The theme of the call was perseverance through financial service sector volatility. It was not “things were bad because of this.” It was “things were good despite this.”

Please feel free to share this article far & wide. We greatly appreciate it when you do.

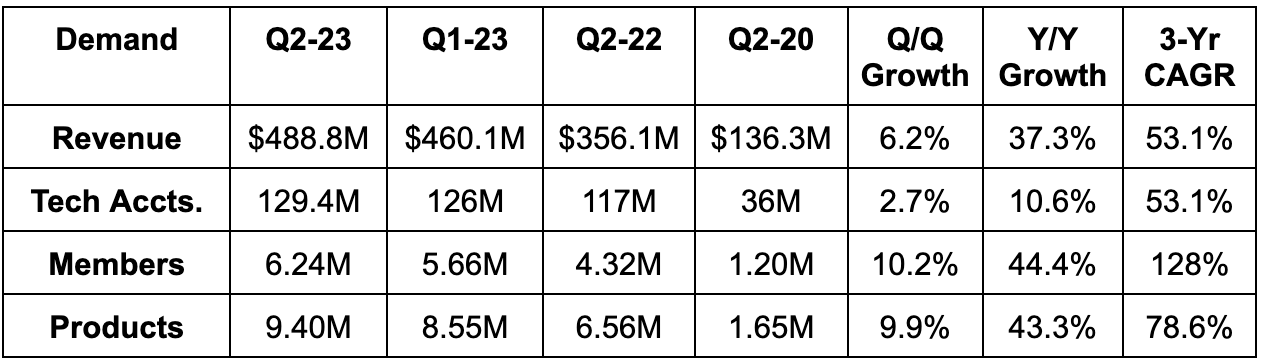

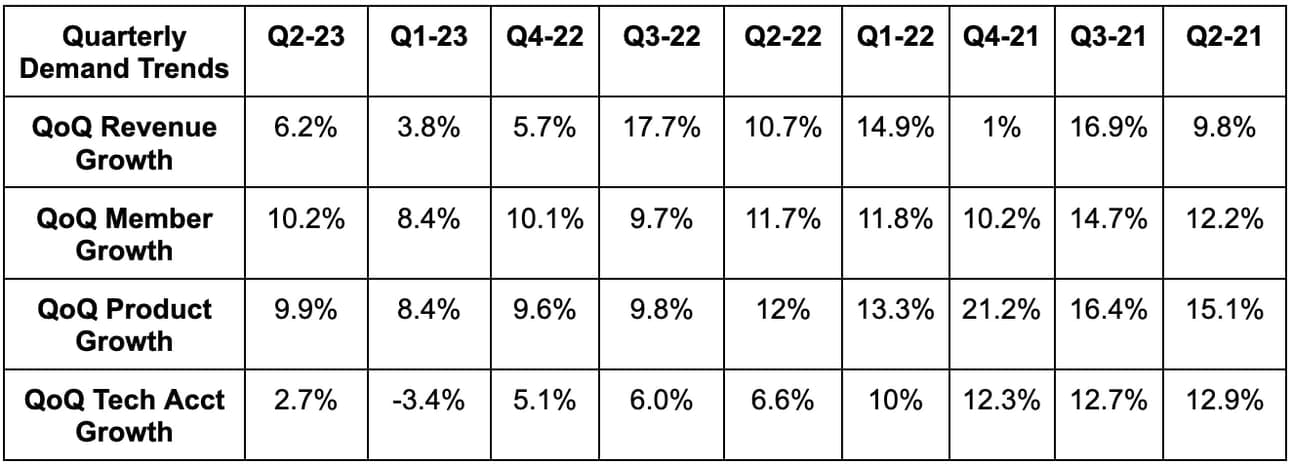

1. Demand

SoFi beat revenue estimates by 3.3% and beat its guidance by 2.9%. This was a record quarter for sequential member adds.

Demand Context:

- Lending revenue rose 29% Y/Y, tech revenue rose 4% Y/Y (8% Q/Q), financial service revenue rose 223% Y/Y

- 2nd highest quarter for new product adds and a record setting quarter for new members.

- Financial service products up 47% Y/Y and lending products up 25% Y/Y.

