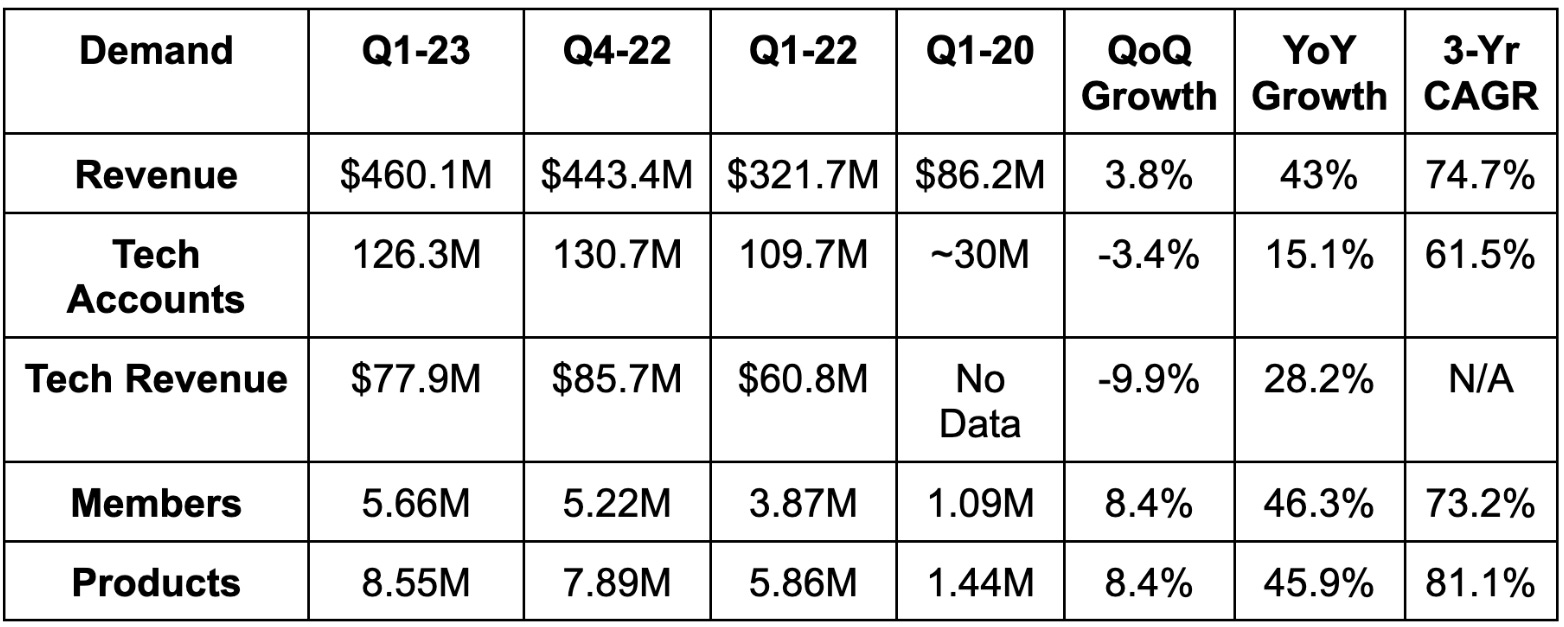

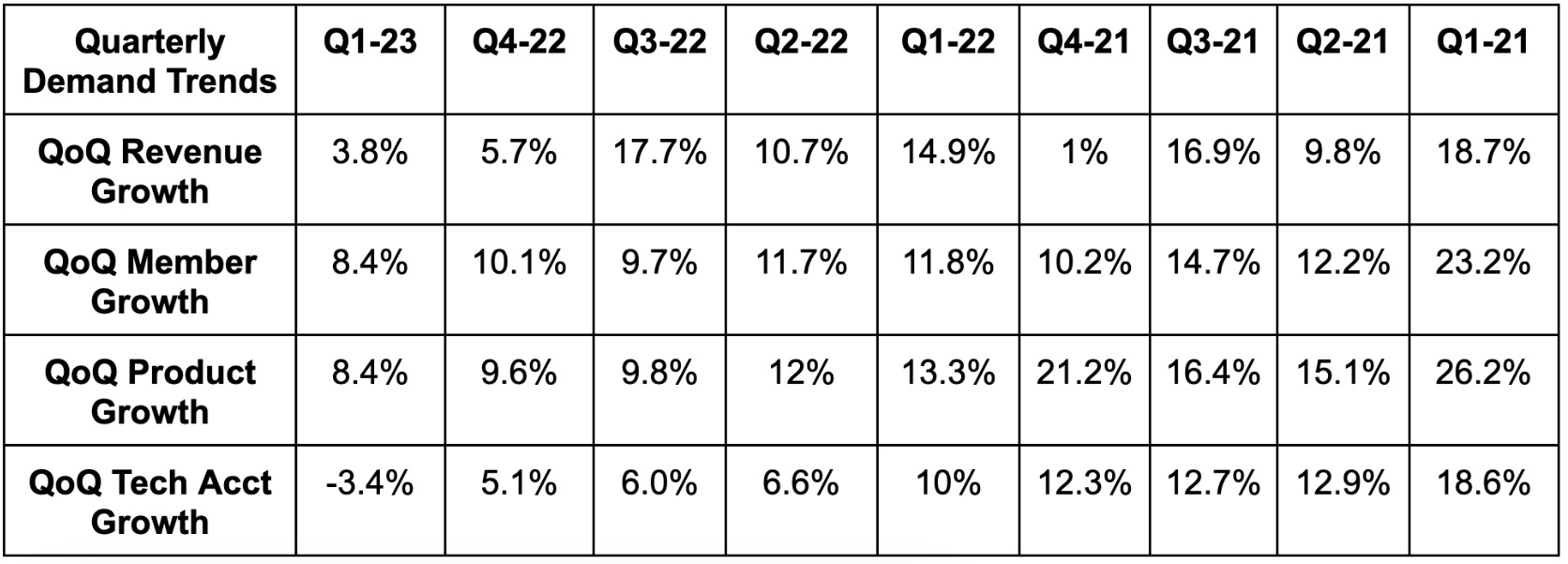

1. Demand

SoFi beat revenue estimates by 5.3% and beat its guidance by 3.4%.

More Demand Context:

The 3 year growth metrics use a Q1 2020 base period. That’s when the pandemic hit this business the hardest and made for very easy 3 year growth comps.

Organic Galileo growth was just 3% YoY. The rest of the tech platform contribution growth came from Technisys M&A which closed towards the end of Q1 2022.

