Hey readers! Please share this article with your network if you feel inspired to do so. That is how we grow and keep the content 100% free.

1. Tesla (TSLA) — Earnings Review

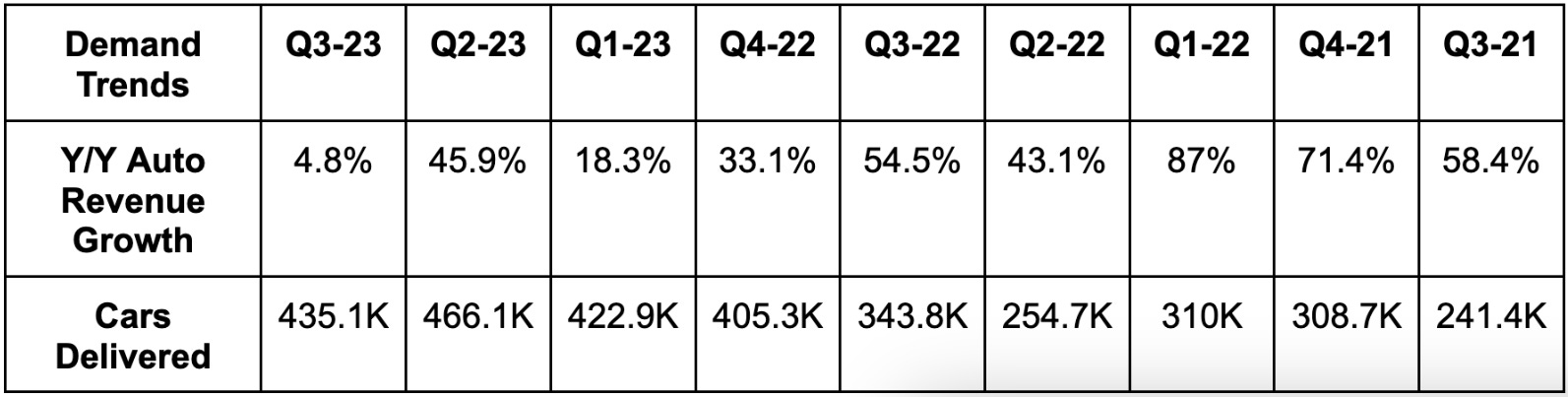

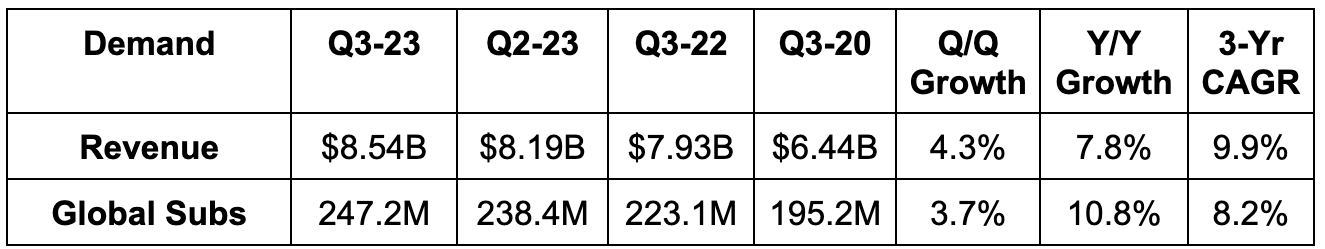

a. Demand

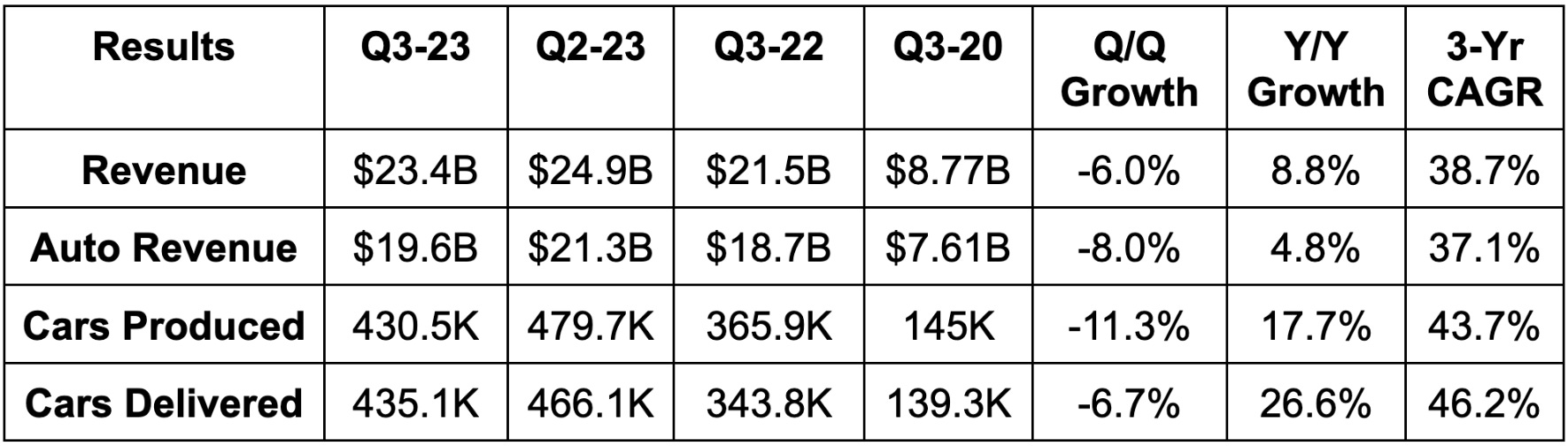

Tesla missed sell side revenue estimates by 3.3%. It does not guide to quarterly revenue.

