Today’s Piece is Powered by our Friends at Long Term Mindset:

We strongly encourage you to share this article far and wide if you find it valuable and feel inspired to do so. That’s how we grow.

1. Tesla Q2 2023 Earnings Review

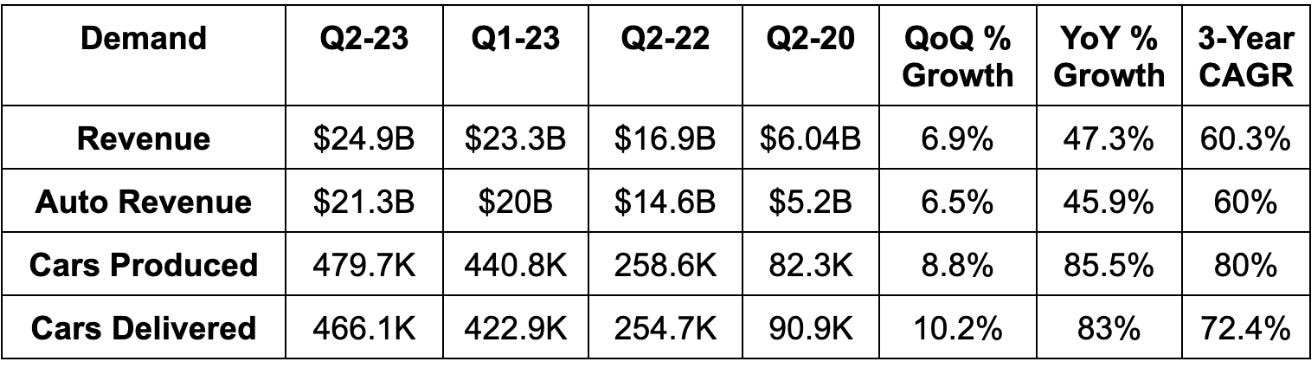

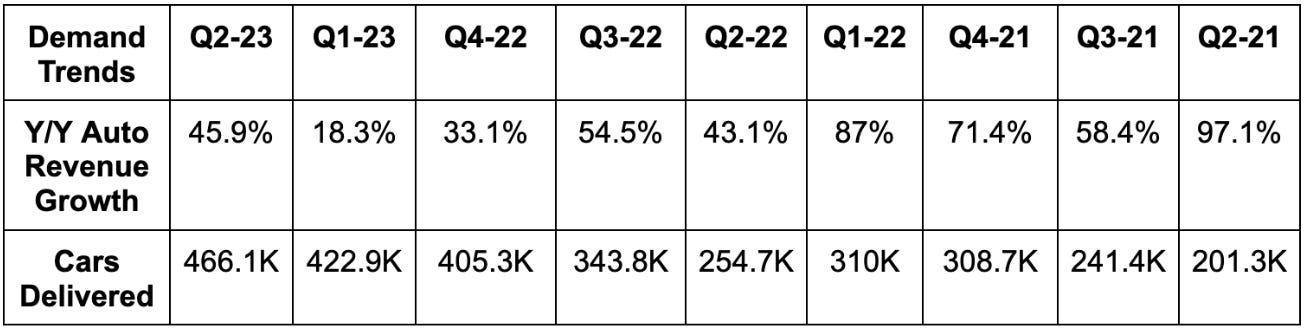

a. Demand

Tesla reports its production and delivery numbers right after the end of the calendar quarter. These results were ahead of consensus by a few percent. In terms of revenue, Tesla beat consensus sell side estimates by 0.8%.

Demand Context:

Deliveries represented 97% of cars produced this quarter vs. 96% last quarter and 92% 2 quarters ago.

60.3% 3-year revenue CAGR compares to 57.2% Q/Q and 48.6% 2 quarters ago.