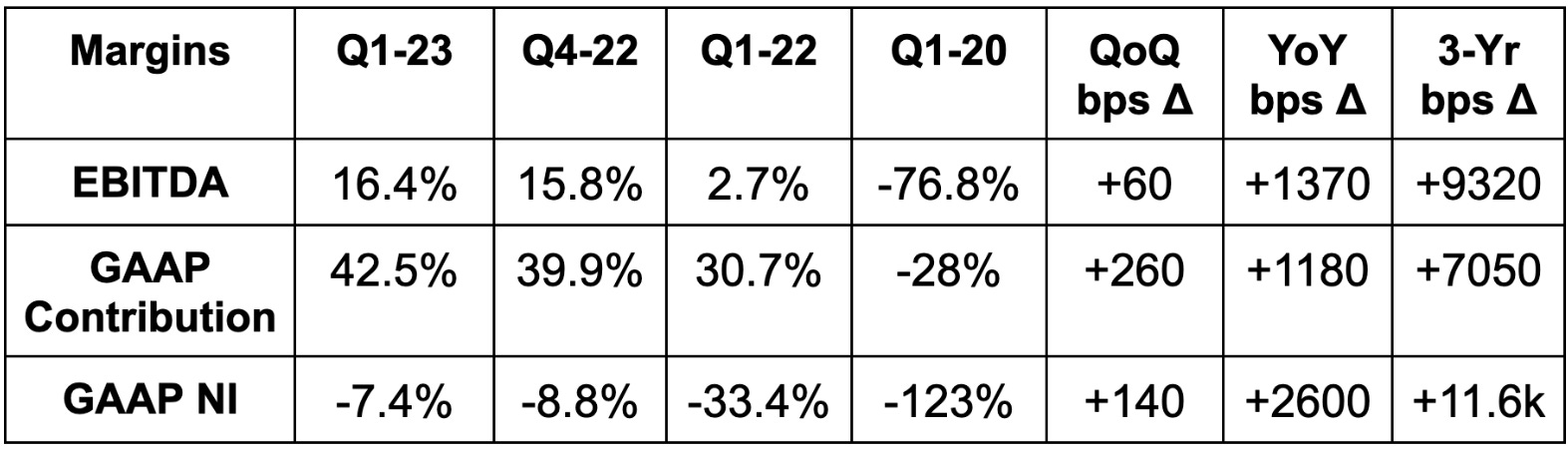

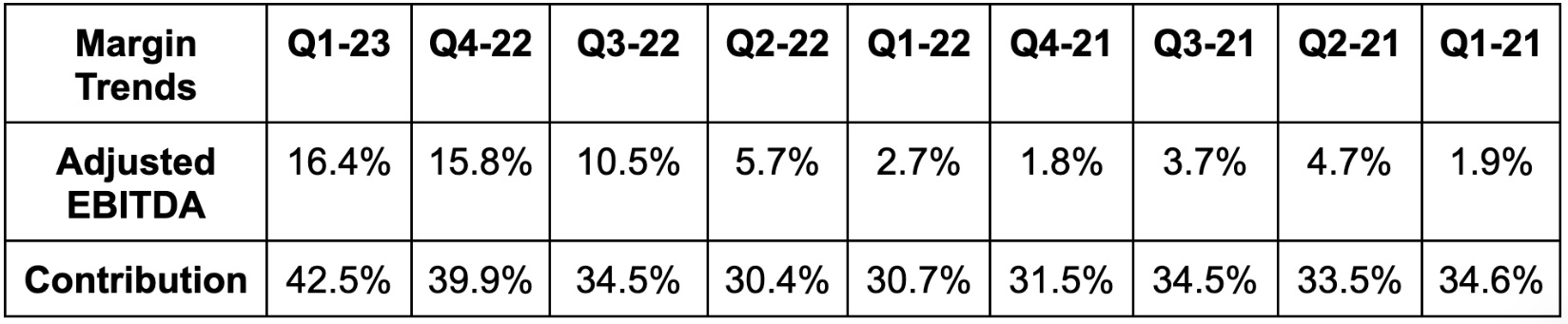

2. Margins

SoFi crushed EBITDA estimates by 81% and beat its guidance by 78%. It also beat estimates of a loss per share of $0.09 by $0.04.

Margin Context:

3 year comps were uniquely easy for margins for the same reason as demand.

SoFi delivered a 54% GAAP net income incremental margin thanks to expanding net interest margin and a 48% incremental EBITDA margin.

SoFi Bank boasted a GAAP net income margin of 20% vs. 11% QoQ.

Contribution margin ex-Technisys was 28% vs. 24% QoQ.

3. Guidance

SoFi’s guide continues to assume 5% unemployment, 2% GDP contraction for the year and unfavorable credit spreads. Well… 2% GDP contraction for the year is looking quite pessimistic at this point while it continues to see more favorable credit spreads for loans sold through capital markets. Its last credit market deal was 8x oversubscribed which inherently fosters tightening spreads. So? It’s setting itself up for more under promise and over deliver.

The company also reiterated its plans to turn GAAP net income profitable by Q4 with the financial services segment turning contribution profit positive at that time. It sees its incremental EBITDA margin in 2023 reaching its long term goal of 30%.

4. Balance Sheet

$2.5 billion in cash & equivalents, $10 billion in deposits, $3 billion in equity capital and $8.6 billion in warehouse capacity.

Stock comp was 13.9% of sales vs. 16% last quarter and 24% YoY. Heading in the right direction… quickly.

CFO Chris Lapointe again told investors SoFi has “ample cash and excess liquidity.”

It incurred just $6 million in unrealized losses on its small available for sale securities portfolio. It has done a great job hedging away interest rate risk and keeping duration as nimble as possible.

5. Call & Release Highlights

Deposits & APY:

SoFi crossed $10 billion in total deposits during the quarter with 37% QoQ growth. The new deposits are very high quality with an average FICO of 749. This source of capital is now funding 44% of its loans. This means that despite SoFi raising its APY on checking accounts to 4.2%, its profit spreads are still much higher than pre-banking charter. The charter and deposits have also allowed it to continue reducing its reliance on more expensive warehouse facility funding.

