progyny requires its clinics to share any and all data they have on treatment selections and outcomes — as I briefly mentioned above. Each quarter, Progyny uses all of this feedback to send out report cards depicting each specialist’s results while also publishing the results of its top performing clinics. This not only creates a healthy sense of competition but allows Progyny to keep track of underperforming clinics and to remove those not meeting the company’s high standards. Inevitably, it leads to the sharing of best practices to raise the level of care across the entire network. All of this data aggregation and sharing is always done in a fully HIPPAA compliant manner.

The company signs 1-2 year contracts with each participating clinic and annual renewal contracts are signed thereafter.

How Employers win:

The better patient outcomes Progyny creates also lowers operating costs for employers. By offering more personalized, appropriate and effective treatment, employers are able to reduce the amount of fertility programs they will actually have to fund.

To begin to quantify this edge, Progyny’s pregnancy rate per IVF transfer is 61.4% vs. 53% for the national average. This translates into an average of 1.63 IVF treatments per Progyny member vs. 1.88 for the USA as a whole. Considering IVF costs roughly $12,000 per round, this leads to savings of $3,000 per employee electing to use IVF treatments. That $3,000 adds up very quickly for the large enterprises Progyny services.

Progyny patients also have multiple births at a rate of just 2.8% vs. 9.9% for the national treated average. Based on twins costing 5x that of a single birth (and triplets nearly 20x), this represents a substantial additional cost reduction as well. These are just two of many areas for cost savings that employers enjoy. Broadly speaking, these large enterprises save on a portion of the tens of billions of dollars spent on annual NICU costs.

Again, when employers focus on fertility coverage efficacy rather than cutting costs, the costs magically fall anyway. Based on the most common hesitation with adding fertility coverage being incremental costs, this is important.

Beyond cost savings, employers enjoy more productive and happy labor forces. Shorter time to pregnancy reduces the emotional burden this process inherently takes on parents and allows them to return to work much more expediently. Superior treatment plans serve as a powerful recruiting tool for employers trying to win over new talent. Based on our nation’s extremely tight labor force at the moment, this adds yet another layer of value for Progyny’s customers.

Along these lines, Progyny often cites a network effect emanating from its operations. Once one large player in a given sector purchases Progyny’s offerings, it generally puts pressure on competing employers to do so to most effectively compete for new hires.

More loyal, productive, healthy and talented labor forces plus lower expenses makes it increasingly difficult for clients not to go with Progyny’s offering.

b. Progyny Rx solution

Progyny also offers a prescription benefits plan — called Progyny Rx — for its members to save on drugs throughout their fertility treatment. This product blossomed from listening to frustrations expressed by enterprises such as difficulty with accessing fertility drugs in a timely manner for their employees. As a reminder, these drugs require a strict schedule and precise administering techniques based on a mother’s finite window of fertility. Perfect timing is of the essence.

So how does Progyny Rx help?

First — similarly to a traditional pharmacy benefits manager (PBM) — Progyny Rx leans on extensive drug manufacturer relationships to save users and employers 20% on fertility drug unit costs. It also generates another 8% in savings for employers from “waste management savings” via common overprescribing issues with legacy solutions.

Progyny Rx uses its broad relationships to cut through a large chunk of red tape and get prescriptions to patients more expediently. As a reminder, these fertility prescriptions are not fulfilled by typical pharmacies but specialty pharmacies which leads to complex authorization and people not getting medications for 1-2 weeks on average. Typical pharmacies are simply not designed to meet the time-sensitive needs of administering fertility medications.

Progyny leverages its industry relationships to cut that 1-2 weeks down to 2 days and even includes a delivery service for all members to boost convenience and thus adherence. The company also provides extensive educational resources (in addition to its PCAs) to ensure all questions about pharmaceutical usage are answered; Progyny Rx’s mission is to ensure medications are taken in the most effective way possible.

This program has only been around since 2018 yet has already been adopted by 73% of Progyny’s clients with 84% of new customers purchasing it in 2020. Just like the fertility benefits product, Progyny Rx is generating lower costs and better outcomes for all associated parties.

c. More Pieces of Progyny’s Value

Employers using Progyny’s services get a clear edge with regard to Environmental, Social and Governance (ESG) claims. While many legacy fertility coverage offerings prevent the LGBTQ+ and single mother by choice communities from accessing appropriate treatment, Progyny does not. It also offers a surrogacy and adoption reimbursement program to guarantee that future mothers needing alternative options have the financial backing to do so.

Finally, Progyny’s member portal functions as a centralized platform for patients to review coverage, study benefits options, track claim details and keep up on account balances. Transparency is of the utmost importance for Progyny. No matter who you are, where you come from or how you choose to live — Progyny has you covered.