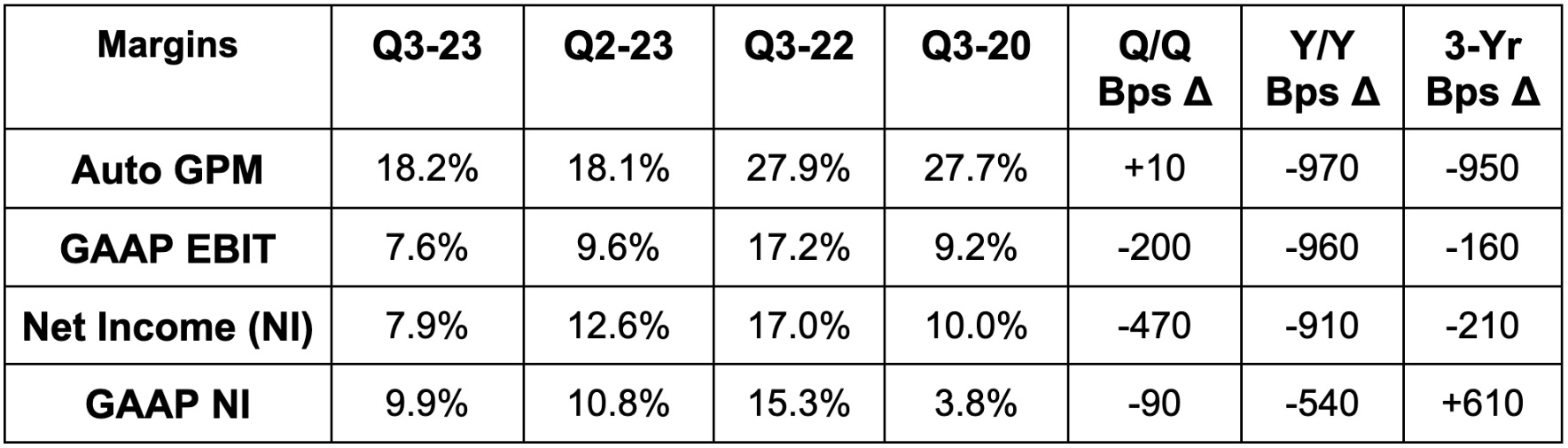

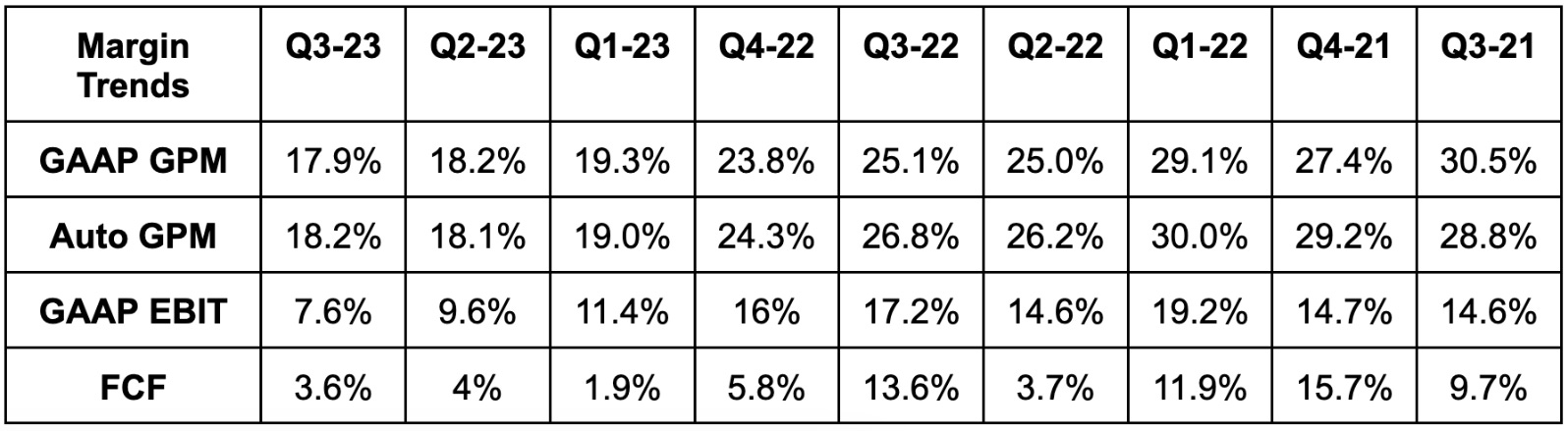

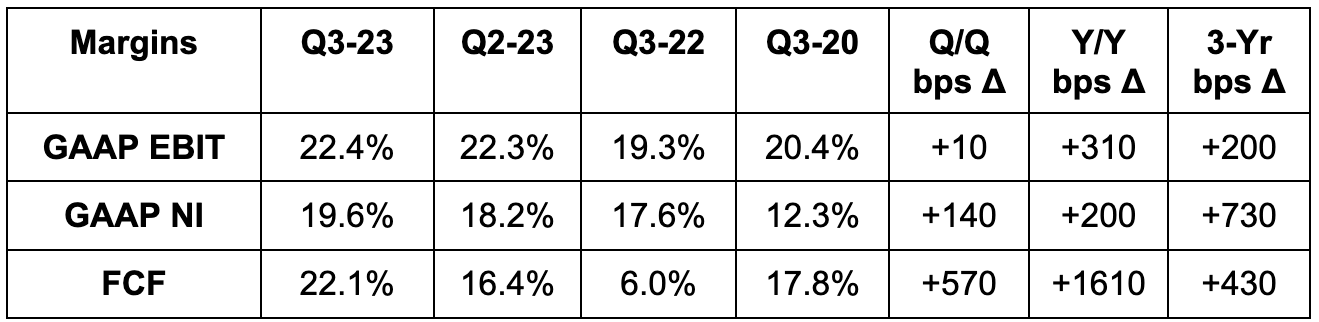

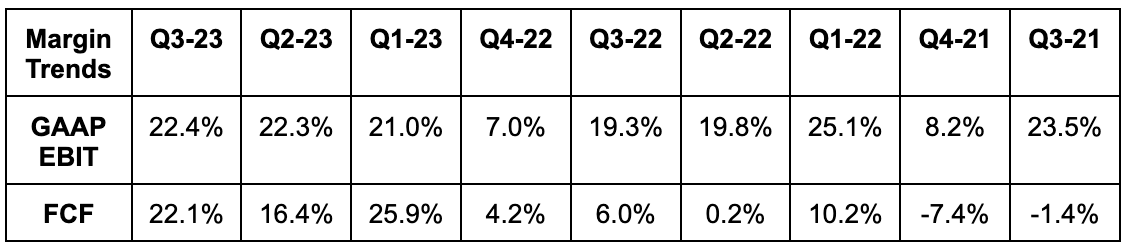

b. Margins

Missed EBIT estimates by 24.1%.

Missed $0.74 GAAP earnings per share (EPS) estimates by $0.21.

Met 18% GAAP gross profit margin (GPM) estimates & roughly met Auto GPM estimates ex-leases.

c. Balance Sheet

Inventory +33% Y/Y.

