“Given the results, I can’t help but to be incredibly optimistic about the future of Sofi. Even in tough market conditions, quarter after quarter we meet and exceed guidance. Our members need us more than ever… and we will continue to rise to the occasion.”-- CEO Anthony Noto

1. Demand

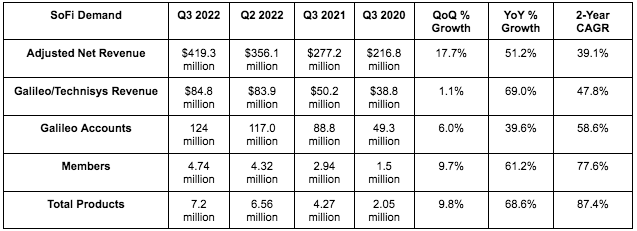

SoFi’s revenue of $419.3 million beat analyst estimates of $391.8 million by 7.1%

More Context on Demand:

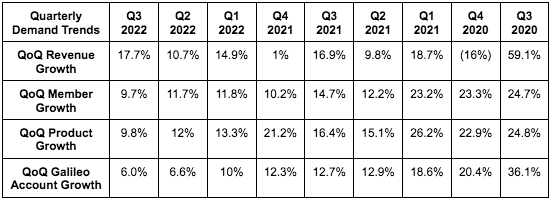

This was SoFi’s 6th straight quarter of record revenue growth as it set new records for all 3 revenue segments… including lending DESPITE the student loan moratorium, soaring mortgage rates and a fulfillment partner transition.

Personal loans more than made up for the 50% volume headwinds that both student and home loans dealt with this quarter as SoFi’s revenue diversification shines amid tough macro.

2. Profitability

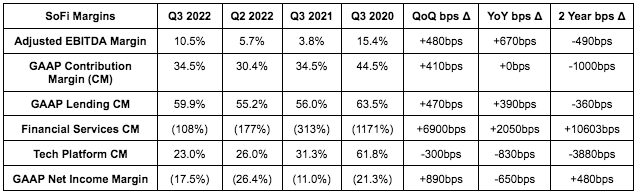

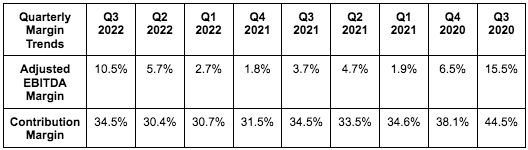

SoFi’s adjusted EBITDA of $44.3 million beat analyst estimates of $30.8 million by 43.8%

SoFi lost $0.09 per share in GAAP net income, missing expectations by $0.02.

More Context on Margins:

The GAAP net loss worsening was solely from Q3 2021 enjoying a $64.4 million boost via a change in fair value of warrant liabilities (SPAC noise). Net loss would have shrunk by $20.2M YoY without this.

SoFi continues to expect positive contribution profit from the financial services segment next year and positive GAAP net income by 2024. There was no update here.

The tech platform would have had a 30% contribution margin this quarter without Technisys which is currently a large margin headwind.

Marketing efficiency continues to improve with its customer acquisition cost now in line with its long term 30% EBITDA margin target.

Current Expected Credit Loss (CECL) building is weighing heavily on financial services margins. That headwind eased this quarter vs. last, but is still there.

3. Balance Sheet

SoFi has $935 million in cash and equivalents on the balance sheet vs. $707 million QoQ and $533 million YoY

SoFi has $2.77 billion in debt vs. $2.70 billion YoY

SoFi’s diluted share count grew 13.6% YoY… BUT QoQ growth was just 0.6% as stock comp expenses slow as we distance ourselves from the company going public. Growth here needs to continue slowing and it is expected to.

SoFi’s interest bearing deposits grew 86% QoQ to $4.94 billion as its $100 million per week deposit rate accelerated further.

SoFi is using 35% of its warehouse loan capacity vs. 23% QoQ.