This company is finally creating incremental flexibility, access and peace of mind in an antiquated space desperately needing a reset.

d. Summarizing the Triple-Pronged Value Proposition:

For Progyny’s Members:

Safer, faster pregnancy.

A dedicated PCA for emotional support.

Vast educational resources.

Less career disruption.

Prescription savings.

For Progyny’s Network of Specialists:

More volume.

Better efficacy due to broad treatment flexibility and full coverage.

An ability to measure results vs. other clinics.

For Progyny Clients:

Less fertility treatment due to higher efficacy.

Lower NICU costs powered by superior safety.

Healthier, happier and more loyal workforces.

Prescription savings.

More competitive in recruiting new talent.

Healthier and happier mothers and children, more successful specialists, safer treatment, constant support and more successful client and specialist businesses. That’s Progyny.

3. Quantifying Progyny’s Impact

It’s nice to say Progyny does things better, but it’s really nice when that claim comes with 3rd party data to quantify its edge. Fortunately, we have it for this company.

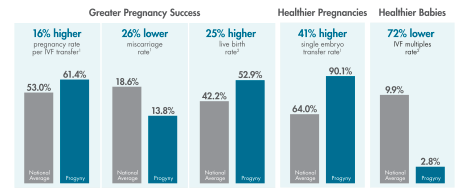

The Society for Assisted Reproductive Technology (SART) and the Center for Disease Control (CDC) recently released a report on the latest American fertility data. The results were wildly encouraging with Progyny delivering a 16% higher pregnancy rate and a 26% lower miscarriage rate both vs. the national average. Additionally, its IVF multiples rate is 72% lower than the national mean with its single embryo transfer rate 41% higher than the national mean.

The encouraging statistical leads continue. Progyny raised its live birth rate lead over the national mean from 23% higher to 25% higher year over year which feeds into a broader overall pattern. The company’s live birth rate has improved 14% since 2016 while the national average has stagnated. Progyny’s lead grows every single year.

The fertility disruptor now boasts a 52.9% live birth rate vs. just 42.2% for the national average which directly leads to lower costs incurred by all parties and happier patients.

Perhaps unsurprisingly, Progyny’s member support services boast an industry-leading net promoter score (NPS) of +79 with its integrated Progyny Rx offering carrying an even higher +81 NPS.

It’s important to note that these superior metrics are vs. the entire industry and not just direct competitors dedicated to the field of fertility like Progyny is. In my discussion with Progyny Vice President James Hart, I asked him how his company compares to its largest direct competitors like Carrot Fertility & Maven Clinic. Because neither publish extensive outcome data — there’s no way to quantify this.

As we can see in the chart above, the specialists in Progyny’s network of clinics also perform better in every single key performance indicator (KPI) vs. the national average — even when they aren’t treating a Progyny covered life. This depicts direct evidence of the true quality of the specialists that this organization has been able to assemble. Only the best of the best can care for Progyny’s members.

National insurance carriers have far deeper pockets than Progyny — so why don’t they just mimic Progyny’s offering? Why can’t they do a better job?

That’s far easier said than done. These managed care providers are focused on minimizing costs within the roughly $3 trillion in total healthcare spend annually. Their core method of doing so is by creating utilization limitations and care mandates like they’ve done within the fertility industry.

To be fair, uniform care does work in some aspects of healthcare such as when someone breaks a bone. Fertility — in an ideal setting — requires specialists to craft individual treatment plans for every single patient based on timing needs and genetic testing.

One-size-fits all just does not work here, but insurers dedicating the appropriate amount of time and attention to the fertility space would require a significant re-allocation away from higher value areas like diabetes. With the fertility market making up less than 1% of America’s total healthcare spend, that is simply not a focus for national carriers. This leaves a compelling and lucrative void for Progyny to fill. It’s doing just that.

4. Progyny’s Pre-Tax Edge

Progyny has deep relationships with all of our national health insurers which allows it to integrate its benefits solutions into their broader coverage plans on a pre-tax basis. This is key. Other fertility benefits managers — such as Carrot fertility and Maven Clinic — don’t enjoy this reality and instead reimburse for treatments on a post-tax basis. This post-tax structure means their members must pay income tax on the amount of the reimbursement thus adding a new layer of inefficiency and substantial out-of-pockets costs.

Based on a typical full round of treatment costing $60,000 — per JAMA — and a 24% income tax rate, this advantage saves Progyny’s members $14,400 per full course of treatment on average.

My 1-on-1 interview with James Hart extensively covered why this inherent integration and taxation edge exists for Progyny over its direct benefits competition. According to Hart, Progyny greatly benefitted early on from the influence of its initial group of clients which included iconic mega cap bellwethers such as Microsoft. These large clients “went to bat” for Progyny and pushed national carriers to allow for Progyny’s integration to create a pre-tax benefits program.

