Quarterly Portfolio & Investing Update

A current overview of my portfolio, my approach, and my plans for each holding.

1. My Holdings

Note that this portfolio chart does not include exited positions such as ViacomCBS (thank you Bill Hwang) and Royal Caribbean which represent 2 of my most successful investments ever. It also doesn't include companies like Butterfly Networks and CuriosityStream which represent two of my worst.

New positions this quarter:

PayPal Holdings

Match Group

Watch List:

Shopify -- I will post a condensed Shopify thesis in a News of the Week article and begin covering the name this quarter. I've made no final decision to start a position, but it's likely that I will own it as some point in the future.

Airbnb

Sprout Social

SentinelOne

2. Summing Up Another Earnings Season

a) The Stand-outs

Revolve Group:

The global online retailer is supposed to be struggling with supply chain issues, input cost inflation and underwhelming e-commerce growth as the industry laps pandemic comps, right? Not so fast. Revolve's management team continues to deliver elite quarter after quarter despite numerous headwinds it has had to continue to successfully navigate.

The company posted an 8.5% revenue beat for the quarter with sales growing 70.3% YoY while its 2-year growth rate continued brisk acceleration from 58% to 63% YoY. As we move through strange YoY comps, growth should slow back to Revolve's long run target of 20%+, although it expects to comfortably surpass that benchmark even after 54% sales growth in 2021.

It reversed a 5-year trend of average order value (AOV) falling (as management told us would happen) and it broke (crushed really) last quarter's customer adds record with 162,000 additions. Revolve's leadership even offered guidance into the first seven weeks of its next quarter (Q1 2022) with results continuing to be exceedingly strong. From a profitability perspective, despite macro issues that other competition readily blamed, Revolve more than doubled its earnings estimates. It also set a new adjusted EBITDA margin record with outperforming gross margin of 55.0% for 2021 as a whole -- which is already at Revolve's long term goal.

How is this company seemingly insulated from somewhat daunting exogenous headwinds?

Revolve's luxury niche and lofty AOV both make its customer cohort generally less price conscious than other areas of the market.

Revolve has been able to combat the margin hit from rising freight costs with things like:

thriving owned-brands growth (margin accretive).

a record percentage of sales at full price.

outperforming top line growth extracting more variable profit out of the portion of Revolve's cost base that's fixed.

12% lower fulfillment cost YoY thanks to automation and other operational efficiency gains.

Revolve sells clothing people wear to go out, go to work and "look and feel their best." It also markets heavily at live events. These two factors actually translate into it being a net beneficiary from the pandemic fading away despite being an e-commerce company.

Upstart:

Another quarter, and another absolute masterpiece delivered by Upstart's team. The company's revenue beat analyst expectations by 16.3% while it posted a 19.3% GAAP net income margin vs. implied expectations of 7.0%. That is not a typo.

Its 2022 revenue guide was 15.7% ahead of expectations despite tightening credit markets and a tougher macroeconomic climate for the company overall. Upstart's 2022 EBITDA guidance was light, but for perhaps the most ideal reason: Its auto business is ramping faster than expected. That allowed the firm to offer a $1.5 billion 2022 auto origination volume guide which will weigh on short term margins as the product ramps and matures (and so becomes more profitable over time). 2023 and 2024 EBITDA expectations from analysts exploded higher after the call to depict confidence in this being "controllable and intentional" like Dave Girouard said it is.

7 partners have now dropped all FICO score minimums which depicts growing confidence in Upstart's risk underwriting and the company even authorized a $400 million share buy-back to take advantage of its stock's volatility, profitability and balance sheet strength. It continues to invest heavily into new growth vectors but its unique unit economics allow it to walk and chew gum at the same time.

As the company told us would occur, default rates have begun to tick up as the world distances itself from stimulus and payment holidays and as credit mix evolves. There's been no impact on its loan performance as Upstart's underwriting model has assumed these changes in its risk assessment. It expects to continue seeing no impact -- hence the strong 2022 guide. We'll see if it can continue to deliver solid results into an increasingly difficult operating environment.