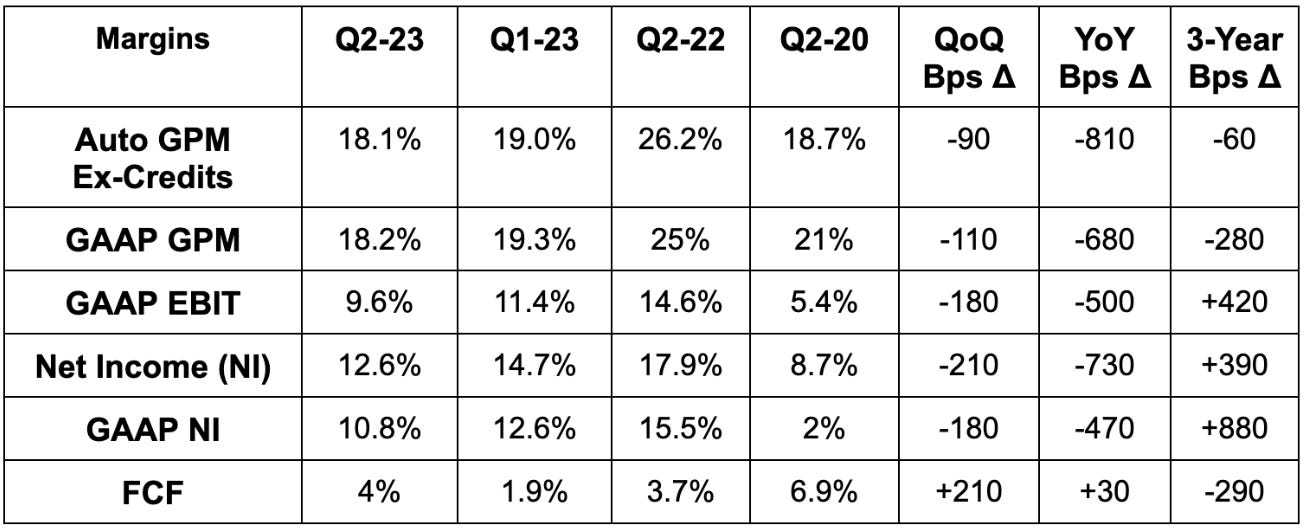

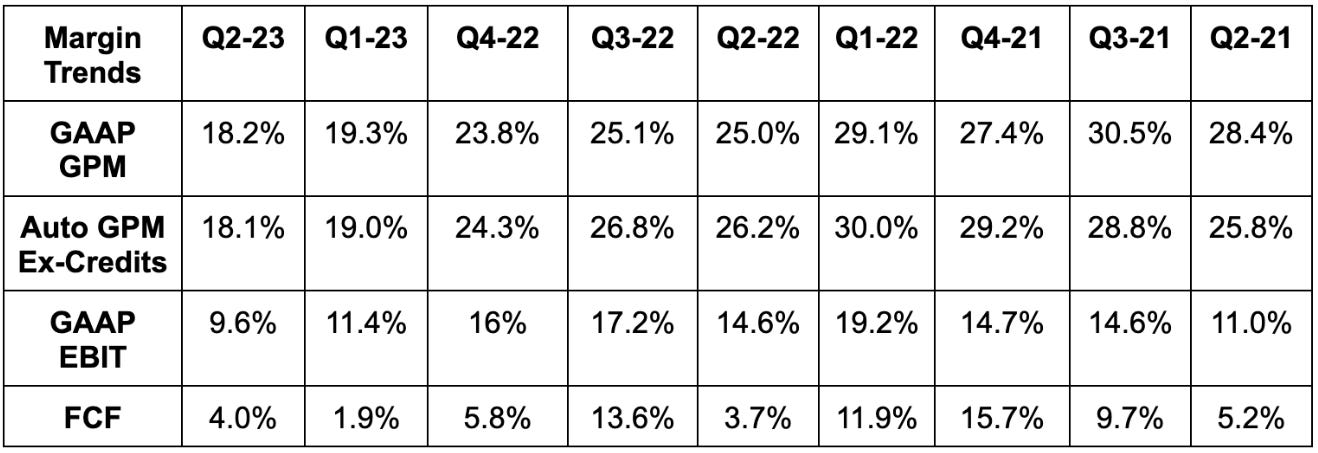

b. Margins

Missed GAAP EBIT estimates by 13%.

Beat $0.68 GAAP EPS estimates by $0.10.