National carriers have little incentive on their own to invite integrations from healthcare point solutions (like Progyny’s); these integrations come with significant administrative headache and little to no economic incentive for the insurer. In reality, the integration could actually hurt a carrier financially as it would ideally like to provide these point solutions on its own.

So — to get started — fertility benefits providers need more influential advocates to force the hands of these carriers to integrate. Thus far, Progyny has been the only direct fertility benefits player with the clout to garner this type of support and this type of massive tax advantage. Despite beginning around the same time as Progyny, both Carrot and Maven have been unable to match this incremental value.

As Progyny rapidly grew its scale and demonstrated its superior efficacy, the firm found it easier to on-board the remaining managed care provider integrations — but it needed the Microsofts of the world in the beginning to get this process rolling.

Progyny’s integrations also make for more seamless new customer on-boarding as the benefits can be plugged into an employer’s existing coverage. It specifically takes the company roughly 6 weeks to on-board a client.

5. Progyny’s Reach and Market

Progyny enjoys a large market share lead over its other direct competitors.

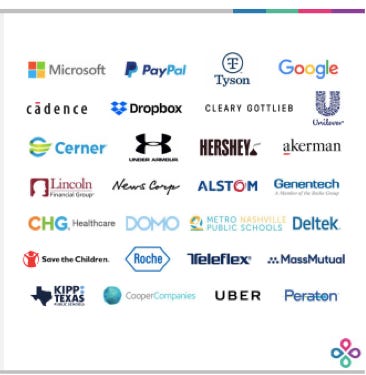

The company serves iconic behemoths such as Amazon, Google, Hershey, PayPal, and Uber while representing 25 total industries overall. It has 182 enterprise customers vs. just 5 when it launched its fertility benefits coverage in 2016. This progress represents a triple digit compounded annual growth rate (CAGR) during the period.

In striking contrast, Carrot Fertility’s most notable public client is StitchFix with some private players like Masterclass using it, but not many other big names. The Maven Clinic’s largest clients are Bumble and Snap.

Progyny also seems to be taking market share from its competitors with roughly 2 out of 3 of the company’s new clients eliminating an existing solution to go with Progyny’s. These clients have been quite happy and loyal with Progyny boasting a “near 100%” client retention rate since 2016 as well as the lofty NPS scores mentioned above. Despite this fabulous success to date, there still remains a long, long runway for growth. The company’s 2.8 million covered lives equates to just 4% of its target market of 69 million Americans.

Today, just 50% of large employers (the target market) provide any form of fertility coverage. In just 14 months, that number is expected to rise to 67% as demand for treatment becomes more broad-based and as CFOs look to initiate cost savings programs. Progyny is by far the best positioned to compete for this incremental 17% of employers.

The trend doesn’t look to be slowing down either due to women making up a greater portion of the workforce and electing to have children later on in life. There’s also some evidence of falling male sperm counts in the United States perhaps due to man-made environmental toxins interacting with reproductive hormones. Both the degree and also the true cause of this decline are uncertain at this point — with several prominent sources disagreeing — but it is something to keep an eye on.

Both of these factors result in higher need for Progyny’s services which places added incentive (beyond cost savings) for employers to purchase the company’s benefits packages.

Interestingly — and likely as a result of infertility not being considered a disease until 2017 — the United States is actually an extremely untapped market for fertility treatment. According to Reproductive Medicine Associates of New York, nearly half of all people suffering from infertility do not get treated. The result is just 2% of U.S. births currently resulting from an ART cycle vs. 5% in Japan and 10% in Denmark. A closing of this gap would be wildly positive for Progyny.

All of this opportunity fosters a total addressable market (TAM) of at least $14 billion dollars that has grown at a 10% CAGR for the last 5 years. Again, with employers spending $40 billion on pre-term births alone, this total opportunity is likely much larger.

6. The Business Model and Sales Cycle

There are 2 pieces to Progyny’s business model. The vast majority of its sales are generated via the utilization of its services. Progyny charges its clients for usage of its Smart Cycles with the price structure varying based on treatment and clinic selected. Similarly, Progyny Rx charges its clients for the consumption of medications dispensed to their employees. In 2020, 98% of Progyny’s sales were generated via client utilization.

Specifically within this utilization segment, Progyny’s fertility benefits business represents 73% of total company revenue vs. 27% for Rx. In 2019 fertility benefits represented 83% of total sales vs. 17% for Rx depicting strong momentum for the Rx segment.

With this revenue model, Progyny’s growth is somewhat correlated to headcount growth for the enterprises it serves. Importantly, Progyny’s utilization rate remains stable as its clients hire new employees. Based on this, a Progyny user like Amazon hiring 125,000 people this holiday season will be a positive revenue driver for the company.

There’s also a population-based piece to Progyny’s business model — although it only made up 2% of total revenue for the year 2020. This segment generates what it calls “per employee per month” (PEPM) fees based on the size of a Progyny client’s workforce.

