SoFi Technologies Q1 2022 Earnings Review

A condensed overview of this firm's quarterly results.

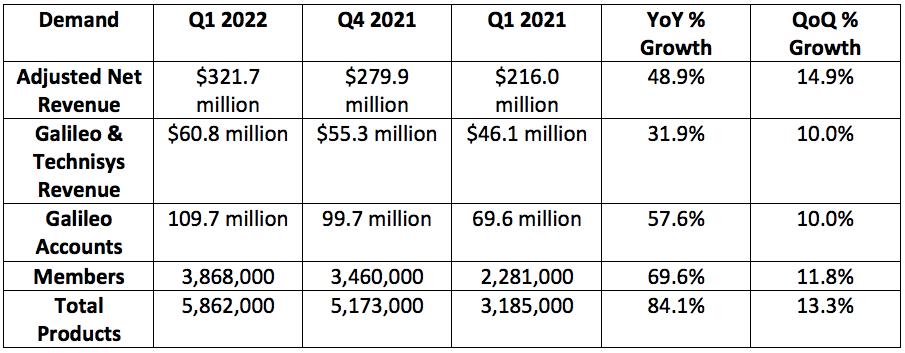

1. Demand

SoFi guided to a midpoint of $282.5 million in revenue for the quarter, while analysts were expecting $284.0 million. The company posted $321.7 million, beating its expectations by 13.8% and analyst estimate by 13.2%.

More context on demand:

This represented SoFi’s 3rd highest member growth quarter and 2nd highest product growth quarter after its record-setting Q4 2021. This is despite the benefits of several product launches in 2021 and 2020.

Cross-selling volumes rose 22% YoY.

Technisys contributed "a small amount" to quarterly sales.

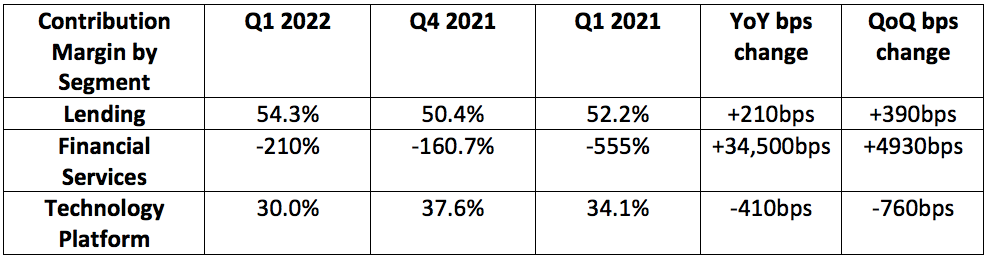

2. Profitability

SoFi guided to a midpoint of $2.5 million in adjusted EBITDA for the quarter while analysts were looking for $5.0 million. It generated $8.7 million, sharply beating expectations.

Analysts were also looking for a net loss of $0.13 per share. SoFi lost $0.14 per share, missing expectations by 7.6% or $0.01.

More context on margins:

Factors contributing to margin compression:

The student loan moratorium is hitting its most profitable segment's volume by just over 50%.

Its thriving financial services growth which comes with lower margins.

SoFi’s long term EBITDA margin target is 30%.

Financial services contribution margin continues to be hit by Current Expected Credit Loss (CECL) reserve building. This is now largely behind us.

The Technology Platform contribution margin compression was powered by “continued heavy investments to capture accelerating secular growth opportunities.”

It expects to operate this segment at a 20-30% contribution margin while it invests in more growth.

Lending contribution margin expansion was powered by an issue with a 3rd party lending partner last quarter which did not reoccur. Underwriting improvements were also given some credit.

Just like last quarter, SoFi's net accumulation of $1 billion in loans on its balance sheet led to technical "cash burn" of $1 billion during the quarter. This is a planned reaction to getting its banking charter as it now will have access to lower cost of capital vs. its existing warehouse facilities and far more loan holding period flexibility. The longer holding periods are the key contributor to the cash burn. While it is considered cash burn from an accounting perspective, it's really just a change in capital/balance sheet structure... not a matter of poor unit economics.

3. Guidance

2022:

SoFi previously guided to $1.47 billion in revenue while analysts expected $1.44 billion in revenue. SoFi changed its guidance to just under $1.51 billion.

This represents a 2.6% raise vs. its own guide and a 4.7% raise vs. analyst expectations.

SoFi previously guided to $100 million in EBITDA while analysts expected $97.4 million. SoFi changed its guidance to $102.5 million.

This represents a 2.5% raise vs. its own guide and a 5.2% raise vs. analyst expectations.

Note that SoFi revised its guidance lower in April due to the student loan moratorium extension. This is now assumed to be extended through the end of 2022.

Q2 2022:

SoFi's Q2 2022 revenue guide of $335 million missed expectations by 1.2%

SoFi's Q2 2022 EBITDA guide of $10 million sharply missed expectations of $25.1 million

This would only worry me if the full year guide wasn't revised higher on both the top and bottom lines.

