1. Shopify (SHOP) – Earnings Review

a. Demand

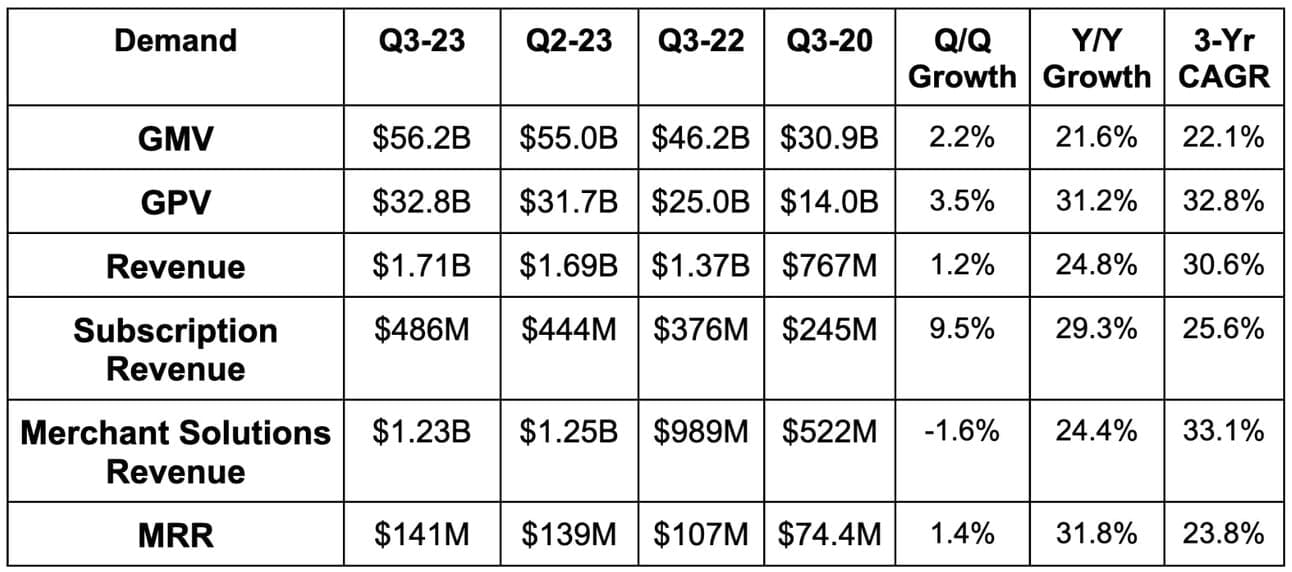

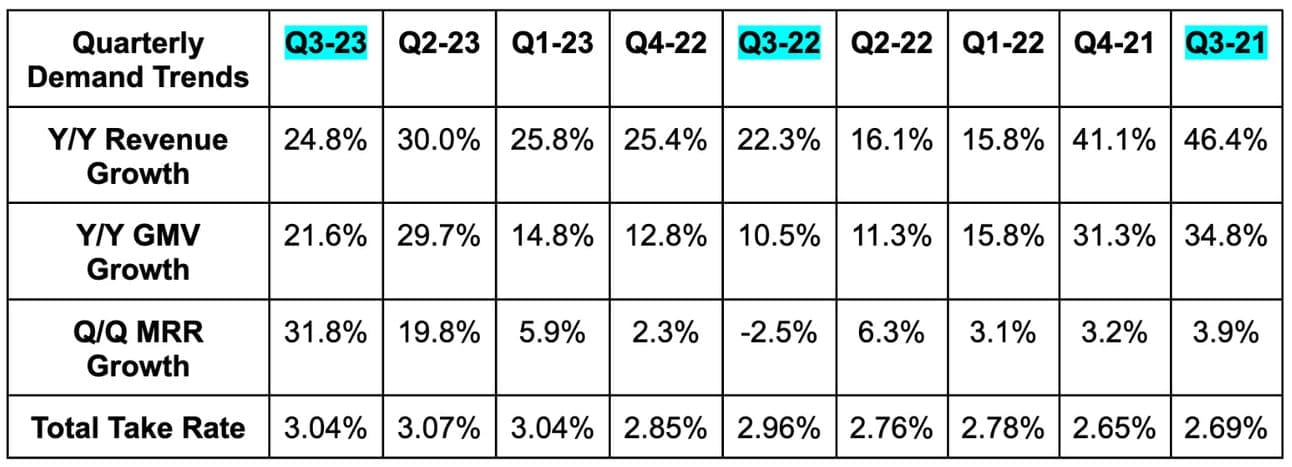

Beat revenue estimate by 2.4% and beat low 20% revenue growth guidance comfortably. The 24.8% growth rate would have been roughly 30% without the headwind from selling its fulfillment business. 30% marks an ex-Deliverr acceleration vs. 28% Y/Y growth last quarter.