While this represents just a sliver of the company’s overall operations, it does serve an important purpose. These fees ensure Progyny can always offer its vast PCA network as well as all of its educational programs regardless of utilization. Essentially, it ensures Progyny can fund a base-level of service even in tough environments like March 2020.

Just like Progyny’s networks of PCAs and specialists are thoroughly vetted, so is its sales team. Relevant experience and a willingness to learn the Progyny way of doing things are two core pieces that the company looks for in a new hire. New employees also participate in a dense 3 month training program before ever talking to a client.

Interestingly, its PCAs and other internal team members frequently switch to more sales-oriented roles as their experience gives them unique personal insight on how to communicate with and relate to employers. Along those lines, the Progyny team loves homegrown talent. This keeps salespeople trained and capable and employees more loyal at Progyny as upward career opportunities are clearly prevalent.

“We are committed to providing personal career growth for our employees. We’ve had many young people step up in a big way and are now playing key roles in our organization.” — CEO David Schlanger

Progyny’s sales cycle runs from January 1st the October 15th although the busiest time of the cycle is from August 15th to October 15th. After the sales cycle concludes, the company spends a few months to educate, onboard and integrate its solution into existing client insurance plans.

January 1st is when these new clients actually become active and begin to count as covered lives for Progyny. Based on this, the company’s most dramatic sequential growth is always between the fourth quarter and the first quarter in the following fiscal year.

The company’s sales cycle was all but halted by the Covid-19 pandemic. In recent interviews, Progyny leadership has continuously reiterated that the 2021 sales cycle feels “a lot more normal.” Normal is good.

With the scale and customer satisfaction/retention Progyny has been able to enjoy, referrals are becoming a larger and larger piece of its growth. Giant, happy clients will generally lead to this and it serves as a cost-efficient means of accumulating customers as Progyny doesn’t spend to generate these referrals.

It’s important to note that legislation such as the Federal Anti-Kickback Statute and the Physician Self-Referral Law (Stark Law) both strictly limit fees for business referrals in the world of healthcare. This means Progyny isn’t asking existing clients to refer — these clients are doing so on their own.

7. What’s Next? (Optionality)

Progyny’s market opportunity continues to be largely untapped with the company roughly a half decade into its journey. Expanding its group of clients as well as cross-selling its Rx solution and up-selling more treatment units will be the primary focus going forward. There remains plenty of low hanging fruit here to capitalize on.

“Companies begin to do other things when they feel like they’re running out of room to grow. We don’t have to look at the world in that way.” — VP of Investor Relations James Hart

Progyny’s efforts have centered on the private, not public, sector to date. It frequently calls out this public sector opportunity as a future growth avenue but there has been little movement here thus far. With the public sector work force equating to an addressable market of 20.2 million covered lives, a successful pursuit there could theoretically grow its target market by 29.2% — from 69 million to 89.2 million targetable members.

The company has also mentioned labor unions and universities (faculty) as likely areas of future emphasis. If these were to be successful endeavors, labor unions could add 14.3 million potential covered lives with Universities adding another 3.1 million. Together these two niches could raise Progyny’s target market by an additional 19.5% — from 89.2 million targetable members to 106.6 million based on my own estimations.

From a product roadmap perspective — considering how precipitous the adoption of Progyny’s Rx product has been — CEO David Schlanger often is asked if there are more products that Progyny can offer in the future. He always reiterates there will be more products, but is not yet ready to announce what those new features will look like.

Progyny is not willing to expand its product suite just for the sake of expansion — it has to actually create incremental utility and solve a real, unmet challenge in the industry. Just like Progyny’s advisory board is always evaluating new treatments for the company’s Smart Cycles, they’re also evaluating pain points in the field of fertility for the company to address and profit from down the road. This process takes time, but also leads to more successful adoption trends once new products are actually introduced.

“We do believe those opportunities exist and are actively assessing them. But we have found that it’s ill-advised to create something with questionable value to sit on top of our existing program. Maybe you can get the sale, but renewals are tough. For Progyny, renewals are not tough because we create value.”— CEO David Schlanger

While the company has been quiet about where the next product launch will come from, some expect it to involve post-birth care. Progyny does a wonderful job helping mothers every step of the way on their fertility journey — and this creates a sense of gratitude and loyalty as evidenced by its sky-high NPS scores. This loyalty could be leveraged to expand Progyny’s niche to infant care. We shall see what happens.

The company continues to aggressively hire new team members pointing to its expectation for durable long term growth. According to LinkedIn data, this year Progyny’s headcount grew 30% to reach 238. Furthermore, its total job openings have soared 164% since the beginning of the year. This is not the hiring activity of a company slowing down.

8. Management and Ownership

David Schlanger has served as Progyny’s CEO since the company transitioned from Fertility Authority to Progyny with the purchase of Auxogyn. Before joining Progyny, Schlanger spent 15 years climbing the ladder from Senior Vice President to CEO of WebMD — a leading provider of health information services. Before joining WebMD he also worked as an executive director of business development at the biotech behemoth Merck.

This experience gives Schlanger over a decade of deeply relevant insight to apply to Progyny’s success which he has done near-flawlessly thus far. He’s calm, cool, and collected in his interviews while always remaining candid and honest over the last few years I’ve covered the company. If there is any issue, he will let us know. With limited reviews on Glass Door, Schlanger’s CEO approval rating sits at an elite 98%.

Peter Anevski — the company’s current COO — has been with Progyny in that role since Schlanger took over as CEO. Interestingly, Anevski also comes from WebMD hinting at a strong professional relationship between these two executives. Anevski previously served as the company’s CFO and COO until 2020, but is now just the COO with Mark Livingston assuming the CFO role for Progyny last year.

Livingston also rose through the ranks with WebMD for several years; I’m sensing a pattern here. Most recently he served as the CFO of Scripps Network — a media company — as well as the CFO of Emerson, Reid and Company which is an employee benefits wholesaler.

The most notable board member outside of the executive team is the Chairperson Beth Seidenberg. Seidenberg is a partner at Kleiner Perkins — a VC firm with a direct ownership stake in Progyny. Throughout her prestigious career, Beth was a Senior Executive with Bristol Meyers Squibb as well as with Merck and was the Head of Global Development and Chief Medical Officer at Amgen. Seidenberg also was the CEO at WebMD before Schlanger.

In terms of ownership, Schlanger owns 5.2% of the company outright with Peter Anevski having 2.7% ownership. All executive officers and directors together own 19.4% of the total company. TPG Biotechnology Partners is the largest holder of Progyny with a 17.4% ownership stake. TPG also has stakes in other disruptors such as AirBnb, C3.AI, Spotify and Calm among many others.

Seidenberg’s Kleiner Perkins owns 10.7% of Progyny with BlackRock and Vanguard together own 12% of the fertility organization. Encouragingly, there has been a general pattern of Progyny share accumulation by institutions since the company went public in 2019.

9. Financial Performance and Outlook

Progyny provides a compelling combination of rapid growth paired with profitability.

a. Recent Demand

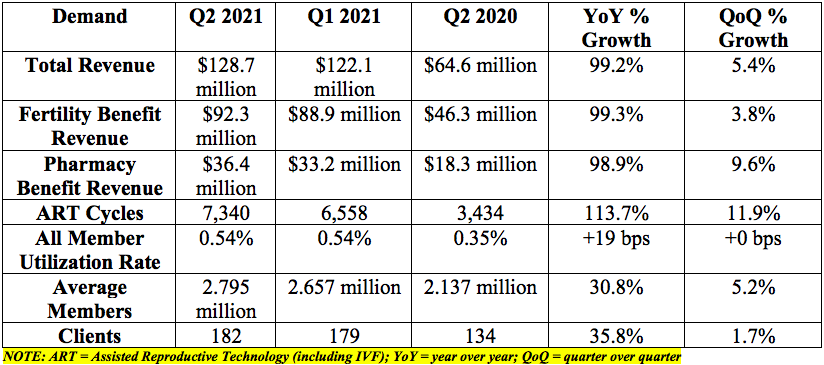

The company guided to $126-$131 million in revenue in its most recent quarter. Its results were essentially in line.

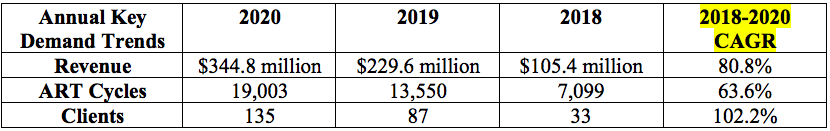

Progyny's most recent demand progress is depicted in the chart below:

The Covid-19 pandemic was a severe demand headwind for the firm so this 99.2% growth was comping vs. a very difficult period and will not be maintained as year over year comparisons normalize. Along those pandemic lines, it’s quite encouraging to see Progyny’s all member utilization rate bounce back so aggressively from the pandemic trough. Demand for fertility treatment in a post-pandemic world should continue to be robust.

b. Historical Demand Trends

Progyny has enjoyed brisk growth since its early days as seen below:

c. Recent Margins

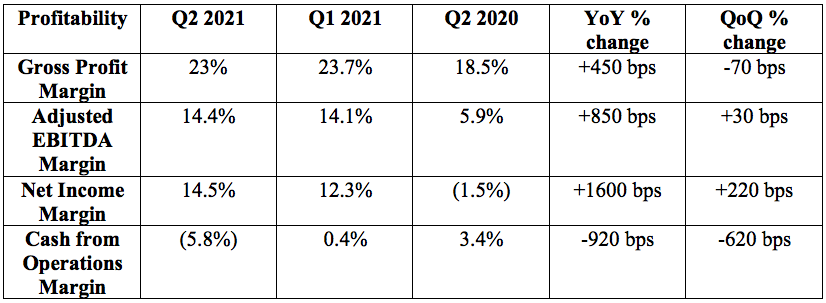

The company continues to find general margin improvement across the board. CFO Mark Livingston has explicitly told us on multiple earnings calls that “margins will continue to improve” and he has been dead right.