4. Notes from CEO Anthony Noto

"Our continued performance positions us for long term sustainable success and to be the winner take most company in fintech." — CEO Anthony Noto

On a strong Q1 amid changing macro:

“Strong results were achieved despite volatile markets and the changing political, fiscal and economic landscape. This demonstrates how our strategy of building a full suite of products has created a uniquely diversified business that can outperform across market cycles.” — CEO Anthony Noto

Noto credits the depth of their product offering with the SoFi's ability to outperform across all macro environments. Things like variable rate loan refinancing -- which is a SoFi core offering -- thrives amid rising rates while things like mortgage originations thrive in falling rate environments. It can pivot dollars to products that are enjoying the most prominent macro tailwinds and away from macro-economically challenged offerings. Noto hosts weekly meets with all product managers to strategize capital allocation. He runs this company like an Army General -- and I love it.

On the technology platform (Galileo/Technisys):

“Client response to the combined Galileo and Technisys value proposition has been quite positive so far.” — CEO Anthony Noto

On segment performance:

Financial services:

Direct deposit accounts added per week have more than doubled (2.7X) into Q2 2022 vs. Q1 2022 with deposits growing $100 million per week ($1.2 billion total today). Noto attributed this to things like the 1.25% APY savings account -- 44X the national average.

All financial services products that are at least 1 year old grew by triple digits.

SoFi added margin loans for invest members and will debut options and extended hours trading this year.

SoFi expects continued rapid growth in monetization per product as well as total products.

Lending

This was its 4th straight quarter of revenue growth acceleration with 20% growth YoY.

Origination volumes rose 30% YoY via 151% personal loan growth which is now at a quarterly volume run rate of 2X pre-pandemic.

Strength in personal lending (where it pivoted more marketing dollars) is offsetting weakness from the student loan moratorium AND issues with on-boarding a new partner -- which was slower than SoFi wanted it to be. SoFi has moved through the growing pains which means it will likely "step on the gas pedal" later this year with more marketing dollars now that it feels it can handle the scale with high quality service.

60% of SoFi's home loan buyers are existing customers.

On brand awareness:

"We are committed to investing in product and brand marketing with appropriate unit economics. These investments are exceeding expectations... unaided brand awareness, which was up 70% in 2021, doubled during Super Bowl Weekend... Even without an ad, SoFi had 5X more searches than any others with ads." — CEO Anthony Noto

On Credit Quality (highlight of the call):

"We're making ongoing investments to build and maintain a robust risk management framework beyond industry standards. Our personal loan delinquencies remain at record lows even as we hit record high origination volumes." — CEO Anthony Noto

Noto added the following stats:

For personal loans:

SoFi's average borrower has $160,000 in total income and a 746 FICO score.

For student loans:

SoFi's average borrower has $170,000 in total income and a 775 FICO core.

CFO Chris Lapointe further added that both 90-day delinquencies and charge-off rate trends remain entirely positive on a YoY and QoQ basis. Music to my ears.

Leadership was explicitly asked about Upstart in the Q&A and how SoFi's lending demographic compares. It seems that the team was expecting this as they provided this information in the prepared remarks.

On the student loan moratorium and possible debt forgiveness:

Noto discussed some recent political commentary that has consistently centered around $10,000 in debt forgiveness for certain individuals vs. other more aggressive plans of $50,000 for everyone that are losing political support. Noto told us that ideally, the moratorium would end tomorrow -- that's no surprise. What was somewhat surprising was how in favor of $10,000 in debt forgiveness he was. There are two likely reasons that explain this enthusiasm:

Average student loan size for SoFi is $70,000 -- this will only forgive $10,000 and would likely mark the end of the moratorium.

There's a large cohort of borrowers waiting to see if their debt will be forgiven before choosing to refinance. The anticipation is a demand headwind which will go away once things clear up.

Noto is rooting for $10,000 or less in student loan forgiveness and sees it as a somewhat likely outcome.

5. Notes from CFO Chris Lapointe

On gain on sale loan Margins:

Gain on sale margins for SoFi -- when including company hedges -- are over 4% for student and personal loans and over 2% for mortgages. The company expects these to remain stable despite assuming the Fed hikes rates 7 more times this year. This is vs. expectations of 5 TOTAL rate hikes in all of 2022 that it had as of last quarter. Its raised guidance despite this depicts its insulation from rate hike pain. It caters to affluent borrowers who are less economically fragile and less sensitive to rising APRs; that's currently paying dividends in this environment.

More notes:

Lantern is enjoying outperforming lifetime value and SoFi plans to invest more in that segment.

Lantern is its lending as a service offering where it re-directs the 70% of its loan applicants who are rejected to another vendor for a fee

The rapid build in EBITDA guided to in the 2nd half of the year is largely via:

Ramping benefits from its banking charter.

High margin personal loans and tech platform products thriving.

6. My take

I can breathe a sigh of relief following this report. The company is doing exactly what it needs to be doing, and I plan to continue slowly adding into more multiple compression (like I did today). Signs of briskly sustainable cash flow and revenue compounding are abundant even with its student loan business operating at under 50% volume. The price action has been brutal, but the results were fine.