Tesla needs no introduction.

a. Demand

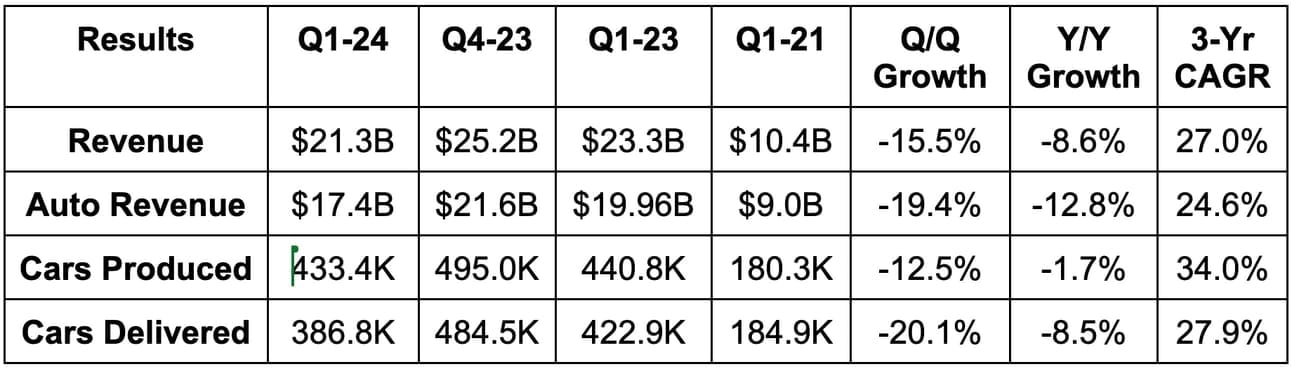

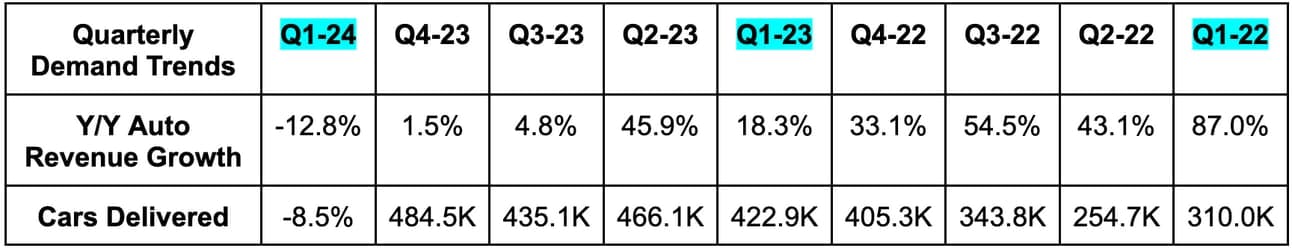

Tesla missed revenue estimates by 4.3%. Its 27.0% 3-yr revenue compounded annual growth rate (CAGR) compares to 33.0% as of last quarter & 38.7% 2 quarters ago.

- Notable revenue headwinds — price cuts; vehicle mix-shift to lower-priced models; production disruptions described later; macro; seasonality.

- Notable revenue tailwinds — Non-auto business; auto-park feature leading to better full self driving (FSD) monetization.

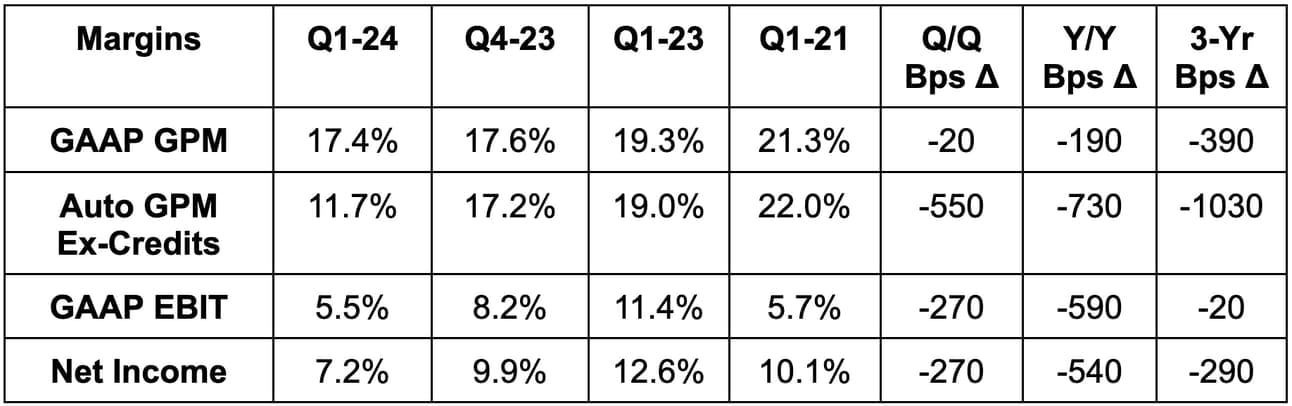

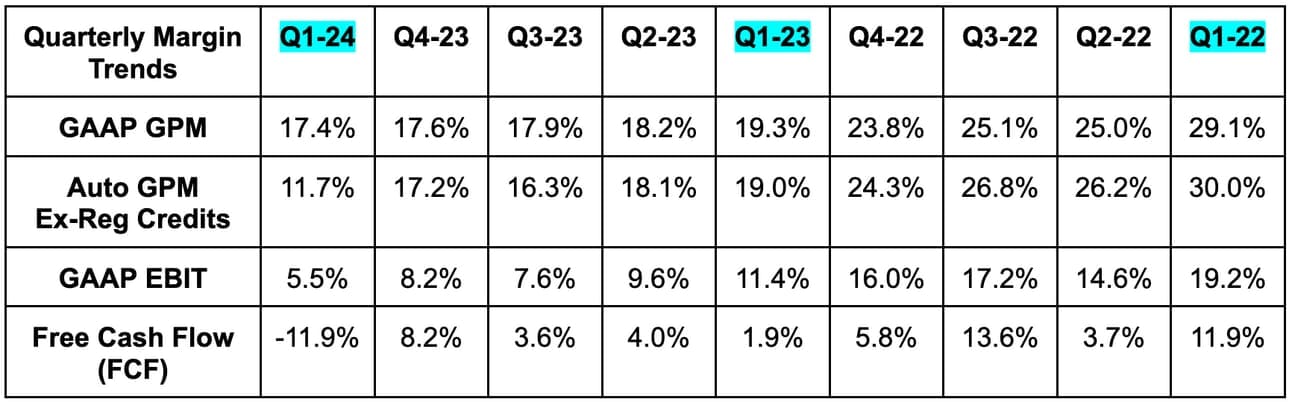

b. Profitability & Margins

Tesla missed GAAP EBIT estimates by 24.0% and $0.42 GAAP EPS estimates by $0.08. Its gross profit margin (GPM) was better than expected thanks to non-auto, while its auto gross margin ex-credits was worse than 15.2% expectations. It burned through more than $2 billion in free cash flow (FCF) vs. expectations of generating a little over $1 billion in FCF for the quarter. More on this later. Notably, Tesla recently laid off 10% of its employees, which should save $1 billion annually in operating expenses (OpEx).

- Notable profit headwinds — all demand headwinds already discussed; Cybertruck.

- Notable profit tailwinds — lower scrap bill from the 4680 battery plant as that scales; raw materials; freight.

There are a few different ways that I’ve seen people calculate auto GPM ex-credits. This, in my mind, is by far the most intuitive way to do it and is the formula that I use:

Auto GPM ex-credits = (auto revenue - credits - auto input costs) / ( auto revenue - credits)

c. Balance Sheet

- $26.9B in cash & equivalents.

- $5.4B in debt.

- Diluted shares rose 0.5% Y/Y. Not bad… but the large comp package for Musk that will soon be voted on would lead to some significant diluted share growth.

d. Guidance & Valuation

Tesla reiterated its vague guidance of slowing volume growth in 2024 and having all of the cash that it needs on hand. Interestingly, Musk told us on the call that auto revenue growth would be better than 0% in 2024. I get that it’s hard to celebrate positive revenue growth for a company that had been compounding at 50%, but this is still important. Sell-side revenue estimates for 2024 have continued to plummet and now sit at 7.2% Y/Y. Combining positive auto growth with energy storage growth (expected to be faster than auto) could put a near term floor in for revenue estimates this year. That matters… a lot.

Tesla trades for 48x 2024 EBIT and 103x 2024 FCF. EBIT is expected to grow by 2% Y/Y with FCF expected to be flat Y/Y. The profit results this quarter will lead to downward estimate revisions (outside of revenue).