Click here for my Upstart Deep Dive.

b) The Good

The following companies materially exceeded expectations while also offering up-beat guidance:

CrowdStrike

The Trade Desk

Duolingo

Ozon

c) The Fine

The following companies reported roughly in-line results and guidance:

Teladoc Health

JFrog

Olo (click here for my Olo Deep Dive)

SoFi Technologies

Green Thumb Industries

Penn National Gaming

d) The underwhelming

The following companies reported underwhelming results and/or guidance based on factors that I find manageable and temporary:

PayPal Holdings

Meta Platforms

Match Group

Cresco Labs

Ayr Wellness

Progyny (Click here for my Progyny Deep Dive)

GoodRx (Click here for my GoodRx Deep Dive)

Lemonade

The Boeing Company

e) The Unacceptable

I sold two of the three companies that were on my hot seat (explained in section 3) -- Tattooed Chef and CuriosityStream.

3. Future Plans for Each Position

I pause adding to names that are fundamentally underperforming to give the companies a chance to right the ship — I call this being on the hot seat like a coach in jeopardy of losing their job. If poor execution endures, I sell the position. No investment deserves our unconditional love. Here is my list of the holdings in that grouping:

Nanox

Lemonade

The Boeing Company

Ozon (geopolitics-related)

When my holdings are fundamentally thriving but the stocks are lagging, I use this as an opportunity to slowly accumulate more shares. Here is my list of the holdings currently in that grouping:

Upstart

SoFi Technologies

Olo

JFrog

Duolingo

Revolve

Green Thumb

CrowdStrike

The Trade Desk

Penn National Gaming

Teladoc Health (No longer full after a recent trim)

Some holdings are struggling for reasons I find understandable and temporary. I am continuing to accumulate shares of these firms (at a slower pace vs. the group above) despite the recently imperfect execution:

PayPal Holdings

Match Group

Meta Platforms

Progyny

Cresco Labs

Ayr Wellness

This leaves us with one more -- GoodRx. I continue to accumulate shares here as well even after its poor quarterly report. Why? The company continues to take market share and grow its incremental value proposition, management just swung and missed on modeling the pandemic's impact. In the wake of extreme uncertainty, management teams are always well-served to be pessimistic in forward assumptions. GoodRx took the opposite approach, but I believe leadership (which is all new to public markets) learned their lesson. I did trim 5% of the position after it jumped from $13 to $20 in a matter of days, but the net trend remains aggressive adding here for me.

4. About My Investing Mindset

a) Stock Picking

I approach investing with a unique set of life circumstances that shape my risk posture and investment horizon. Personal aspects such as not having dependents and being in my early 20’s account for this. As a result, I have a strong stomach for prudent, diversified risk.

This all contributes to my objective to seek out young disruptors with the potential to delver life-changing returns. The coveted, lucrative upside also coincides with a higher-than-normal probability of being a failed investment — I accept that. Your different circumstances could call for a different approach.

How am I so comfortable with occasionally making bad picks and incurring the coinciding losses? A few notes on this. First, the potential profit structure of public equities make imperfection entirely okay. The sought-after “10 bagger” everyone seeks out can work wonders in more than making up for several losers. Finite downside and infinite upside is a wonderful thing and means slugging percentage matters much more than batting average here. Similarly to private equity or venture capital, this approach frees me to succeed while simultaneously being frequently wrong.

Secondly, accepting some failure as inevitable is a large part of the battle. Humility goes a long way here and without it — markets will humble us all in a hurry. When we expect perfection, we leave ourselves vulnerable to over-indulging or over-allocating into high conviction names. Over-allocation is the antithesis of good diversification and is a great way to get hurt. To combat this tendency, I've instituted a rule that I will never allocate more than 6% of my wealth into any single profitable name with a 4% max for cash burners. No matter how certain I am about a holding, I will never put in more than that. Higher portfolio allocations can result from winners growing larger thereafter (see CrowdStrike). Again, effectively realizing that edge of finite downside relies on diversification -- if I place all of my funds into one name then the same finite downside still equates to 100% of my capital.

