Today’s piece is powered by Masterworks:

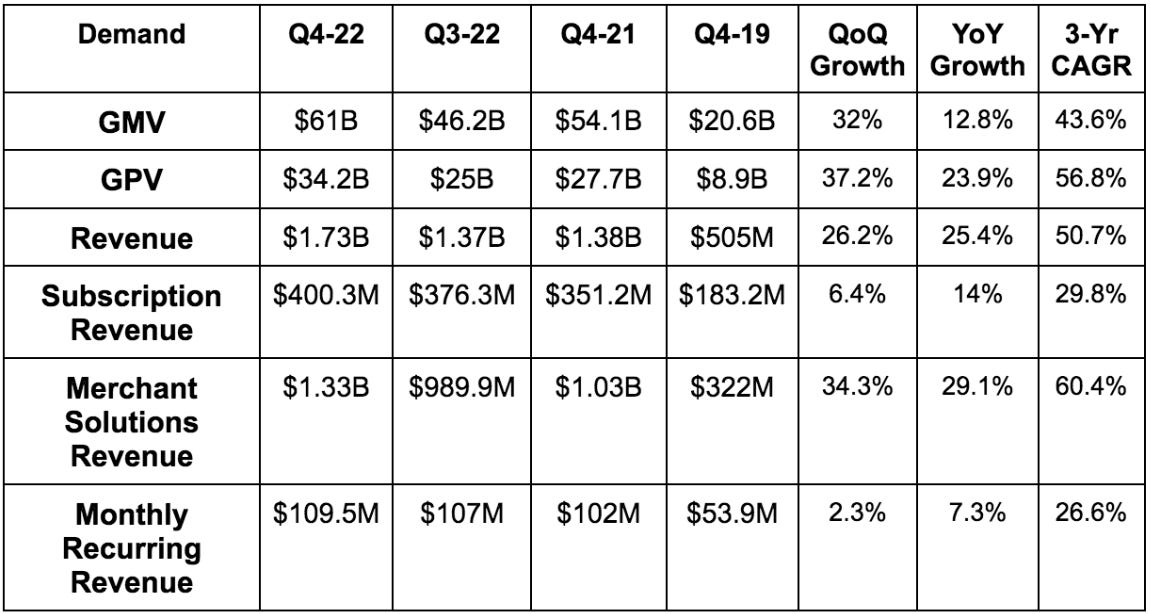

1. Demand

Shopify beat revenue estimates by 4.8%. This includes 200 basis points (bps) of foreign exchange headwinds.

More Demand Context:

Shopify’s 13% GMV growth more than doubled overall retail growth of 6% during the quarter as it briskly takes more market share. It enjoys a 10% share of e-commerce with more gains expected.

GPV was 56% of GMV vs. 51% YoY as Shopify Point of Sale (POS) and Payments continue to rapidly proliferate.

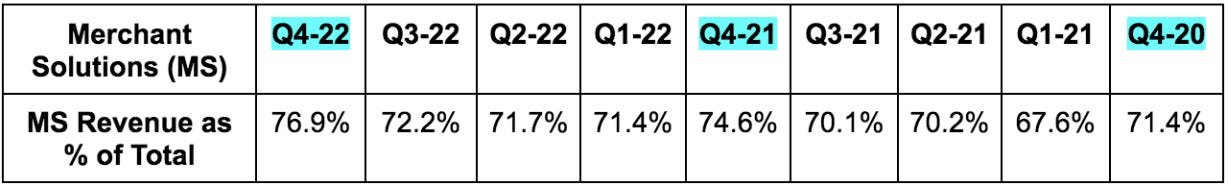

Merchant solutions revenue is more closely tied to GMV than subscriptions. It’s based on usage of tools like fulfillment & marketing rather than pre-set subscription rates. As a result, the seasonal Q4 GMV boost helps that bucket more than subscriptions.

The 50.7% 3-yr revenue CAGR compares to 51.8% last quarter & 52.9% 2 quarters ago.

Shopify Plus = 33% of MRR vs. 29% YoY.

Inorganic Deliverr growth propped up merchant solutions revenue but this impact was not quantified for us.