Gross Payment Volume (GPV) was 58% of Gross Merchandise Volume (GMV) vs. 54% Y/Y. The Shopify Payments proliferation continues.

Pricing changes helped prop up subscription revenue growth just a tad. These price changes were for non-plus tiers. This is why Plus Merchant monthly recurring revenue (MRR) as a percent of total fell from 33% to 31% Y/Y.

b. Profitability

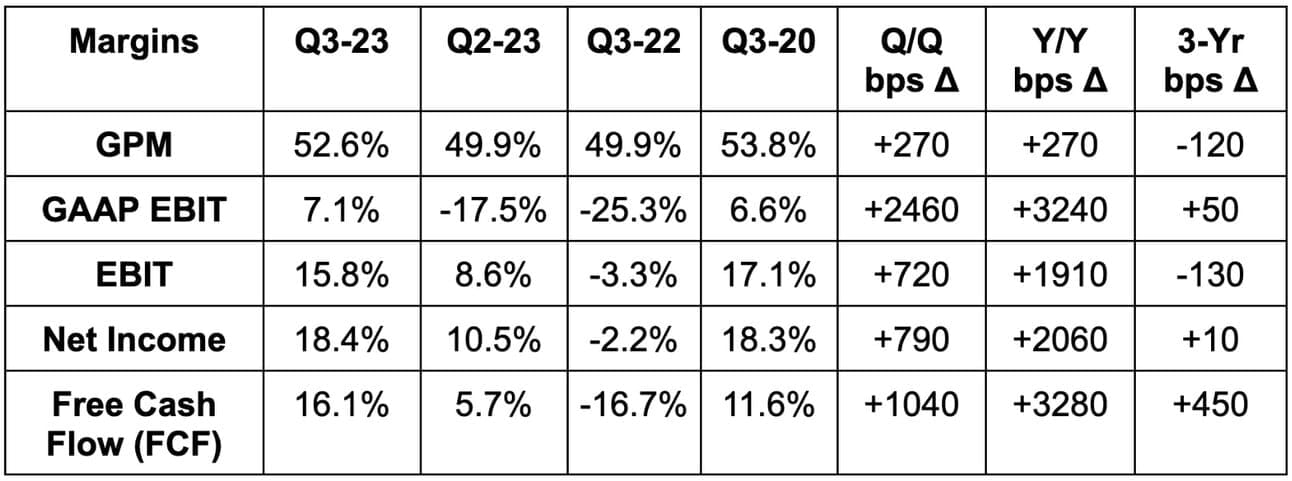

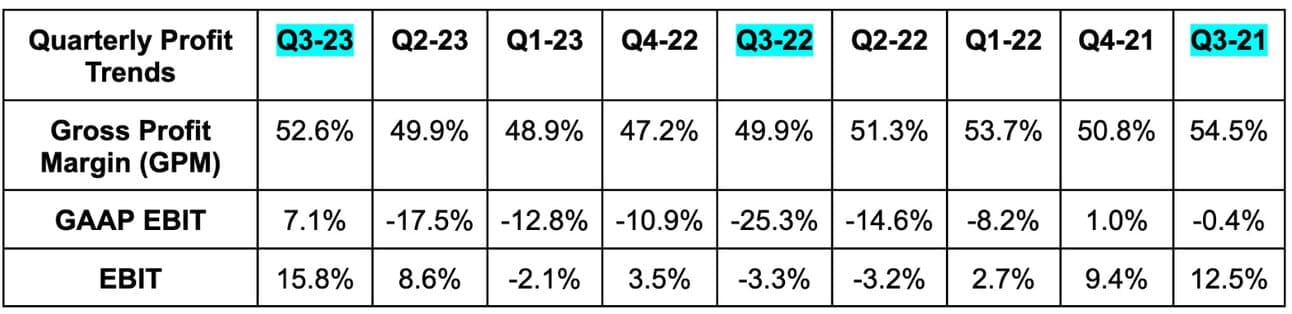

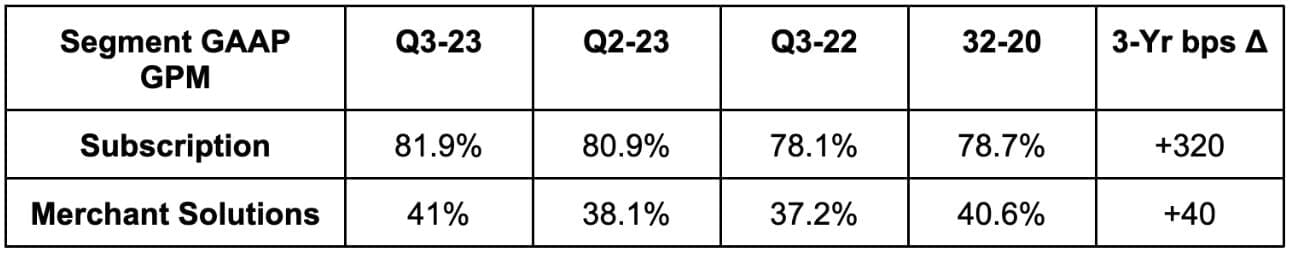

- Beat 52% GAAP gross profit margin (GPM) estimates by 60 basis points (bps) and beat its GPM guide by 80 bps.

- Beat Free cash flow (FCF) estimates by 43% and beat its guide by 51%. FCF of $276 million compares to -$148 million Y/Y.

- Beat EBIT estimates by 65%.

- Beat $0.21 earnings per share (EPS) estimates by $0.04 (19% net income beat).

c. Fourth Quarter Guidance

Shopify roughly met revenue estimates & also met GPM estimates. It handsomely beat FCF estimates by 42%. This 42% beat assumes its “high teens free cash flow margin” guidance means 18%. Finally, it told us that operating expenses would continue to fall Q/Q as it remains laser focused on growing profitably.

d. Balance Sheet

- $4.9 billion in cash & equivalents.

- $915 million in senior notes.

- Diluted share count rose 2% Y/Y while basic share count rose 1% Y/Y.

- Stock comp dollars fell by about 30% Y/Y via layoffs.

e. Call & Release Highlights

Brick & Mortar:

Shopify grew offline volume by 26% Y/Y thanks to its point of sale (POS) and payments suite. 26% Y/Y growth accelerated vs. 23% Y/Y growth last quarter. It’s also signing larger physical retailers. This quarter, it landed the Sacramento Kings, Banana Republic and Princess Polly; a third of offline’s overall growth is coming from Plus merchants. Subscribers to its full service POS Pro software rose 34% Y/Y as well.

In response to this continued outperformance, Shopify launched a new “Retail Plan.” This includes the POS hardware and Pro software subscription with “tools to build a simple online presence.” This plan, since launching in August, already represents 16% of its POS Pro subscription growth. It costs $89/month. Beyond the Retail Plan, it also debuted new POS hardware called “POS Terminal.” This pulls from the mobility and broad use cases of its POS Go product pictured below.

