1. Demand

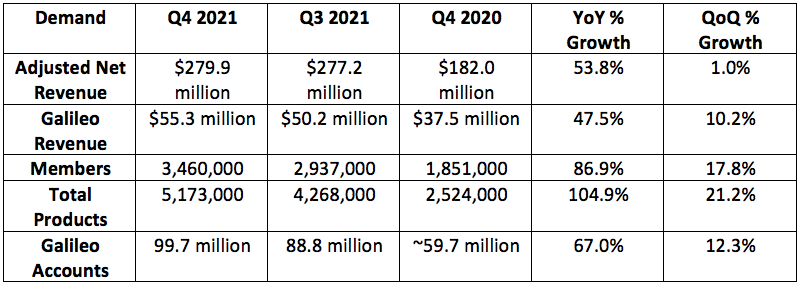

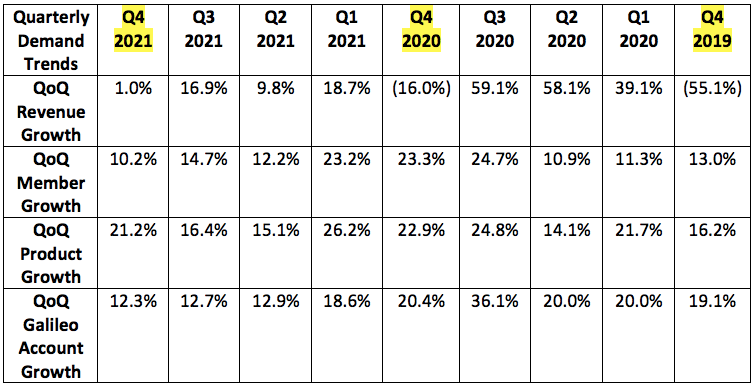

SoFi guided to $277 million in quarterly revenue and analysts were looking for $279.5 million for the period. The company posted $279.9 million, beating its expectations by 1.0% and analyst estimates by 0.1%.

Notes:

The company originally guided to reaching 3 million members by the end of 2021 in its SPAC investor presentation. The 3.46 million members it boasts today shattered that estimate by 15%.

SoFi’s product growth exceeding its member growth is direct evidence of deepening cross-buying momentum in the business.

Member, product and Galileo sequential growth all accelerated form last quarter.

The quarter represented a new record for both sequential member and product adds at 523,000 and 906,000 respectively. Product adds specifically beat its previous record by nearly 50%.

SoFi posted $1.01 billion in sales for the year. This beat its original $980 million forecast by 3% DESPITE the student loan moratorium in the U.S. extending through the remainder of 2021 (and a delayed banking charter). This extension yielded a 50% volume hit to SoFi’s largest business line. In its original $980 million 2021 sales guide, SoFi assumed the moratorium would end in September, 2021.

Student loan demand had been building throughout the 4th quarter in anticipation of the moratorium expiring in January — but it was since extended. The extension severely hit SoFi’s student loan demand in the last week of December, 2021 which hurt these quarterly results.

Note that SoFi had seen a sharp sequential revenue decline from Q3 to Q4 in 2020 and 2019. That trend encouragingly reverted this year.

