Inception:

The year was 2006. A passionate coder by the name of Tobias Lütke wanted to find a new snowboard online. While sifting through options, frustration set in as a seamless ability to locate compelling products simply did not exist. Determined to fix this, Lütke embarked on a journey to build his own online snowboard shop.

Some 17 years and $60+ billion in market cap later, that idea would blossom into the foundation of an online store builder for any merchant wanting to run a business. What started as a singular dedication to remove snowboard purchase friction has transformed into a core mission to tear down the barriers to entrepreneurship for businesses of all sizes.

Lütke set out to trail-blaze a means to “arm the rebels” with all needed commerce tools -- all under one roof, all with one interface and all hassle-free. This work gave way to the birth of what he hopes will be a “1,000-year company” and what he calls “the best idea he’ll ever have.” It gave way to Shopify.

Here, we will explore all there is to know about Shopify’s business model and investment case -- the good and the bad. After finishing this article, you will be an expert on the company and will be able to answer virtually any question thrown your way. More importantly, you’ll be able to assess new developments from an informed position. We’ve read every report, every earnings call, every transcript, every leadership interview and every single piece of relevant information that we could find. We’ve condensed it down into an intricately synopsized view of Shopify’s business, prospects and risks. This is a real deep dive. We hope you appreciate it as much as we enjoyed creating it and we encourage you to share it far and wide. Let’s begin.

Section 1 – The Basics

1a) Product Philosophy & General Differentiation

Shopify makes it easy for merchants -- large and small -- to thrive online with near-endless scalability. It provides the support, integrations, and ease of use to ensure businesses have access to any & all needed functions across their daily operations. These tools are readily available and deployable on the Shopify Admin for an overarching view of a business across all channels of selling. The Admin is the back-end that unites all disparate areas of business into a perfectly harmonized birds eye view of everything that matters to a merchant. This allows for more effective and contextualized decision making and enables those decisions to be pushed to all selling surfaces where a merchant presides. Importantly, decisions are easily synced with the front-end (what the consumer sees) in a way that always reflects their own brand.

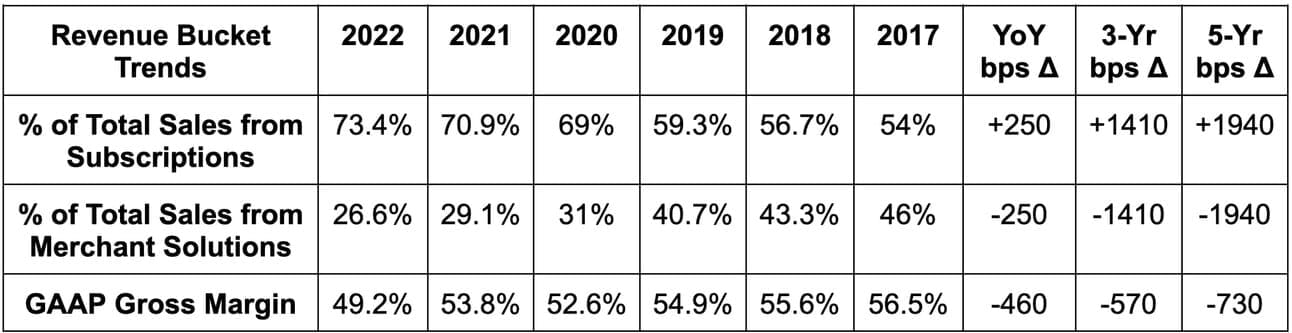

Shopify’s general product categories are meant to remove pain points associated with enterprise maintenance and growth. The more headaches it solves, the more valuable it becomes. It obsesses over being a merchant’s “more important piece of software” by facilitating powerful ease of use. Specifically, its general product categories are split into two well-defined buckets: Subscription Solutions and Merchant Solutions.

It does serve many large enterprises, but the suite and mission were originally incubated for smaller merchants to offer them the same enterprise-level utility previously reserved for the behemoths. Shopify allows ALL merchants to enjoy these tools -- from single person start-ups to Fortune 100 brands.

Shopify’s unique value proposition comes from a few places. First, it boasts the scale-based benefits of selling through an aggregated marketplace while secondly granting complete authority over brand and data. Merchants enjoy a win-win not typically available: More demand and total control over customer relationships. No longer must a business choose between one or the other. Merchants get it all while enjoying several unique perks that Shopify’s economies of scale (10%+ share of U.S. e-commerce volume) allow. Why does this matter? Marketplaces routinely withhold consumer data and compete with successful products via white-labeled knockoffs. Shopify doesn’t and, in turn, avoids a real conflict of interest while building trust.

This concoction of perks is rare and means that businesses at all stages of maturity can grow with no limiting technological factors. The ensured scalability guarantees that merchants can handle holiday spikes and flash sales with confidence that soaring volume will not crash the site or foster latency. Competing web builders deal with frequent crashes which is actually a material source of lead generation for Shopify.

To test the resilience of its platform, Shopify runs constant 3rd party breach tests, bug bounty programs & vulnerability assessments. It seeks out holes and sluggishness in the infrastructure to proactively address. As latency and shopper conversion are directly correlated, this matters a lot.

Singular interoperability is another real selling point. Because all Shopify products tie perfectly back to a centralized Admin, the tools are cohesively amassing data to make all products work better together than they do in isolation. For a specific example, demand data can be used to more accurately guide inventory reordering and marketing investments. It calls this product silo unification its “Commerce Operating System.” This is how it accomplishes its mission to be the most important piece of merchant software. More relevant data means less guessing and more effective strategizing.

Furthermore, Shopify features a light-weight suite of Application Program Interfaces (APIs) providing seamless integrations between all Shopify apps as well as 3rd party apps (more later).

API Defined: APIs are the glue that tie together software-based utility by enabling broad use cases to be carried out by 1st and 3rd party developers. They provide the digital workspace and tooling for developers to create apps and experiences. As the name implies, APIs are an interface for programming applications. We realize that’s a circular definition, but we think it helps to view it in this light. APIs can also be considered blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower developer access to data services, operating systems, and other applications to create an end product.

Shopify intentionally designed its business to ensure it only does better when its merchants sell more products. This selling translates into more gross merchandise value (GMV) on which Shopify commands a take rate. So? It is solely focused on helping merchants thrive and is fully aligned with their motivations. It has every incentive to make sure clients succeed. That’s why it never knocks off a product like Amazon or Costco and never opaquely siphons off needed customer insights for itself. There’s no reason for Shopify to do so which is the beauty of this model.

1b) Developer Partner Philosophy

The breadth and extensibility of the firm’s product suite relies on a vibrant community of developers motivated to build in Shopify’s Developer Environment. These partners round out Shopify’s offering with niche tools to ensure merchants can have whatever they want, however they want, and in a simplistic manner.

“Partners make Shopify better by extending our API functionality so merchants can customize stores to meet unique needs.” -- President Harley Finkelstein

In terms of what Shopify offers itself vs. what it uses developer partners for, there’s an easy rule of thumb. If the use case is needed by most merchants, Shopify will build it. Less commonly used software is usually delegated to partners. This delegation not only extends the tooling that Shopify can provide, but it also serves as a strong source of referral-based lead generation to reel in new merchants. Specifically, partners delivered roughly 40,000 new merchants to Shopify in both 2021 and 2020.

To help partners sell more through Shopify, the company debuted “Built for Shopify” in 2022. This program comes with a slew of new tools and authorizations to craft developer apps in ways that “look and perform like they’re natively part of the overall platform.”

It’s clear that Shopify fixates on being a rewarding place for these developers to work. Specifically, its partners make $7 in revenue per every $1 that Shopify collects. As of 2022, Shopify developers earned 1.5x more than Apple developers and 4x more than Google developers for the same amount of work.

Unsatisfied with this tangible edge, Shopify doubled down. In August 2021, it removed all revenue share for developer application and theme sales for their first $1 million in revenue. This figure resets annually and means that the vast majority of Shopify’s ecosystem partners pay nothing in app store fees. Quite the refreshing dichotomy vs. Apple and Google. As part of this news, Shopify lowered its take rate on revenue beyond the first million from 20% to 15%. The glass half full view of the change is that Shopify is deepening the value that it offers talented, scarce software engineers to augment the quality of its platform. It’s better incentivizing them to build integrations and use cases for its ecosystem vs. others. The glass half empty view is that this is a necessary move to better compete with other app stores to win developer time and attention. There’s likely truth to both arguments.