More rules I strictly adhere to:

No margin, ever. Debt is for reliable, cash flowing assets such as quality real estate. It's not for speculative assets in my view.

No warrants, options, futures contracts or any other derivative instruments. Common equity only. It's hard enough to be right about the long term fundamental thesis of a firm. It's even harder to forecast the timing of being right about that opinion and the coinciding stock move. Common equity doesn't require me to express any vital opinion on timing, derivatives do.

Long only.

More general qualities I look for in a prospective position:

Revenue growth > 15%.

Profitability and/or brisk margin expansion.

Management integrity.

A tangible value proposition/competitive edge ("X% better than the competition at X).

A long runway.

Seamless optionality (product expansion without heavy spend or operational overhaul)

Easy optionality example -- Lemonade expanding from renters insurance to other verticals using the same software base.

Hard optionality example -- AMC buying a stake in a silver miner.

Balance sheet health (especially for cash burners)

b) Portfolio Management

My cash position fluctuates between 5%-25% of total holdings as cycles of panic and mania play out in stock markets. Yes, I use the wildly cliche mantra from Warren Buffett when it comes to cash management: "Be greedy when others are fearful and fearful when others are greedy." Macroeconomic events like supply chain chaos and monetary policy can work wonders to indiscriminately sweep up every public company via hefty stock pullbacks. It is vitally important -- as a stock picker during these times especially -- to be able to identify which companies deserve this selling and which are the babies being unfairly thrown out with the bath water.

A broken stock is only a compelling opportunity if it coincides with an executing, healthy company. Firms like Butterfly Networks offering severely underwhelming revenue and profit guidance with contradictory reasoning deserve to be aggressively sold off -- while others continuing to underpromise and overdeliver and compound with reasonable valuations do not.

To put it plainly, when fear grips minds, markets take a guilty until proven innocent approach which can create real opportunity for claiming alpha. I will not be perfect in uncovering these diamonds in the rough, which is why allocation limits per holding are so important.

As multiples compress, I focus on accumulating more shares of fundamentally healthy companies showing clear signs of brisk, sustainable demand and profit compounding. It's at these times when my cash position slowly dwindles closer to that 5% minimum as I slowly accumulate. Conversely, when things like "40X sales" becomes a normal part of investor dialogue, I don't liquidate positions but I do trim and allow my cash position to slowly climb towards that 25% maximum. More on this later.

For these firms I consider healthy, people often poke fun at me for my slow pace of position building, but it's a bi-product of the wildly volatile firms that I commonly invest in. These high-growth disruptors that I seek out are inherently rollercoasters as stocks (see the last several months and also the last 100+ years). Considering this, I love the idea of keeping some dry-powder available for when that rollercoaster dips down once more.

My style of accumulation is not dollar cost averaging as that approach allocates new funds on a pre-determined, scheduled basis. There's nothing scheduled about my accumulation path. Instead, it's purely a reaction to multiple compression and Mr. Market's madness.

I'm not looking for technical strength and I am never trying to perfectly time a bottom, I'm merely taking advantage of more favorable risk-reward as valuations shrink via stock price turbulence. Still, stock markets can be quite irrational in the short term as they're based on unpredictable human psychology; considering this, it makes the most sense to me to accumulate in very small pieces so I have the flexibility to take advantage of more irrationality. Not only does this allow me to benefit from future deals, but it also works wonders for my tranquility. There are two not-so-secret, secrets to my discipline amid hectic price action: First is developing a complete understanding of the actual firm, but second is my material cash position. A complete understanding of the firm and its value proposition is what allows me to have confidence to hold and accumulate when stock is dropping. The cash position is what enables that.