Shares up slightly Y/Y.

$26B in cash & equivalents.

$4.4B in debt ($2B is current).

d. Guidance

Tesla reiterated its general long term guidance and its 1.8 million car volume guide for 2023.

e. Call & Presentation Notes

Costs & Selling Price:

Tesla has removed nearly $2,000 in input costs per vehicle over the last year to reach $37,500 on average. This is despite planned maintenance and upgrades on numerous production lines across the globe. Cost initiatives across all factories paired with new locations ramping to full capacity are both helping. Tesla’s newer 4680 cell also lowered the firm’s scrap bill by 40% sequentially. This will be a more and more meaningful gross margin driver over time.

Average cost per vehicle fell due to a combination of continued price cuts as well as mix shift to lower cost vehicles. Tesla explains the cuts in two ways. First, it’s optimizing its margin advantage over the competition. Tesla’s margin profile is astronomically better than all other EV programs.

Most competition doesn’t even have a positive gross margin. It sees pricing competition today, thanks to its vertical integration, scale and overall input cost edges, as the correct approach to maximize market share gains. It thinks it can “harvest” the lost margin over time via software upsells. Secondly, this is a reactionary response to rising interest rates. Tesla is trying to maintain monthly payment affordability while rates soar. Bears would say the reasoning is more product and competition based. As an innocent bystander, I’m not quite sure who pessimists think the formidable Tesla competition is today. I don’t see any. Again… not a shareholder… just a realist.

More Margin Context:

Its non-auto businesses are becoming real profit contributors. Together, they added more than 10% to the firm’s overall gross profit. Energy storage is by far the largest factor here with a 24% gross margin.

Hefty Cybertruck costs without any revenue yet generated are also weighing on margins along with large AI investments. These buckets will eventually deliver revenue (not just more cost) to ease the margin headwinds.

Regulatory credit growth helped offset a small portion of margin pressure during the quarter.

AI & Full Self Driving (FSD):

Tesla doubled its AI training compute capacity (with Nvidia H100 chips) to help FSD and its Optimus Robot project both scale.

The FSD price cut is temporary. The price of this should grow with rising FSD value over time.

Solar & Energy Storage:

Solar megawatts (MW) deployed were 49 for the quarter vs. 66 Q/Q and 94 Y/Y. This is another area where higher cost of capital greatly hinders growth. The cutting of net metering in California is hurting a lot too. This cuts the value of excess energy credits that producers can then sell back to the grid… thus making solar energy less appealing.

Energy Storage megawatt hours (MWh) rose 90% Y/Y.

Supercharger stations rose 31% Y/Y to reach 5,595.

North America Factory News:

The Austin Factory began pilot production of Cybertruck and will make its first deliveries this year. Elon cautioned that this truck will take years to be a strong free cash flow contributor. He sees Tesla selling 250,000 of them annually, but not until 2025. Tesla is also gradually ramping Model Y production here as we speak. Tesla was asked about where growth will come from in the future. It reminded us that the Austin location is 2,000 acres and leaves ample room for expansion.

It will not go full speed ahead on the Mexico facility until the macro backdrop isn’t so poor. Elon cited “PTSD” associated with living through the Great Financial Crisis as part of the reasoning. It’s “laying the groundwork” to start construction next year, but has not committed to doing so. The plan is macro-dependent.

4680 cell production is “progressing as planned.”

Tesla is building more cathode and lithium refining capacity in the USA.

Final Notes:

The Model Y remains the best selling vehicle in Europe despite the higher price point. Elon sees a very clear path to it being the best selling car across the globe.

Tesla famously does not advertise. Elon explicitly said there could be “something to be gained from advertising” on the call. The philosophy could be changing.

