Hey readers! Please share this article with your network if you feel inspired to do so. That is how we grow and keep the content 100% free.

1. Demand

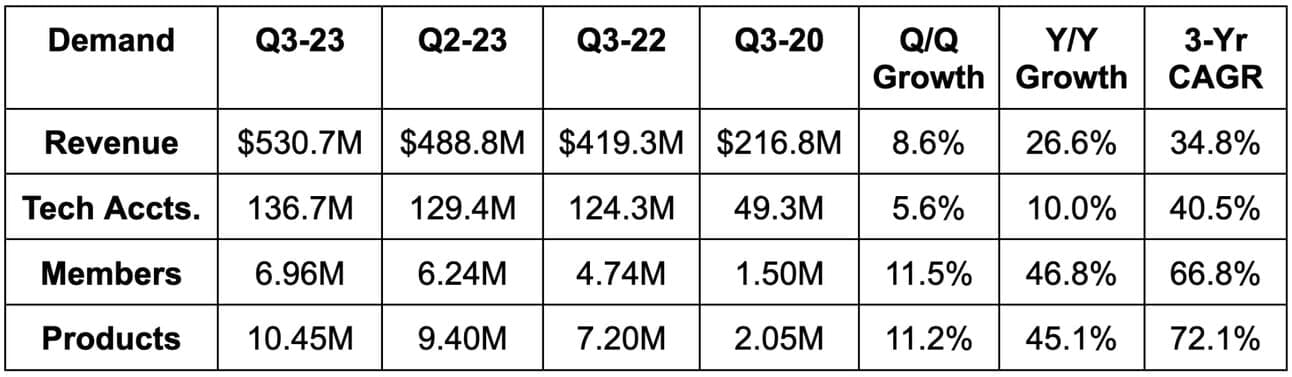

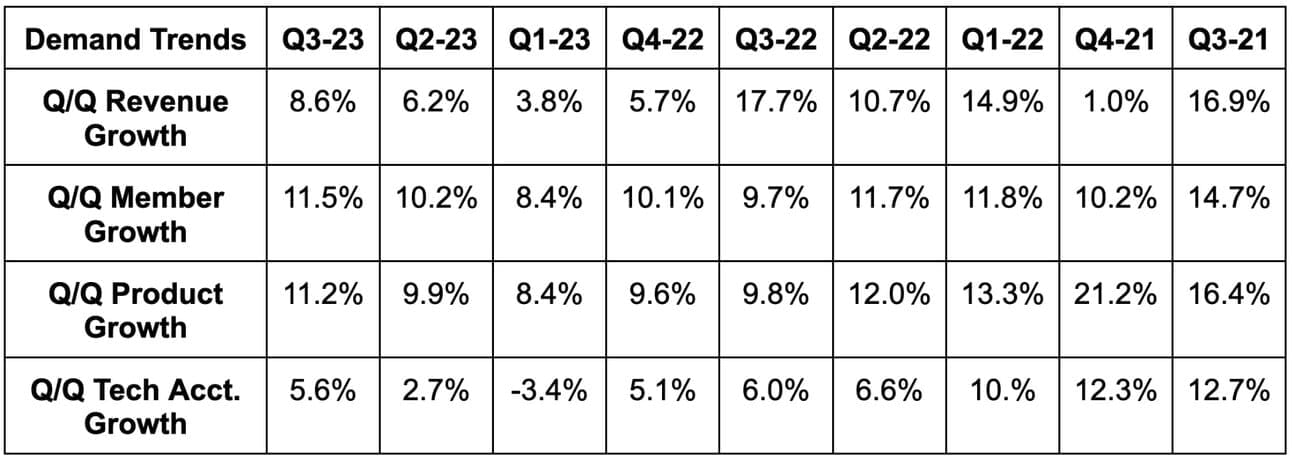

SoFi beat revenue estimates by 2.9%. It added $2.9 billion in deposits vs. its guidance of “more than $2 billion.” Its 34.8% 3-yr revenue compounded annual growth rate (CAGR) compares to 53.1% Q/Q & 74.8% 2 quarters ago.

This was a record quarter for sequential product additions and among its strongest ever for member additions. Both product and member Y/Y growth accelerated for the first time in a while. Products per member stayed at 1.5x despite rapid new member growth.