While Shopify readily caters to and supports its vibrant partner network, it can be a vicious competitor when need be. It demands elite product quality from 3rd parties and won’t settle for less. It has shown a willingness to cut ties with underperforming partners and to vertically integrate services that it thinks it can do better. For example, in the last few years, it ended its relationship with Kabbage to internalize more of its loan suite and moved on from Mailchimp as it realized it could deliver better ad return metrics to merchants on its own.

With all of this in mind, we can now discuss the two revenue buckets in detail: Subscription Solutions and Merchant Solutions.

Section 2 -- Subscription Solutions Revenue Bucket

2a) Subscription Solutions

Basics:

Shopify’s first revenue bucket -- called Subscription Solutions -- centers on website building. The core of the infrastructure was created through a popular open-source platform called Ruby on Rails. There are 4 established tiers ranging from $39 per month all the way up to $2,000 per month. “Basic” is the cheapest plan, followed by “Shopify”, “Advanced” and “Plus.” Very recently, it added a “Lite” plan as a bare-bones package for start-ups and a large enterprise tier called Commerce Components by Shopify (CCS) -- discussed later. In total, there are 4.25 million Shopify stores according to Builtwith and “millions of merchants” in 175 countries per Shopify’s most recent annual filing.

More expensive plans provide capacity for additional staff accounts, more trackable inventory locations, and heavier discounts on other products. For example, there’s a 2.9% + $.30 processing fee for basic plans with that take falling to 2.6% for the Shopify plan, 2.4% for the advanced plan and even more for Plus. Basic merchants also get up to 77% shipping label discounts while more premium tiers can tap into upwards of 88% discounts.

Subscription APIs to Build Merchant Stores & their Architecture:

This bucket creates value by allowing merchants to enjoy beautiful, unique online stores to easily sell direct to consumer (DTC). Facilitating this powerful granularity is a suite of Shopify APIs. These APIs are how developers customize merchant shops, how tedious integration work is sidestepped, how apps are built and how data is queried (or pulled) to populate sites with information. Simply put, APIs are an imperative vehicle used by developers to actually build on Shopify. Merchants see only the finished product, not the product creation process.

All of Shopify’s competition relies on these app programming interfaces to power functionality. It’s the sheer diversity of Shopify’s API use cases that create a point of differentiation. In total, the firm has a few dozen of them for inventory, webhooks and every other product that we’ll cover in this piece. Most notably, there are two core examples to call out for subscription solutions:

First is the Storefront API. This product allows developers to access and personalize store layouts for merchants. It facilitates custom checkout flows and so much more. If the Storefront API is the cause, delightful design and functionality is the merchant effect.

Importantly, Storefront API leans on Graph Query Language (“GraphQL”) to provide a real-time channel of data. This means stores are constantly fed a wealth of information to fill out product descriptions and glean actionable operational insights. Facebook created GraphQL specifically for mobile applications so that developers could precisely select ONLY the data they required. That rigor inherently diminishes cost and complexity and Shopify is taking advantage.

Apps cannot be effectively leveraged without scalable data querying. With no data, gorgeous Storefront API designs would be “just another pretty face” devoid of all needed details. Customization is peanut butter and data is jelly. Shopify’s integrations and APIS are the freshly baked bread bringing these two ingredients to life.

Shopify’s GraphQL-powered APIs like this one are often used alongside a JavaScript library called “React.” There are alternative libraries, but this is the most common here. In essence, React provides pre-built, recyclable interface features to expedite store design. It allows developers to customize without starting from scratch every single time.

The second subscription-focused API to highlight is the Admin API. Where the Storefront API powers front-end customization, the Admin API powers the back-end. It also plugs into React’s library, but doesn’t utilize it all that frequently as React is typically for front-end tailoring.

Like the Storefront API, the Admin API leans somewhat on GraphQL web building architecture. Differently from Storefront API, the Admin API heavily utilizes an alternative building approach called “RESTful API.” RESTful stands for Representational State Transfer. It allows for a different style of data querying via developers pre-setting parameters and protocols to populate an app.

Finally, unlike the Storefront API, the Admin API allows developers full ability to tweak and manipulate data. This means they must secure needed permissions from merchant clients before building on their behalf. The Storefront API doesn’t permit this as populated data can be read but not altered.

As an important aside, to make developer app and theme integration easier, Shopify offers an App Bridge API. This provides a simple process for developers to slickly embed their work into Shopify’s platform -- regardless of where that work was completed.

Online Store Building:

Shopify developers predominately author store themes through two template languages: Liquid and Hydrogen. There are many other languages that developers can utilize to build, but this encompasses Shopify’s main offering. Template languages are used to build store designs; APIs equip these designs with custom use cases and data. Both are vital.

There are a few template language hurdles: Merchants generally aren’t tech-savvy coders with bountiful software engineering experience or large rosters of internal builders. Secondly, developers are selling directly to these non-tech-savvy merchants through Shopify’s app store. This means easier app onboarding leads to more sales and more developer focus on building for Shopify.

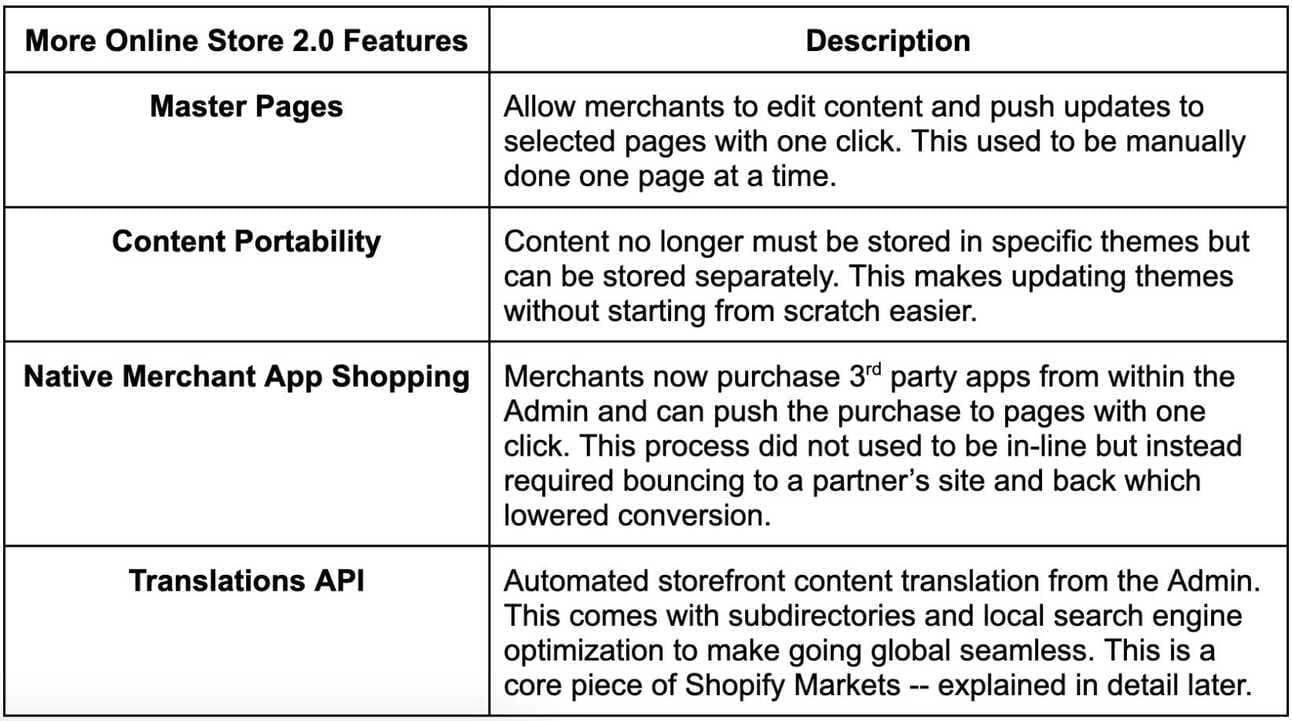

To address this reality, Shopify debuted Online Store 2.0 in 2022. There are two main purposes behind this update. First was to trim latency-fostering redundant infrastructure and second was to remove the rest of the instances when merchants were required to code. Put differently, it was to make everything easier. So how does it work?

With Online Store 2.0, layouts are split into small app blocks which can now be dragged and dropped as if they were puzzle pieces. Vendors like SquareSpace and Wix have long offered this style of design which Shopify now does too. Under the old building model, this level of malleability was only available on welcome pages. Now it’s available throughout stores. This is one of the many ways Shopify is lowering the barrier to entrepreneurship by making store building as easy as playing with Legos. Less stressed merchants, and more successful Shopify developers. That’s online store 2.0.

