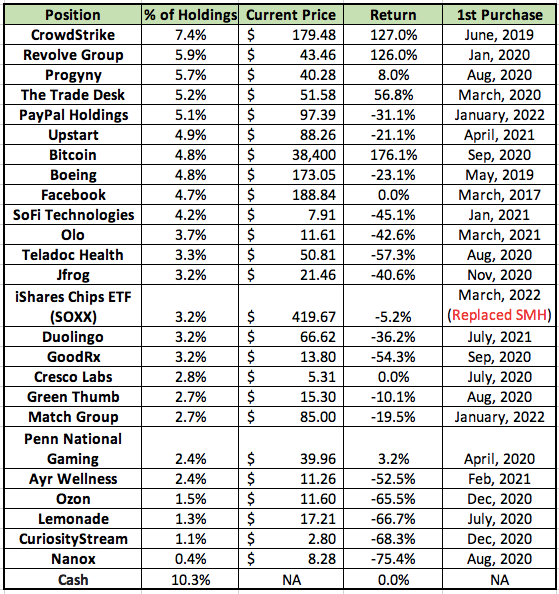

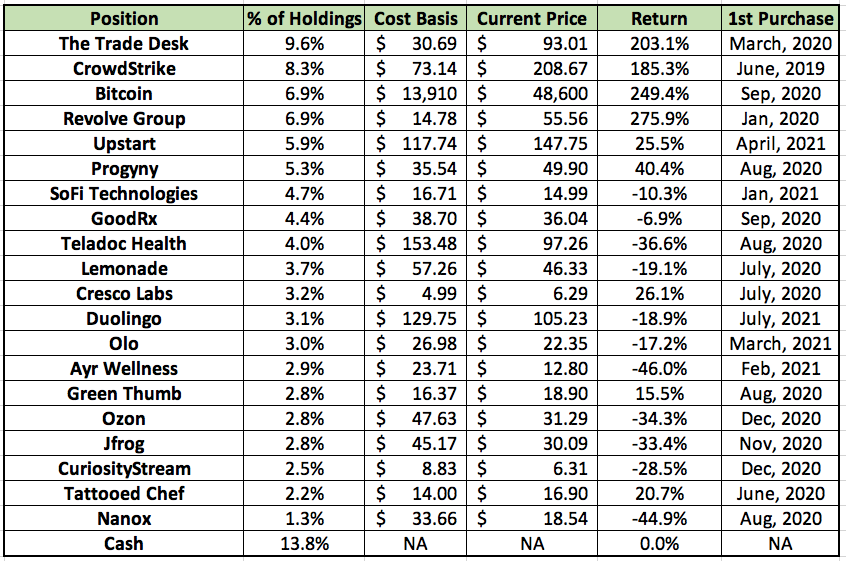

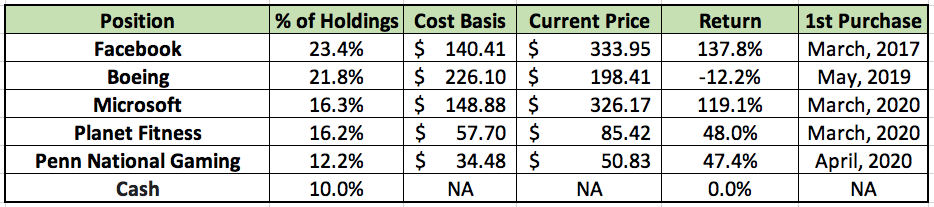

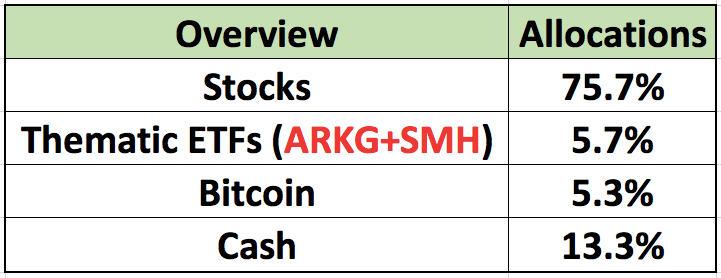

1. My Holdings

UPDATED MARCH 14th 2022:

a. Growth Bucket (~73% of equity holdings)

b. Value bucket (~27% of equity holdings)

c. Overview

2. Summing Up Another Earnings Season

Another earnings season has now come and gone. Detailed commentary on all 24 reports can be found on my Substack. After reading through the results of all 24 positions, here are the key takeaways:

a. The Stand Out — Revolve Group (RVLV)

Revolve Group continues to shine. This quarter, its top line results beat expectations by 14% with 58% revenue growth posted vs. the most recent pre-pandemic period. The company named Kendall Jenner — arguable the most ubiquitous fashion icon on Planet Earth — as its FWRD brands’s new creative director. Her fashion clout is already paying dividends with the brand taking market share from formidable peers.