It allows POS Go to plug into a fixed terminal to transform the mobile POS into a “connected countertop payment device.”

Partnerships & Pricing:

- The announced Buy with Prime app will go live on Shopify in the coming weeks.

- Shopify and Flexport finalized their deepened partnership following the sale of Shopify Fulfillment Network (SFN) to Flexport.

Its partner network is 4x the size of its closest competitor. This means more use cases, more interoperability and more unique value delivered by Shopify. That value directly translates into pricing power. This is why Shopify’s subscription price hikes this year were met with 0 material churn. That success is leading the company to contemplate more price hikes in the near future. It thinks its “value to cost” ratio is sharply skewed to value and that it can strike a better balance.

Checkout Upgrades:

Shopify revamped its single page checkout during the quarter. This is speeding up time to checkout by 4 seconds. Every second saved means more shoppers converting. Furthermore, its Checkout Extensibility product for more customization features is going very well. The product is faster than others and so converts at a higher clip. Supreme, Mr. Beast and Thrive are among the early users. This tool is fully integrated into Shop Pay which is Shopify’s consumer-facing checkout accelerator. That integration makes this the only fully customizable one-click checkout on the market. That’s how you stand out in a commoditized, crowded field.

Shop Pay is in the early days of opening up to non-Shopify merchants. This will pin it more directly against PayPal, Apple and others.

Europe:

After a few warnings from European Fintechs on Western Europe weakness, some investors were rightfully nervous about Shopify. It does a ton of business in Germany, France and other nations that were called out for soft demand. Shopify isn’t experiencing this headwind. European GMV rose by over 40% Y/Y as it continues to rapidly take share in that region.

Shopify Markets Pro, which is its full-service cross-border tool, could help more. This localizes shopping experiences by market while handling compliance and currency headaches. It’s only available for U.S. merchants selling globally (starting this quarter), but will expand to Europe in 2024. That could offer meaningful upside to the 15% of its volume coming from cross-border trade. Cross-border is higher margin than domestic volume.