App Blocks Defined: Use cases that are portrayed within applications to augment customization and utility. They’re a force multiplier for developer efficiency by allowing them to build tools on top of pre-built code. App blocks are how merchants add custom perks like flash sales or rank shipping options by carbon footprint.

Merchants now create store layouts with a tool called Metafields. Metafields serve as no-code layers of more sophisticated customization. They allow for tweaking things like product and order flows at the company-specific attribute level. They enhance the amount and depth of data storage that can be enjoyed through the Admin. Effectively, Metafields make querying and customization easier and less intimidating for merchants. Shopify stakeholders use them to enhance the customer shopping experience or to better grasp back-office operations. Again… all no with no coding.

Previously, and still occasionally with Shopify’s competitors, data and apps had to be manually hardcoded into themes with clunky integrations. That headache is now completely gone. Finally, the upgrade came with a new Cart API which unlocks customization options like loyalty program on-boarding and upselling automation.

Online Store 2.0 includes a brand-new reference theme (bare bones theme applicable to most businesses) called Dawn. The theme loads 35% faster than its predecessor called Debut. Just a 10% improvement here fosters 7% higher merchant conversion (per Crazy Egg), so this advantage means 24.5% higher conversion. Think about how happy a merchant must be to convert 245 more shoppers per 1,000 into loyal customers. This matters… a lot.

QL Notebooks:

Fitting into this theme of approachable customization regardless of tech background is a GraphQL tool called QL Notebooks. Notebooks turns queried datasets into graphic key performance indicator (KPI) visualizations to make decisions more obvious. It’s easiest to think of this as a low-code, recommendation tool to hold a merchant’s hand while they glean insights from their operations. For example, a t-shirt vendor could use this to uncover high intent customer cohorts, return rates per size to tweak fit or even observe trends of other brands to know exactly what’s in vogue.

The powerful feature lets merchants emulate the work of large data science teams without having to hire and maintain the talent. QL Notebooks is a cost saver, another means of lowering the entrepreneurship barrier and makes technical processes extremely user-friendly. It frees businesses of all sizes to tap into more enterprise-level tools. For an idea of how needle-moving QL Notebooks is, Shopify Merchant Rumpl enjoyed +39% shopper conversion with it.

As another compelling Notebooks example, let’s consider Decathlon -- the largest sporting goods retailer in the world. Decathlon used QL Notebooks to fully automate data capturing and leveraging processes. In the past, the merchant’s developer teams tediously had to do all of this manually. With Notebooks, Decathlon can now see KPI trends in real-time to track performance in an automated fashion.

“Without using Notebooks, I would have done an extract in Google Sheets or Excel, maybe critiqued some pivot tables, and delivered it to leadership for comment. The problem with that is it's just one shot. It's out of date. That’s why we use Notebooks -- it’s specifically adapted to all of our data mining and storytelling needs as an e-commerce brand.” -- CTO of Decathlon Tony Leon

Liquid vs. Hydrogen Template Languages:

We briefly discussed how Shopify offers two template languages -- Liquid and Hydrogen -- to support developers. But what’s the difference and why are both needed?

Liquid is a Ruby on Rails-powered Shopify development format. It’s purpose-built to facilitate commerce design by intelligently surfacing assumptions and recommendations to expedite work. It also boasts a roster of templates to be utilized for faster app construction. It is the language and style of building that Shopify’s partners have used since the company’s inception. But now there’s a new option.

Hydrogen is Shopify’s newer developer kit used to power what’s called Headless Commerce. It’s built through Shopify’s acquired open-source web-development language called Remix rather than Ruby. It provides the same no-code customization as Liquid, but with a few key differences.

Headless Commerce (utilized through Hydrogen) Defined: Headless Commerce means the separation of the front-end (what consumers interact with) and the back-end (tools merchants use to manage operations).

Headless Commerce is how Shopify allows merchants with unique requirements to further customize without needing to build from scratch. It gives clients with more in-house developer resources the freedom to create what they want and how they want it. Notably, Hydrogen is one of the ways Shopify is securing larger merchants which routinely have more customization wants.

Headless Commerce development separation means expedited user experience (UX) customization. Why? Because the more configurable front-end does not need to wait for changes to be reflected in the back-end. Rather than waiting, Shopify uses the Storefront API as a bridge to communicate changes between ends to ensure they’re eventually accurately reflected. This allows interface and back-end developer teams to work in parallel without stepping on each other's toes.

The detachment allows for faster page loading since the front-end is not tied to the slower back-end’s bulkier processing requirements. This frees real-time front-end rendering as store edits take place -- something Shopify calls “progressive hydration.” Under this format, whenever a customer shopping on a Hydrogen-powered site activates a front-end touchpoint, the Storefront API sends that info to The Admin. This occurs without the customer seeing anything but a pretty user interface (UI).

The added layer of separation is used by merchants to power incremental store granularity. For some examples: Ilia uses Headless commerce through Hydrogen to perfectly match shopper skin tone with makeup shade. Using this style of build helped it lower site bounce rates by 10%. Bols used it to reduce disparate app integrations and workarounds that were slowing page load times. With it, those load times fell by 50%.

Allbirds launched with Headless on their mobile app in under 30 days. They were so pleased that they’re now embarking on a multi-year journey to move their entire software ecosystem to it. Patta & Tommy (Hilfiger) used it to add animation and HD video to their site with ultra-fast load times despite soaring bandwidth. It used Hydrogen to sidestep a tradeoff between more beautiful stores and lower latency to boost shopper conversion. In the right scenario, a Headless Hydrogen build can be an invaluable part of a merchant’s operations.

All Hydrogen stores run through Shopify’s back-end server called Oxygen.

Hydrogen Means Customization without Custom Builds:

Shopify has historically refused to custom build from square one for merchants. It routinely rejects these requests and forgoes the potential business. To the firm, custom build and maintenance revenue is not worth the time-consuming, expensive processes that coincide. It’s throwing good money after bad. Instead, the firm sees real-time configurability and speed to market as more valuable to merchants than full customization. This is why businesses frequently go with custom builds elsewhere before boomeranging back to Shopify. Leadership has even called custom builds a “death sentence” in the past where scale is nearly impossible.

That’s changing somewhat with Hydrogen. Effectively, this new framework brings Shopify much closer to emulating full customization in an economically rational manner. Hydrogen marries all of the tools and infrastructure that Shopify provides with more jurisdiction to tweak to exactly what a merchant requires. This is how merchants get the best of both worlds: scalability plus near-limitless flexibility.

Why Most Merchants Still Use Liquid:

This all sounds great, so why doesn’t every merchant build with Hydrogen? A few reasons. First, it’s more expensive. Most merchants do not have the customization needs or resources to justify going with Hydrogen. For them, Liquid works. Liquid is quicker to set up and, on Shopify, boasts more than enough adaptability for most merchants. Finally, Headless builds receive less support as they include external code not natively supported by Shopify’s architecture. Consequently, merchants are more on their own when building with Hydrogen.