Despite Revolve catering to fancier, going out clothing and the pandemic severely impacting that demand, it managed through admirably with briskly expanding margins. Its core marketing channel — live events — was also halted amid the pandemic yet it still executed. It’s now taking advantage of the demand recovery with remarkable success. Not only that, but Revolve is also maintaining market share gains in the pandemic categories that it pivoted to last year.

It crushed all of its profit and margin estimates and reported zero supply chain issues while countless other retail players struggled with logistics. How? Revolve’s management leaned on its internal inventory system to observe consumer activity and predict these supply chain issues 9 months ago — it was able to prepare accordingly. Now, the firm is seamlessly capturing rapidly growing demand as our world slowly normalizes. This was yet another elite quarter for the company.

b. The Good

The following companies modestly exceeded expectations while also raising guidance:

Upstart

CrowdStrike

The Trade Desk

SoFi Technologies

Teladoc Health

Lemonade

JFrog

Olo

Ozon

Duolingo

Planet Fitness

Microsoft

c. The Fine

The following companies reported results that either exceeded expectations with no further guidance raises or roughly met expectations and guidance:

Green Thumb

Cresco Labs

GoodRx

CuriosityStream (next quarter and 2022 guidance will be make or break for the investment)

d. The Bad

Ayr Wellness — EBITDA guidance reduction

Boeing — Missed estimates across the board + 787 Issues

Progyny — Slight miss and slightly lowered guidance

Tattooed Chef — Estimate misses and a guidance reduction across the board

Penn National Gaming — Missed profit estimates with in-line demand + Missing out on a New York sports gambling license

Nanox — pre-revenue and no further production delays but an SEC subpoena that it’s responding to

Facebook — missed demand estimates + sharply rising OpEx (which I support)

e. The Unacceptable

I exited my position in Butterfly Networks after its last quarterly report. The results were very poor and the rationale contradictory. Click here to read my full reasoning for the move and why I originally liked the company. I do not regret investing in the firm as I acted on all available information at the time. When the information changes, I change my mind.

3. About Me

a. My Circumstances and Stock Picking Approach

I approach investing with a unique set of life circumstances that shape my risk posture and investment horizon. Personal aspects such as not having dependents and being in my early 20’s account for this. As a result, I have a strong stomach for prudent, diversified risk.

This all contributes to my objective to seek out young disruptors with the potential to delver life-changing returns. This lucrative upside also coincides with a higher-than-normal probability of being a failed investment — I accept that. Your different circumstances could call for a different approach.

How am I so comfortable with occasionally making bad picks and incurring the coinciding losses? A few notes on this. First, the potential profit structure of public equities makes imperfection entirely okay. The coveted “10 bagger” everyone seeks out can work wonders in more than making up for several losers. Finite downside and infinite upside is a wonderful thing — slugging percentage matters much more than batting average here. Similarly to private equity or venture capital, this approach frees me to do exceptionally well while simultaneously being wrong on numerous occasions.

Secondly, accepting some failure as inevitable is a large part of the battle. Humility goes a long way here and without it — markets will humble us all in a hurry. When we expect perfection, we leave ourselves vulnerable to over-indulging or over-allocating into high conviction names. Over-allocation is the antithesis of good diversification and is a great way to get hurt.

To combat this tendency, I have instituted a rule that I will never invest more than 4% of my wealth into any single name. No matter how certain I am about a holding, I will never put in more than that. That feature of infinite potential upside discussed above means that’s all I need.

I plan to publish an article on my overarching investment philosophy in the coming weeks. After that is published, it will be linked to this section of all future portfolio updates and updated as the process evolves.

b. My Cash Position Approach

My cash position fluctuates between 5%-20% of total holdings as cycles of fear and greed play out in stock markets. As excessive fear and multiple compression sweeps up thriving companies, I slowly accumulate. This accumulation is not uniform but instead dictated by company performance and valuation.

For example, multiple compression does not appeal to me for a company like Butterfly that isn’t succeeding or meeting expectations as a company.

For a company like Lemonade — that is thriving but also peaked at a ridiculous valuation of roughly 80X sales — I do look to accumulate into multiple compression but I widen the amount of said compression needed to do so. The Trade Desk is in a similar boat for me but the stock continues to outperform so I continue to simply hold.

For a company like Progyny that I perceive to be both affordable and thriving — I more aggressively accumulate into multiple compression. It’s at these times when my cash position generally falls towards 5% (at a snail’s pace) as I use the liquidity to take advantage of enhanced risk-reward.

Conversely, as excessive mania, greed and multiple expansion drags markets higher, I slowly trim. It’s at these times when my cash position rises to re-load my toolkit to take advantage of future pullbacks and opportunities. I am always predominately invested in markets, but I do use macro signals and market sentiment/conditions to trim and add around my permanent positions.

For this cycle of fear, I plan to continue slowly allocating more and more cash. As I/if I approach 5%-6% cash I will likely consider selling holdings like Microsoft and Planet Fitness trading at historically rich valuations to add more flexibility. We shall see if we get there.

I cannot time market bottoms. I can — however — free myself to slowly accumulate into more turbulence as it comes if I continue to do 2 things:

Trim into severe multiple expansion to add fire power for accumulation

Never invest in a position all at once. Buy in small bites.