Missed 18.9% GAAP gross margin (GPM) estimates by 70 basis points (bps).

Missed 18.2% auto GPM estimates ex-credits by 10 bps. Some data sources had 18% consensus estimates so we can call this wildly important metric for Tesla roughly in line with expectations.

Sharply missed $2.8 billion free cash flow (FCF) estimates by $1.8 billion. Capital Expenditures (CapEx) rose by 19% Y/Y.

Margin Context:

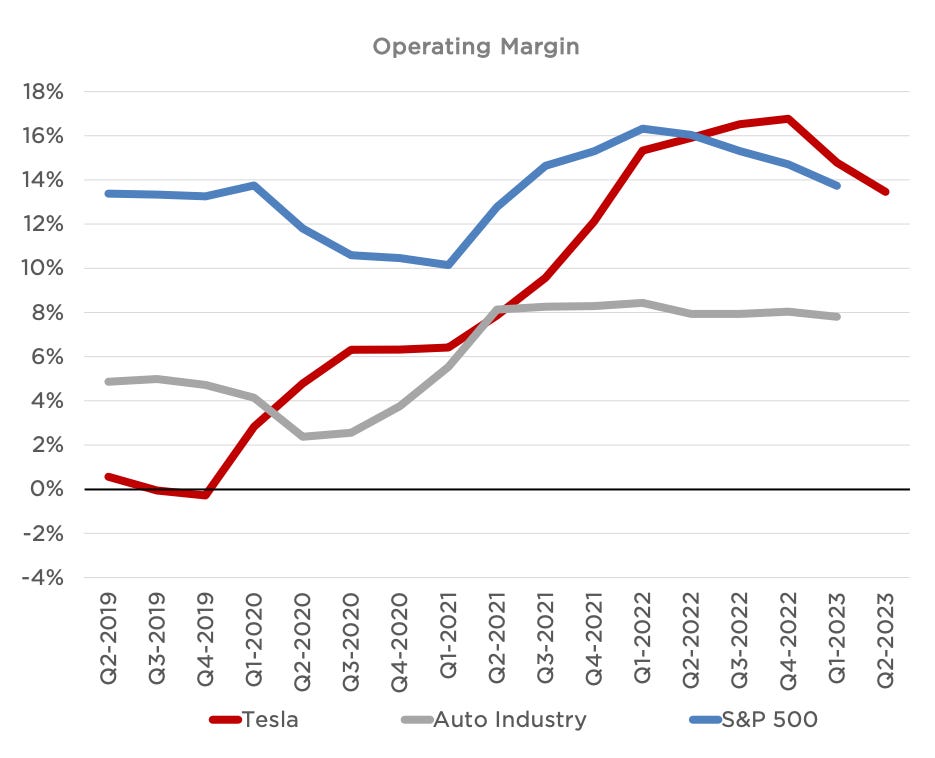

Tesla’s strategy has recently shifted to rationally maximizing production and deliveries. It wants to take advantage of its input cost leads (depicted in the graph below) over competitors to grow share as rapidly as possible. For context, most legacy automakers have EV programs running at negative gross margins (the image shows overall margins). This is the time for Tesla to distance itself from the competition and this is how it’s trying to do so. It’s willing to make sales at lower gross margins because of this and thinks it can “harvest more margin” over time with technology up-sells. The falling GPM was fully expected and makes it tougher to compete with for legacy brands. That’s the present philosophy.

For the quarter, EBIT margin headwinds included:

Reduced selling price via mix shift and price cuts.

Its 4680 battery cell production still ramping (which will eventually be a margin tailwind).

More CyberTruck OpEx.

Austin and Berlin factories still ramping production capacity.

Some disinflation for raw materials helped offset some of this contraction. It enjoyed raw material disinflation in virtually every key area including lithium, steel and aluminum.