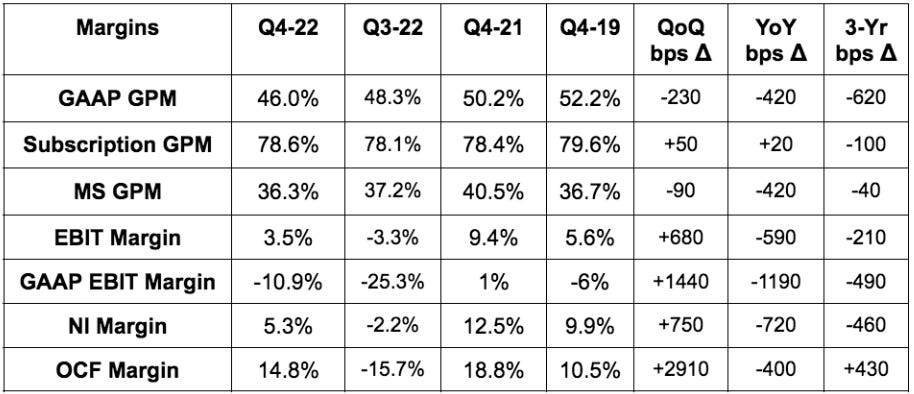

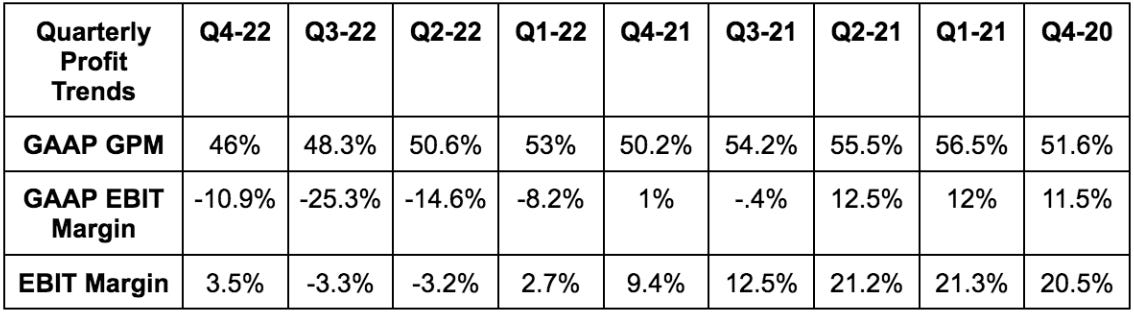

2. Profitability

Beat non-GAAP EBIT estimates of -$45 million by $106 million or 135%. Wowza.

Beat -$0.02 EPS estimates by $0.09. It unexpectedly turned a non-GAAP profit.

GAAP EPS missed estimates of -$0.18 by $0.31 largely due to one time real estate, legal & severance charges.

Missed 46.7% non-GAAP gross profit margin (GPM) estimates by 70 bps.

More Margin Context:

When excluding one-time charges from real estate downsizing, legal settlements and severance charges, operating expenses (OpEx) were flat QoQ. This powered the adjusted operating leverage.

The team sees more low hanging cost control fruit within things like cloud usage optimization and enhanced marketing discipline to become more lean and efficient.

GPM headwinds cited include:

The “dilutive impact of Deliverr.”

Payments proliferation and a shift back from debit funding to credit funding as the stimulus impact ends. Credit comes with higher 3rd party interchange fees and so lower Payments margins.

Lower gross margin merchant solutions growth outpacing subscription solutions growth. This is due partially to a lowered take rate on subscriptions last year but mainly just via robust merchant services demand.

Importantly, despite the lower gross margin associated with merchant solutions, the operating margin vs. subscription revenue is similar due to lower OpEx needs. This merchant solutions proliferation trend is depicted in the chart below:

If you follow me on Twitter, you’d know the pace of the Fed’s rate hikes has been the fastest since the 1980s. And during these hikes, investors lost an eye-popping $350B.

But one investing app posted record gains in 2022 through all of the chaos.

It’s called Masterworks – the company that has finally democratized access to fine art.

They make real multimillion-dollar paintings investible through shares, similar to how a company is broken up into pieces through stock.