4. My Future Plans

I pause adding to names that are fundamentally underperforming to give the companies a chance to right the ship — I call this being on the hot seat like a coach in jeopardy of losing their job. If poor execution endures, I sell the position. Here is my list of the holdings in that grouping:

Nanox

Tattooed Chef

CuriosityStream

For more mature names in my portfolio, I usually reach a point where I consider my position full. At that time I stop accumulating shares into stock price pain and simply hold. Here is my list of the holdings in that grouping:

Boeing

Microsoft

The Trade Desk

Planet Fitness

Penn National Gaming

When my holdings are fundamentally thriving but the stocks are lagging, I use this as an opportunity to slowly accumulate more shares. Here is my list of the holdings currently in that grouping:

Upstart

Progyny

SoFi Technologies

GoodRx

Teladoc Health (approaching a full position)

Lemonade

Olo

JFrog

Duolingo

Revolve

Ayr Wellness

Cresco Labs

Green Thumb

Ozon

CrowdStrike

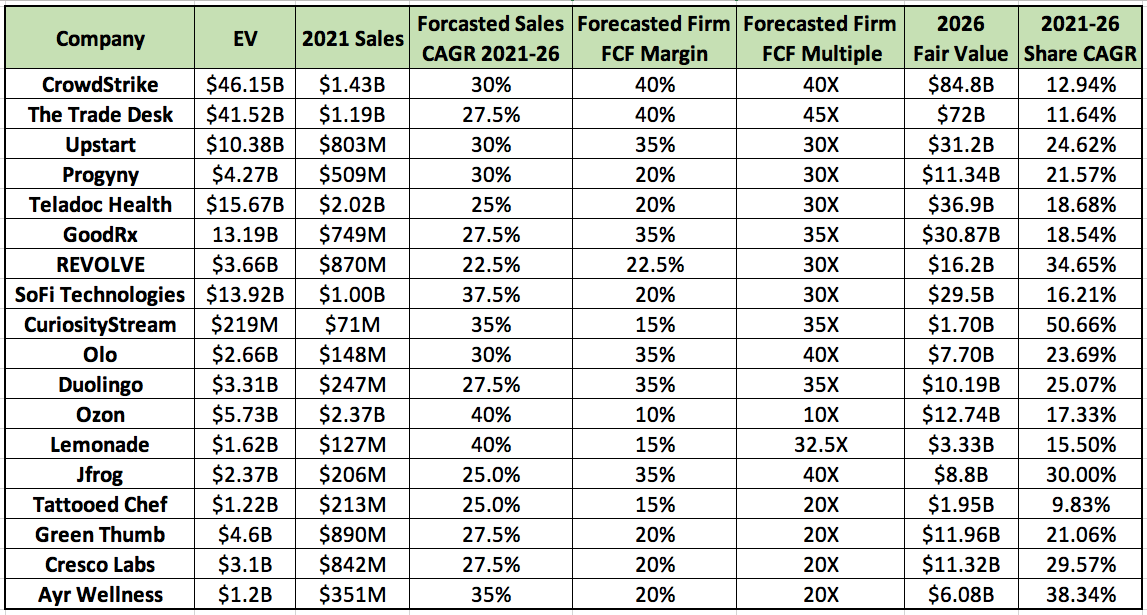

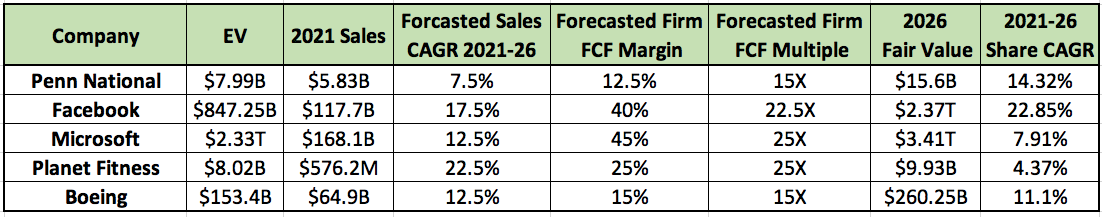

5. Long Term Forecasts

Below are my forecasted fair value and compounded annual return estimates for all holdings (besides pre-revenue Nanox). I aggregated data from historical results, comparable firms and industry research to arrive at these values — which should all be taken with a large grain of salt. The amount of assumptions that go into stock forecasting make the process inherently inaccurate — actual results will surely differ from my projections. This merely paints a picture of where I think my holdings can be in five years if things go relatively well. I tried to be pessimistic with growth and margin assumptions.

a. Growth Bucket

b. Value Bucket

As always, please reach out to me with any remaining questions. I will continue to post updated portfolio summaries after each earnings season as I use these filings as progress reports to gauge recent performance.

What a great read - Thanks Brad! Love your approach especially as it relates to cash management. Have a great holiday!

Thank You Brad !!! Relatively new investor, investing a lot of time to understand and I especially appreciated this article and another of yours I also just read. My sincere thanks for your consideration to post and share and educate. Thank you, Steve