The downside of this strategy vs. investing as cash becomes available could manifest in things like me holding a lofty cash position as markets rip higher -- but that's an opportunity cost I'm very willing to accept. This works for me. My approach also undoubtedly means that I will occasionally underperform on a shorter-term basis. Accepting that is important for me to limit portfolio churn that can work to erode my long term alpha. I want to outperform on a multi-year basis -- I don't care about a quarter.

I am always predominately invested in markets, but I do use macro signals and market sentiment/conditions to trim and add around my permanent positions.

The idea of seeking out multiple compression within thriving firms to justify position-building requires more context. While I rarely pass on a position due to a lofty valuation, I do start with much smaller purchases when I love the company but see the stock as simply too expensive. The starting point of the actual valuation still does matter a lot. This past year, we've seen countless firms publicly debut at 30X+ sales -- 30X+ earnings used to be expensive. Yes, the re-setting of the assumed Federal Funds rate from 4% to between 2-3% should lead to multiple expansion (all else equal), but this was extreme. One great example of this was Olo, an IPO that I invested in on day one -- although its 40X sales peak valuation kept the position initially tiny.

Olo's sales multiple compressed to 35x, then 30x and then 20x while the company continued delivering -- but I did not start adding. I waited until the organization's forward EBITDA multiple fell below 100 (still expensive but far more reasonable) to begin precipitously building out the position. There's a benchmark of multiple compression that I require each healthy but expensive position to clear before my accumulation accelerates. It's not uniform as things like margin expansion and faster, more sustainable growth can make what's traditionally considered to be expensive far more tolerable.

Again, this approach could have led to me owning a much smaller long term position in Olo than I wanted, but I was comfortable assuming 40X sales just would not last. See the last century+ of public market valuations.

The flip side to multiple compression is multiple expansion. To have cash for future accumulation, I need to be willing to trim small pieces of positions as they get more and more expensive (and so as fellow investors get more and more excited). As a rough guideline -- and based on my cash position fluctuating between 5-25% -- I generally consider 75-80% of a current position to be permanent (as long as company performance remains strong) and the other 20-25% as more temporary and trade-able as valuations become loftier or more compelling. For example, last year when Lemonade soared from $50 per share to $180 per share on no profit growth or outperforming demand, I sold (link to time-stamped tweet) roughly 40% of my original investment (10% of the position at that time). This is personally how I practice fear/caution when others are greedy.

There's an important idea within that anecdote: Capital gains via multiple expansion are less appealing to me than capital gains via outperforming profit compounding. Within the price to earnings (P/E) multiple, I'd much rather see the "P" rising in tandem with the "E" vs. independently of it. For example, Upstart's stock price has soared since its public debut -- but its estimates have as well. The company is now expected by analysts to earn $2.28 per share this year while 12-months ago, expectations for the same period were for $0.76. The "E" in the P/E tripled, so I trimmed less aggressively vs. a Lemonade as the "P" moved higher.

c) Quick notes on valuation and liquidity

I've used earnings/net income multiples in my examples thus far, but that's not always appropriate. When a company is investing every single gross profit dollar it generates into more growth vs. letting that gross profit flow down to earnings, does it really make sense to still use a P/E multiple? Probably not. Of course when you're using a valuation ratio denominator that is intentionally near-zero, then the earnings multiple will be lofty. This can distort views of expensive vs. reasonable.

As companies mature, I generally use profit multiples from further and further down the income statement and begin using the cash flow statement more readily as well. I always start with gross profit or occasionally contribution margin multiples and transition to EBITDA, or operating cash flow multiples once a company has matured enough to be generating a material base of those two denominators. As soon as there's a solid base of earnings and/or free cash flow, I transition to using those as denominators. I prefer free cash flow vs. earnings if I had to pick one vs. another.