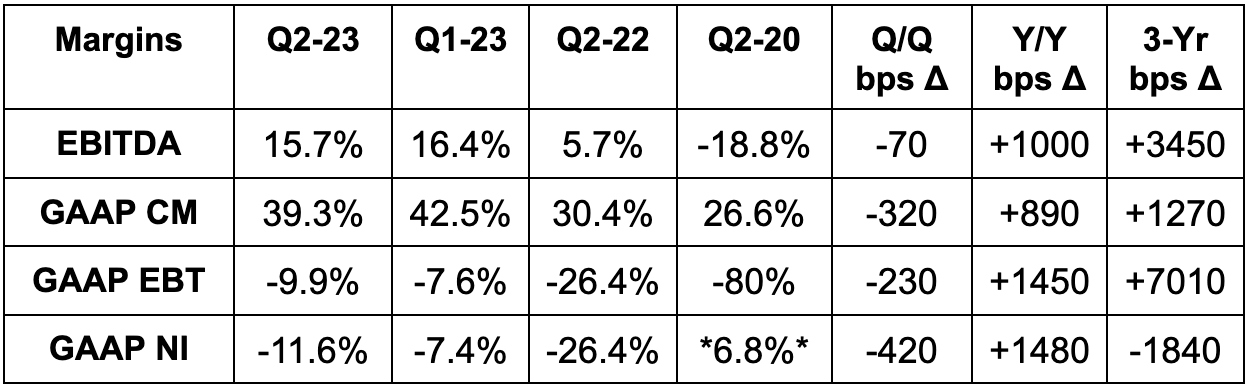

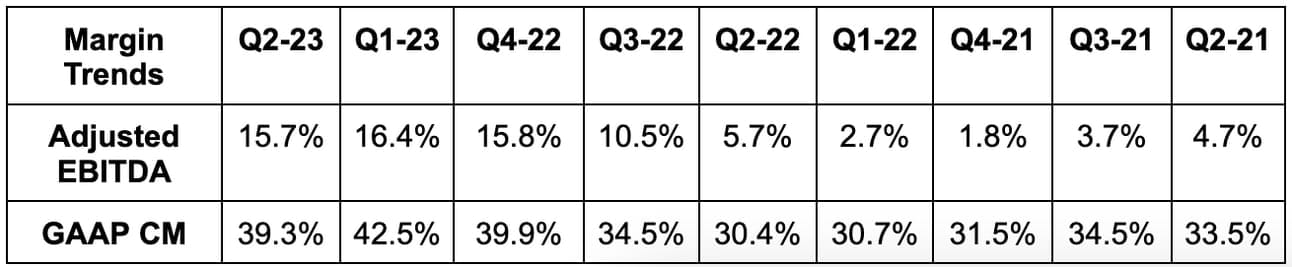

2. Margins

- Beat EBITDA estimates by 35.9% & beat guidance by 39.6%.

- Beat EPS estimates by a penny.

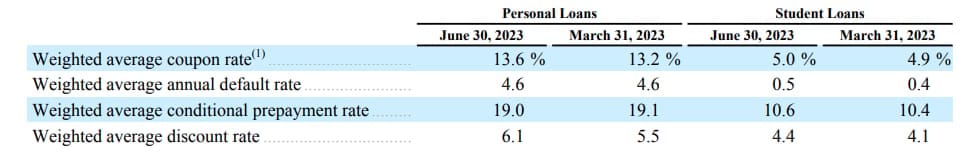

Fair Value Credit Markings:

SoFi added a table showing the variables and data guiding its markings to offer more clarity on that matter. As you can see, weighted coupon continues to rise Q/Q while defaults and pre-payments are steady. Discount rate rose for personal loans this quarter (I’m sure analysts will love seeing that) and fell a bit for student loans.

- Personal loan volume impressively rose 51% Y/Y to offset -1% Y/Y student loan volume growth and -27% Y/Y home loan volume growth.

- 103% Y/Y growth in net interest income was driven by higher loan balances and net interest margin expansion via higher weighted coupons, strong loss rates and a shift from warehouse funded credit to deposit funded credit (cheaper capital).

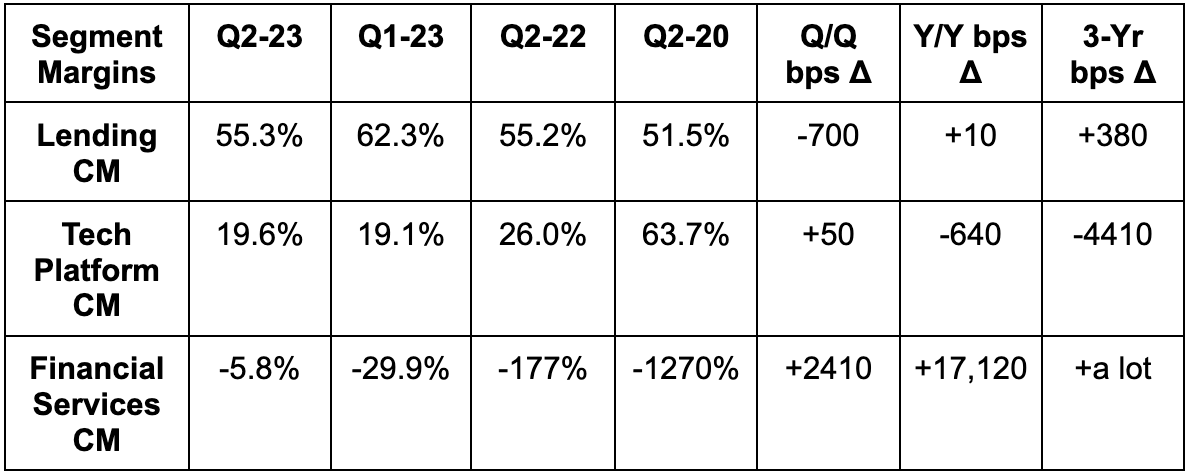

Credit Quality & Fair Value Markings:

Despite rapid volume growth, net charge off rate for personal loans FELL Q/Q to 2.94%. Its annual default and 90 day delinquency rates are steady. Furthermore, SoFi’s fair value markings (which offer a sense of expected gain on sale margin) fell for all 3 lending segments. Analysts will love that. For personal loans specifically, markings fell from 104.3 to 104.1 as discount rates rose with more rate hikes (offset by higher coupon & falling prepayment rate). Student loan markings went from 102.6 to 101.9 as well. Home loans are now marked at 89.2. A few added notes on just how safe and conservative these markings truly are: