If you find this article valuable, I’d greatly appreciate you sharing it with your network. That is how we grow.

1. Snowflake (SNOW) – Earnings Review

Snowflake 101:

Snowflake’s overarching platform is called the Data Cloud. The infrastructure unlocks the ability to affordably store, organize, query and learn from data sources at gigantic scale. The architecture naturally separates the functions of data storage and consumption, unlike legacy data warehouse solutions. That means data consumption capacity is untethered from public computing resources. This removes the computing capacity bottleneck and enhances the scalability of data storage.

Under this framework, I can store as much data as I want without the requirement to immediately process all of that data. Processing utilizes computing capacity. In Snowflake’s case, the storage is done in a centralized data repository in the Snowflake Data Cloud. It’s processed only as needed. Data is utilized virtually, which removes the need for dedicated hardware. This scalable or “elastic” reality limits waste and cost. Snowflake does all of this for clients in a managed fashion to diminish client talent and infrastructure needs. There are a few key products to know & track progress of:

The Snowflake Data Warehouse is where structured data is stored and (on command) processed. Structured data is formatted data. It’s utilized for record keeping and report creation. Data can be easily fetched via structured query language (SQL).

- It just added a new data streaming tool called dynamic tables. It’s in early preview and allows for more automated data querying. With it, reports are automatically updated with current data as that data is ingested by the Data Cloud.

Snowflake Data Lake does what the warehouse does for unstructured data. Unstructured data is unformatted and used to uncover new insights and patterns.

- This debuted in 2020 (Warehouse in 2014). Unstructured data consumption is growing like crazy. It’s up 17x Y/Y as of last quarter. No update today.

- Generative AI leans heavily on unstructured data for model training. This means that proliferation will directly support unstructured data consumption on Snowflake.

The Snowpark product frees developers to work with data in any source code language desired. With it, developers can process and visualize data (through Snowpark functions) and build apps (through Snowpark Native Apps). Snowpark is their data-equipped playground to build new things. Snowpark usage has been growing exponentially Y/Y in recent quarters (newer product).

- Snowpark Container Services was soft-launched in Q4. This allows clients to deploy software containers (software packages) from Snowflake. That, in turn, enables the running of applications without needing to transfer data or manage deployment.

- GenAI models are voracious data consumers. Snowpark Container Services allow GenAI models to run closer to the data that they require. This enhances performance and expedites model training. Snowpark Container Services is a key part of the firm’s GenAI strategy.

Snowflake data sharing is its secure product for, as the name indicates, sharing data among the rest of Snowflake’s participating users. As more opt in, a compelling network effect of relevant data builds and Snowflake’s value proposition deepens.

- 28% of its customers are now sharing their data amongst the Snowflake network vs. 23% Y/Y. Sharing is done via “edges” which are data sharing connections between clients and a data provider.

Miscellaneous tools:

- Snowflake Machine Learning is its suite for training ML models within the Snowflake Data Cloud. This can be used to automate data querying and organization.

- Snowgrid is its omni-cloud tool to unite a client’s data across the various clouds they use.