Analysts expected the company to earn $0.09 per share in its most recent quarter. The organization’s $0.19 per share result beat expectations by 111% but this requires some added context. This beat included a one-time $0.07 per share tax benefit not related to the underlying profitability of Progyny’s operations. Without this help, Progyny’s results still would have surpassed expectations by 33%.

The organization guided to $17.5-$19 million in adjusted EBITDA and posted in-line results of $18.4 million.

Progyny’s most recent margin progress is depicted in the chart below:

All margin lines improved year over year except for cash from operations which was hurt by the timing of payments received from pharmacy partners. Its accounts receivable doubled year over year in its most recent quarter for explicit proof of this. The dip here had nothing to do with the underlying profitability of Progyny’s operations. This will correct itself in the quarters to come.

A few months ago, Progyny re-negotiated the terms of its Rx contracts with pharmacy and manufacturer partners. The company’s broader scale puts it in a more favorable bargaining position in negotiations over which part of the Rx value chain will command which chunk of the overall profits. It’s not clear yet how to quantify to impact of this change as Progyny has provided little additional color — but it will be a margin tailwind nonetheless.

As Progyny scales, its operations will also inherently become more profitable. Remember, its oldest commercial benefits product was launched just 6 years ago. Schlanger and the rest of the executive team have a background featuring a merger of technology and healthcare from their time at WebMD. This ingrained a drive to always look for that next layer of efficiency in the treatment or sales-cycles processes to enhance profitability wherever possible. We are in the very early innings of this taking hold.

“All processes that can be automated will be automated and will scale with the business.” — CFO Mark Livingston

“Customer acquisition cost continues to fall.” — CEO David Schlanger

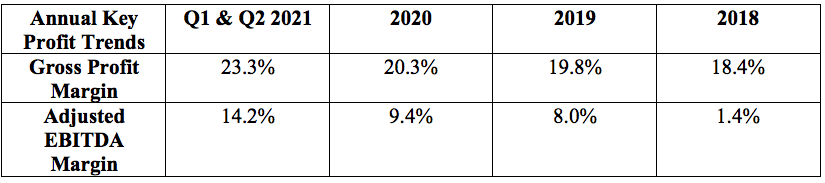

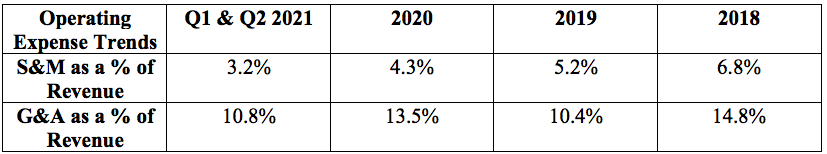

d. Historical Margin Trends

Progyny has delivered not just a few quarters of key margin expansion, but several years of it as depicted in the chart below:

Cost line trends:

Encouragingly, there is more direct evidence of room for incremental margin expansion. Each quarter, Progyny discloses its adjusted EBITDA margin on incremental revenue won. This gives a sense of how profitable its newest operations are at Progyny’s current scale and efficiency. The adjusted EBITDA margin on incremental revenue sits at 22.9% — 8500 basis points ahead of its current EBITDA margin. This is powerfully direct evidence that profit margins will rise further.

The company continues to find fabulous success with cross-selling its Rx product and the more adoption Progyny gains here, the better margins should become. Why? It costs Progyny far less to on-board an additional product to an existing client than it does to seek out a brand new client. This specific type of growth is simply more efficient for Progyny’s business.

Similarly, the up-selling of more treatment units is exceeding the company’s expectations and also positively impacts overall margins. Existing clients are leaning more heavily on Progyny by purchasing more coverage per employee or by adding new treatment options like egg freezing. According to CFO Peter Anevski, the company has already reached its goal for annual up-selling revenue for 2021.

“Commitments received [from existing clients] is the most we’ve ever seen at this point in the selling season and beyond our expectations.” — COO Peter Anevski

e. Guidance

While a guidance reduction is never a positive event, it is more understandable in this situation. The reduction was solely driven by a sudden drop in the utilization rate of Progyny’s treatment bundles. This same drop was felt sector-wide and was not in any way unique to Progyny’s business.