“Even with price reductions in Q1 and Q2, EBIT remained healthy reflecting cost reduction efforts, the Berlin and Texas ramps and strong performance of our Energy, Services and other businesses.” -- Shareholder Deck

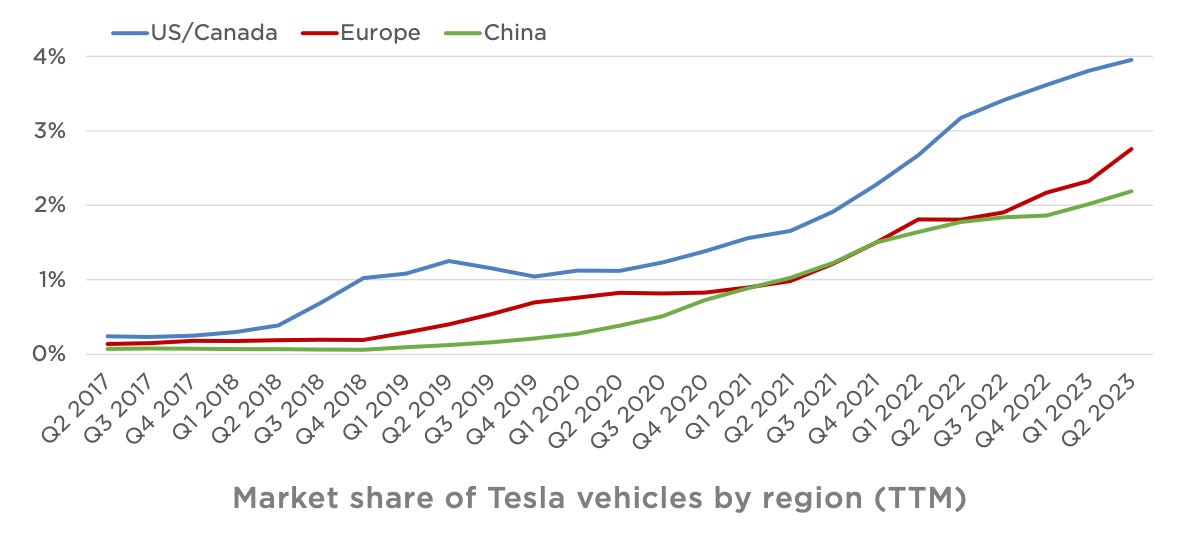

With its first goal today being marketshare growth, this graph below offers evidence of its aim working:

c. Guidance

Tesla reiterated its general long term guidance. It expects a long term 50% volume CAGR which is incredible at this scale. It also has the cash on hand needed to fund investments while it re-committed to Cyber Truck deliveries in 2023. Finally, it expects software-powered margin expansion to kick in over time.

Elon told investors he thought “Full Self Driving (FSD) would be as good as a human driver” but the end of the year. He said he could be wrong and that regulatory clearance will take time too.

The team did not update its annual auto gross margin ex-credits floor this quarter. That implies it should be just below 20% as CFO Zach Kirkhorn told us last report that the floor slightly fell from 20% with price cuts.

Finally, Tesla continues to target 1.8 million 2023 deliveries. Q3 production will be down Q/Q a bit due to factory upgrades and will normalize thereafter.

d. Balance Sheet

Inventory levels are roughly flat Q/Q and rose 77% Y/Y.

$23 billion in cash & equivalents.

$2.3 billion in total debt with about 70% of it being current (due in next 12 months).

Share count rose very modestly at well under 1% Y/Y.

e. Shareholder Deck & Call Notes

Dojo:

Tesla development of the Dojo super computer is now underway. This is not another language learning model, but takes more of a video training approach to help Tesla pursue FSD. Dojo should “satisfy immense neural net training needs” to vertically integrate a large chunk of that technology for Tesla. The vertical integration simply cannot be matched by legacy auto makers and could form another edge. Importantly, it will use Dojo AND Nvidia for graphics processing unit (GPU) needs. To train AI algorithms and create utility-building use cases, companies need access to giant supplies of relevant data. Tesla leads peers here with its 300 million FSD test miles now driven.

Auto Business Context:

5,265 supercharger stations vs. 4,947 Q/Q and 3,971 Y/Y.

Still working on smoothening out deliveries throughout a given quarter to make in-period cash collection less lumpy.

The Berlin factory produced its first Model Y vehicles this quarter.

