1. The Results

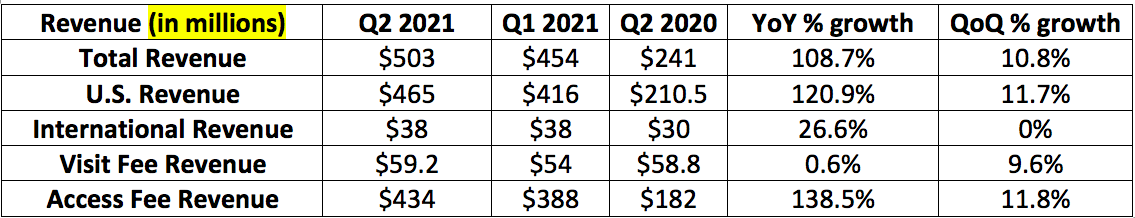

a. Revenue

Teladoc Health’s organic revenue grew by 41% vs. 69% sequentially.

The 2nd quarter internal guide was for $495 to $505 million in total revenue.

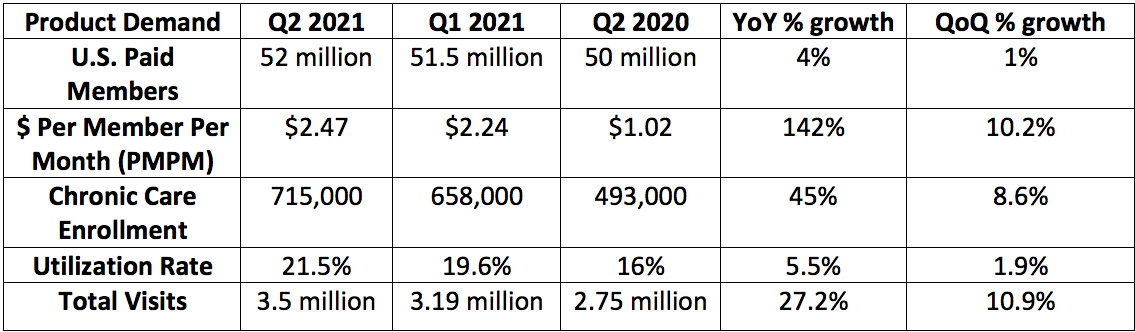

b. Product Demand

The 2nd quarter internal guide was for 52 to 53 million U.S. paid members and 3.2 to 3.4 million total visits.

c. Profitability

Teladoc’s internal 2nd quarter adjusted EBITDA guide was for 12.1%-12.9%.

Over the first 6 months of 2021, Teladoc’s cash flow from operations margin was 3.5% vs. 6.9% in the year-ago period.

Total net loss in the quarter was $133.8 million. This includes $83 million in stock based compensation related to the Livongo Transaction, $46 million in amortization expenses related to m&a and $31 million in debt extinguishment charges. When subbing these non-recurring costs out, Teladoc earned $26.2 million in net income.

2. The Outlook

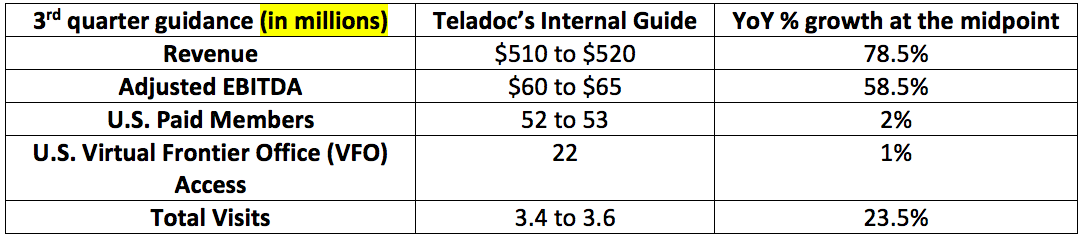

a. 3rd Quarter Guidance

Analysts were expecting $514.4 million in 3rd quarter revenue.