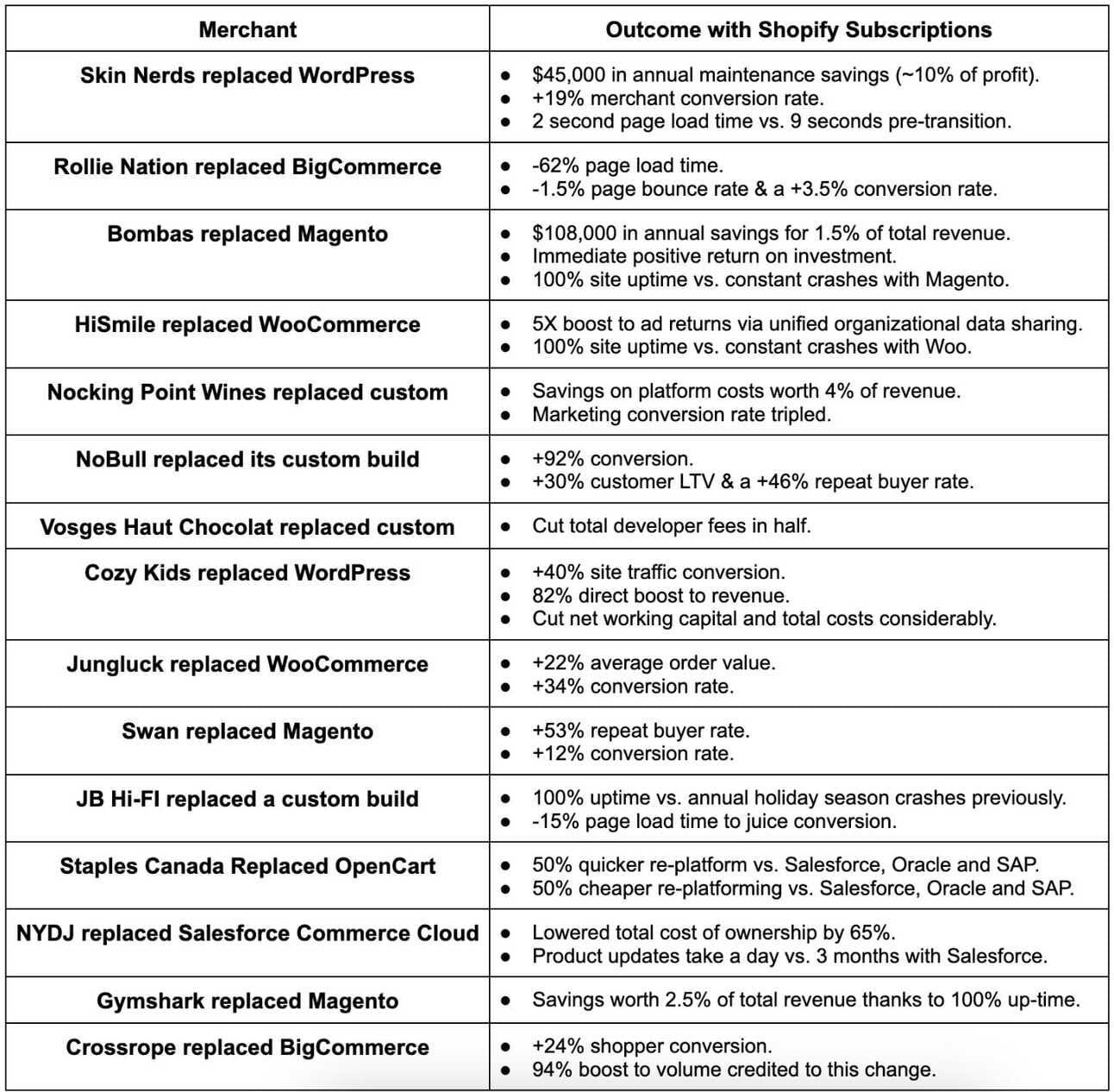

2b) Powering Lower Total Cost of Ownership (TCO) -- With Concrete Examples:

Web-building is highly competitive. Shopify wins by creating more value while cutting total cost of ownership (TCO) and powering delightfully convenient shopper experiences. This source of differentiation is quite abstract, but fortunately there are many customer case studies to quantify this edge vs. competition:

2c) Catering to Larger Merchants

Shopify’s mission to “arm the rebels” explicitly implies its bread & butter niche of smaller merchants. Interestingly, it has positioned itself, especially over the last few years, to be a more legitimate and valuable large merchant vendor as well. Now, it’s arming the rebels AND the generals. By serving larger merchants, Shopify enjoys brisker revenue ramps, better retention (via typically longer-term subscription contracts), and more up-selling of ancillary products. This will be an increasingly important growth vector going forward. Hydrogen is a big piece of this niche extension, but there are a few other key developments to discuss.

Shopify Plus:

Shopify Plus is the enterprise level subscription package directed at larger merchants. There are nearly 30,000 Plus stores in circulation today per Builtwith. This package debuted in 2017, but really took off when Shopify accelerated investment dollars there in 2019 and went global in 2020. The original utility creator for Shopify Plus had been allowing all selling channels and geographies to be run through one singular Admin rather than individually.

If this sounds familiar, that’s because it should. Today, this perk is available for all Shopify subscription levels which follows a typical company pattern. It elects to siphon off material pieces of its suite for only Plus merchants to motivate upgrades. Over time, when these exclusive tools become more table stakes or expected throughout commerce, it opens the products to lower subscription tiers. Considering the roster of brands and celebrities like Tom Brady, The Kardashians, Wayne Gretzky and Derek Jeter using Plus, this approach is working:

“The cool kids all built successful direct to consumer (DTC) businesses on Shopify. Large retailers are now trying to look like the cool kids.” -- Chief Commercial Officer Loren Padelford

Plus merchants enjoy even cheaper access to card interchange fees and discounts across other products. Customers also enjoy higher transaction limits and more seamless onboarding. For example, Kraft Heinz stood up a brand-new online DTC store through Plus in just 7 days for its first foray into digital selling. With other vendors, estimated time to build was several months. Beyond the speed to market, discounts, and other perks, there are a few incremental services to highlight that deepen and cultivate Plus’s unique proposition.

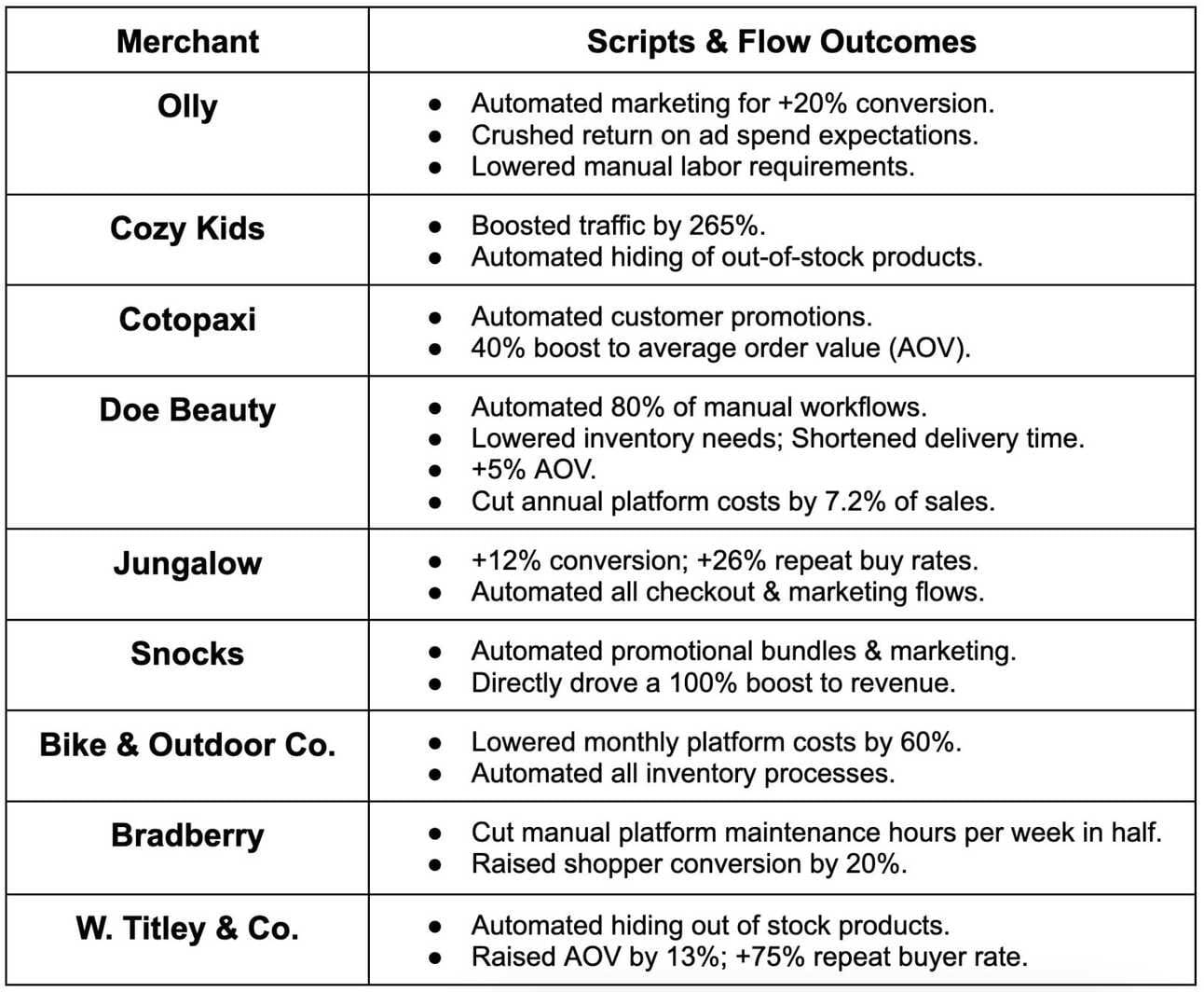

Shopify Scripts is one of the main value creators exclusive to Plus merchants. Scripts elevates user experience (UX) customization on a deepen level via things like fulfillment ranking by fragility or setting discounts based on shopper frequency and bounce rate probability. Other useful examples include promotion offering on an individual shopper basis or separating customer segments by a certain variable to target advertisements. It’s not no-code but is relatively low code.

