1. Demand

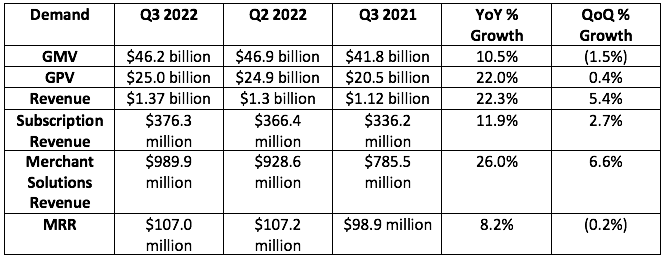

Shopify generated $1.37 billion in revenue which beat analyst estimates of $1.34 billion by 2.2%

More Context on Demand:

Shopify’s overall GMV growth beat the industry by 22%. Offline GMV grew by 35% to greatly outpace the broader market.

As a reminder, in Q1 2022, Shopify changed its developer revenue take rate from a flat fee of 20% to 0% on the first $1 million and 15% thereafter. This will continue to hit subscription growth through the first quarter of next year. It’s around a 400 basis point growth headwind today. Also in Q1 2022, Shopify began recognizing theme (design) sales on a net (not gross) basis which will weigh on growth through Q4 2022.

Revenue was impacted by a 200 basis point FX headwind.

Shopify’s 3-year revenue compounded annual growth rate (CAGR sits at a robust 52%.

MRR growth was held back by free trial extensions during the quarter.

Shopify Plus now is 33% of MRR vs. 28% YoY & 31% QoQ

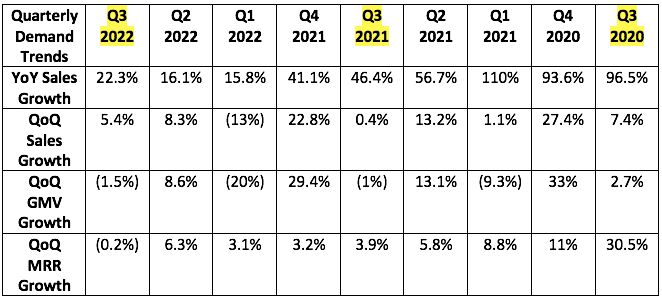

The pandemic’s impact on Shopify’s demand (and also margins) was most positive from Q2 2020 to Q4 2021. For this reason, the company will still have very tough YoY growth comps through the end of the year. Growth is expected to sharply accelerate thereafter.

GMV through partner selling channels like Facebook and TikTok tripled YoY.

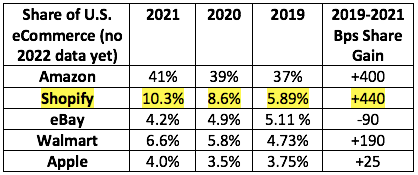

Market Share Data:

The only commentary we have surrounding 2022 market share data is Shopify consistently telling us that it’s outgrowing the market (so gaining more share).

This gradual rise in take rate is a direct result of Shopify’s Merchant Services proliferation. Up-selling these services lets Shopify do more for the merchant, and so allows it to fetch a larger cut. Specifically, the merchant solution take rate set a new record high for the company at 2.14% vs. 1.38% 5 years ago.

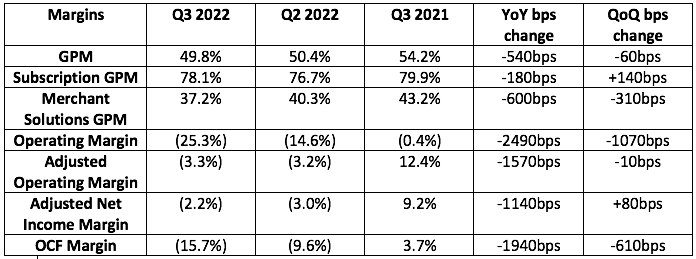

2. Profitability

Analysts were looking for -$95.7 million in adjusted EBITDA (similar to adjusted operating income). Shopify posted a loss of $45 million, sharply beating expectations. It told us to expect a “larger operating loss this quarter vs. last.” That turned out to be the case, but the loss only grew by a few percent.

It lost $0.02 per share in net income which beat analyst expectations of an $0.08 loss. It is controlling costs effectively.

More Context on Profit:

2022 has been an investment year for Shopify. Its objective all along has been to invest all gross profit dollars back into more growth and product seasoning. It reversed a decade long trend of operating leverage to aggressively invest in fulfillment and other products. Operating leverage is now expected to resume starting next quarter.

The lower margin merchant solutions segment growing as a percent of total sales is and will continue to be a gross margin headwind.

It’s interesting to keep in mind that lower gross margin products like payments actually have relatively strong segment operating margins because of the low comparative OpEx needs.

The aforementioned change in developer fees is also a large gross margin headwind (as it hits its highest margin revenue) until those comps normalize next year.

3. Balance Sheet

Shopify has $4.9 billion in cash, equivalents and marketable securities vs. around $7 billion last quarter as a result of its Deliverr acquisition closing.

This 3 year share CAGR encouragingly slowed from 4.1% growth last quarter. It needs to slow more.