“We have ample cash and excess liquidity.” -- CFO Chris Lapointe

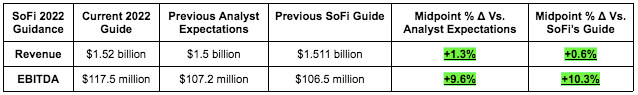

4. Guidance

5. Conference Call Notes

On the Bank Charter and Direct Deposits:

The bank generated $29 million in net income vs. $25 million QoQ.

SoFi’s company savings via using customer deposits to fund loans vs. warehouse facilities grew from 100 bps to 125 bps QoQ.

The median FICO score of new direct deposits is over 750 -- SoFi isn’t finding growth by moving outside of its core, generally affluent demographic. It’s thriving within it which makes credit losses and delinquencies less of a concern.

50% of new direct deposit customers are setting up direct deposit accounts within 30 days of joining SoFi vs. 37% QoQ. This is helping support annualized spend per account growth of 100%+.

On SoFi’s Consumer:

Account balances continue to grow sequentially.

SoFi’s net interest margin of 5.85% rose 126bps YoY and 62bps QoQ as it’s able to raise its weighted average coupon per loan to more than offset rising interest rates. Importantly, these rising coupons are not impacting demand.

SoFi’s average personal loan borrower continues to have an average income over $160,000 and a FICO of 746 vs. 748 QoQ.

SoFi’s average student loan borrower continues to have an average income over $170,000 and a FICO of 771 vs. 773 QoQ.

“Delinquency rates are healthy and below pre-pandemic levels. Annualized net charge-off rates for personal loans are 1.95% and 0.33% for student loans… we continue to expect very healthy performance vs. broader industry levels.” -- CFO Chris Lapointe

On Financial Services:

Again, SoFi expects positive contribution profit for this segment next year… and for evidence of this being doable, sales & marketing as a % of fin services revenue fell from 105% to 50% YoY with further material reductions expected.

Revenue per financial services product of $34 grew 112% YoY & 46% QoQ. Financial services products overall grew 83% YoY.

Options trading is now in beta testing.

SoFi is raising its annual percent yield (APY) on savings accounts from 2.5% to 3% (as mentioned on Twitter yesterday) to feed the top of funnel.

SoFi’s investment payback period within financial services is 12-18 months. This was a new disclosure.

On the Tech Platform:

Galileo signed 10 new clients.

30% of the pipeline is business to business (B2B) clients vs. 30% QoQ and 10% YoY.

40% of the pipeline is clients outside of the USA.

Galileo and Technisys are now attracting the largest of established financial institutions. This means a far quicker revenue ramp once these institutions become contributing clients.

Galileo debuted a more granular management account level control and immediate funding access to assist with working capital during the quarter.

The Galileo transition to the cloud is now '“99% done.”

On 2023:

“I’m Looking forward to having a year of continuity and stability across markets and company specific initiatives. We haven’t had a time where all businesses have the wind at their backs in 5 years. I’m aware of the environment for macro and rates, but we could have a year where all businesses have strong tailwinds… we’ve barely scratched the surface of how big we can be.” — CEO Anthony Noto

SoFi Plus is having the impact on revenue and churn that leadership expected.

On Lending:

“Overall appetite for our loans continues to be robust with $1 billion sold to investors this quarter.” -- CFO Chris Lapointe

Gain on sale margin by lending category:

Personal loans was 3.25% ex-hedging and 4% with hedges

Student loans was 4.3% ex-hedging and with hedging

Home loans was -1.7% ex-hedging and 0.9% with hedging.

SoFi fully expects to be able to continue raising its weighted average coupon with rising interest rates to preserve margins. Over the last 2 quarters, this average coupon has risen by 120 bps across the ENTIRE loan portfolio (not just for new loans).

Time to fund a personal loan is now down to 2 days vs. 8 days in the past.

6. My Take

This quarter was flawless. Growth is rapid, operating leverage is crystal clear, the runway is miles long and leadership is executing in every sense of the imagination. No student loans & a severely challenged mortgage environment? No problem. This company continues to shine amid a tough environment, and I can’t help but to be both elated and impressed. Go SoFi.

Now all they have left to do is call Upstart and get on the auto lending network.

Thorough write up, always a pleasure to read from you.