f. My Take

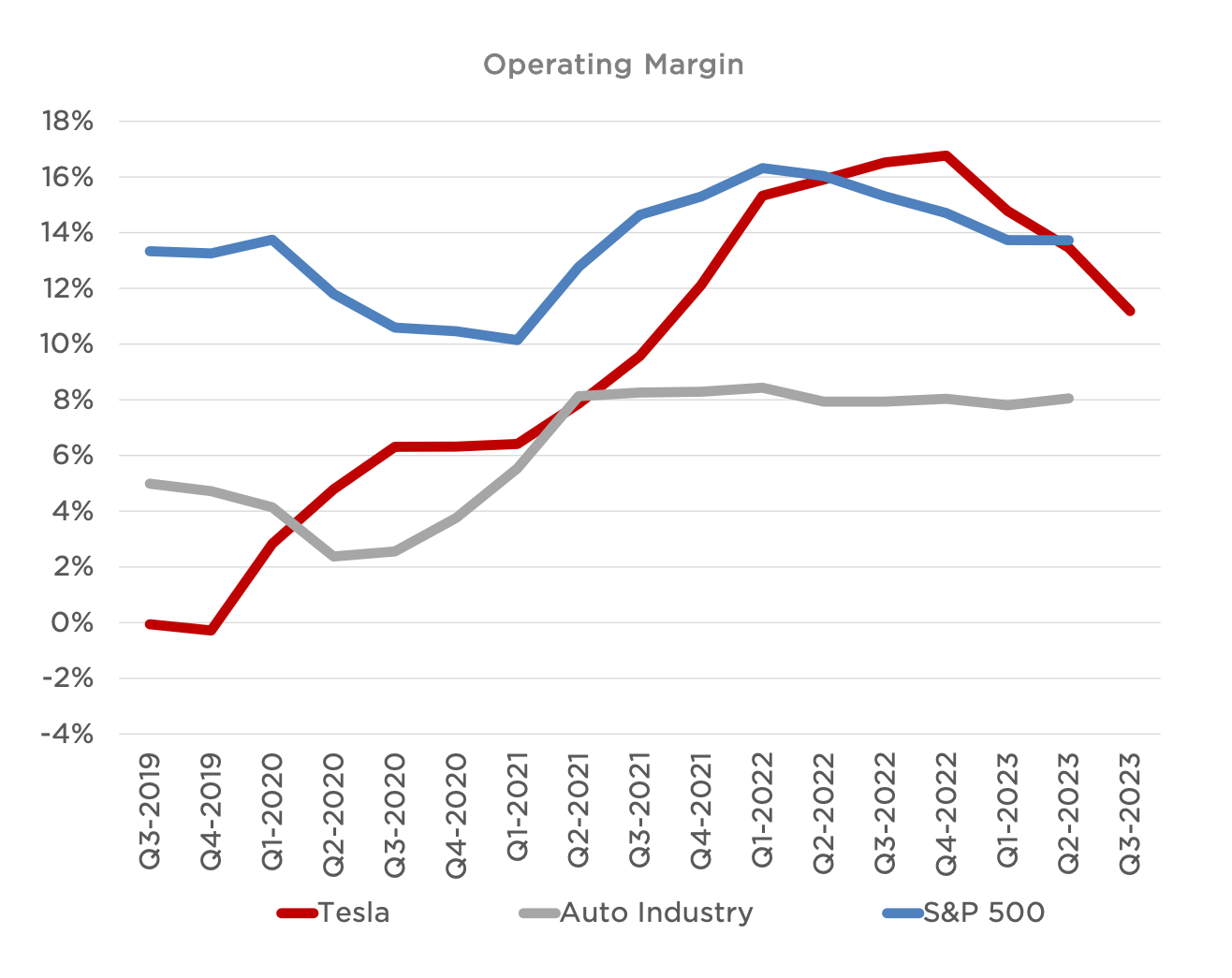

This was not Tesla’s best quarter. It wasn’t the second or third best either. Still, while it was underwhelming, it was supposed to be. Not good but good enough seems to be the 30,000 ft. takeaway. Soaring rates and hectic macro always inflict pain on the cyclical auto sector. Tesla is faring better than most but is certainly not immune.

2. Netflix (NFLX) – Earnings Review

a. Demand

Met revenue estimates & beat its revenue guidance by 0.5%.

Beat subscriber estimates by 41.0% & beat its subscriber guidance by 48.5%.

b. Margins

Beat EBIT estimates by 2.1% & beat EBIT guidance by 1.1%.

Beat $3.49 GAAP EPS estimates by $0.24.

Beat free cash flow estimates by 52%.

c. Balance Sheet

$8.5 billion in cash & equivalents.

$6.5 billion in net debt.

Share count slightly fell Y/Y.

