1. Demand

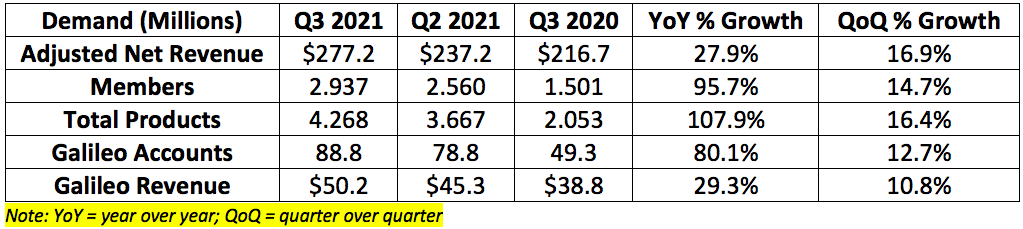

SoFi guided to $245-$255 million in adjusted net revenue and analysts expected $251.6 million. The company posted $277.2 million beating its midpoint guidance by 10.8% and analyst expectations by 10.2%.

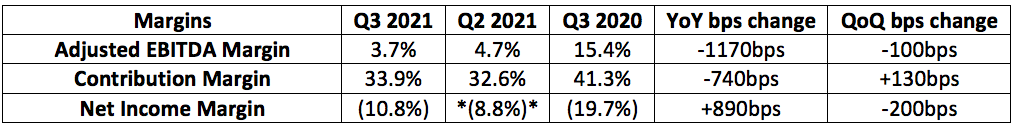

Sequential revenue, product and member growth all improved in this quarter vs. last quarter.

CEO Anthony Noto told us on the call that SoFi is now over 3 million members.

Galileo was immensely helped by stimulus in Q3 of last year. It still reported 80.1% year over year growth regardless of the difficult comparison.

Product additions continue to greatly outpace member additions pointing to strong cross-selling momentum and the “one-stop-shop” approach working more and more every quarter.

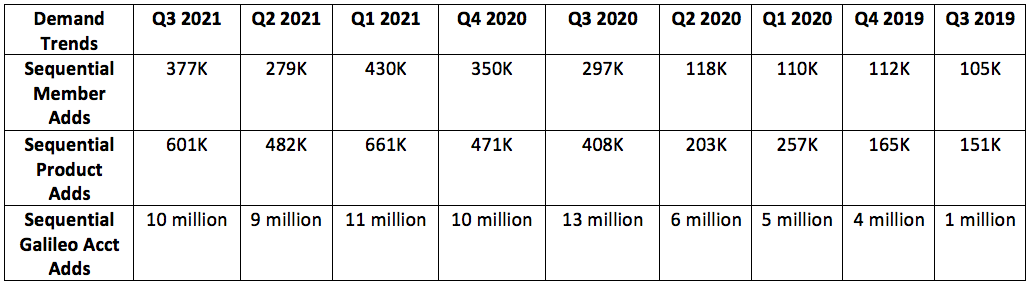

Here’s a breakdown of where all of this product growth is coming from via the company’s shareholder letter:

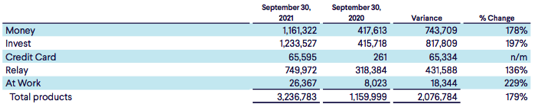

2. Profitability

SoFi was projected to lose $0.14 per share. The company lost $0.05 per share beating expectations by $0.09.

SoFi guided to ($7)-$3 million in adjusted EBITDA for the quarter. It posted $10.2 million in adjusted EBITDA beating the midpoint of expectations by $12.2 million.

**Note that the (8.8%) Q2 2021 net income margin is adjusted for the hit that profit took last quarter via a change in the fair value of warrant liabilities. My adjustment made the comparison more apples to apples but the true net income margin was (69.6%) last quarter.**

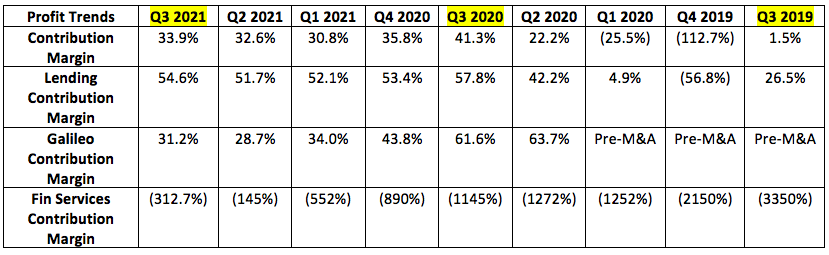

SoFi’s total financial service products in circulation is now more than triple its total lending products. These 2 were roughly the same just a year ago. The proliferation of the newer, lower margin financial services segment is what is weighing on some (not all) margin lines. Specifically, financial service products grew by 166.6% year over year which outpaced the company’s growth as a whole. Financial services revenue also soared by 290% to depict the momentum it’s enjoying.