2. Margins

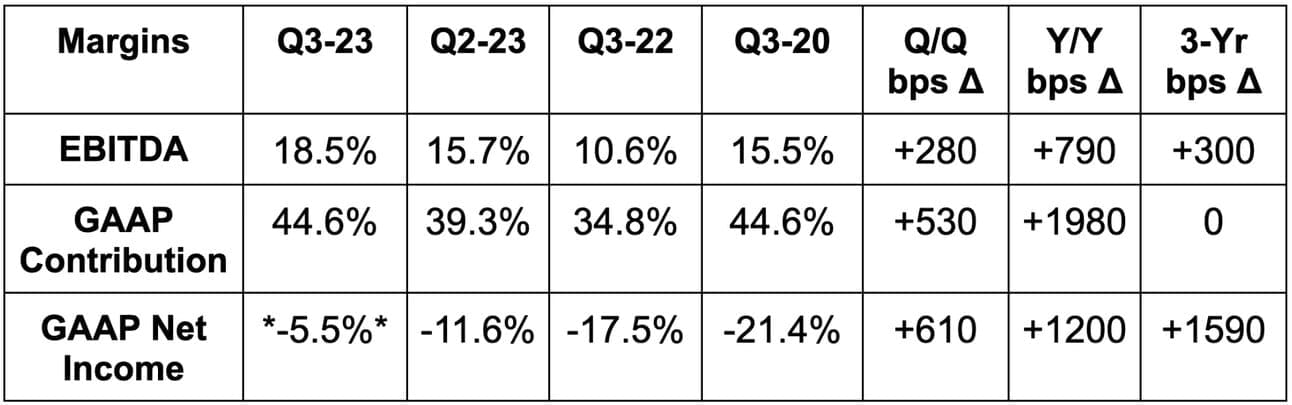

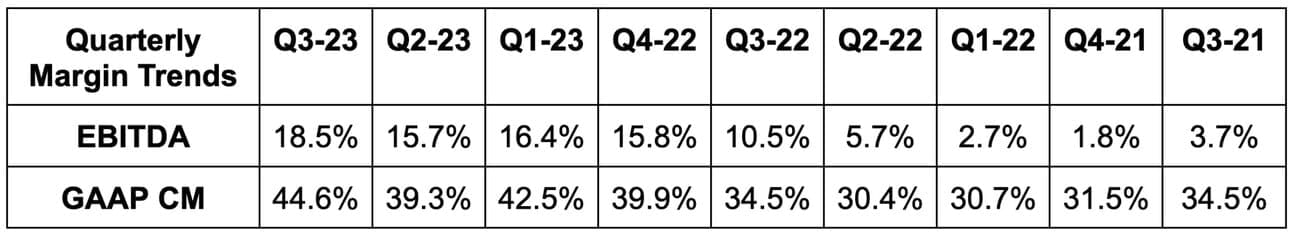

SoFi beat EBITDA estimates by 54%. It actually missed -$0.08 GAAP earnings per share (EPS) estimates by $0.21. This was solely driven by a nearly $250 million impairment charge. The source of the charge wasn’t specified on the call, but it’s likely from acquiring Technisys. Without the non-recurring, non-cash impairment charge, SoFi would have beaten EPS estimates by $0.05.

3. Guidance

For the full year, SoFi raised its revenue guidance by 2.5% and beat estimates by 1.4%. This guidance includes material “conservatism” associated with things like net interest margin (NIM).

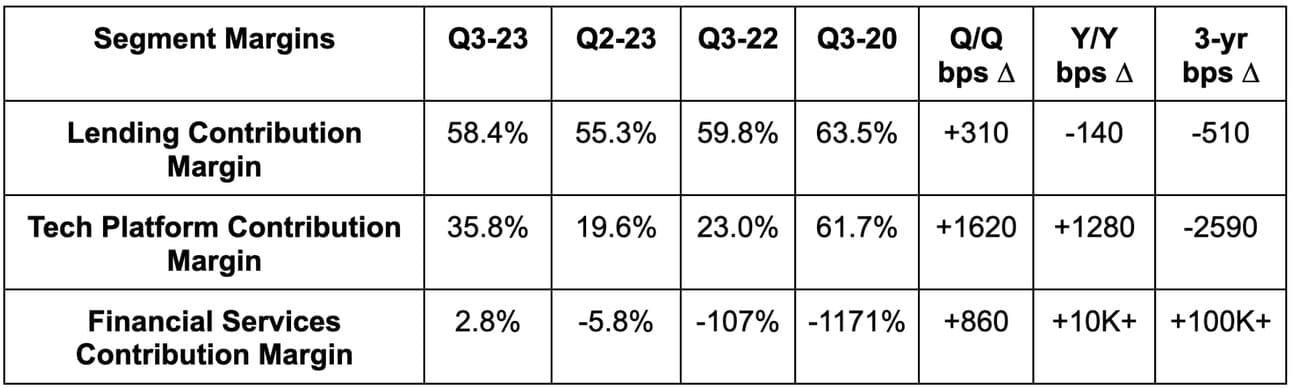

It also raised its EBITDA guidance by 15.7% and beat estimates by 13.5%. The company importantly reiterated that it will be GAAP net income positive next quarter and in 2024. It reached contribution profit positive within financial services a full quarter early. This is despite a $100 million profit drag from investing heavily in new products like credit.

This annual guidance implies Q4 guidance that is comfortably ahead on revenue and EBITDA.

Interestingly, Noto told us to expect 500,000+ member adds per quarter. This compares to 400,000+ adds in the past.

4. Balance Sheet

- SoFi’s total capital ratio sits at 14.5% which is comfortably ahead of its 10.5% regulatory minimum. The company is "well capitalized with excess liquidity” per CFO Chris LaPointe.

- It has $2.8 billion in cash & equivalents, $8.4 billion in warehouse capacity ($4 billon used) and $3 billion in equity to go along with $15.7 billion in deposits.

- $21 billion in loans held for sale v. $18.2 billion Q/Q.

- Tangible book value rose 5.5% Y/Y as it continues its new trend of book value growth.

- Share count rose 3.7% Y/Y. This must slow and that is fully expected.

Clear evidence of SoFi’s balance sheet being healthy is its warehouse facility usage trend. It’s now using 47% of this higher cost of capital source vs. over 50% in the past (despite rapid origination growth).