Shopify Flow, which was exclusive to Plus merchants until late last year, is a tool to seamlessly automate Scripts creation. Put simply, while Scripts is a tool to “build incremental back-end custom logic,” Flow is a close complement that frequently pulls from this logic to automate the workflows that it innately creates. All customizations are easily deployed (in a no-code manner) to stores via Metafields.

Below are merchant case studies concretely showing how these two products create value:

Beyond these tools, there are a few ancillary services Shopify offers that are only for this tier. Those include Shopify Markets Pro (its cross-border automation tool explained in detail later), the Notebooks product and Business to Business (B2B) selling.

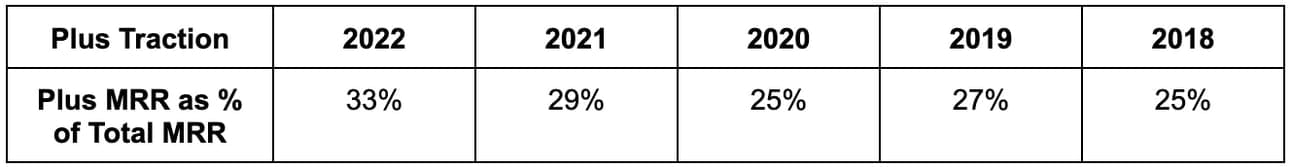

An important way to gauge Plus traction is through Plus monthly recurring revenue (MRR) as a percent of total MRR. MRR is the most tightly correlated gauge of growth in value from its subscription revenue. It includes all subscription revenue minus theme and platform fees. Plus is a large and growing chunk of total MRR as Shopify sharpens the appeal. It has taken temporary hits via cheaper tier trials accelerating growth in other plans in relation to plus (see 2020). But the long-term trend is higher:

Commerce Components by Shopify (CCS):

Beyond Shopify Plus’s and Hydrogen’s abilities to offer more flexibility and tooling, Shopify has recently made it a point to become a better evolution partner for large merchants. What do we mean by this? In the past, it had required bigger brands with established tech stacks to effectively “rip and replace” existing infrastructure in favor of Shopify’s. Yes, it did offer abundant 3rd party integrations, but didn’t allow for much legacy custom software to be kept. That was partially resolved with Hydrogen, but there’s another key contributor to it embracing large client transitions at their own pace. This contributor is “Components by Shopify” (CCS). While Plus is for larger, more established merchants, CCS is for the largest and most established. It’s geared toward Global 2000 enterprises.

Announced in early 2023, this package enables clients to pick and choose pieces of Shopify’s store building infrastructure in a fully à la carte manner. This way, they can keep pieces of their legacy software while using seamless integrations to plug them into the Shopify tools they use. This is especially important to older, larger brands with ingrained standard operating procedures and a desire to not overhaul decades of comfortable workflows. They understandably want to keep their favorite bits and pieces to shrink the learning curve.

Shopify avoided these legacy integrations in the past due to fear of low performance and little flexibility for required updates. Now, it’s ready to permit them without sacrificing store functionality or quality. Hydrogen + CCS means merchants can select exactly what they want and emulate customization without requiring the intense work on Shopify’s end usually associated with custom builds. Hydrogen alone got them much closer to this; CCS gets them all the way.

The firm has always been a great à la carte vendor for smaller merchants, but not so much for larger merchants. Why? Larger merchants inherently use more products, require more customizing and more granular store design. This means they routinely rely on more API calls to power desired functionality than do smaller merchants.

API Call Defined: When one application or store front asks another application to use its software/product within its own.

Before CCS, all Shopify subscription plans, including Plus, had finitely capped API call limits. Those limits require merchants with the widest array of tooling needs to prioritize their most desired store traits. Now, CCS offers massive companies a Shopify plan with limitless API calls.

Enterprise Resource Planning (ERP) Program:

In Q3 2020, Shopify announced its Enterprise Resource Planning (ERP) program. This endeavor gives merchants easy integration access to all their desired data sources. Whether it’s SAP, Microsoft, Salesforce, Oracle or others, the program creates a much broader virtual highway for merchants to access needed data to guide operational direction.

Simply put, while CCS unlocks more evolutionary flexibility, this unlocks additional data infrastructure integrations. The combination merges near-endless storefront tooling with omnipresent access to needed information to ensure merchants have everything they could possibly need on Shopify. Both make the company an easier partner to work with -- especially for larger merchants with richer, often siloed datasets.

Fragmented data is a cliché for the world’s largest consumer packaged goods (CPG) conglomerates. That’s why launches like this one have resulted in such rapid momentum with Unilever, Procter & Gamble, Nestle and others since 2020. It’s also proven to be quite valuable for other clients like Mattel and Hasbro considering the sheer volume of brands and businesses operating under one combined umbrella.

System Integrator (SI) Program:

Candidly put, large merchants are typically slow moving and resistant to change. That’s where its System Integrator (SI) program comes in. This program kicked off in 2019 -- right when CCS development initially began -- and involves partnerships with global consulting bellwethers like Deloitte, EY, KPMG, and Accenture. Massive brands utilize these iconic firms to manage major platform overhauls. Because Shopify hadn’t been working with them, hadn’t trained them on the product suite, and hadn’t incentivized their selling, the company missed out on big opportunities. Not anymore.

Shopify now educates and financially motivates these consulting firms to sell its tools to their clients. It trains the firms on how to expedite client on-boarding while making that process painless. For EY specifically, Shopify is training 500 of its employees to be dedicated sellers of its offering. Early on, this has already led to Shopify adding Audi and World Vision as new customers. Many more are expected to follow.

It’s one thing to be sold on modern commerce evolution by a somewhat quirky company like Shopify that loudly and proudly “arms the rebels.” It’s another thing to be sold on this transition by classic institutions. Shopify embraced this and created a go-to-market approach for CCS to find optimal traction. Referral networks of freelancers and developers work wonders for smaller merchants and even moderately sized Plus merchants. SIs are needed to land whales. Reflecting this change in philosophy, Shopify is finally participating in request for proposals (RFPs) which essentially let vendors audition for new business. It previously had refused to do this. All these new focus areas help explain why total Shopify Plus merchants have compounded at a rate of 37% over the last 3 years.

2d) Channel Ubiquity

The online store is by far Shopify’s largest channel for volume and revenue creation. More recently however, social, app-based, and physical channels have become more important. Being everywhere that a buyer could possibly shop is what makes a commerce operating system the most valuable to merchants. This complete availability means more successful clients with more volume and more Shopify success. So? Shopify obsesses over offering multi-channel ubiquity in a way that neatly ties back and integrates into the centralized Admin.

Social:

Shopify has strong partnerships with Meta’s Family of Apps (FOA) and Alphabet which both began in 2019. Today, merchants can sync their product catalogs from Shopify directly to Facebook, Instagram and Google Shopping. They can even build branded stores within FOA’s ecosystem to stand out in an increasingly competitive e-commerce world. Furthermore, Shopify’s accelerated consumer checkout (called Shop Pay) is available to merchants on these surfaces. Shop Pay provides fully in-line checkout (meaning within Meta’s or Google’s environments) rather than forcing consumers to bounce to Shopify and back. In-line always means higher conversion via less clicks and pages to checkout.

In Q2 2022, Shopify added a native product integration with Alphabet’s YouTube. This offers the ability to push product catalogs directly into YouTube Streams or its store tab and connects to Shop Pay just like Google Shopping does.

Most recently, Google and Shopify joined forces to “tackle search abandonment.” This type of issue is quite costly to merchants considering they’ve done the work to procure the search and the sale yet lose the revenue. So? Google’s discovery AI tools are now integrated into CCS stores. This partnership more intelligently displays search results by mining relevant Alphabet data to paint a more accurate picture of what the shopper is seeking. Rainbow Shops is among the first merchants to tap into the product which raised its search volume by 48%.

Shopify has a similar partnership with TikTok. It allows for the same product catalog syncing into TikTok’s Shopping Channel and an ability to create shop-able in-feed video ads amid the scrolling. Shopify just added native Pinterest and Twitter integrations -- although there’s no native checkout product on Twitter to date.

When looking across the web builder landscape, Wix is the only competitor boasting all of these native channel integrations. WooCommerce has Google and Meta natively, but not YouTube or TikTok. SquareSpace has all of them besides TikTok. BigCommerce has them all minus YouTube. When clients of competitors want channels without a direct integration, they must stitch together clunky, 3rd party, labor-intensive connections. This jeopardizes latency, accuracy and so conversion. It’s certainly doable, just less seamless and heavier weight than with Shopify.

