1. My Holdings -- July 2022

Please note that I treat my cash position as one total position. I split it among my two portfolios based on the proportional size of each. Also note that my portfolio update does not include exited positions like FedEx and Viacom which represent two of my best investments to date.

a) Emerging Growth Portfolio

Notable Changes during the quarter:

Exited Teladoc Health.

Most aggressive adding with Progyny, JFrog, Olo and SoFI.

Most aggressive trimming with Upstart Holdings (still trimmed well under 20% of the total position).

b) Established Growth Portfolio

Notable changes during the quarter:

Exited Boeing.

Started Lululemon

Added most aggressively to Match Group and Revolve Group.

I did zero trimming in this portfolio.

Watch List:

Shopify

Chipotle

Google

2. Summing Up Another Earnings Season

a) The Stand-Outs

Duolingo (DUOL):

While Duolingo was lumped into the bucket of pandemic beneficiaries that would flame out as the world normalized, that has simply not happened. Don't let the cuddly, lovable owl mascot fool you -- this team means business and business is booming.

The Duolingo team comfortably surpassed revenue expectations while posting its fastest sequential user and subscriber growth since the pandemic struck. And it significantly raised 2022 demand expectations as well. It continued to grow its percentage of users that subscribe and easily soared past its previous pandemic pull-forward engagement records. Note that this growth outperformance forecast does not include any contribution from its new Duolingo Math product in beta testing -- it was solely a matter of core strength. It also broke out its budding Duolingo English Test (DET) revenue which is rapidly displacing legacy proficiency exams and growing at a casual 62% YoY clip.

“We believe that the future of standardized assessment is online, and our ongoing DET innovation continues to make us a pioneer in the field.” — Co-Founder/CEO Luis von Ahn

But it's not just demand that is impressive. The company continues to see its gross margin expand (with a little help from diminished Google Play fees) and even generated positive EBITDA despite expectations of a loss. That growth continues via word-of-mouth, which is incredibly cost-efficient. As a result, Duolingo saw its marketing as a percent of revenue cut in half from 36% to 18% despite thriving demand. Ideal.

Looking ahead, Duolingo’s strong results led to analysts dramatically improving 2022 profit estimates from a loss of over $1.00/share to a profit of $.04. That's is not normal.

“We have no reason to believe there’s going to be a slowdown. Our user growth numbers are accelerating. We are not a pandemic story like other digital educational services. Furthermore, we are product driven. A lot of these other companies spend a lot of their resources on marketing. We spend on making excellent products that work and grow via word of mouth.” — Founder/CEO Luis von Ahn

Revolve Group (RVLV):

Revolve is quickly becoming a quarterly member of this Stand-Outs section. Revenue beat expectations by 10.4% while the firm enjoyed its fastest customer growth since 2019. It has now set sequential customer add records in 3 straight quarters and offered upbeat early commentary on this current quarter with growth well above its long term target. Its profit metrics beat expectations across the board despite normalizing tax rates with a record Q1 gross margin of 54.5%. Revolve’s main marketing channel of live events and festivals is now coming back in full swing, and management is fully taking advantage. With a $270 million cash cushion and no debt, Revolve has the firepower, the clout and the leadership to continue the current trajectory. Its niche of catering to affluent, macro-economically resistant customers helps a lot as well.

“As founders, we’ve been focused on profitable growth from day one. This quarter was no exception to continuing our long track record of delivering a unique combination of growth and profitability… Our results for the past several quarters demonstrate that we are gaining meaningful market share.” — Co-Founder/Co-CEO Mike Karanikolas

b) The Good

The following companies materially exceeded expectations while offering up-beat guidance:

CrowdStrike

The Trade Desk (honorable mention for a stand-out quarter)

Lululemon

SoFi Technologies

Penn National Gaming

JFrog

Lemonade

Olo

Ozon -- The company is actually thriving while Russian stock trading remains halted.