Note that I never use sales multiples as this metric entirely ignores the quality of revenue growth. Any company with funding can invest $2 to create $1 in growth -- and while this will make revenue growth look more impressive, it is far from sustainable. If there's no gross profit to grade a company's valuation, I do not invest.

Balance sheet health also matters a lot when determining the appeal of company's valuation. One of my recent exits, CuriosityStream, now fetches a gross profit multiple of roughly 2X with 35% growth expected this year. While this seems compelling, we need to dig deeper. The company has $82 million in total liquid assets on its balance sheet and will burn through 42% of that funding just in the first 6 months of this year. Expectations for inflecting to profitability are also being pushed out further which makes significant equity dilution and/or expensive credit deals all but inevitable. While the enterprise value at $3 per share is $70 million today, it will likely be much higher at some point in the not-too-distant future. ALWAYS pay attention to shareholder dilution and capital leverage trends when judging the viability of an investment and also its current valuation.

Two final notes:

If the profit metric in consideration is calculated on a pre-interest expense basis (gross profit and EBITDA for example), enterprise value should be used as the numerator. If the profit metric in consideration is calculated on a post-interest expense basis (EBT or net income for example), market cap should be used as the numerator.

I'd also like to express my appreciation for the "PEG" ratio -- or the P/E ratio divided by earnings growth. 80X earnings is far more allowable when earnings are growing 80% YoY and far more of a nose bleed when earnings a growing instead at a more modest 10-20%. As a general rule of thumb, above or below a PEG ratio of 1.0X is considered an extremely rough guideline for what is or isn't expensive.

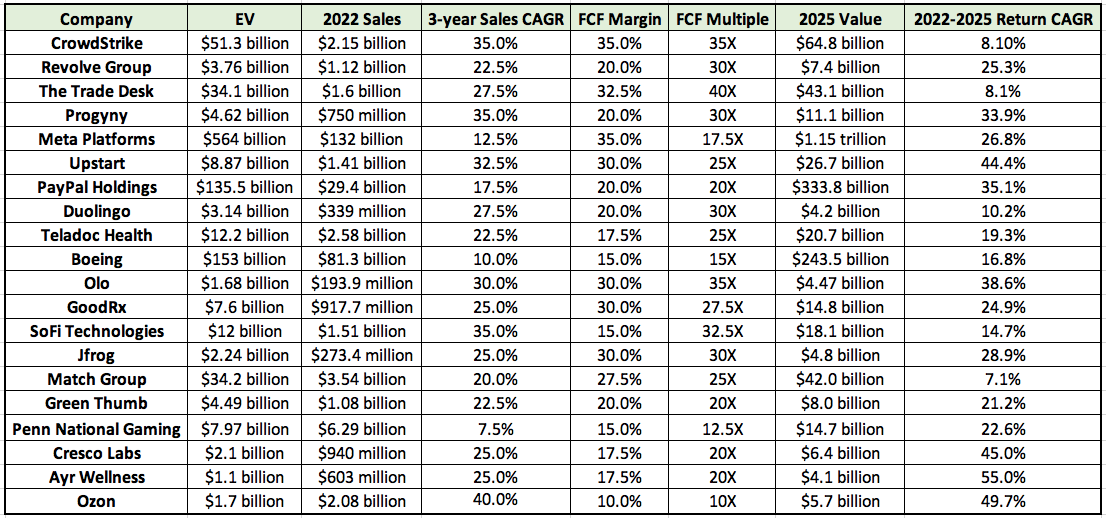

5. Long Term Forecasts

Below are my forecasted fair value and return estimates for all holdings (besides pre-revenue Nanox and Lemonade with its deep cash burn). I aggregated data from historical results, comparable firms and industry research to arrive at these values — which should all be taken with a large grain of salt. The amount of assumptions that go into stock forecasting make the process inherently inaccurate — actual results will surely differ from my projections. This merely paints a picture of where I think my holdings can be in five years if things go relatively well. I tried to lean pessimistic with growth and margin assumptions. AGAIN, take these projections with a large grain of salt.