Considering social commerce is expected to compound at a 26% growth rate through 2025, merchants can greatly benefit from more native and complete integrations here. And if they want all of them, they must go through Wix or Shopify. Perhaps that’s why social commerce GMV continues to grow at a triple digit clip for Shopify -- even as the base becomes a more material part of its overall business.

Marketplaces:

Marketplace integrations are a bit of a differentiator for Shopify. All web builders offer Amazon selling channels, but Shopify’s roster of marketplace integrations is uniquely broad and global. It showcases a tight channel integration with Walmart to allow merchants to place products directly on its marketplace. WooCommerce and BigCommerce have this. SquareSpace and Wix make merchants go through an external third-party integration to enjoy the perk.

Shopify uniquely offers native integrations with key Chinese marketplaces including JD.com and Alibaba as well as a barebones plugin to Mercadolibre in Latin America. For JD specifically, the relationship unlocks Chinese demand for Shopify’s merchants while allowing them to store goods in U.S.-based JD warehouses. With Alibaba, Shopify added Alipay as a payment option to support Chinese shopper conversion.

Dedicated Business to Business (B2B) & Wholesale Channel:

Not every merchant wants every transaction to be DTC. Profits and success can be reaped by large quantity sales to other enterprises -- even with discounting. This opportunity meshes perfectly into Shopify’s commerce transformation considering Gartner sees 80% of B2B transactions being digital by 2025. Knowing this, while Shopify predominantly operates on the DTC side of things, it has more recently added this means of selling to the fold.

Merchants frequently must force manual workarounds to patch together consumer-facing and enterprise-facing demand into one set of operational insights. Shopify fixed this. Its B2B offering -- with most of the tools only for Plus and CCS clients -- can be easily added to a merchant’s Admin to run it like any other channel. This means all lucrative B2B selling and inventory data is fed to the singular point of Admin analysis. Merchants can separate these channels if that better meets their needs, but most don’t want to.

No longer must merchants run each means of selling in parallel tech stacks. No longer must they maintain clunky, heavy integrations into antiquated vendors. Shopify provided the ibuprofen to solve this annoying headache so that merchants can easily activate and integrate the channel.

The tool features all basic B2B tools that merchants expect including: customer specific pricing, taxation, and payment terms as well as B2B-specific analytics reports. Beyond that, it offers (Metafield-powered) no-code site building customization to tweak themes and flows on a by-customer basis. This level of granularity ensures a merchant’s largest customers have excellent shopping experiences.

Finally, the B2B channel directly integrates with Shop Pay for single click checkout. Demandware competition cannot match this. All these tools helped Laird, which replaced BigCommerce with Shopify Plus, automate B2B and enjoy savings worth a few percent of overall EBIT. For this merchant, the tool “covered the cost of Shopify several times over.”

This is yet another way that Shopify is more effectively appealing to larger merchants. Global CPG giants virtually all have wholesale and B2B selling divisions making up large portions of their overall operations. This product was mainly built for them and other big potential customers.

The Shop App:

The company’s consumer-facing shopping app -- called Shop App -- is a rapidly growing commerce destination. As always with Shopify, it offers marketplace-like demand aggregation, but with full control over brand, data and the customer relationship. As this becomes more successful, Shopify enjoys another growingly important, low-friction DTC channel that it can offer while its competition can’t. And it’s clearing gaining rapid traction:

This traction means more complexity routed through the singular Shopify Admin which, in turn, deepens Shopify’s value proposition. So how does this app create consumer value and where is the traction coming from?

Shopify calls the tool a “mobile shopping companion” for consumers buying from all their favorite brands. Using a person’s purchase history data to season the app’s algorithms, Shopify offers product suggestions to make this channel uniquely powerful. So? Consumers enjoy a more personalized experience. As a result, merchants sell 17% more on average to Shop App users vs. other customers. A brand new ChatGPT integration in the search and discovery function could strengthen this edge more.

The app pulls from Shopify’s core competencies to create the most successful selling channel possible. Specifically, Shop Mini is its software development kit (SDK) allowing developers to take beautiful online store builds from other channels to use here. Upgrades like this have directly translated into 15% more product traffic for merchants. Shop App also features a native Shop Pay integration to offer fully in-line, single click checkout -- and so maximum conversion.

It plugs into Shopify Flow & Scripts to automate operational learnings and allows consumers to seamlessly track and edit orders with the “Arrive” function. Alone, this service has proven to juice reordering rates by 11%. All of this utility was tied into brand new customer accounts in February 2023 to allow shoppers to manage all activity from a singular place (just like merchants can). Merchants secure a better understanding of high intent buyers as they enter sites via the customer account’s “Sign in with Shop” identifier.

To make the selling channel even more powerful, Shopify added a loyalty program to the consumer app called Shop Cash. This is free for merchants to use; they only pay a success-based commission when new business is won from the program. Shoppers get 3% cash back (in Shop Cash) on all app purchases and even larger rewards if they leave product reviews. Specifically for a merchant like HydroMate, this has been the “best customer acquisition cost tool it could find” according to its co-founder. 43% of its entire new customer growth is now coming from Shop Cash.

Offline:

Finally, Shopify Point of Sale (POS) has become a paramount piece of this company. Much more later.

2e) Pricing Power

The clearest sign of a strong, defensible market position is pricing power. If you can hike pricing without significantly raising churn, that means merchants cannot find the same level of value elsewhere. That is pricing power. According to Shopify President Harley Finkelstein, there is “unequivocally room to increase prices and ample elasticity of demand.” He calls Shopify “intentionally the best deal in commerce” to make them tougher to compete with for other vendors.

Clear evidence of pricing power came in early 2023. Shopify hiked its Basic plan by 34% to $39 per month, its Shopify plan by 33% to $105 per month and its Shopify Advanced plan by 33% to $399 per month. It did not hike Plus or CCS prices in a move to motivate more merchant upgrades (and because CCS is brand new). These were the first hikes to the three packages in roughly a decade.

Shopify’s goal is to continue to add more incremental value than it charges for. This value-to-cost gap makes it inherently difficult to displace. Importantly, there has been “no pushback” from merchants on the price hikes according to Finkelstein -- pointing to this gap being maintained post-hike. The move leaves Shopify with an ideal choice: Either it can use the added high margin revenue to invest back into the business, or let it flow down the income statement to bolster profits. We see significantly more pricing wiggle room based on numerous total cost of ownership case studies and Finkelstein’s own words. The team is actively considering hiking more expensive subscription tiers, but has not made that final decision.

“In terms of pricing, our subscriptions are the best value out there.” -- President Harley Finkelstein

Section 3 -- Merchant Solutions

The Basics:

As briefly mentioned, merchant solutions are ancillary services offered on top of Shopify’s store building subscriptions. Virtually all revenue here is usage-based unlike with the subscription bucket.

Each merchant solution fixates on a large pain point not being effectively solved for businesses. The instruments consolidate disparate 3rd party offerings into the Admin to ameliorate and centralize decision making as well as lower TCO. The bucket is a major source of Shopify eclipsing a 10% share of U.S. e-commerce volume as of early 2022 with that share growing since then. It’s how Shopify makes itself uniquely valuable to merchants, how it motivates retention and how it can claim broader use cases stemming from its API suite vs. competitors: Each merchant solution is powered by a product-specific API. Without these incremental services, the firm would be just another web-builder with slightly better tooling and integrations. Merchant solutions distance Shopify from its competition.

Products from this bucket all leverage Shopify’s massive economies of scale to allow enterprise-level discounts to business of all sizes. Each solution shares utility and insight-rich data amongst each other to uplift the total value proposition. They all function in a better together manner. This aggregated demand works wonders in seasoning Shopify’s AI/ML algorithms to ensure merchants are as informed as possible.

Compared to subscription solutions, merchant solutions carry lower gross margins. Interestingly however, they also boast lower operating expense intensity which makes the EBIT margin profit similar. Still, as merchant solutions become a larger piece of overall sales, gross margin should continue to fall. This is a trade-off that Shopify is eagerly happy to make as an investment in growth, EBIT & retention.

3a. Shopify’s Suite of Payment and Checkout Tools

Shopify Payments:

The payments landscape is important to understand in the context of this product. For the sake of making this deep dive shorter than 100 pages, we wanted to link to our previous explanation of the sector (in the context of Shopify specifically) rather than repeating it here. That explanation can be found here and clearly defines all terms used in this section.