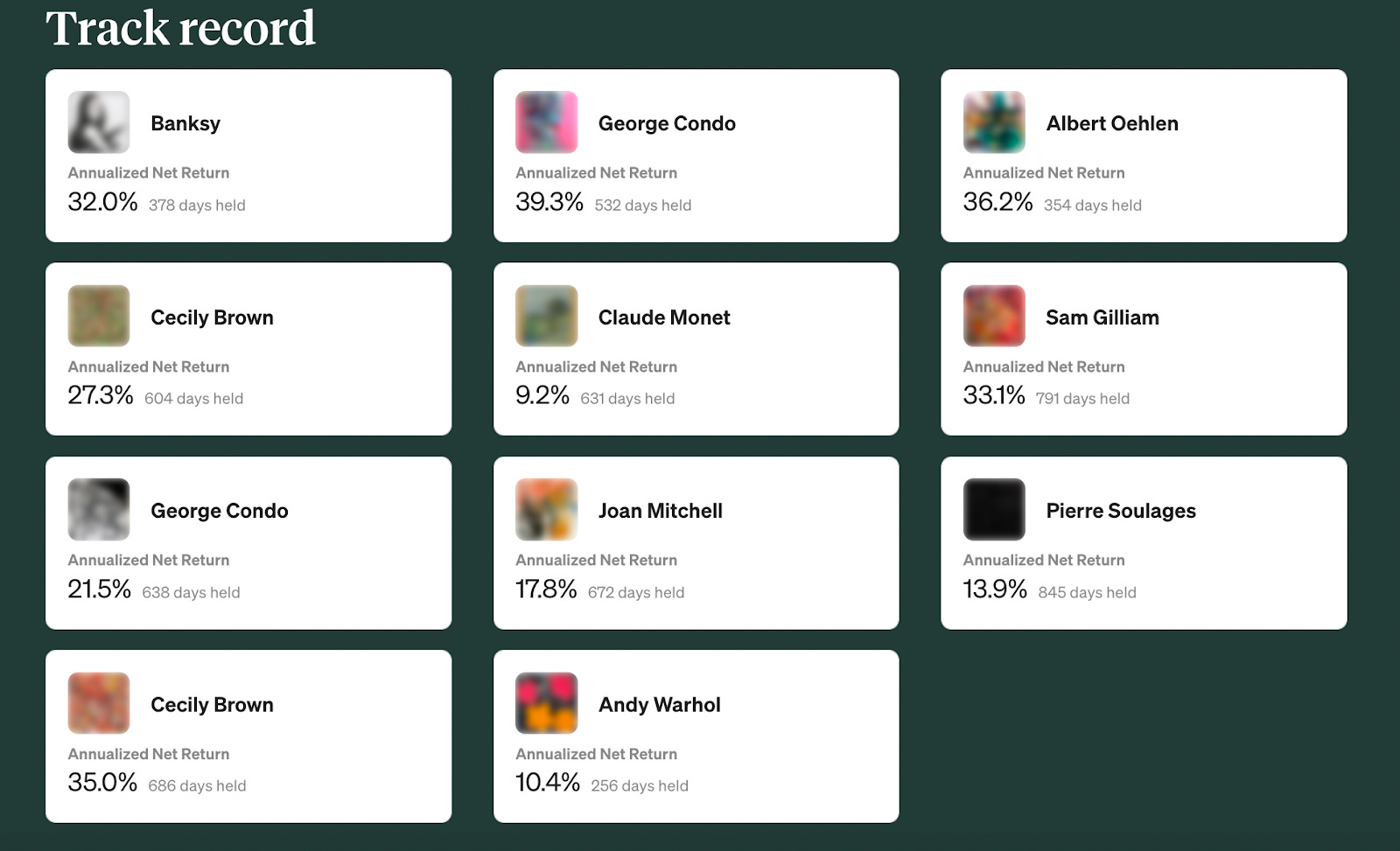

And, the returns speak for themselves — all 11 exits were profitable:

It’s no surprise why. Their experts from Sotheby's and BofA analyzed +5,000,000 proprietary data points to identify great opportunities for your capital.

The takeaway? While your friends stress about market timing, inflation, and rate hikes, many Masterworks investors have enjoyed +10% net returns like clockwork… across all pieces of economic cycles.

Thanks to our partnership, if you have a +$250,000 portfolio, you can skip the waitlist now.

*“Net Return" refers to the annualized internal rate of return net of all fees and costs, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. See important Regulation A disclosures.

3. Forward Guidance

Shopify’s implied revenue guide missed estimates by 2% if we assume “high teens percent growth” means 18% growth. The miss was closer to 1% if we assume it meant 19% growth. Either way, not too bad vs. how others have fared.

This guide assumes poor macro and elevated inflation persists through the end of March.

Shopify expects GPM to expand sequentially as subscription solutions revenue will be a larger portion of total sales via typical seasonality.

Stock comp will be similar in Q1 2023 vs. Q4 2022.

Sequential OpEx growth will be in the low single digits.

4. Balance Sheet

The 3-yr dilution CAGR has fallen for several consecutive quarters as stock comp is controlled via the new flex comp offering and as we move through M&A impacts. Still, with Deliverr’s 400 new employees, stock comp is growing for now.

Stock comp was 9.8% of 2022 sales vs. 7.2% YoY and 8.4% in 2020. This includes the impact of the large, $2.1 billion Deliverr acquisition. The payout for this M&A was 80% equity & 20% cash.

$5.1 billion in cash & equivalents.

$913M in senior convertible notes.

5. Call & Earnings Release Notes

On New Business Tailwinds:

Accelerating new business application growth should provide a tailwind to Shopify in 2023. Specifically, new business starts per the Census Bureau averaged 5 million over the last 2 years vs. 4 million during the previous 5 years. As a company born to arm the rebels and remove entrepreneurship pain points, this should help.