Added $10 billion to its buyback program after buying back $2.5 billion this quarter. It now has about $11 billion in total remaining buyback capacity.

d. Guidance

Next quarter revenue guidance was slightly behind, but slightly ahead when adjusting for a small foreign exchange (FX) impact. The firm actually just debuted an FX hedging program using forward contracts to lock in exchange rates (thus removing some of its currency risk). It guided to subscriber adds being similar to this quarter, which is well ahead of consensus.

For the year, Netflix now sees $6.5 billion in FCF vs. $5 billion previously. $1 billion less in 2023 content spend helped a lot here. It also now sees its 2023 EBIT margin at 20% vs. 19% previously. Finally, it guided to a 22.5% 2024 EBIT margin. Leadership during investor conferences this past quarter was quite cautious about future pace of operating leverage. This guide shows that the caution may have been a bit unwarranted.

e. Call & Letter Highlights

Market Share:

Netflix lost a little streaming market share Q/Q in the USA. It owns 7.8% of that pie vs. 8.2% last quarter. Streaming’s share of overall screen time also fell Q/Q from 37.7% to 37.5%. The long term trends for Netflix’s share and streaming’s share overall both remain positive. Netflix’s own market share has risen from 6% to 7.8% since May 2021.

Advertising:

Netflix enjoyed 70% Q/Q growth in its ad-based subscribers. What’s more impressive to me is that 30% of its new signups are opting into ads in the countries where they’re offered.

As expected, ads are still not a material contributor to revenue.

Netflix added simultaneous streams, higher video quality and more ad-supported content last quarter as it continued to perfect the offering. Downloads will debut this quarter.

T-Mobile and Nespresso will be among the presenting sponsors for its first live sporting event title called Netflix Cup

Netflix introduced between episodes ad placements following consistent requests from buyers.

It’s working hard with Microsoft to add better targeting and to open its content bidding to more demand.

Content Windowing:

The content exclusivity that streamers thought was so valuable doesn’t seem to be important. Suits aired on Netflix after being on multiple other services for years. Still, the title broke viewership records for Netflix. Audience overlap is smaller than one may think. This is why competition like Disney, which had previously ended streaming licensing agreements to support Disney+, is now re-embracing these types of deals.

Omni-Channel:

Let’s stick with Disney for a moment. That company’s strength is activating relevant IP in omni-channel settings (parks/games/etc.) to extract more loyalty and lifetime value from fans. Netflix is now looking to emulate that playbook. It will launch “Netflix House” in the coming years with “physical flagship destinations to offer live experiences for fans.”

Paid Sharing:

Paid sharing has been rolled out in all regions. Not all subscribers in those regions have already been impacted as Netflix sticks with a slow, tiered roll-out. This is to avoid too much consumer shock. As a result, the revenue boost from this policy will continue to bolster demand for several more quarters.

The cancel reaction to this move (limiting accounts/devices per subscriber) has been better than expected with new accounts boasting high retention rates. Netflix is revenue positive in every nation where this change took hold.

Member Growth vs. Average Revenue per Member (ARM) Growth:

Netflix leadership sees ARM growth and member growth becoming more balanced in 2024 and beyond. Mix shift to lower ARM countries should slow. This will happen while advertising more meaningfully boosts subscriber value over time. Taken together, ARM growth will re-accelerate in 2024.

Price Hikes:

Netflix paused price hikes while it rolled out paid sharing. Those hikes have now resumed in the USA, UK and France. It’s hiking just the basic and premium plans. Why is it hiking the basic plan while also actively phasing it out? To push more subscribers to ad-supported plans where it enjoys higher ARM.

Content Spend:

Netflix content spend will grow from $13 billion in 2023 to $17 billion in 2024 as strikes end and talent gets back to work. New demands from actors as part of ongoing strikes could delay some of these plans. Content spend will continue growing after 2024.

f. My Take

This was a solid quarter. The margin expansion is better than I thought it would be after hearing its CFO’s comments at the recent investor conference. I also love the idea of tapping into brick and mortar settings to juice the value of its beloved brands.

Paid sharing continues to prop up its growth, but that won’t stop any time soon as that policy roll-out will remain staged. Lower content spend continues to prop up FCF as well. Candidly, these aren’t the best drivers of demand and profitability. Still, they’re drivers none the less. The market share losses are not concerning to me (not a shareholder) as long as they revert like they should.

A mere pothole in the Road to Fortunes.

Thanks Brad, outstanding report as usual my friend.

"True Love Never Runs Smooth"

Gene Pitney

Kiwi