2. Profitability

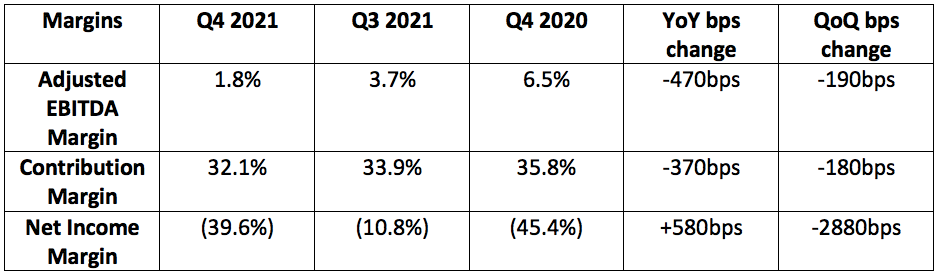

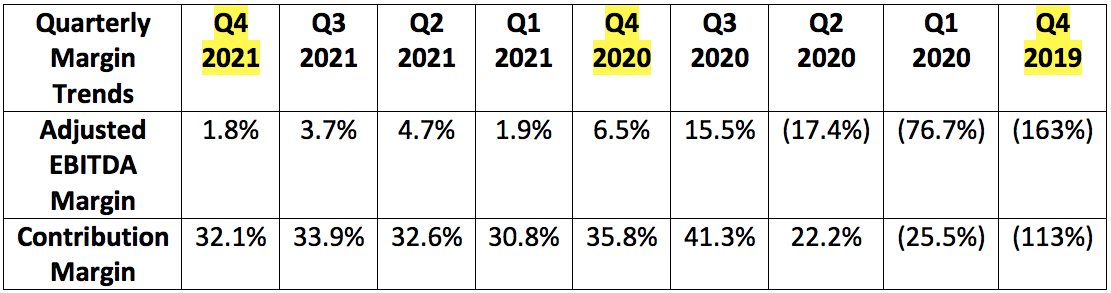

SoFi guided to $3.5 million in adjusted EBITDA for the quarter and analysts were expecting $3.0 million in adjusted EBITDA. The company generated $5.0 million in adjusted EBITDA, beating its estimate by 42.8% and analyst estimates by 66.7%.

Analysts were also looking for a loss of $0.12 per share for the quarter. The company lost $0.15 per share, missing expectations by $0.03.

SoFi earned $30.2 million in adjusted EBITDA for 2021 as a whole vs. losing $44.8 million in 2020. Similarly to revenue outperformance for the firm, the $30.2 million EBITDA outcome beat SoFi’s original SPAC guidance of $27 million for 2021. While many de-SPACs haven fallen victim to overpromise and underdeliver, CEO Anthony Noto and SoFi are the polar opposite — they’re the exception.

Again, this is all DESPITE student loan volumes being immensely challenged in 2021. This is not only SoFi’s largest business, but its most profitable as well.

SoFi’s lowest margin financial services segment continues to rapidly grow. That — plus heavy investments in Galileo — is the source of the margin compression seen below:

SoFi has long term EBITDA margin targets of 30% and it is already there when looking at the incremental EBITDA margin on its new business having eclipsed 30%. This hints at vast margin expansion to come over the very long term.

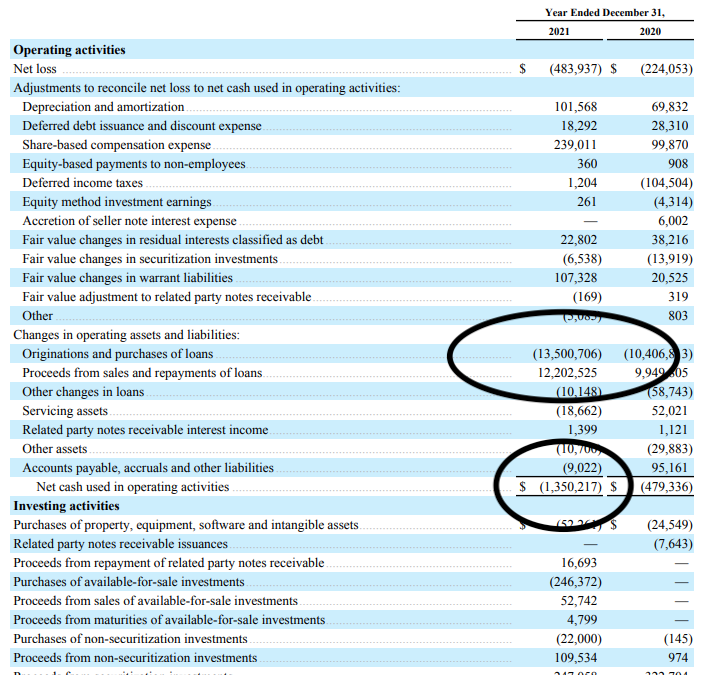

Note that some have pointed out SoFi’s $1.4 billion operating cash burn in 2021 as a red flag — it isn’t. This appears to be solely related to accumulating more loans on its balance sheet. While it’s called “cash burn” in accounting terms, it’s really just a change in capital structure. I’ve reached out to Noto to confirm. See the image below for what I’m referring to:

3. Guidance

a. Guidance assumes the following:

A $30-$35 million negative impact from the moratorium extension.

The moratorium will not be extended past May, 2022.

Student loan refinance origination volume returns to pre-pandemic levels in Q2.

SoFi Bank will start contributing meaningfully to results in Q2, not Q1.

“Because SoFi Bank was initially capitalized with cash from the balance sheet and not loans, SoFi will not begin to realize the lower cost of capital benefits of SoFi Bank until it can originate and fund loans for SoFi Bank. Management believes this will take until Q2.”

20-25% Technisys growth.

Incremental adjusted EBITDA margins of 30% ex-Technisys in 2022 — consistent with its long term target.

b. 2022 — Analysts were looking for the following:

$1.45 billion in 2022 revenue. SoFi guided to $1.57 billion, beating expectation by 8.3%. This includes a roughly $65 million contribution from Technisys. Without this boost, SoFi’s guidance of roughly $1.5 billion would have beaten expectations by 3.4%.

$155.5 million in 2022 EBITDA. SoFi guided to $180 million, beating expectations by 15.8%. This beat was all organic, as Technisys is not yet a material EBITDA contributor.

A loss of $0.60 per share. SoFi doesn’t offer guidance here.

c. Q1 2022 — Analysts were looking for the following:

$303.6 million in Q1 revenue. SoFi guided to $282.5 million, missing expectations by 6.9%.

This miss includes the unforeseen hit from the student loan moratorium extension. Without the headwind, SoFi would have guided to $315 million in revenue for a 3.8% beat.

$18.6 million in Q1 EBITDA. SoFi guided to $2.5 million, sharply missing expectations.

This miss includes the unforeseen hit from the student loan moratorium extension. Without the headwind, SoFi would have guided to $25 million in EBITDA for a 34.4% beat.

A loss of $0.08 per share. SoFi doesn’t offer guidance here.

Again… SoFi’s strong 2022 guide is despite the incremental headwinds it’s dealing with in the first quarter.

4. Notes from CEO Anthony Noto

On 2021:

“We were able to reach both our adjusted revenue and adjusted EBITDA milestones ahead of plan in an increasingly challenging operating environment — while also significantly exceeding our member growth guidance.”

“We think we are well on our way to building the AWS of fintech. We have the right offering, team, liquidity and strategy to achieve our long term strategic goal to be the digital one-stop shop for banking. Having celebrated my 4th anniversary as CEO of SoFi last month… I feel like we are just getting started.”

SoFi’s brand awareness rose 70% YoY in 2021 thanks to successful marketing and influencer campaigns. This bump does not include the strong boost it got from hosting the Super Bowl at SoFi Stadium.

On lending:

Contribution margin for the lending segment fell from 55% to 51% sequentially due to the following 2 reasons:

One of SoFi’s 3rd party fulfillment partners reduced their loan conversion rates. This impacted SoFi’s ability to serve the strong demand it was (and is) seeing. These issues have since been resolved with SoFi on-boarding another 3rd party fulfillment partner.

It accelerated Q4 student loan marketing spend thinking the moratorium would not be extended in January. It was, which which weighed on margins as those promotional dollars didn’t translate into more revenue.

Encouragingly, student loan originations were rapidly recovering before the extension — meaning they may rapidly recover in May when the restrictions are hopefully lifted.

Personal loan demand made up for the student and home loan voids. Personal loan originations of $1.6 billion in the quarter rose 168% YoY to allow SoFi to meet its guidance despite the challenges.

