a. Demand

The company guided to the following:

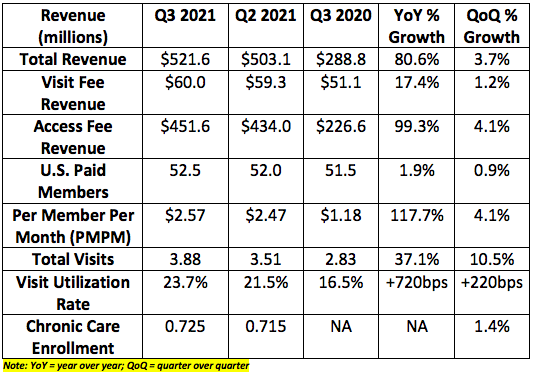

$510-$520 million in sales for the quarter. The company generated $521.6 million in sales beating expectations by roughly 1.3% at the midpoint.

52-53 million U.S. paid members. It posted in line results.

Total visits between 3.4-3.6 million. It posted 3.88 million beating expectations by 10.8% at the midpoint.

Total revenue growth was largely driven by U.S. access fee growth of 113% year over year. International access fee growth was 19% and is a much small piece of the business.

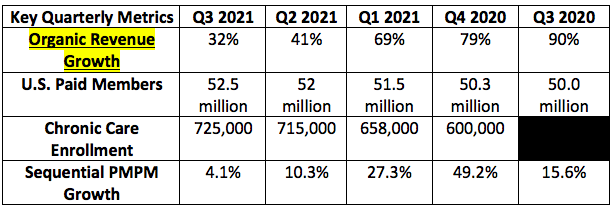

As a note, this quarter is a seasonally weak period for chronic care enrollment (Livongo). This result came in as expected.

The first 2 metrics in the quarterly chart below depict the strength of demand for Teladoc’s core legacy business. The following 2 metrics in the quarterly chart below depict the traction for Livongo’s products that Teladoc is enjoying.

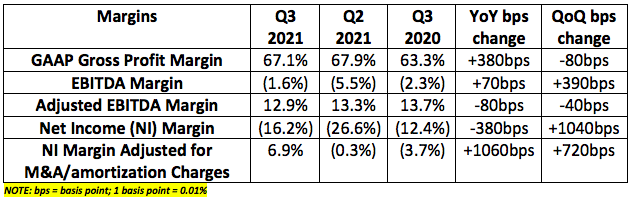

b. Profitability

C. Balance Sheet

Highlights:

$826 million in cash & equivalents = ~2.5 years of cash burn at the current (temporary) quarterly net loss rate.

$1.21 billion in convertible and long term debt.

$111 million in year to date operating cash flow.

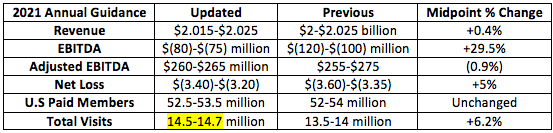

d. Guidance

Expectations for Q4 2021 guidance were as follows:

Roughly $539.7 million in next quarter revenue. It guided to $536-$546 million beating expectations by 0.2% at the midpoint.

$(0.69) in next quarter net loss per share. It guided to $(.73)-$(.53) in net loss per share beating expectations by 8.6% at the midpoint.

Updates to the 2021 annual guide:

e. CEO Jason Gorevic Conference Call Notes

General Notes:

Late stage demand pipeline more than doubled year over year.

BetterHealth continues to outperform the company’s expectations for 50% year over year growth.

Repeat usage rose 25% year over year.

Utilization rate continues to rise even as the pandemic begins to ease and vaccinations scale — Telehealth does not appear to be a fad. This utilization is increasingly driven by non-infectious disease meaning chronic and mental health for example. These segments are more recurring than infectious.

Mentioned that industry experts are now expecting virtual visits to rise to 25%-50% of total healthcare visits over the long term.

#1 in JD Power Telehealth customer satisfaction — as previously announced.

The company is being very methodical and slow with international growth. It’s debuting localized products market by market which results in slower short term growth but a longer expansion runway.

Cost of customer acquisition continues to “consistently fall.”

On Whole Person Care Traction & Primary360:

“We’ve signed several new Primary360 agreements including with CVS Health and Aetna — as previously announced — and also a new, deepened relationship with Centene beginning with 4 states next year.”

“The MyStrength pipeline grew by a healthy double digit percentage sequentially. We are just beginning to roll out internationally.”

“I had a conversations with the CEO of a large health center just two weeks ago about how we can stand up a white label Primary360 offering to serve as a front door to wrap around hospital systems. The capability of the product is beyond what we can even imagine today.” —> the Microsoft Teams partnership will be a large piece of this integration.

Chronic Care notes:

Chronic care enrollment is up 31% YoY to 725K — +16,000 members sequentially which is in line with expectations.

24% of chronic care patients are now enrolled in 2+ programs vs. 8% YoY and 20% as of last quarter. Chronic care momentum continues to be very positive.

Total chronic care program enrollment rose 45% YoY vs. 60% YoY growth last quarter.

Several modules on the way (combining Livongo’s assets).

Gorevic teased (several times) all of the new information Teladoc is planning on providing on Primary360 at the company’s investor day next month.

On Competition:

“Our win rates are consistent vs. prior years despite the new competitive entrants. Retention rates are strong and 70% of our bookings this year have been multi-product in nature vs. 50% last year. We are winning because of the breadth of our full-suite of services. The point solutions are really struggling at this point.”

“There were naysayers doubting our visit growth after last year. We are very pleased with our substantial visit growth.”

On 2022 Guidance:

“We are as confident as ever in our multiple growth levers for 2022 and beyond. Given our insight at this stage in the selling season we are guiding to 2.6 billion 2022 revenue representing 29% growth at the midpoint.”

“Chronic care is growing in line with initial expectations but we expect to be more conservative with growth expectations going forward. Our guide assumes chronic care growth of 25-35%.”

The company does not generally provide forward annual guidance at this stage in the year.

Both Gorevic and CFO Mala Murthy told investors this guidance is conservative as companies are honed in on bringing workers back to the office before adding new benefits. It does expect this to resolve itself for next year’s selling season but wanted to be careful with the guide.

f. My Take

This quarter was largely as expected. The company continues to demonstrate the positive and improving unit economics of its business when considering the transitory M&A expenses. Growth remains lofty, guidance was satisfactory (and thankfully conservative) and the immense opportunity for Primary360 remains in the top of the first inning.

The stock will do what it will do, but I am personally fine with the report.

Thanks Brad! I really appreciate your perspective. Good luck in the game on Saturday :-)

Great👍