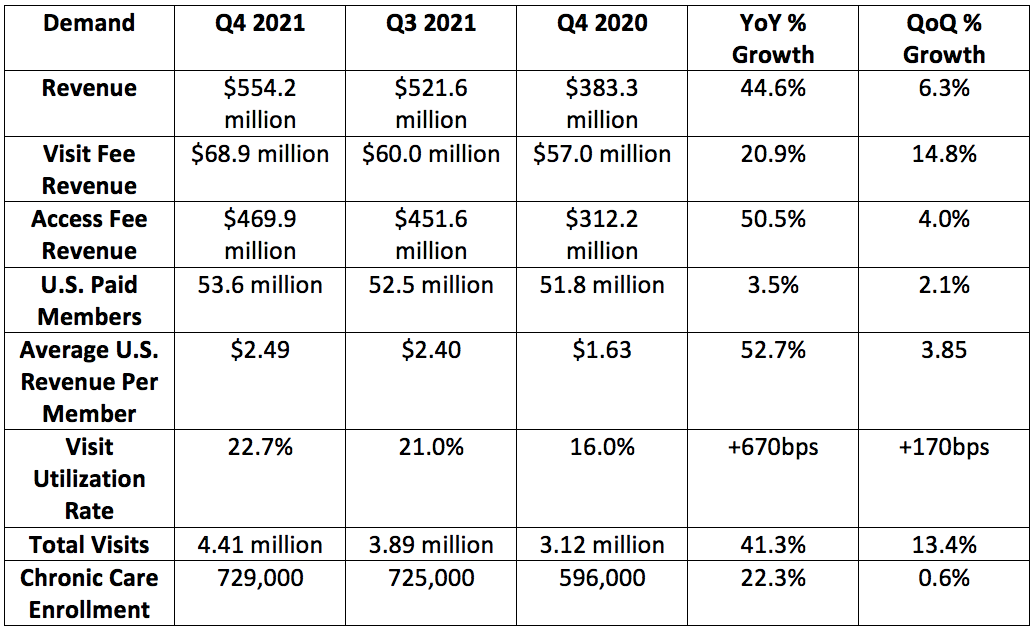

a. Demand

Teladoc guided to $541 million in revenue for the quarter and analysts were expecting $546.5 million. The company posted $554.2 million, beating its expectations by 2.4% and analyst estimates by 1.4%.

Teladoc posted 53.6 million U.S. paid members for Q4 2021 which was 1.1% ahead of its estimates. The company also facilitated 4.41 million total visits which was 10.3% ahead of its estimates. Total visits for the quarter would have been 4.2 million but the company received a 221,000 visit boost from an accounting change. Without this tailwind, the organization would have beaten its estimates by 2.4%.

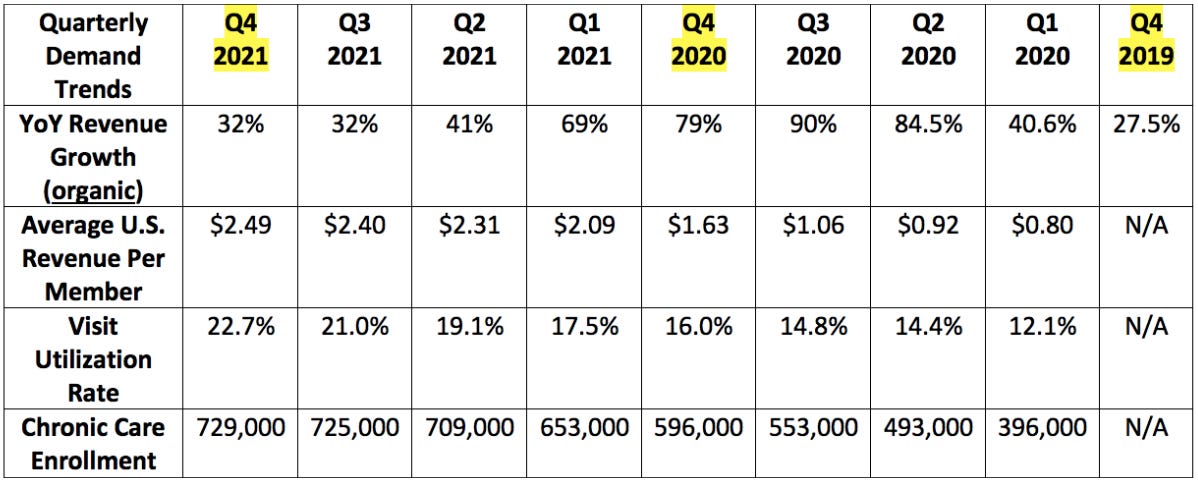

NOTE: The company moved a large chunk of BetterHelp revenue from its domestic bucket to the international bucket. This messed with visit utilization rate and also per member per month (PMPM). If you’re seeing previous utilization and PMPM metrics change from previous reports to this one, that is why. For PMPM specifically, the company changed the disclosure to Average U.S. Revenue Per Member during the period.

