1. Demand

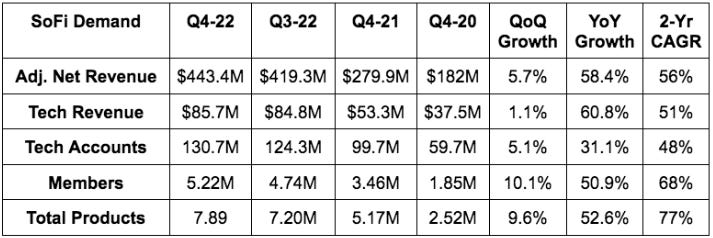

SoFi’s $443.4 million in adjusted net revenue beat analyst estimates by 4.2%.

More Context on Demand:

SoFi’s 2022 guide anticipated a student loan volume ramp in December as the moratorium was supposed to end January 1st 2023. The extension prevented any ramp from taking place, which hit both revenue and -- as it’s a high margin product for SoFi -- profitability. It beat regardless of this.

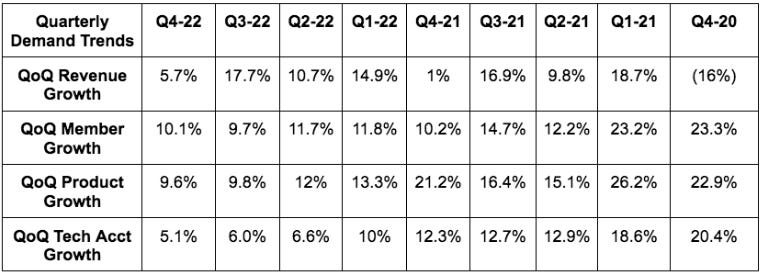

Revenue growth of 58% YoY accelerated from 51% YoY growth last Q.

The 56% 2 year revenue CAGR compares to 39.1% last quarter.

2. Profitability

More Context on Margins:

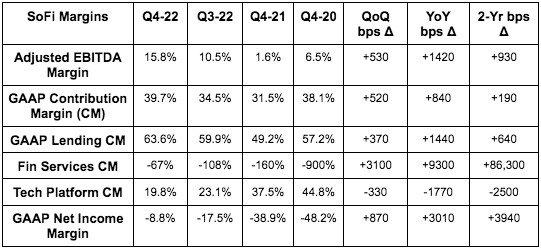

SoFi’s incremental GAAP Net Income margin for Q4 2022 was 42%. Of the $171 in new GAAP revenue, $71 million flowed down to GAAP net income.

Tech platform contribution margin was 24% ex-technisys. It expects margins here to expand in 2023 for the first time in several years.

Improving financial services contribution margin is DESPITE raising marketing spend by $13 million QoQ to attract deposits. Conversely, this margin line is still being hard hit by SoFi building current expected credit losses (CECL) in connection with its newer credit card business.

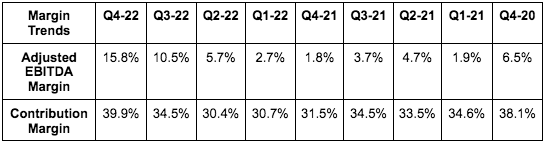

SoFi’s adjusted EBITDA margin for 2022 was 9% vs. 2.7% in 2021.

3. Balance Sheet

$2.2 billion in cash & equivalents.

$12 billion in personal and student loans.

$5.4 billion in total debt including $1.2 billion in convertible notes.

Using 36% of its warehouse facility capacity vs. 35% QoQ.

Stock comp fell to 16% of sales vs. 27.5% YoY.

This is still being heavily impacted by equity awards in connection with going public & includes restricted stock units with strikes that aren’t remotely close to vesting but still count as stock comp. We’ve been consistently told that this will fall below 10% of revenue in 2024.

Adjusted EBITDA dollars reached stock comp dollars for the first time in SoFi’s history with that expected to continue like it needs to.

2 straight quarters of tangible book value growth.

Total deposits grew 46% QoQ to reach $7.1 billion vs. just $1 billion at the start of 2022. The pace has accelerated greatly from $100 million per week in new deposits earlier in 2022.

88% of these deposits are of the direct deposit variety.

“We have ample cash, excess liquidity and strong capital and leverage ratios.” — CFO Chris Lapointe

4. Guidance

Q1 2023 revenue & EBITDA estimates missed by 4.2% & 21% respectively.

Please note that this outlook includes the following pessimistic macro assumptions:

A 2% 2023 GDP contraction

Elevated credit spreads (which already began to improve in January thus improving its access to capital markets so far)

5% unemployment

Peak 5% Fed Funds rate with 2 cuts in the 2nd half of the year (not as pessimistic as the other 3 assumptions).