I will continue to slowly add to all of these names besides Ozon.

c) The “Meh”

The following companies reported roughly in-line results and guidance with perhaps a bit of downside amid chaotic macro:

Match Group

Nano-X Imaging

Progyny

Meta Platforms

Green Thumb (no material forward guidance as per usual)

Cresco Labs (no material forward guidance as per usual)

I will continue to slowly add to all of these names besides Nanox.

d) The underwhelming

The following companies reported underwhelming results and/or guidance:

GoodRx -- which led me to pause accumulation.

PayPal

Upstart -- results weren't terrible but previous guidance was overly ambitious and balance sheet usage was a large negative. This could turn into a deal-breaker if it becomes a trend. We have been told it will not repeat.

I will continue to slowly add to PayPal.

e) The unacceptable

I sold Boeing during the quarter after an additional "one-off" billion dollar charge plagued yet another earnings report. I continue to absolutely love this company's competitive positioning -- and it's hard not to. The odds of success for a supply-constrained global duopoly do not get more heavily skewed in a firm's favor than for Boeing. And yet, I have zero confidence in the leadership team being able to execute; the balance sheet strength destruction merely adds to my concerns. I'd be happy to explore re-entering if the team is replaced with EXTERNAL hires -- not another existing board member.

I also sold Teladoc Health during the quarter. The company's overly ambitious long-term guidance offered at its last investor day wasn't warranted, yet it continued to offer upbeat forward expectations into 2022 while other pandemic darlings re-set their own. Its direct-to-consumer mental health offering -- BetterHelp -- was seemingly so above and beyond the competition that it was immune from marketing pressure. Just a few weeks later, that's what was blamed for poor results. I loved the opportunity of combining Teladoc Health and Livongo to round out the vision of whole person care and to marry a full virtual suite of products with remote monitoring. That is objectively unique in telehealth, yet a combination of provider competition and a leadership team I no longer trust contributed to my exit. I'm not interested in re-entering and going forward, I will carry a large negative bias against "transformative M&A."

3. About my Investing Mindset

This section serves as a living document of my approach towards investing. For those who have read previous quarterly updates, there are two key rule changes:

I raised my max allocation per holding from 6.0% to 6.6%

I changed my cash band range from 5%-25% to 5%-33%.

a) Stock Picking

I approach investing with a unique set of life circumstances that shape my risk posture and investment horizon. Personal considerations (a child-free millennial) account for this. As a result, I have a strong stomach for prudent, diversified risk. Your different circumstances could call for a different approach. Based on my own circumstances and preferences, my objective is to seek out two different types of companies:

Young, emerging disruptors with the potential to deliver life-changing returns and so also coming with immense downside risk.

Established, maturing growers with long track records of effective compounding, the ability to continue growing 10%+ per year, strong cash flows and expanding or durable margin profiles.

How am I so comfortable with occasionally making bad picks and incurring material losses? A few notes on this. First, the profit potential of public equities makes imperfection entirely okay. The sought-after “10 bagger” everyone seeks out can work wonders in more than making up for several losers. Finite downside and infinite upside is a wonderful combination. Similarly to private equity or venture capital, this approach -- especially with the emerging portfolio -- frees the overall portfolio to succeed while still being wrong quite a bit.

Secondly, you can’t win if you won’t accept the potential of a loss. That is the essence of risk. Accepting some failure as inevitable is a large part of the psychological and financial battle. Humility goes a long way here and without it — markets will humble us all in a hurry. When we expect perfection, we leave ourselves vulnerable to over-indulging or over-allocating into high conviction names. Over-allocation is the antithesis of good diversification and is a great way to get hurt. To combat this tendency, I've instituted a rule that I will never allocate more than 6.6% of my wealth into any single name with a 4% max for cash burners. No matter how certain I am about a holding, I will try to avoid putting in more than that. Higher portfolio allocations can result from winners growing larger thereafter (see CrowdStrike) or portfolio values being cut as they were this last quarter. Again, that edge of finite downside only happens through diversification -- if I place all of my funds into one name, then the same finite downside still equates to a potential 100% loss of capital.

More rules I strictly adhere to:

No margin, ever. Debt is for reliable, cash flowing assets such as quality real estate. It's not for speculative assets.