Translation? The reduction has nothing to do with Progyny’s value proposition, competitive edge or market share progress. It’s purely a macro-based issue and has even been referred to by Progyny leadership as an “anomaly.”

The event causing this utilization drop — somewhat surprisingly — is not delta-variant-related or COVID-19 related at all. Utilization rate drops were consistent across regions regardless of varying intensity of renewed outbreaks. Considering the damaging toll the pandemic took on Progyny’s business I find this quite encouraging.

Instead — according to Progyny and other industry insiders — the cause is related to the unwinding of pent-up travel demand as families took advantage of normal summer vacations for the first time in 2 years. Encouragingly, the utilization rate has already bottomed out around 88% of normal levels and has begun to rise back above 90%. Progyny’s forward guidance assumes utilization rate remains at 90% or rises to a maximum of just 95%.

“The factors critical to our ongoing growth — including industry-leading outcomes, high member satisfaction rates and high retention rates — are all going extremely well.” — CEO David Schlanger

Progyny’s David Schlanger has also offered optimistic 2022 revenue guidance. He didn’t mention a specific metric but did say growth rates would be similar to that of 2021 (so 48%-54%) which would take revenues past $1 billion annually. This assertion provides us with a sense of real confidence from leadership that the current utilization dip truly is temporary.

10. Balance sheet

Progyny’s balance sheet is wonderfully clean and simple. It has $94 million in cash, equivalents and marketable securities with zero debt outstanding. It also features $42 million in net receivables plus $4 million in pre-paid expenses. The company does have a $15 million credit revolver with Silicon Valley Bank that remains entirely undrawn at this time. Yes, the pandemic placed added pressure on its operations, but Progyny weathered the storm with “no material liquidity deficiencies” to speak of.

11. The Competitive Landscape

Progyny considers its main competition to be legacy health insurance carriers with built-in fertility programs. According to CEO David Schlanger, Progyny’s customizable programs can’t be emulated by national carriers in their current states. Instead, these insurers would have to embark on a significant re-tooling of their existing operations and a re-allocation of time, attention and resources. None have done so, but instead all have allowed Progyny to integrate its benefits programs into their broad coverage.

“Our primary competition is the legacy carriers, and they have largely adopted the status quo approach to fertility. Carriers have shown no effort to improve their fertility programs other than maybe coming up with a new brand name.” — CEO David Schlanger

So what about more direct competition. As I discussed above, Progyny’s uniform integrations with national carriers provide it with a key pre-tax advantage over its direct competition.

But there is another Progyny edge over the direct substitutes. Carrot Fertility and Maven Clinic still use defined benefits with set lifetime dollar maximums rather than structuring benefits around full courses of treatment. Even for these so-called “next generation” direct competitors, their approaches mirror legacy insurers, not Progyny’s.

Not only does this lead to inferior outcomes vs. Progyny, but it also gives the direct competition less visibility into their own businesses. How? As covered above, dollar maximums lead to patients often running out of coverage in the middle of treatment. The patient will then have to fund future treatment out of pocket where the fertility benefits managers loses all patient progression and outcome data. This makes it impossible to connect treatment to efficacy as the data is too incomplete.

Because of all of this, Progyny enjoys a large market share lead within its core niche and — according to Schlanger — has had virtually zero trouble in maintaining its dominance:

“Even with direct competitors, we hardly ever see them in a competitive situation and lose business to them even more rarely, almost never.” — CEO David Schlanger

Overall, while some competition in the fertility market exists, Progyny is clearly the cream of the crop.

12. Risks

a. Politicians:

When investing in the world of healthcare, new regulation always must be a consideration. We cannot control politicians and we cannot read their minds (just their insider trades). Along those lines, the Affordable Care Act (ACA) fortunately does not directly regulate the operations of Progyny’s business and further amendments to ACA also have not covered fertility regulation.

Still, this is always a possibility and lawmakers are focused here for the time being. Since an executive order was signed in January of this year, federal agencies have been rigorously re-examining regulations and policies to gauge if any strengthening of the ACA is needed via more amendments. There’s nothing to report here regarding fertility benefits specifically but we can never say never.

b. Pandemic and Variants:

In March, 2020 the American Society for Reproductive Medicine (ASRM) issued a new recommendation to halt any new treatment cycles. Naturally, this led to a collapse in demand for Progyny’s services until this recommendation was revised two months later to offer clinics with a long path to eventual normalcy.

Not only did this normalization take time and financial resources for clinics, but the pandemic itself made consumers less eager to seek out elective care (like fertility treatment is considered) due to fear of infection. For evidence — according to data published by GoodRx — the elective care backlog in the United States sits at 1.1 billion visits and has just recently stopped growing and finally leveled off.

Yes, the eventual unwinding of this elective care backlog will invariably accelerate demand for Progyny. Conversely, renewed outbreaks from the delta variant or others could lead to consumers once again forgoing elective care and fertility treatment more specifically.