California, Nevada and Texas:

Currently installing Cyber Truck equipment in the Austin factory for expected 2023 deliveries. Truck deliveries to sharply ramp in 2024.

It continues to ramp production of its new lithium refinery in Texas.

Model Y is the best selling car in Europe year to date and was the best selling car globally in Q1 despite its higher price point vs. other top sellers.

Non-Auto Segments:

66 solar megawatts (MW) deployed vs. 67 Q/Q and 106 Y/Y.

High cost of capital continues to hold back solar deployments across the sector.

3,653 megawatt hours (MWh) storage deployed vs. 3,889 Q/Q and 1,133 Y/Y. It’s ramping production of its first mega-pack factory in California as we speak which will come with a 40 gigawatt hour capacity.

The storage segment saw meaningful margin expansion.

Licensing its Tech:

Elon pushed back against an analyst question about licensing Tesla's charging tech to competition. It’s not licensing the supercharger network, it’s merely opening it up for integration. Tesla views this as accelerating EV adoption and a large positive for its business. Very interestingly, Elon did say they’d explore licensing FSD software to competition. Tesla in early talks with a large OEM on this right now.

4680 Cell Battery Update:

4680 cell battery production rose 80% Q/Q while Tesla reduced its scrap bill by 40% Q/Q as manufacturing scales and processes mature. This resulted in input costs falling 25% Q/Q. For now, this is a large margin headwind. At scale, it will be a large margin tailwind due to lower costs and higher efficiency associated with the battery update.

Elon’s Charisma:

Elon has a magnetic personality. He’s smart, he’s witty and he’s often hilarious. He also never lacks confidence. When he says things like “we have a clear path to 5x or 10x market cap” or tells people to buy the dip when Tesla stock falls, investors should be keenly aware of this reality. He’s a historically successful businessman and someone who many rightfully look up to. But he’s a showman and is often wrong in his predictions -- as he’ll readily tell you.

f. Take

The quarter was as expected. Tesla is purely focused on taking share and growing production. Its large cost advantage over other EV programs is emboldening it to operate at lower up-front margins which makes it even tougher to compete with. As innocent bystanders, we think this is the right approach given ample software up-selling potential and its still comparatively healthy margins. It, however, could lead to more margin noise throughout 2023.

Long-Term Mindset is a FREE weekly newsletter emailed each Wednesday. Each issue contains five pieces of timeless content to encourage you to think long-term. All issues can be read in less than 1 minute. There’s a reason why we are consistent readers and think you should be too. Subscribe here.

2. Netflix Q2 2023 Earnings Review

a. Demand

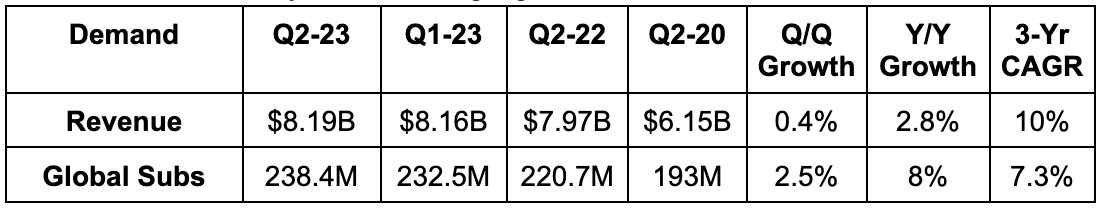

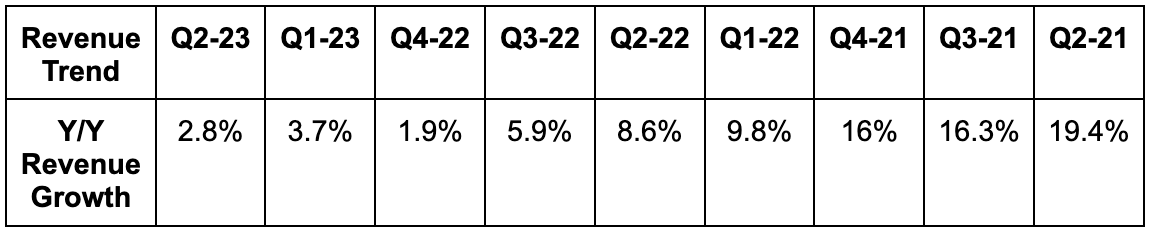

Netflix missed $8.3 billion revenue estimates by 1.3% but roughly met its own revenue guidance. Last quarter, Netflix also told us that net subscriber adds for Q2 would be similar sequentially. It handsomely beat this implied 1.75 million subscriber guidance by about 4.1 million.