This revenue growth includes an inorganic contribution — Teladoc delivered 32% organic growth.

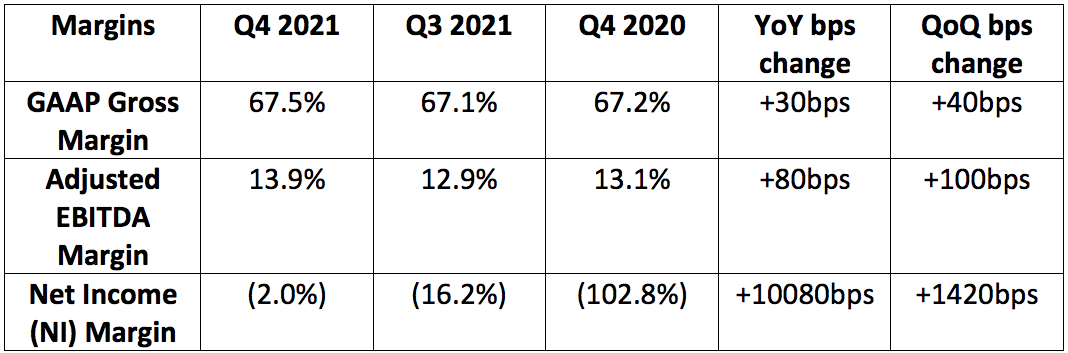

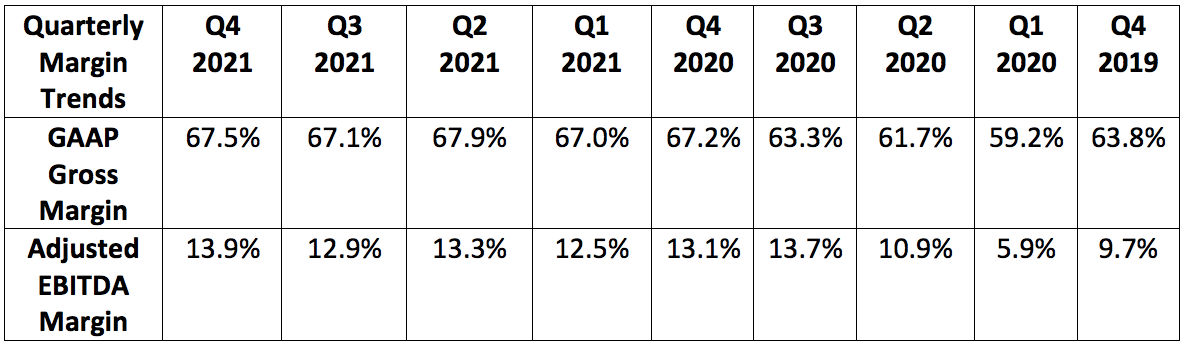

b. Profitability

Teladoc guided to $72.5 million in adjusted EBITDA for the quarter and analysts were expecting $72 million. The firm generated $77.1 million in adjusted EBITDA, beating its estimates and analyst projections by 6.3% and 7.1% respectively.

Teladoc guided to a loss per share of $0.63 for the quarter and analysts expected a loss per share of $0.54. Teladoc lost $0.07 per share, beating its estimates by $0.56 and analyst expectations by $0.47. Note that the loss of $0.07 per share includes a stock based compensation and amortization charge of $0.67 in total as well as a $0.31 per share income tax benefit. When excluding all of these temporary impacts, we are left with earnings per share of $0.10. Note that I only excluded half of the Q4 stock based compensation charge to represent a rough estimate of what was M&A related vs. what part will be more recurring in nature.

Take the YoY net income margin improvement with a large grain of salt as it was powered by far less stock based compensation and amortization expenses associated with the Livongo purchase.

c. Guidance (using midpoints)

For 2022:

Analysts were expecting $2.57 billion in 2022 sales. Teladoc guided to $2.60 billion, beating expectations by 1.2%.

Analysts were looking for $352 million in adjusted EBITDA for 2022. Teladoc guided to $342.5 million, missing expectations by 2.7%

This represents a 12.9%-13.4% margin and 90-140 bps expansion YoY on an apples to apples basis.