On the Recently Announced Price Hike:

The positive impact on subscription revenue won’t begin until Q2 as new prices for existing merchants take hold April 23rd.

This will boost MRR growth later in 2023 but MRR will continue to be pressured until then due to more free and paid trials. These trials are converting to paid clients at an “encouraging” clip.

On Merchant Wins During the Quarter:

Signed a new global agreement with CPG giant Mars to migrate its brands to Plus. Mars joins Unilever, Procter & Gamble Nestle (which moved more brands to Plus during the quarter) and Kraft Heinz as CPG titans migrating to online and direct to consumer with Shopify Plus.

New Shopify Plus merchants during the quarter include Supreme, Sergio Rossi, Black & Decker, Butcher Box, Bally and another Pharrell Williams brand. Giant Tiger is also replacing its tech stack in favor of Shopify Plus across 260 locations.

Landed Culture Kings to power its planned global retail expansion.

Signed Mom’s Spaghetti (Eminem’s new Business). This isn’t a gigantic development, but I love Eminem so I included it :).

Vuori is implementing Shopify Point of Sale (POS) across a large chunk of its stores.

27% of POS Pro subscription sales during the quarter came from Plus merchants vs. 12% YoY. Shopify’s offline product suite is attracting larger merchants.

On Deepening Partnerships:

Shopify launched a new Audiences integration on the Pinterest selling channel. This allows merchants to extend granular audience targeting beyond Shopify’s ecosystem to other advertising partners including Meta's Family of Apps and now Pinterest.

Shopify added IBM’s consulting arm as its latest system integrator partner. System integrators are typically the preferred method for large brands migrating tech stacks. So? IBM -- along with Accenture, Deloitte, EY and KPMG -- make Shopify an easier vendor to evolve with. This is important.

On Shop Pay -- It’s Checkout Accelerator:

Shop Pay was the #1 converting accelerated checkout on the internet for 2022. It has 100+ million opted in buyers.

Shop Pay integration GMV with Meta and Alphabet’s YouTube doubled YoY.

Leadership told us it’s working on extending Shop Pay to more surfaces and channels to open the product up further.

On Product Enhancements & Traction:

Shopify Markets Pro (launched a few months ago) is raising cross-border conversion by 36% for merchants.

Shopify POS can now support up to 1,000 merchant locations per customer through one singular dashboard.

Shop Pay & its buy now pay later product are being integrated into offline POS to offer the same brick and mortar payment flexibility as online channels. This is currently beta testing.

Initial responses to Shopify’s mobile POS system -- “POS Go” -- has been “exceptionally strong. Shopify Tax (a new product) is off to a “great start.” Leadership is always charismatic on these calls so take abstract comments like these with a grain of salt.

Shopify’s self serve program for merchants upgrading to Plus is working. 25% of all Plus additions can from this project in 2022.

Shopify Fulfillment Network (SFN):

Orders per SFN merchant rose 40% YoY.

Deliverr grew units fulfilled by 50% YoY.

Shop Promise (its 1-2 day delivery guarantee) is raising conversion by 25% just like Amazon’s Buy with Prime does. And Shop Promise doesn’t require products to be listed on Amazon which many merchants hesitate to do via losing control of brand and data.

Deliverr and SFN integration work remains ongoing. Leadership won’t start aggressive CapEx plans here until this is done. INTERESTINGLY, new CFO Jeff Hoffmeister alluded to Deliverr’s product suite changing the way Shopify thinks about SFN CapEx. According to him, Deliverr is enabling the company to think about SFN in more of a partner-first, asset-light manner. This was the original plan for SFN before partner service fell short of Shopify’s needs and it embarked on adding more of its own leased warehouse space. Ideally SFN will be as asset-light as possible. So this was encouraging. Still, Deliverr and SFN will be a margin headwind in the near term as it builds out the network.

Amazon and Buy with Prime integration talks remain ongoing with no formal update given on the call.

6. My Take

This was another wonderfully boring quarter for Shopify. We’re still in the midst of it building out SFN, but overall growth was impressive to me and the surprise adjusted operating and net profits were as well. It continues to take market share and the value of those gains will only grow as e-commerce and macro headwinds ease over the next several quarters. It has put itself in a great position to exit this painful period for e-commerce from a position of strength with a strong balance sheet and continued new (and old) product traction. Was this perfect? No it was not. Was it mostly positive? Yes it absolutely was. Thumbs up from me.

I don’t plan to trim any more of my position or add to it after this report. It’s still expensive at a roughly 100% gross profit multiple premium to markets. I’d like to see it get cheaper before I resume building the stake.

Thanks Brad