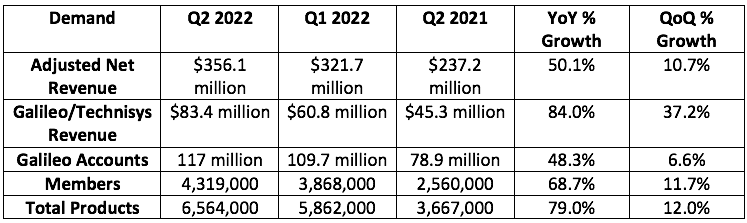

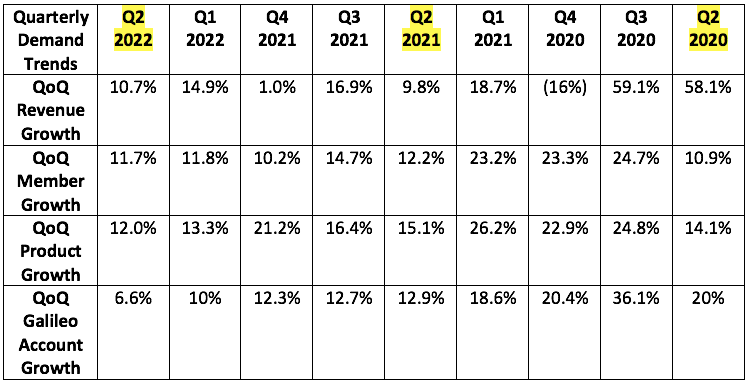

1. Demand

Analysts were looking for $344.5 million in revenue for the quarter while SoFi guided to $335.0 million in revenue. It posted $356.1 million, beating analyst estimates by 3.3% and its own guide by 6.3%.

“While the political, fiscal and economic landscapes continue to shift around us, we have maintained strong and consistent business momentum. We built SoFi to provide durable growth and that is what we are delivering.” — CEO Anthony Noto

More Context on Demand:

Lending products rose 22% YoY to mark SoFi's 5th straight quarter of acceleration there.

This was SoFi’s 2nd highest member and product net add quarter... ever.

Cross-buying volumes rose 24% YoY.

YoY financial services revenue growth was held back by one-time IPO revenues in Q2 2021. Growth here was 78% YoY, but 140% without this headwind.

The Technisys acquisition slightly propped up YoY growth rates.

SoFi's loan volumes are at double its pre-pandemic levels.

Student loan volumes are now 25% off of pre-pandemic levels vs. 50% off previously.

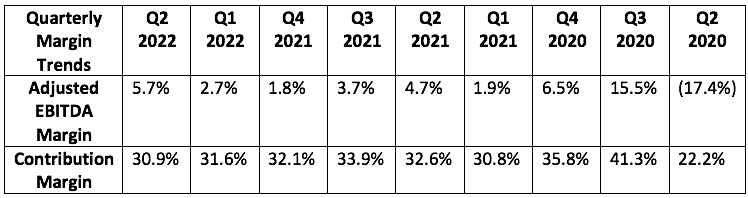

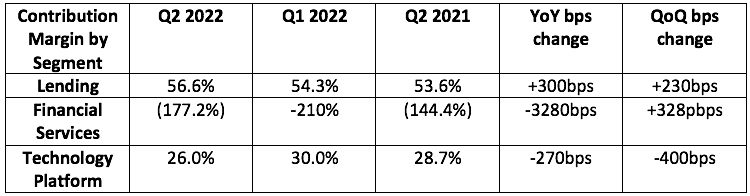

2. Profit

Analysts were looking for $9.5 million in EBITDA for the quarter while SoFi guided to $10.0 million. It earned $20.3 million, more than doubling estimates.

Analysts were also looking for a loss of $0.10 per share for the quarter. SoFi doesn't guide to this. It lost $0.12 per share, missing analyst expectations by $0.02.

More context on margins:

SoFi has now delivered positive EBITDA for 2 straight years.

Financial service contribution margin continues to be hard hit by building current expected credit losses (CECL) within its new SoFI Credit Card business. This will continue for now.

Sales and marketing as a percent of revenue has declined for 2 straight quarters. The benefits of rising monetization and brand awareness are kicking in.

3. Balance Sheet

SoFi has $1.4 billion in cash and highly liquid investments -- up about $200 million YoY.