Downward pressure on Galileo’s contribution margin was the result of continuing to invest in broadening and improving the platform’s suite of products. Operating expenses for this segment rose 132% year over year to support all of SoFi’s ambitious plans. The company anticipates this segment’s contribution margin will be in the 20%-30% range going forward to fund these plans. Right now, Galileo’s bread and butter is payment processing and SoFi feels the company can offer many more APIs and use cases in the future. Q3 2020 margins also benefitted from an APEX clearinghouse contribution (a company that SoFi acquired) that it did not enjoy this period.

Application Programming Interfaces (APIs) Defined: APIs are blocks of code that enable software to perform various tasks. APIs act as the ‘language’ that empower access to data services, operating systems, and other applications to create an end product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build the platform’s UI and user experience (UX).

3. Guidance Updates

SoFi guided to the following for the 4th quarter:

$272-$282 million in next quarter revenue. Analysts were expecting $274.9 million. This revenue growth estimate implies an acceleration to 49-55% YoY growth.

Adjusted EBITDA of $2-$5 million.

4. CEO Anthony Noto Conference Call Notes

On brand awareness and marketing success:

“Unaided brand awareness” doubled during the “Money Moves” campaign that I’ve touched on in a previous News of the Week post.

SoFi Stadium has averaged more than 20 million TV viewers per game vs. a mean audience size of 17.3 million for the NFL. SoFi reached 5 million viewers per year before acquiring these naming rights and the company sees an uptick in awareness and downloads every Sunday.

Barron’s named SoFi the best robo-advisor for 2021

On cross-selling:

SoFi enjoyed a 65% sequential increase in cross-buying volume from its customers starting with the money product.

Specifically, SoFi Money, Invest and Credit Card (encouragingly) drove 79% on new member growth and 73% of the cross buying volume during the period.

On referrals:

Initiatives such as enhancing and expanding the incentives within its referral program led to referrals contributing 18% to SoFi’s member growth vs. just 3% last quarter.

SoFi’s Rewards program accounted for 15% of its quarterly product growth vs. just 9% last quarter. It added several new rewards programs to bring its total incentives offerings to 33.

Marketing cost per member fell 8% sequentially despite an acceleration in spend.

On student loans:

This segment remains extremely challenged from the CARES Act moratorium extension on federal student loans. Student loan volume remains 50% off pre-CARES levels. Despite this, the company still managed to find 21% growth thanks to 166% growth in personal loans and 26% growth in home loans. Diversifying beyond student loans is what allowed SoFi to weather the storm for the last 20 months.

Personal loan NPS scores, approval rates and automation all reached “record highs” during the quarter.

Time-to-fund a personal loan reached a record low despite the outperforming demand.

70% of personal loans are now fully automated or “no touch.” This is vs. 50% sequentially.

On home loans:

“In home loans, we progressed further in our efforts to transition into the purchase side of the business through new, high-quality lead generation partnerships.”

Nothing more was said about this but I found it very interesting.

On underwriting:

A new underwriting model that SoFi introduced has led to more loan approvals without changing the risk parameters of its credit model. For evidence, despite this approval uptick, SoFi’s average FICO score is near an all-time high of 749.

On Galileo:

Galileo added 13 new clients in the quarter to reach 35 additions so far this year. It was averaging 11 new client adds per quarter before this result.

“We think the growth opportunity with Galileo is so massive that we want to make sure we are making the investments to capture it.”

On Pagaya:

Pagaya is partnering with SoFi Lantern (a loan marketplace) to direct demand (that SoFi isn’t capturing) to other loan funders for a commission. This did not contribute materially to results during the quarter but should contribute more going forward and will be “very high margin revenue.” This will also keep more consumers in the SoFi ecosystem to drive more cross-selling.

On the bank charter:

There was no update provided here.

5. CFO Chris Lapointe Conference Call Notes

The company has now generated $37 million in trailing 12-month EBITDA vs. ($138) million in the prior period.

Incremental EBITDA margin on new revenue over last 12 months was “north of 40%.” It was 30% last quarter. The incremental margin will be closer to 30% going forward as SoFi is committed to investing 70% of revenues back into growth — but this still points to the opportunity for much more margin expansion.

The company lowered its cost of capital by retiring warehouse credit facilities which helped boost net interest income in the lending segment.

The remaining SoFi warrants must be exercised by December 6th and will result in worst-case shareholder dilution of 3.5%.

6. My Take

With its most established segment (student loans) still more than 50% off of normal volumes due to the CARES Act, I was not expecting a guidance raise. We still got one. There’s not much to say other than great job SoFi. It’s exciting to think where this business will be with a normal student loan market and a bank charter in hand.

Pagaya integration would have far higher upside if Sofi enters the auto loan, mortgages segments. Aided with the bank license, the costs of funds will be lower, and AI platform leading to lower delinquencies, significant margin expansion. Long Sofi