a. Demand

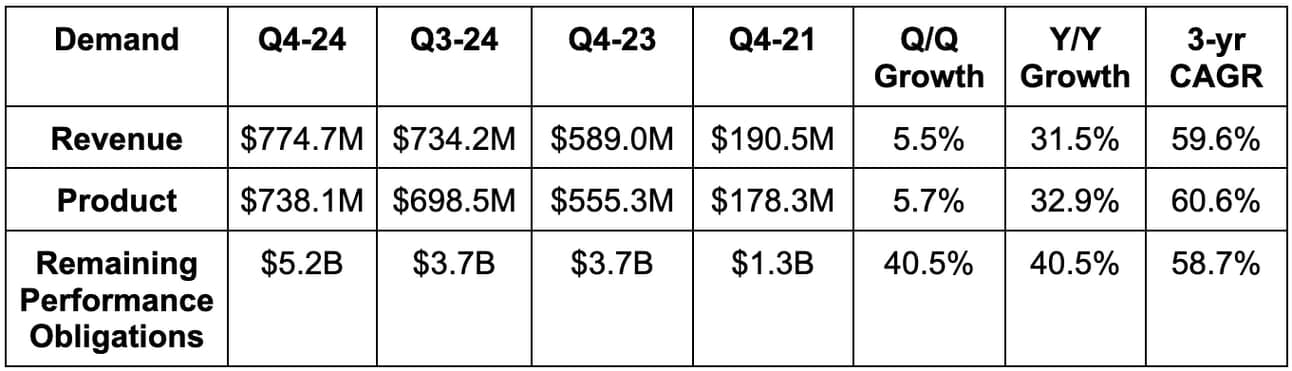

- Beat product revenue estimates by 2.1% and beat guidance by 2.7%.

- Beat revenue estimates by 1.8%.

b. Profitability

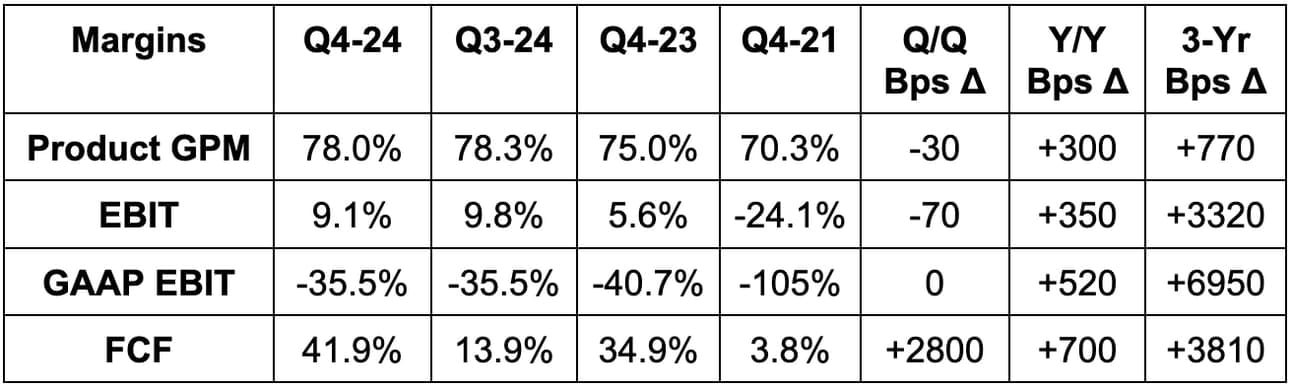

- Doubled EBIT estimates & doubled EBIT margin guidance.

- Crushed $0.18 earnings per share (EPS) estimates by $0.21.

- Beat free cash flow (FCF) estimates by 19%.

c. Balance Sheet

- $3.8 billion in cash & equivalents. $916 million in investments.

- Share count rose 2.8% Y/Y (no buybacks this quarter). Share count is expected to rise by less than 2% in fiscal year 2025.

- Headcount crossed 7,000 to reach 7,004 vs. 6,783 Q/Q. It’s still hiring.

d. Guidance, Vital Context & Valuation

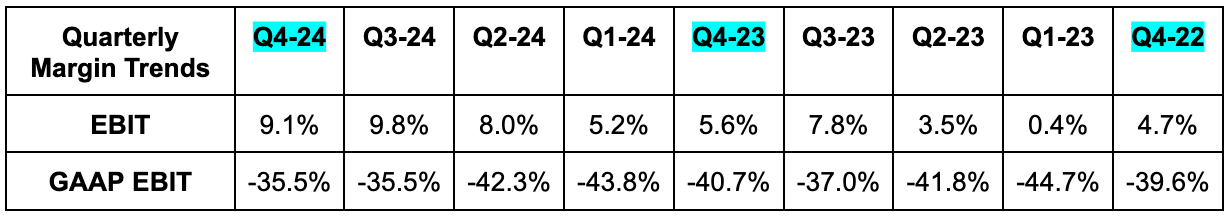

On the margin side, ramping AI investments, including $50 million in added GPU costs, were cited. That $50 million alone only makes up about half of the margin disappointment. It’s dealing with another $30 million in EBIT headwinds due to changing the commission structure to expense immediately rather than over a 5 year period. Together, these two factors make up the majority (not all) of the EBIT margin miss.