90% of these deposits are direct deposits vs. 88% YoY. Direct deposit customers buy more services and spend more with these financial services. They’re also stickier users. Importantly, through SoFi’s new FDIC insurance program, 97% of its deposits are insured vs. 92% QoQ.

Deposit trends stayed positive into April with Noto telling us to expect over $2 billion in QoQ deposit adds. Wonderful, wonderful news.

One of the most interesting parts of the call was Noto’s comments on SoFi’s APY when rates start to fall. He sees the company in a far better position to “hold the rate higher for longer” than its competition can and thinks its share gains will accelerate at that time.

Lending:

SoFi’s delinquency and net charge off rates are still below pre-pandemic levels. It continues to expect more normalization, although that normalization has not really been all that noticeable. It also expects to continue durably outperforming industry underwriting benchmarks. It continues to easily pass on rate hikes to customers via higher weighted average interest rates. The strong loss rates and pricing power are both thanks to its credit demographic skewing very affluent.

Lending interest income exceeded non-interest income again and that revenue bucket (without servicing or referral revenue from non-interest contributions) exceeded directly attributable expenses. This is another key step in its path to GAAP profitability this year.

Personal loan growth remained rapid with continued share gains. It did this without loosening any credit standards. Its average borrower here earns $164,000 in annual income and has a 747 FICO.

Student loan originations fell 47% YoY due to continued moratorium headwinds. SoFi still expects demand to ramp back up in Q4 of this year and still sees a large chunk of volume that it can attractively refinance with today’s higher rates. Its average borrower here earns $173,000 in annual income and has a 769 FICO.

Home loan volume fell 71% YoY due to mortgage rate spikes and also 3rd party origination issues. It continues to expect to integrate Wyndham this year and see accelerating demand and volume in 2024.

Customer acquisition cost per loan fell 20% QoQ.

Capital Market Access for its Loans:

SoFi sold $78 million in home loans through capital markets with a gain on sale margin of 4.7% and 3.7% with hedging. After the quarter ended, it sold $440 million in consumer personal loans through asset backed securitization (ABS) markets. Because the deal was 8x oversubscribed, credit spreads improved by a brisk 90bps vs. its last comparable offering. Again… its 2023 guide is too pessimistic.

Financial Services & Driving Cross-Selling”

The segment delivered positive variable profit for the first time.

SoFi announced a new Expedia partnership for SoFi Travel with access to discounted bookings and 3% cash back when using a SoFi card.

Revenue per financial services product rose to $45 vs. $40 QoQ and $20 YoY.

Financial services products rose 51% YoY with relay leading the way to 98% YoY growth. Cards rose 65% YoY; invest grew 22% YoY; “At Work” rose 71% YoY.

Technology Platform:

The tech platform continues to transition its strategy to winning larger clients and forgoing chasing smaller wins. This will continue to weigh on growth until the end of the year.

Technisys entered a proof of concept stage with a large legacy U.S. financial institution. This could be the first whale that leadership told us would come.

Growth was held back by the client that churned from the platform in Q4.

Adoption of its natural language customer service bot “Konecta” is “strong.”

It’s making “great progress in the strategy to sign larger clients.”

Galileo signed 5 new customers. 4 have existing client and product bases.

The cloud migration is done.

Final Notes:

Unaided brand awareness continued to rise despite significantly falling sales and marketing as a % of revenue of 475 bps YoY.

Bank capital ratios will be confirmed when the company releases its quarterly filing. We’ll update readers.

6. Key Takeaways

The stock will do what it will do. This was an excellent quarter for the company. When investor appetite towards high growth, banking and fintech begins to improve, this company is positioning itself to lead the pack. For now, it is caught up in a trifecta of negative sentiment.

From a company standpoint, despite multiple exogenous headwinds that its competition has readily blamed for poor results, SoFi keeps executing. Margins are well ahead of schedule and growth continues to outperform despite little student loan demand and the challenged mortgage business. The lone soft spot was the tech platform as it continues its transition. As long as the expected acceleration comes in Q4, that concern will be put to bed. Great results… again.

I like the format of your report. Not sure I want to get back into SOFI, but I'll take another look at it.

Great results stock reaction underwater, why?