No warrants, options, futures contracts or any other derivative instruments. Common equity only. It's hard enough to be right about the long-term fundamental thesis of a firm. It's even harder to forecast the short term timing of being right about that opinion and the coinciding stock move. Common equity doesn't require me to express any vital opinion on timing, derivatives do.

Long only with cash position serving as my hedging mechanism.

More general qualities I look for in a prospective position:

Sustainably brisk revenue growth with a long runway.

Profitability and/or material margin expansion.

Management integrity (lack of red flags).

A tangible value proposition/competitive edge ("X% better than the competition at X").

Seamless optionality (product expansion without heavy spend or operational overhaul). Easy optionality examples:

Lemonade expanding from renters insurance to other verticals like car insurance using the same software base.

Progyny expanding into Canada where its employer clients have significant U.S. overlap.

Olo expanding beyond restaurants to convenience stores with very similar, less met needs.

Balance sheet health (especially for cash burners)

b) Portfolio/Risk Management

Risk management and the Macro Bogeyman:

My cash position fluctuates between 5%-33% of total holdings as cycles of panic and mania play out in stock markets. I am always predominately invested in markets, but I do use macro signals and market sentiment/conditions to trim and add around my permanent positions.

I use the wildly cliché mantra from Warren Buffett when it comes to cash management: "Be greedy when others are fearful and fearful when others are greedy." Macroeconomic events like supply chain chaos and monetary policy can work wonders to indiscriminately sweep up every public company via hefty stock pullbacks. It is vitally important -- as a stock picker during these times especially -- to be able to identify which companies deserve this selling and which are the babies being unfairly thrown out with the bath water.

Still, the babies are being throw out with no questions asked at this point in time with soaring inflation, record low consumer confidence, tanking GDP forecasts and diminishing liquidity offering clear reasons as to why. And Mr. Market is taking a fully "guilty until proven innocent approach" as a result. To me, that will continue for now until the Fed’s inflation battle climaxes and it means there's absolutely no hurry to get aggressive.

As a stock picker, I'd love to focus on microeconomics and what my holdings can control rather than fixating on what they can't. But the unspoken stock-picker’s truth is that most risk assets are correlated and that a dropping tide lowers all boats. At this point in time, the uncontrollable is uniformly negative for companies and the tide is still sinking. Fellow stock pickers ignore that at their own peril, but to me, macroeconomic headwinds are to be deeply respected while also being treated as longer-term opportunity.

The shellacking of multiples leaves us with fantastic companies still fundamentally thriving, but now with far more favorable risk-reward propositions as the valuations start to look quite compelling. I'm inching in, but that inching is intentionally slow and deliberate as exogenous headwinds rage on. I'm playing a delicate game of balancing cash-fostered flexibility while still slowly taking advantage of better and better deals.

At some point during this year or 2023, I do think that some combination of layoffs, inventory gluts, and the wealth destruction from equity and crypto market drops will give the Federal Reserve the ability to slow the pace of tightening as their tools work. When that happens, I'll be ready to lean in with my currently elevated cash pile. I'll remain data and macro dependent and will keep my readers posted in the macro section of every single weekly article. I'm elated by the prospects of sinking my teeth into accumulating more shares of fundamentally thriving companies at much lower multiples (who doesn’t love buying on sale?). But as markets always overshoot in both directions, compression could always continue in the period of extreme uncertainty.

Non-Scheduled Turtle Mode:

I’ve had questions regarding my slow pace of position building, but it's a natural bi-product of the wildly volatile firms that I invest in. These innovators that I seek out are inherent rollercoasters as stocks (see the last several months and also the last 100+ years). Considering this, I love the idea of always keeping some dry-powder available for when that rollercoaster dips down once more -- especially when macroeconomics are giving markets so many reasons to be intimidated.

My style of accumulation is not dollar cost averaging as that approach allocates new funds on a pre-determined, scheduled basis. There's nothing scheduled about my accumulation path. Instead, it's purely a reaction to multiple compression, Mr. Market's madness and how the exogenous backdrop looks.

I'm not looking for technical strength, although that frequently coincides with macroeconomic strength, and I am never trying to perfectly time a bottom. I'm merely taking advantage of more favorable risk-reward as valuations shrink via stock price turbulence and/or profit growth. Still, stock markets can be quite irrational in the short term as they're based on unpredictable human psychology; considering this, it makes the most sense to me to accumulate in very small pieces so I have the flexibility to take advantage of more madness.

Not only do I benefit from future deals, but this also works wonders for my tranquility. There are two not-so-secret, secrets to my discipline amid hectic price action: First is developing a complete understanding of the firm (not the stock) so I can understand signs of execution or failure, and second is my cash management. A complete understanding of the firm and its value proposition is what allows me to have confidence to hold and accumulate when stock is dropping. The cash position is what enables that.

The downside of this strategy vs. investing as cash becomes available could is the potential of me holding a lofty cash position as markets rip higher -- but that's an opportunity cost I'm comfortable with. This works for me. My approach also undoubtedly means that I will occasionally underperform on a shorter-term basis. Accepting that is important for me to limit portfolio churn which would otherwise work to erode long term alpha. I want to outperform on a multi-year basis -- I don't care about a quarter.

Valuation Starting Point Matters:

The idea of seeking out earnings multiple compression within thriving firms to justify position-building requires more context. While I don’t necessarily pass on a position due to a lofty valuation, I do start with much smaller purchases. The starting point of the actual valuation still does matter a lot. This past year, we've seen countless firms publicly debut at 30X+ sales while 30X+ earnings used to be expensive. Yes, the re-setting of the assumed Federal Funds rate from 4% to between 2-4% should lead to multiple expansion (all else equal), but this was extreme. One great example of this was Olo, an IPO that I invested in on day one -- although its 40X sales peak valuation kept the position initially tiny. Olo's sales multiple compressed to 35x, then 30x and then 20x while the company continued delivering -- but I did not start adding. I waited until the organization's forward EBITDA multiple fell below 100 (still expensive but far more reasonable) to begin building out the position.

There's a benchmark of multiple compression that I require each healthy but expensive position to clear before my accumulation accelerates. It's not uniform as things like margin expansion and faster, more sustainable growth can make what's traditionally considered to be expensive far more tolerable. Again, this approach could have led to me owning a much smaller long term position in Olo than I wanted, but I was comfortable assuming 40X sales just would not last. See the last century+ of public market valuations.

No Shame in Trimming:

The flip side to multiple compression is multiple expansion. To have cash for future accumulation, I need to be willing to trim small pieces of positions as they get more and more expensive (and so as fellow investors get more and more excited). As a rough guideline -- and based on my cash position fluctuating between 5-33% -- I generally consider 67% of a current position to be permanent (as long as company performance remains strong) and the other 33% as more temporary and trade-able as valuations become loftier or more compelling. For example, last year when Lemonade soared from $50 per share to $180 per share on no profit growth or outperforming demand, I sold roughly 40% of my original investment (10% of the position at that time). This is personally how I practice fear/caution when others are greedy.

There's an important idea within that anecdote: Capital gains via multiple expansion are less appealing to me than capital gains via outperforming profit compounding. Within the price to earnings (P/E) multiple, I'd much rather see the "P" rising in tandem with the "E" vs. independently of it. For example, Upstart's stock price has soared since its public debut -- but its estimates have as well. The company is now expected by analysts to earn $1.83 per share this year while 12-months ago, expectations for the same period were for $0.76. The "E" in the P/E nearly tripled.

c) Quick notes on valuation and liquidity

I've used earnings/net income and cash flow multiples in my examples thus far, but that's not always appropriate. When a company is investing every single gross profit dollar it generates into more growth vs. letting that gross profit flow down to earnings, does it really make sense to still use a P/E multiple? Probably not. Of course when you're using a valuation ratio denominator that is intentionally near-zero, then the earnings multiple will be lofty. JFrog, Duolingo and Olo are all trying to operate at $0 in EBITDA for example and this can distort views of expensive vs. reasonable.

As companies mature, I generally use profit multiples from further and further down the income statement and begin using the cash flow statement more readily as well. I start with gross or contribution profit multiples and transition to EBITDA, or operating cash flow multiples once a company has matured enough to be generating a material base of those denominators. As soon as there's a solid base of earnings and/or free cash flow, I transition to using those as denominators. I prefer free cash flow vs. earnings if I had to pick one vs. another, but both are very useful.

For example, a company purchasing loans to collect net interest income will be penalized via deducting that purchase from free cash flow -- but not net income -- when it was really just a change in balance sheet structure. Conversely, weird mark to market items within equity investment valuations can mess with net income while leaving free cash flow un-impacted. Again, both are important for completing the full picture of profitability.

Note that I never use sales multiples as this metric entirely ignores the quality of revenue growth. Any company with funding can invest $2 to create $1 in growth -- and while this will make revenue growth look more impressive, it is far from sustainable. If there's no gross profit to grade a company's valuation, I do not invest.

Balance sheet health also matters a lot when determining the appeal of company's valuation. One of my recent exits, CuriosityStream, now fetches a gross profit multiple of under 1X with 35% growth expected this year. While this seems compelling, we need to dig deeper. The company has $82 million in total liquid assets on its balance sheet and will burn through nearly half of that funding just in the first 6 months of this year. Expectations for inflecting to profitability are also being pushed out further which makes significant equity dilution and/or expensive credit deals all but inevitable. While the enterprise value at $1.70 per share is just $7 million today, it will likely be much higher at some point in the not-too-distant future. ALWAYS pay attention to shareholder dilution and capital leverage trends when judging the viability of an investment and also its current valuation.

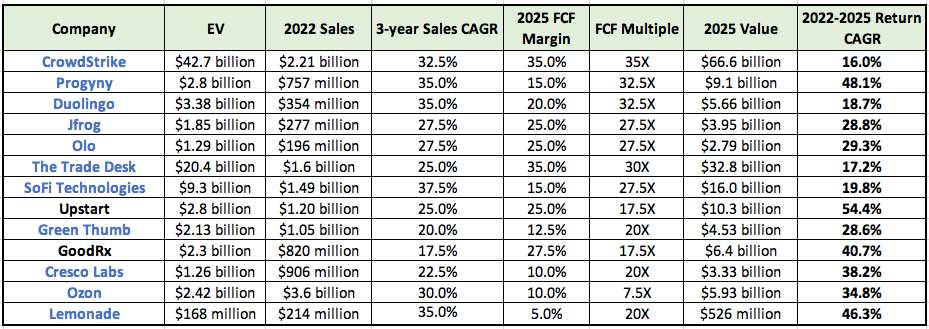

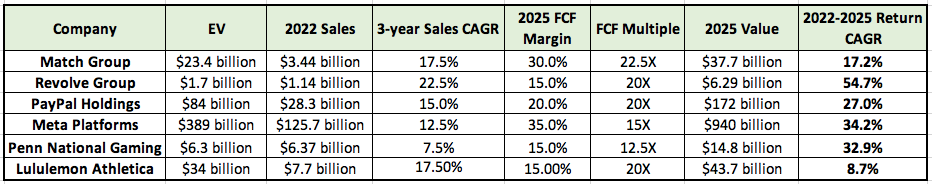

4. Forecasts

Below are my forecasted fair value and return estimates for all holdings (besides pre-revenue Nanox with its deep cash burn). I aggregated data from historical results, comparable firms and industry research to arrive at these values — which should all be taken with a large grain of salt. The amount of assumptions that go into stock forecasting make the process inherently inaccurate — actual results will surely differ from my projections. This merely paints a picture of where I think my holdings can be in five years. I did try to lean quite pessimistic whenever possible with growth, margin and multiple assumptions.

AGAIN, take these projections with a large grain of salt. Especially for the holdings with depressed enterprise values and sky-high 3-year forecasts, there is significant risk to that result coming to fruition!

One more item that's very important to note is stock based compensation. For companies with dilution expected over the next three years, I accounted for this by adjusting the current EV reading higher. For the companies that I did this with, the firm's name is colored in blue. For most, the adjustment was between 2-3% annually, although I made it 4% for SoFi, Cresco Labs and Lemonade. Note that GoodRx's and Upstart's buybacks will offset future dilution.