Sequentially, the decline in cash was via funding the bank and its loan book. That cash is now deployed and earning yield.

SoFi is using $1.6 billion of its $7 billion in warehouse capacity vs. $2.7 billion QoQ.

This is part of the power of the bank. It can fund more loans with its deposits vs. more expensive warehouse facilities.

"We've got excess liquidity and ample cash." — CFO Chris Lapointe

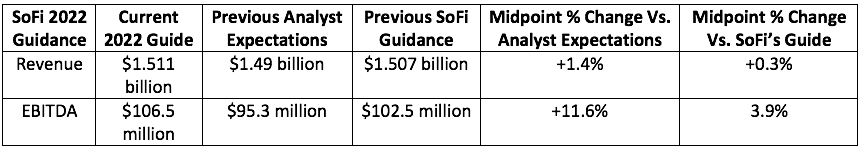

4. Guidance

Analysts didn’t really believe in SoFi’s projected second half EBITDA ramp with its bank charter in hand. It looks as though they should have.

"The 3rd quarter is off to a good start." — CEO Anthony Noto

5. Press Release/Past Quarter’s Highlights

SoFi raised its checking and savings annual percent yield (APY) to an industry leading 1.8%.

Noto spent a few percent of his overall net worth on SoFi shares during the quarter. Gobble, gobble.

SoFi partnered with OnDeck (largest SMB lender in the USA owned by Enova) to enhance access to this type of credit.

6. Notes from CEO Anthony Noto

On The Bank Charter:

“Our bank charter is enabling new flexibility that has proven even more valuable in light of the current macro environment. The economic benefits are materializing.” — CEO Anthony Noto

Deposits grew 135% sequentially to $2.7 billion. The deposit rate remained above $100 million per week. I was worried that it dipped below $100 million because SoFi raised its APY again and said it wouldn't unless deposits slowed. This was great news.

Deposit rates have accelerated since the APY boost.

SoFi continues to raise is proportion of members who are direct deposit customers. This vastly boosts customer lifetime value (CLV) for SoFi.

SoFi Bank generated $25 million of positive GAAP net income in its first full quarter.

On Lending:

Volume origination for home and student loans both remain severally challenged. Student loans via the moratorium and mortgages via the rising rate environment and SoFi fulfillment partner transitions. Outperforming personal loan growth of 91% more than offset all of this pain. Can you imagine what these results will look like when student loans turn back on?

Note that SoFi's 2022 guidance assumes the student loan moratorium continues all year.

SoFi's product diversification allows it to re-allocate resources to products -- like variable to fixed refinancing -- which do better amid rising rate environments. This insulates it from macro volatility.

"The diversification of our funding channels with the charter means we don't have to access ABS sales channels amid sub-optimal conditions." (that's a shot at Upstart) — CEO Anthony Noto

On the Technology Platform:

Galileo grew revenue by 39% organically and operated at a 33% contribution margin.

Technisys weighs on overall tech platform margins for now as it operates at breakeven while SoFi heavily invests.

Galileo's Business to Business (B2B) traction is building. 30% of its pipeline is B2B deals vs. 10-15% YoY.

Galileo added 12 new clients during the quarter. It had 44 total as of the end of 2021.

SoFi is in talks with "several large U.S. banks" that weren't interested in its offering pre-Technisys.

Technisys launched a new banking core for a top 5 Brazilian bank.

7. Notes from CFO Chris LaPointe

On SoFi's Borrower:

Its personal loan borrowers average a $160,000 income and a 748 FICO score vs. 746 QoQ.

Its student loan borrowers average a $170,000 income and a 773 FICO score vs. 775 QoQ

Delinquency and charge-off rates remain "extremely healthy" at "50% below pre-stimulus levels." Best part of the call.

This borrower strength contributed to SoFi's whole loan selling channel demand remaining very robust while others have seen theirs shrink. Its whole loan sale volumes grew 46% YoY and 15% QoQ. The other evidence of this capital market funding remaining durable is SoFi's gain on sale margins staying elevated and stable throughout 2022.

On Financial Services Profitability:

SoFi continues to expect financial services to be contribution margin positive by 2023.

SoFi continues to expect financial services to be GAAP net income positive by 2024.

8. My Take

This was a flawless quarter. Enough said. The 10Q will be published next week and I'll share any interesting new details that come from it.