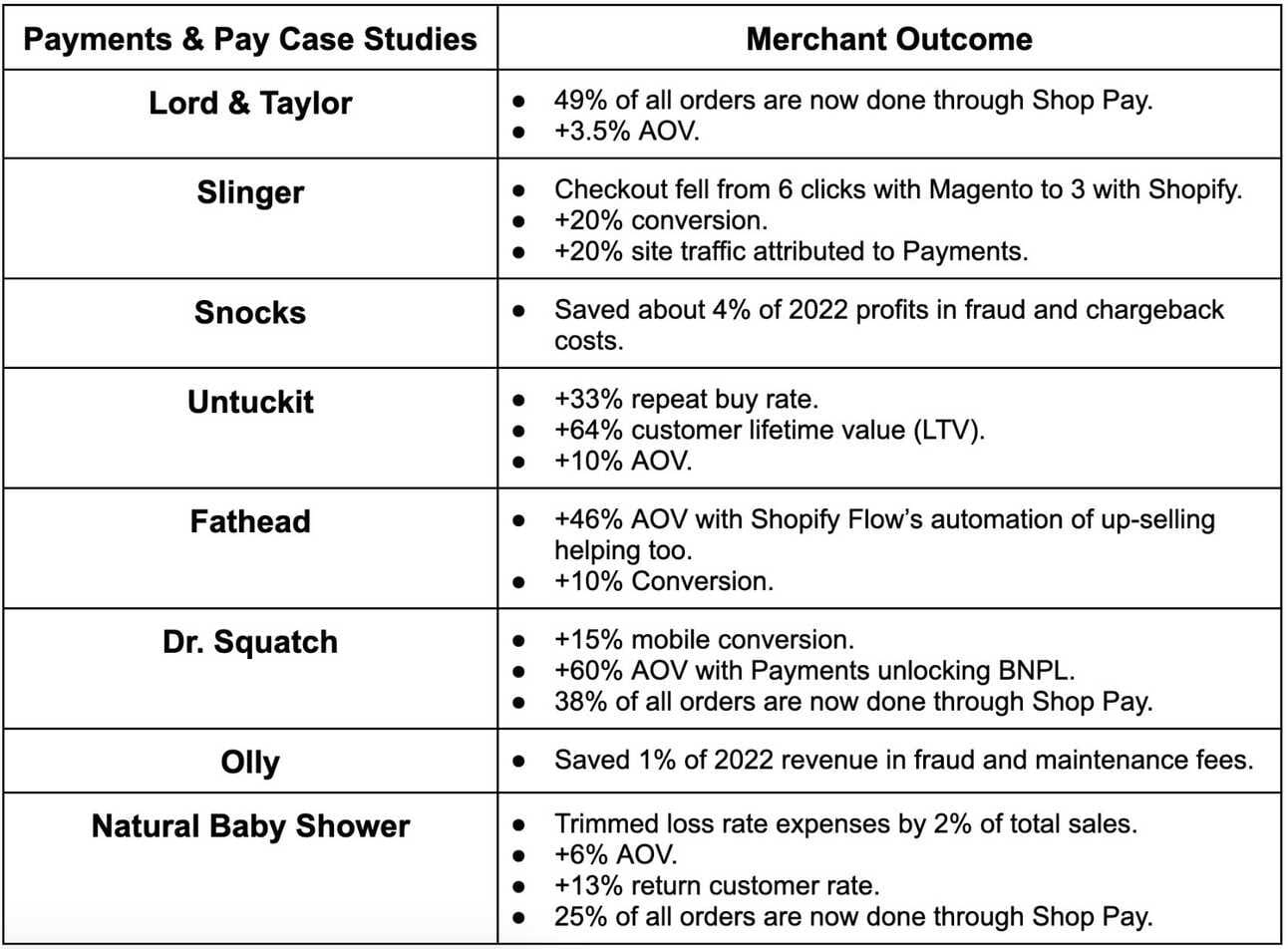

Shopify payments is a native payment gateway for merchants and a processor via a Stripe partnership. While today Payments is a large profit contributor, this product was not initially launched in 2013 to make money. It was instead launched to eliminate merchant friction. Shopify had been sending merchants to alternative, 3rd party gateways, thus forgoing business and forcing use of fragmented vendors. This also meant losing direct access to merchant payment data which Shopify now uses to do things like offer cheaper access to growth capital. Remember, the overriding goal of Shopify’s product amalgamation is to create a frictionless, uniquely valuable one-stop shop for online commerce.

The product eliminates the need to maintain an external, clunky and unreliable gateway integration. It removes the headache associated with payment relationship upkeep by serving as as a cohesive layer on top of those value chain pieces. And while making things easier, it makes things more configurable too. Tools like its Payments and Checkout APIs are readily available for developers power, customize and automate on behalf of merchants. These products free merchants to offer and automate up-selling promotions, loyalty program on-boarding and omni-channel buy now, pay later (BNPL). Powerful and easy is a wonderful combination.

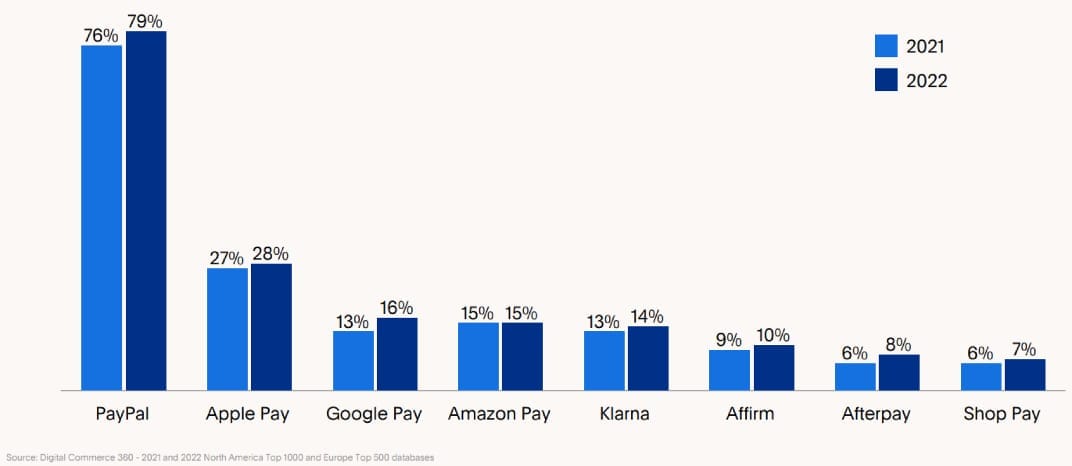

Shopify Payments painlessly connects to its internal checkout accelerator and gateway called Shop Pay. Simply put: Pay is consumer-facing and Payments is merchant-facing. Shop Pay uses Shopify Payments as the default processor and orchestrator to collect incremental fees.

The checkout accelerator is not the only consumer payment option on a merchant’s site -- and far from it. Part of the benefit of Shopify’s massive, diverse partner ecosystem is access to relevant 3rd party gateways and alternative payment methods (APMs) -- largely thanks to Stripe. This means other payment options like PayPal are available for merchants to integrate while local payment methods (LPMs) in key international markets are usable as well. With Shopify’s APIs, checkout integrations always emulate the native feel of merchant sites to keep the shopper experience consistent -- raising conversion further.

More access to the most relevant payment options means better shopper conversion, less baskets abandoned, and more revenue. To assist in international selling, multi-currency transactions are available to shoppers and merchants. This multi-currency perk was extended from Plus merchants only to all merchants in 2020.

Aside from more convenience and expedience, Payments offers the same control of checkout branding that Shopify demonstrates elsewhere. Interestingly, in response to popular demand, brand clients can now implement a “Powered by Shopify” label which has been shown to raise conversion due to Shopify’s growing clout. It’s up to them if they want their brand to be alone or joined by Shopify’s.

As briefly mentioned, Shopify Payments leans on a tight partnership with Stripe to power processing. It charges a typical merchant transaction fee of 2%-2.9% + $0.30 with volume discounts for Plus and CCS merchants. Shopify uses its aggregated demand to negotiate better interchange fees with 3rd party rails than could merchants on their own. Payments merchants also get free access to Shopify’s fraud protection program like many other competitors such as PayPal provide. This program has shown to lower loss and chargeback rates vs. both industry incumbents and next-generation competition.

Shop Pay:

Shop Pay (launched in 2017) is the firm’s internally developed checkout accelerator and gateway built right into Payments. It was among Shopify’s first consumer-facing initiatives and has been a big piece of “people realizing Shopify is behind their favorite brands” -- per President Harley Finkelstein.

The gateway functions like any other payment vault. It stores consumer card and shipping info to automatically populate upon password-less, single page verification. Considering forgotten passwords are by far the largest source of cart abandonment, this is a very meaningful feature.