Demand Context:

Its 3-year revenue CAGR of 10% compares to 12.3% Q/Q and 12.8% 2 quarters ago.

A new tool allowing accounts to add an additional profile helped boost subscriber adds and will next quarter too.

FX neutral growth was 6% Y/Y.

Average revenue per member (ARM) fell 3% Y/Y (-1% FX neutral) due mainly to mix shift to lower ARM countries.

Retention is improving for its newest subscriber cohorts.

Netflix has had the top show and movie in streaming for most of the year -- per Nielsen

b. Profitability

Beat GAAP EBIT estimate by 15.1% and beat its guidance by 14.4%. EBIT dollars were also ahead of estimates by a slightly lower amount due to the small revenue miss.

Beat $2.86 GAAP EPS estimate by $0.42.

Crushed FCF estimates by 117%.

Margin Context:

EBIT and FCF outperformed largely due to cost controls, less hiring and pushing out content spend.

c. Guidance

Next quarter guidance:

2% light on revenue.

The 19% EBIT margin guide was well ahead of 16% estimates.

It also sees next quarter net subscriber adds equal to the robust number it posted this quarter.

For the full year:

Netflix reiterated ramping revenue growth and a 19% EBIT margin. The EBIT margin guide met estimates.

Paid sharing will be the source of revenue acceleration with ads not yet a big contributor.

Netflix also now sees $5 billion in 2023 FCF vs. $3.5 billion previously.

d. Balance Sheet

Netflix has $14.5 billion in debt with $8.6 billion in cash & equivalents. Its cash pile is “running above targets” so it will accelerate buybacks throughout the rest of 2023. This quarter, it bought back $645 million in stock vs. $400 million Q/Q while basic share count modestly fell Y/Y.

e. Letter and Call Highlights:

Paid Sharing:

Netflix launched paid sharing in over 100 countries last quarter. Following the change, revenue is higher in every impacted country and sign-ups quickly re-surpassed cancellations. It will roll the change out to all other markets this quarter.

Paid sharing is by far the most material source of expected revenue acceleration in the back half of the year.

Ads:

Ads plan members doubled Q/Q off of a small base. This is not yet a material revenue contributor.

The ad market is soft but Netflix’s supply remains scarce and has been able to find lucrative demand at high cost per 1,000 impressions (CPMs).

ARM for the ad-tier continues to be higher than the basic plan.

Dropping Ad-Free Basic Plan:

Netflix removed its cheapest (basic) ad free tier in Canada with plans to do so in the USA and U.K. this quarter. The response in Canada was as expected. There was very little churn and more people signing up for the ad-tier and more expensive standard plan. This should materially boost ARM over time.

Debuted a new filter to target only top 10 shows.

Announced a new partnership with Nielsen to improve measurement for advertisers.

Competition:

On the Writer Strikes:

Netflix leadership was asked multiple times when it would run out of content to release if the strikes didn’t end. It refrained from answering.

f. Take

The quarter was largely as expected. Not incredible and not bad. Commentary on Q4 should get investors excited about where growth can return to, but the absence of writer strike commentary is somewhat concerning. Great FCF raise due to less content spend (not core operational efficiency) and a great start to paid sharing and ads were notable positives. The Q3 guide of subscriber adds = to a great Q2 number was too. All in all, positive showing despite the light Q3 revenue guide.

TSLA - "Its large cost advantage over other EV programs is emboldening it to operate at lower up-front margins which makes it even tougher to compete with". Interesting take. Other observers have flagged the tightening margins as a negative, but I think you make a good point.