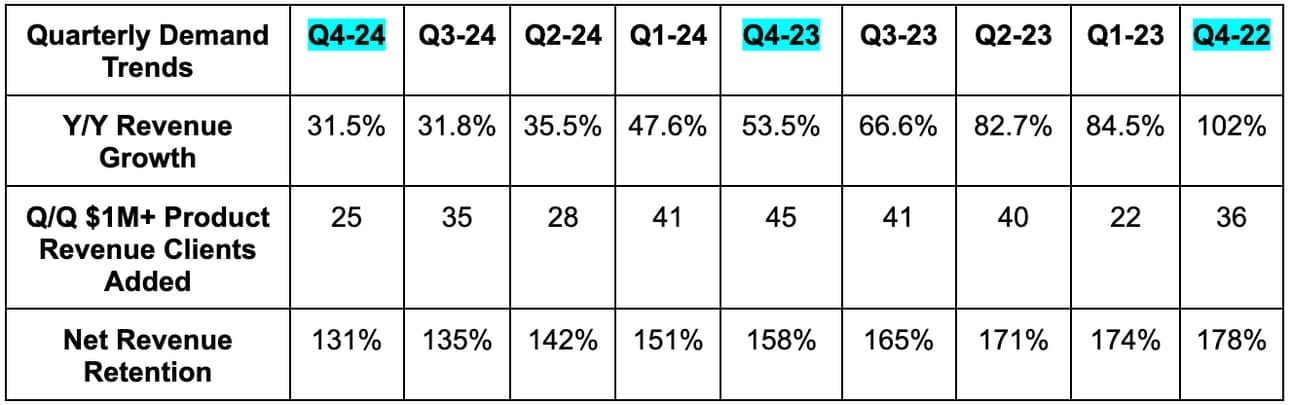

In terms of demand, Snowflake refrained from assuming any consumption trend improvements in the annual guide. As a reminder, this is not a recurring revenue model. Revenue visibility is not as good as for a CrowdStrike or a Zscaler. It is a predominantly consumption-based business, which makes it easier for customers to cut Snowflake costs when times are bad, and vice versa. In this light, annual guidance prudence makes sense.

Consumption patterns improved throughout the second half of the year, but its guide assumes the improvement is now over. It’s also assuming zero revenue contribution from any new product besides Snowpark (Snowpark should do about $100 million in revenue vs. $35 million last year). That new assumption was a 6.3% guidance growth headwind, which is the entire source of the product revenue miss.

Interestingly, product efficiency gains are actually also weighing on Snowflake’s growth. Traffic growth of 62% Y/Y in 2023 compared to revenue growth of 33% as it passes performance improvements on to customers. That traffic growth shows you this is not Snowflake being competitively displaced, as leadership reiterated on the call. Headwinds here include its new tiered storage pricing model, which offers more pricing flexibility for customers. It thinks this will accelerate total workload growth over the long haul due to incremental utility, but it will slow growth next year.

Another big piece of the revenue miss is related to something called “Iceberg Tables.” These are open-sourced data storage offerings that are becoming popular due to lower storage costs, open-source integration flexibility and more data control. The proliferation here is leading to data storage and duplication revenue headwinds, with storage making up about 10% of Snowflake’s total business. It’s currently beta testing its own Iceberg Table product, but that won’t go live until June; there’s no revenue contribution from the launch for next year in the guide.

Why did it guide like this? Probably to set a new CEO up for an easy year of outperformance.

Finally, it backed away from its previous timeline to reach $10 billion in product revenue. It still thinks getting there on schedule is possible, but “needs more data” to know for sure. Good job ripping off the bandage and getting all of the bad news out of the way at once. I’m not being sarcastic.

“I think we are definitely being more conservative this year.” – CFO Michael Scarpelli