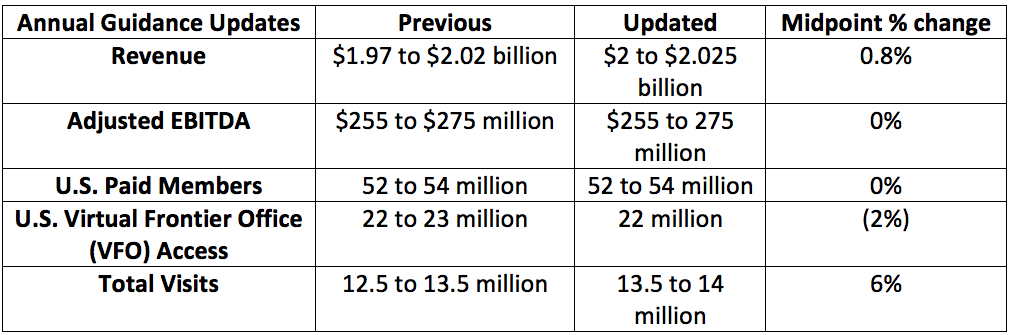

b. Annual Guidance Updates

3. Management Commentary

a. CEO Jason Gorevic Highlights

Gorevic spoke on the new agreement Teladoc signed with HCSC — the 5th largest health insurance company in the USA. Teladoc will now provide its suite of chronic care products across all of HCSC’s commercially insured members. Starting next year, HCSC members will be able to buy insurance plans with direct access to Teladoc’s diabetes and hypertension programs.

2 compelling quotes from Gorevic:

“Just this week we signed a significant Primary360 contract with a national payer and we are also in late stage discussions with several other health systems. The pipeline here continues to grow.”

“Last year 50% of our product bookings were multi-product in nature. This year that is over 75%. Our average deal size is up another 10% vs. where it was last year.”

Some additional notes from Gorevic:

Even as more people are vaccinated and restrictions are lifted, consumers continue to increasingly rely on Teladoc’s virtual care

20% of chronic care patients are now enrolled in multiple programs vs. 6% year over year

Teladoc saw a 60% year over year increase in total chronic care program enrollment

2000 Teladoc users were surveyed about their virtual mental health service satisfaction. These were the results:

Over 90% saw improvement

40% reached a “significant breakthrough”

[Non Covid-19] infectious disease transmission is beginning to tick up for the first time since the pandemic began

Will launch Primary360 with several Fortune 1000 clients in the 2nd half of the year. “Stay tuned for some exciting announcements”

Continued cross-selling and product introduction is expected to drive higher PMPM going forward (acronym defined above)

80% of B2B visits in the quarter were related to non-infectious diseases vs. 50% pre-pandemic

Not a ton of information on Mystrength’s early results other than saying interest is strong

This is the first product release combining Teladoc & Livongo’s capabilities

b. CFO Mala Murthy Highlights

Gross profit margin expansion is driven by 2 things:

Higher subscription revenue mix from the Livongo and InTouch acquisitions

Increased cross-selling activity thanks to Livongo’s product suite

Expansion in adjusted EBITDA is driven by realized synergies from previous purchases (Livongo & InTouch) and cross-selling.

2 Compelling Quotes From Murthy:

“Specialty visit growth including mental health more than doubled. There is massive pent-up demand for these services. I would expect the high growth across specialty to continue.”

“Sequential growth in the Primary360 Pipeline is very strong.”

4. My Take

41% organic growth comping over peak pandemic pain is impressive. The gross profit and adjusted EBITDA margin expansion is quite positive. Teladoc is still working through the expenses related to its large Livongo purchase which is why net loss remains bloated. These expenses will continue for the next few quarters. To me, this merely provides more time to accumulate shares as the charges will end and are not related to the business’s fundamental performance. The unit economics of Teladoc’s actual operations continue to improve and growth continues to be lofty.

I’m pleased.

Thank you for reading!

Hi Brad, thanks for your insightful analysis! Is the very poor growth of TDOC in paid member subscriptions and VFO access (2% and 1% respectively) a concern for you?

Great article ! Thanks for sharing :)