SoFi’s direct purchase loans are now a low double digit percentage of its mortgage volumes vs. low single digits YoY. This will help drive continued growth in a rising interest rate environment.

On Pagaya:

“Providing loan referral fulfillment services to Pagaya enabled SoFi to access a broader audience to drive further growth without more underwriting risk. Pagaya provided an incremental 7,700 loans to SoFi for the quarter.”

SoFi only approves 30% of its loan applicants. This allows it to create a lead generation fee from other partners willing to originate at different parameters.

On Galileo:

H&R Block selected Galileo to power a piece of the payment processing within its “Spruce App.”

T. Rowe Price added Galileo as a client for its emergency savings program.

Galileo added 9 new clients in the quarter to reach 44 additions for 2021 as a whole.

Galileo will debut securitized debit and dynamic fraud protection products in 2022. To support these releases and more, Galileo operating expenses rose 61% YoY vs. 45% revenue growth which weighed on contribution margin. This is temporary.

Noto acknowledged how Galileo was boosted from stimulus but thinks “other tailwinds” will make up for this to drive continued rapid growth.

On how the bank charter boosts Galileo:

“We have a competitive advantage with Galileo as we can have SoFi Bank serve as the sponsor bank for Galileo’s partners to save them 10-12 basis points on those services.”

Noto always talks about its consumer products being “better together.” This is that philosophy in action on the business to business side of things as well.

On financial services:

Every financial services product is enjoying triple digit growth.

SoFi credit card grew from 6,000 accounts to 91,000 YoY thanks to successful rewards program debuts.

SoFi now offers 30 cryptocurrencies through SoFi Invest vs. 5 last year.

SoFi credit already has an NPS in the mid 50s.

On Cross-buying:

Cross-buying volume tripled to 380,000 products YoY.

33% of new product growth came from existing members.

Consumer acquisition cost (CAC) fell 17% YoY thanks to this momentum.

On an early banking charter boost:

Direct deposit activity rose 50% in Q4 sequentially and another 50% sequentially into Q1 so far thanks to the high yield consumer products. SoFi Money is now SoFi Checking and SoFi Savings.

5. Notes from CFO Chris Lapointe

On rate hike impacts:

“Our current guidance contemplates five 2022 rate hikes. We have a series of levers we can pull to counteract the impact of rate hikes. Our interest rate coupons have started to rise in Q1 but demand has remained particularly robust.”

“Our diversified product model allows us to adjust and re-allocate capital to different products that do better in different macro-backdrops.”

Lapointe assured investors that SoFi’s capital market and securitization reliance is low which “insulates” the company from evolving macroeconomic conditions leading to “demand mismatches.”

Noto added that SoFi successfully navigated the taper tantrum in 2018, the subsequent dovish pivot and the pandemic:

“Having navigated through these environments in the past gives us a playbook to do so in the future.” — CEO Anthony Noto

On the balance sheet:

SoFi’s warehouse facility borrowing is only at 25% of capacity. Its diminished reliance on this form of credit is actively lowering its cost of capital and will continue to do so with its bank charter in hand.

SoFi’s book value is $4.7 billion.

All SoFi private and public warrants have been redeemed.

6. My Take

Despite SoFi’s largest, most profitable student loan segment continuing to take incremental regulatory hits, the company continues to meet or exceed its guidance. Countless companies have used macroeconomic excuses to explain away poor results and weak 2022 guidance. SoFi had a legitimate excuse in this moratorium obstacle — but it didn’t matter. I’m excited to own this company and to continue accumulating shares going forward. Great job SoFi.

“ • SoFi now offers 3 cryptocurrencies through SoFi Invest vs. 5 last year.”

https://www.sofi.com/invest/buy-cryptocurrency/

"Now you can trade Bitcoin, Ethereum, Dogecoin, Cardano, and 26 more coins—24/7."

Very nice summary! Thanks! :)