Shop Pay’s checkout process is fully native to merchant stores and also the Shop App. This means as the merchant base and app traffic grow, the convenience associated with Pay merely builds as friction melts in ways that cannot be emulated by individual merchants. The overarching result of Shop Pay is consumers speeding through checkout in one click. PayPal and others are still working to get 100% of their merchants to two click, in-line checkout. Shopify is ahead here.

While gateways are similar among vendors in some ways, Shop Pay still stands out. As of 2023, the tool is 4x faster than the average competitor and converts at 1.72x the rate of competition. It has been the fastest to completion, highest converting checkout accelerator in the entire industry for the last two years. The accelerator is also now the top selected for Shopify consumers amid a sea of options. These leads enabled Pay to eclipse 100 million users in 2022 growing at a 2-year compounded annual rate (CAGR) of 41.4%.

“If consumers must fill out a form, we’ve lost them. Enabling Shop Pay made the most painful point of the customer experience delightful. Since it’s tied into the merchant ecosystem, even new customers can check out in one click.” -- KOTN Co-Founder Ben Sehl

Shop Pay would ideally want 100% of checkout share within Payments to juice revenue and profits, but that’s not realistic. What is realistic is being the most preferred provider while integrating with PayPal, Adyen and countless other gateways to power diverse consumer payment options. This ends up raising conversion and is a net positive to Shopify’s financials. More, relevant consumer choice is always a good thing at checkout.

In terms of what’s next for Shop Pay, the product is leading Shopify’s charge to open its product ecosystem to more external surfaces. It offers 2 click (soon 1 click) checkout on email, direct messaging, shoppable web links and social avenues. Pay can be added to all of these selling channels with the Shopify Wallet API.

Specifically on social, through partnerships with Meta and Google, Shop Pay is now available across those rapidly propagating commerce destinations. As part of this arrangement, through Stripe, Shopify Payments became the default processor for all transactions using Shop Pay. This is the first time Shop Pay is being offered outside of Shopify to compete with other checkout service providers more directly. According to leadership, investors should expect more of these relationships going forward. The firm wants to push its latency and speed advantages to more shopping surfaces to ensure merchants can enjoy Shopify-level conversion everywhere.

This goes back to doing whatever it can to juice merchant GMV so Shopify can make more money. Truly a win, win, win with Shopify, merchants and partners all benefitting. It’s still very early in the process of opening this up to large partner surfaces as seen below. The combination of Shop Pay’s better consumer experience paired with low merchant adoption today leaves a long runway. We expect traction to accelerate here.

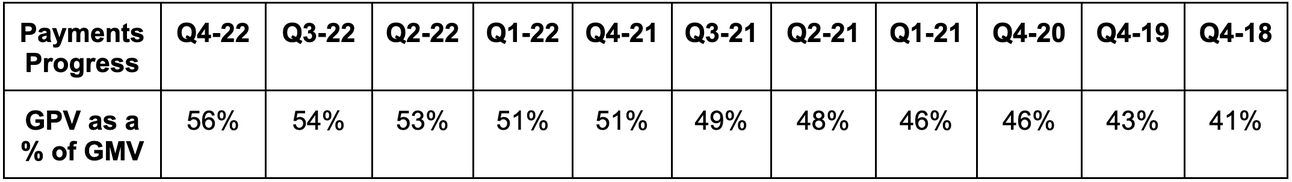

To track the progress of payments suite adoption, investors can look at Gross Payment Volume (GPV) trends as a percent of overall GMV. The GPV proportion growing is direct evidence of outperforming traction here as payment-based volume makes up a larger portion of overall volume. This trend has been consistently higher over the last 4 years via Shop Pay share gains and growing cross-border volumes (which require merchants to have Shopify Payments). This pattern is fully expected to continue.

Installments:

Shopify hopped on the Buy Now, Pay Later (BNPL) bandwagon amid the COVID pandemic. Stimulus checks created a debit usage shock which contributed to the rapid proliferation of this new tool. Fortunately, Shopify went about this in a more asset-light way than did some others like Block (purchased Afterpay). Rather than making a massive M&A splash, Shopify partnered with Affirm to build out this offering. The two, following the signing of a multi-year exclusive agreement, rolled out the product in Q3 2020. Under the arrangement, Shopify uses Affirm’s software and gets a cut for procuring BNPL demand through Shop Pay and its network. Shopify also got equity compensation as part of the deal. As of Affirm’s most recent proxy statement, Shopify owned a total of 14.4% of Affirm’s total voting stock through warrants.

Shopify Installments has no late fees while competition like Afterpay does. The tool boasts no hidden costs, no interest payments and is the “most transparent BNPL product” according to leadership. For merchants, the added payment flexibility raises repeat buyer activity by 23% while powering higher conversion, better retention and a boost to AOV. The benefit is very similar to competing BNPL offerings. Merchants also get access to funds immediately to avoid any balance sheet or transaction risk -- just like with PayPal and many others. This offering became the top chosen BNPL provider for Shopify Merchants within 6 months of launch; it continues to take more market share into 2023 per leadership.

Shopify’s take rate and margin profile for BNPL transactions is better than the rest of checkout. This is partially because of added transaction complexity, but mainly due to how popular debit is as a means of payment for BNPL. Debit-funded transactions come with lower 3rd party interchange fees. This impact was most pronounced during the stimulus era. While the degree of this benefit has dampened since then, it remains in place to a lesser extent.

BNPL, in our opinion, does not work as a standalone product. It must be a tool in a toolkit rather than the entire suite. On its own, there’s nothing at all unique about the feature. There are no barriers to entry which is why PayPal has enjoyed such rapid traction and why Apple is now working on its own BNPL product. To be truly differentiated, BNPL must pull from relevant data sources to underwrite vs. new entrants more effectively. Shopify’s diverse product offering paired with its 10%+ U.S. e-commerce volume share delivers that prerequisite.

Shopify Point of Sale (POS):

Over the last few years, Shopify has aggressively ramped brick & mortar commerce efforts. As a company determined to be channel ubiquitous and agnostic for its merchants, physical shopping obviously is an important piece of the puzzle. Up until 2019, the firm had been using white-labeled hardware and what it called an “underwhelming” POS software package to integrate with external vendors. That changed in early 2020 when it launched its own, fully integrated hardware and software solution and established a dedicated POS sales team.

Why did it do this? Merchants were struggling to sync other hardware options into the Shopify Admin for a full, omni-channel view of operations. Furthermore, 3rd party vendors commonly forced manual delegation of employee tasks which slowed down decisions and product release cadence. These vendors also struggled with APM integrations and adding shopping formats like buy online, pick up in store. This all meant frustrating friction and poor physical conversion rates for Shopify merchants.

Shopify needed to move faster, be more organized, offer more customization and create better experiences than hardware partners were able to manifest. It needed to do this on its own. The pandemic-era launch of the integrated POS hardware and software subscription delivered these needed upgrades. It’s called Shopify POS Pro and is sold on a monthly subscription basis. POS Pro comes with the same QR code, tap to pay, swipe and chip functionality that has been commoditized in the space. So what’s unique about it? I’m glad you asked.

It removes offline integration headache to provide an end-to-end view of merchant channels through the centralized Admin -- for both digital and offline surfaces. This cohesion ensures that inventory data is complete with an easy ability to hide out of stock products in store and handle returns and refunds with ample scalability. That data, as always, is available to guide reordering, marketing, store expansion and more. The full integration also means extending Metafield-powered customization to physical checkout to bring offline store flexibility up to par with online. If a merchant wants rapid loyalty program onboarding, granular promotions or BNPL in brick and mortar settings, this means they can now have it.

Beyond these distinctions, merchants can use this software to organize pack-and-ship from in-store to leverage real-estate and raise revenue per square foot. And while tap to pay has become standard, Shopify does offer a slightly broader integration roster which includes ALL major digital wallets. It was also among the first to offer contactless pay through iPhone (thanks to Stripe).

The impact of these tools can be tracked by merchants with an intuitive smart grid to visualize graphic performance trends.

Imperatively, the new POS suite allowed Shopify to raise location limits from 50 to 1,000. That led to 35% of POS Pro sales in Q4 2022 coming from its larger merchants vs. just 14% year over year (YoY). Scale was a bottleneck for POS traction; that’s no longer the case as merchants embrace the service at a briskly accelerating pace.

While Shopify’s POS apparatus was once an afterthought, it has now morphed into a powerful top of funnel driver of merchant acquisition. How much of a driver? POS locations doubled in 2021 while continuing explosive growth into 2022 and 2023. Offline GMV for Shopify grew by 40% YoY in 2022 vs. 16% for the entire business. As a secondary benefit, this proliferation drives Shopify Payments volume as it is the default processor (thanks to Stripe) for Shopify POS transactions.