The good news for long term investors here is that this backlog must unwind eventually. The bad news is that the timing of this unwind is entirely unclear which could lead to volatility in the recovery for elective care as a whole.

c. Concentration Risk:

Progyny also has some modest — but not non-existent — revenue concentration for investors to consider. In 2019, its 3 largest clients accounted for 10%, 15% and 16% of its total revenue for 41% combined. In 2020 its 2 largest clients accounted for 17% and 18% of its total revenue although the 3rd largest client fell below 10% of total sales so was not disclosed.

Thanks to Progyny’s customer growth, near-perfect retention rate and concrete value proposition this is more of a yellow flag vs. a red flag for me. Still, it does leave the company vulnerable to material disruptions in its growth trajectory if one of these larger clients were to leave.

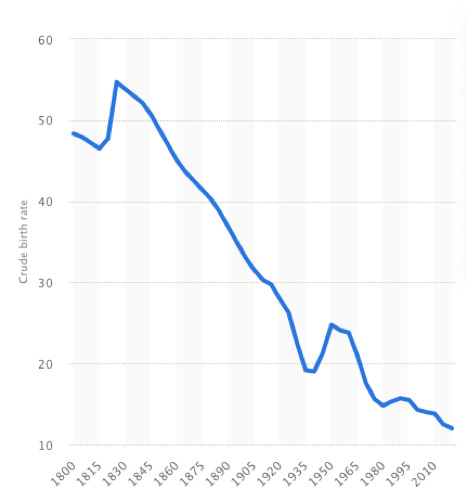

d. Birth Rates:

During 2020, the United States birthrate declined 4% to reach a record low. Currently, the United States’ total fertility rate (how many babies a group of 1000 women will have) sits at 1.6.

For context, 2.1 represents the replacement rate meaning the United States is having less babies than it needs to, to maintain its population without more immigration. While this could be partially related to the pandemic, it follows a decades-long trend that long-predates COVID-19.

So what’s the reason?

One of the driving forces behind falling rates of birth is that women are choosing to have children later in life thanks to enhanced career opportunities. Based on this, one could argue that this trend will actually boost demand for Progyny’s services as women rely more and more on treatment as they get older.

Still, the prospect of a shrinking population is becoming more realistic and would certainly be bad for this organization.

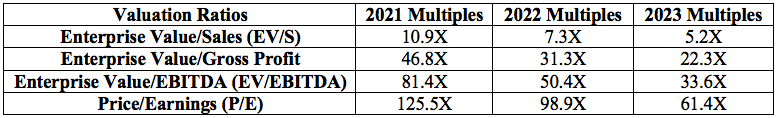

13. Valuation Table

A few notes on how I arrived at these multiples:

These multiples are based on a fully diluted share count of 101 million share and a share price of $58.36. This gives us a fully diluted enterprise value of roughly $5.7 billion.

I used Progyny’s most recent 6-month gross profit margin for the enterprise value/gross profit multiples in all 3 years. As the company does not provide specific gross profit guidance, this is the best I can do and is likely very pessimistic considering Progyny’s consistent gross profit margin expansion.

For the year 2021, I used the midpoint of Progyny’s guidance.

For all of the 2022 and 2023 multiples, I used data from KoyFin.

Based on Progyny’s financial performance, these multiples feel reasonable to me. I expect this company to compound its revenue at a rate of 25% for the next decade based on its untapped opportunity, market share and efficacy. With a base of $520 million in sales, that compounded growth rate would leave Progyny with $4.6 billion in revenue.

If we pessimistically assume that net income margin remains at 14.5%, that would translate into $667 million in earnings. With a multiple of 30 times earnings, Progyny would then boast a $20 billion enterprise value. That valuation equates to a roughly 15% compounded annual stock return over the period. Net income margin will likely continue to expand which would bolster returns further.

These numbers merely provide an educated estimate to give a better sense of how large this company can be if things go well. There’s never a guarantee that things will go well.

14. My Approach

Progyny currently represents 5.7% of my growth portfolio. It’s the 5th largest position in that portfolio and my 8th largest holding overall. The cost basis (average cost per share) sits at $32.55 and — based on my 1.17 year holding period and an 87.4% total return — it has delivered a 72% compounded annual growth rate (CAGR). While that rate of return will almost invariably fall, I remain very bullish.

I have zero interest in selling shares and would actually look to accumulate an even larger stake into any significant stock decline. Progyny’s rare combination of premium growth, strong profitability and its immense value proposition puts it in a compelling position to continue leading this market forward. I’m excited to hold this fertility disruptor as a core position in the years to come.

Thank you for reading!

Thank you for the article! I have a question: since Progyny's advantages and better service/results stem from data collection and larger availability of them compared to their comps, do you know if Progyny discloses specific figures or info about them?

Great stuff Brad!