Analysts were looking for a loss per share of $1.62 for 2022. Teladoc guided to a loss of $1.50, beating expectations by $0.12.

Teladoc also expects 55 million U.S. Paid Members and 19.25 million total visits for all of 2022.

Q1 2022:

Analyst were expecting $589.0 million in Q1 2022 revenue. Teladoc guided to $568.5 million, missing expectations by 3.7%.

Analysts were expecting $77 million in Q1 2022 adjusted EBITDA and Teladoc guided to $53 million in EBITDA, missing expectations by 31.2%.

Analysts were expecting a loss per share of $0.43 and Teladoc guided to a loss of $0.55 missing expectations by $0.12.

The first quarter miss paired with the largely reiterated 2022 guide is a factor of 2 things:

One significant new client was set to launch with Primary360 in the beginning of the year but “due to their own data delays and errors” will now not launch until the back half of the year.

$4 million in incremental physician spend to incentivize visit participation and meet demand as Omicron led to a temporary January visit request spike. This will not be recurring.

d. Notes from CEO Jason Gorevic

“Large employers need a virtual care offering that can scale across insurers and geographies. We’re uniquely positioned to be that partner given our track record of global success… We remain confident in our long term outlook offered at the 2021 investor day… bookings continue to show strong sequential growth into 2022.”

On BetterHelp:

BetterHelp did over $700 million in 2021 revenue.

BetterHelp is pacing to onboard 14,400 therapists this year vs. 10,000 last year.

Despite some players in the virtual mental health space dealing with rising churn, BetterHelp is not. Its customer acquisition cost (CAC) has actually fallen with its customer lifetime value (LTV) rising in recent quarters.

Mental health visits more than doubled YoY in 2021.

“Having other virtual mental health vendors out there not performing at our level castes a negative shadow. To be honest, we simply outperform in this market. We are seeing all BetterHelp metrics make a tremendous amount of progress. Whether it be membership, churn or acquisition cost.”

On early Primary360 and Chronic Care (Complete) notes:

“It’s very early but so far we’re pleased with Primary360 engagement and enrollment.”

Gorevic highlighted a case study for a large insurer that is seeing Primary360 enrollment well exceeding expectations with 75% of its enrollees being new to the carrier. Teladoc beat out an existing telehealth competitor with a contract in place for this business.

The percentage of chronic care members enrolled in 2+ programs doubled YoY which fostered total chronic car enrollment growth over 30%.

On whole-person care:

To give evidence of Teladoc’s whole-person care approach working, 80% of its 2021 bookings were multi-product vs. 70% year to date as of last quarter. This implies virtually all Q4 bookings were multi-product.

As a reminder, the core products within the whole-person care suite include:

Primary360 for primary care

Chronic Care Complete for chronic care

BetterHelp + MyStrength Complete for mental care

e. Notes from CFO Mala Murthy

“The timing of our client on-boarding will be second half weighted partially due to the launch of large new health plans signed on over the last several months such as Florida Blue. We expect a $40-$50 million sequential step up between the 1st and 2nd quarter with a larger sequential revenue ramp throughout 2022. EBITDA will expand sequentially as well as it follows the revenue ramp. This ramp is not dependent on new sales but on signed contracts giving us good visibility .”

This means any new, large sales could provide some upside to the guidance.

“We are seeing all of the right trends to realize our chronic care growth target. I am very comfortable with the growth rates and expectations we have set.”

General notes:

Teladoc generated $194 million in 2021 cash flow from operations.

Teladoc has $896 million in cash on hand with $1.23 billion in total long term and convertible debt.

f. My Take

This quarter is nothing be be elated about and also nothing to be upset about. It was largely as expected just like most of the company’s reports have been in the past. Gross margin and EBITDA margin expansion encouragingly both continue as operating leverage takes hold. The company has overcome much of (not all of) its M&A related expenses and leadership remains confident in its long term targets set at Teladoc’s 2021 Investor Day. BetterHelp remains the company’s shining star.

The firm’s ambition to differentiate itself via transforming a sector of disparate point solutions into one company delivering virtual, whole-person care remains in the early innings; this will be the key enabler of Teladoc’s potential long term success. So far so good, but there is a long way to go. My position is over 90% full at this point which leaves me with little incremental room to accumulate more shares. For this reason, any of my future Teladoc adding will only coincide with (more) extreme multiple compression.

it was very useful. Thank you

Thanks for the detailed analysis.. one q on primary 360 product., will it have a designated provided for a member? Like a pcp in any American insurance policy. Any thoughts