Leadership told us there is significant upside to forecasts if the exogenous backdrop turns out to be not so gloomy.

The 2023 guide also assumes the student loan moratorium ends in June with volumes ramping 60 days later starting in September. It further expects monthly volumes here not to reach pre-pandemic levels in 2023. For now, industry student loan volumes are 75% off of pre-pandemic levels.

5. Notes from CEO Anthony Noto

On Demand & Outlook:

Noto told us that SoFi would be GAAP Net Income positive by Q4 2023. This was a great piece of news.

Reiterated that financial services will be contribution margin positive by the end of the year.

Strong member & product growth “carried into Q1 2023.”

On Lending & the Charter:

Asset Backed Security (ABS) markets remained available to SoFi throughout the quarter with access improving further so far in 2023. Great news for this company and countless other fintech players that lean on this source of capital.

SoFi’s net interest margin for the quarter rose to 5.92% from 1.39% YoY. It expects this to keep rising with interest income for its loan business now exceeding non-interest income for the first time this past quarter. That means it was contribution profit positive WITHOUT any help from high margin non-interest income via referring or servicing loans.

Referred loans rose 435% YoY.

SoFi share of its personal loan target demographic rose to 6% in 2022 from 4.5% in 2021.

SoFi’s bank charter saved it 190 basis points by being able to use deposits to originate loans rather than warehouse facilities. This benefit grew from 125 basis points QoQ & 100 basis points 2 quarters ago. This added savings is despite it consistently raising its savings APY during that time.

The home loan fulfillment issue lingered into this quarter and will remain a headwind until later in 2023. Noto told us they’ll “step on the gas pedal” to take advantage of all of the expected demand only when this service quality issue is resolved.

Personal loans grew 50% YoY while student loans fell 72% YoY & home loans fell 84% YoY due to the fulfillment issue. Overall, volume fell 21% YoY but net interest income and margin strength offset that anticipated weakness.

SoFi Bank generated an 11% GAAP Net Income margin during the quarter.

CFO Chris Lapointe told us that deliquency and charge-off rates remain well below pre-pandemic levels despite the end of stimulus. Charge-off and delinquency rates by product were roughly stable QoQ. Not surprising given its average borrower has a 745+ FICO score and $160,000+ in income… but still music to my ears. He continues to expect outperformance here vs. the industry thanks to the strength of SoFi’s underwriting and its demographic .

On direct deposits specifically, spend per average direct deposit account rose 25% QoQ. 50% of SoFI Money accounts are setting up direct deposit within 30 days vs. 20% YoY.

On the Technology Platform:

Galileo signed 11 new clients (vs. 10 last quarter)

36% of its pipeline is B2B vs. 30% QoQ

Technisys signed 16 new clients including its first deal in Mexico.

Two things about this segment were slightly concerning to me. First, a customer migrated to a different processor. This cost it $6 million in revenue and to me can only be considered customer churn. Secondly, SoFi is tweaking the tech platform’s go-to-market to focus on larger clients that it views as capable of weathering this current macro environment. It’s already seeing success in its pipeline, but this will lead to low double digit organic growth in 2023 as the tech platform selling becomes more targeted & intentional. Technisys will inorganically add to this growth. We were told there could be upside to the guidance if the pipeline & conversion remain strong.

On Financial Services:

Revenue per fin services product nearly doubled YoY from $21 to $40.

6. My Take

Was this quarter perfect? No it was not. Was this quarter strong & impressive? Yes it was. My least favorite part of the call was Galileo losing a customer & the slowing 2023 tech platform growth guide -- but strong client adds and upbeat pipeline commentary assuaged that dissatisfaction.

And again, the positives were significantly more numerous:

Despite missing a large chunk of its high margin loan demand, unit economics are improving much faster than I thought they’d be while revenue continues to rapidly compound. Market share gains remain brisk & underwriting quality remains strong. It’s effectively balancing savings APY boosts to feed the top of funnel while still improving loan margins simultaneously. Thank you bank charter. New products are all working, and again, the base case environment assumed in its 2023 guide is overly pessimistic. Mastercard and Visa aren’t even expecting a mild recession. The pessimism leaves material room to beat and raise throughout the year like management has done since going public. That’s what I expect.

Hi Brad,

Thank you so much for this article. You are doing a good job.

I am long on SOFI and will keep buying.

Hello Brad,

Enjoyed your appearance on SoFi weekly (YouTube). Hope to see you on there in the future as well.