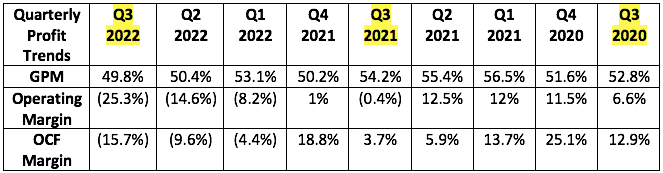

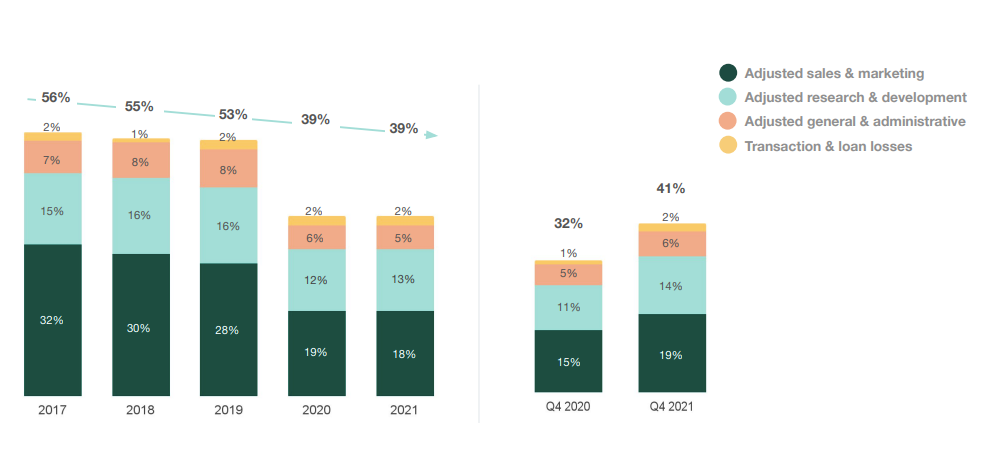

Evidence of consistent operating leverage pre-pandemic (Q2 2020):

I like to include this chart to remind everyone how consistent Shopify’s margin expansion was (without the pandemic) for the better part of a decade. Next time someone tells you the team doesn’t know how to manage capital, show them this. Yes, 2021 and 2022 have been years of transition and heavy investment. And yes, that timing has been quite poor as worsening macro makes those heavy investments less appealing. But when management tells me to expect operating leverage to resume next quarter, I take that seriously. The track record is there:

3. Guidance

Shopify continued to avoid providing specific forward guidance. Instead, it reiterated the following:

GMV will continue to outgrow competition for more share gains.

Merchant solutions growth will be 2X that of subscription growth.

Gross profit dollar growth will trail revenue growth.

Operating Expense growth will continue to fall. BUT, it now expects next quarter’s operating loss to be similar to this quarter vs. previously expecting it to be slightly smaller. With the larger revenue base expected, the margin will still improve.

Shopify now expects around $575 million in 2022 stock based compensation vs. previous guidance of $750 million as its flex comp package eases that dilution pressure.

4. Notes from the Call:

New Products:

Shopify Collabs debuted to connect merchants to influencers and their loyal fans to sell more product.

Launched Shopify Markets Pro to allow for fully automating the turning on of selling in 150 countries (with localized payments, translated language and easy returns/duties).

Shop Promise is now rolled out to all merchants with 67% of packages being fulfilled within 2 days vs. 2% YoY. This tool has been shown to raise conversion by 9%.

Shopify continues to expect 75% of packages to be fulfilled within 2 days by year’s end.

Shopify Audiences (its curated customer marketing tool) is working. With it:

hiya has enjoyed +172% return on ad spend (ROAS), a 158% conversion rate boost and 35% lower acquisition cost.

Nathan James enjoyed a 5.6X ROAS, a 200% rise in purchases and a 52% lower acquisition cost.

Shopify Tax is a new backend tool to automate that process for Plus merchants.

Amazon Buy with Prime integration negotiations are ongoing.

On Deliverr and Shopify Fulfillment Network (SFN):

The Deliver integration has begun. Shopify is working on a new app combining the capabilities of SFN and Deliverr’s talents such as cross-docking.

Shopify saw a 10X rise in merchants holding inventory at its Atlanta facility QoQ.

Shopify enjoyed 80% QoQ growth in merchants using 1 or more of its logistics services and a 450% rise in fulfillment volume.

SFN is cutting delivery time for merchants by 20% on average AND cutting cost per fulfillment. Nice win-win.

Harley told us the company doesn’t need more M&A to round out SFN.

On Shopify Plus Merchant Wins Highlighted:

Glossier; Cole Haan; Panasonic; SuperGa; Converse Japan; GNC India; NewEra

“We expect large merchant momentum to continue.” — President Harley Finkelstein

On Ernst & Young (EY) and partners:

Shopify and EY announced a new partnership. EY will train 500 of its employees on Shopify’s product offering and will aid it in bringing on large, new merchants. EY represents many of the largest consumer-facing companies in the World. As a note, KPMG and Deloitte are two other high profile Shopify selling partners.

Shopify teased new tools coming soon in partnership with Google.

On the Consumer’s Health:

Outgoing CFO Amy Shapero spoke on the weak consumer and its shift away from discretionary spend. The company’s guidance assumes this macro pain will continue next quarter.

5. My Take:

This was a wonderfully boring quarter. Headwinds for the e-commerce space are violent, abundant and stubbornly persistent -- and I find Shopify’s perseverance through all of this to be more impressive than others in its space. While this was by no means an amazing quarter, it was far better than I was fearing as the firm beat diminished expectations across the board.

Shopify continues to gain meaningful share on the broader market and continues to differentiate its offering through thriving merchant solutions. For those reasons, I see it as able to capitalize on any economic recovery more gracefully than its competition.

It was heartening to hear the company re-commit to controlling OpEx after an aggressive investment year and for leadership to reiterate its spend plans on Shopify Fulfillment Network. And speaking of fulfillment, progress there remains objectively positive and ahead of expectations.

I will continue to slowly build out this new position following the positive report.

Hi Brad, I really appreciate the continuous updates on your holdings. Incredibly helpful to keep being updated on potential buys I don't have the time to constantly monitor myself. Keep it up!

Hi! Good work. Thx for sharing. When will the deep dive follow?