The American Cannabis Regulatory Environment

A detailed look into the implications of cannabis politics.

Introduction:

American cannabis is a movement. Legalization momentum for the product is growing with each passing election season, and there is no sign of that slowing down.

To put into perspective how overwhelming the interest in marijuana already is, the state of Illinois now collects 50% more tax revenue from cannabis than from alcohol. The demand has always been strong, it’s just now shifting from illicit market activity to the regulated, legal world.

With a 20% compound annual growth rate (CAGR) expected for the next decade and a current total addressable market (TAM) of roughly $20 billion, this legal opportunity is now coming to fruition before our eyes. Already there exist several American multi-state operators (MSOs) boasting rapid growth and strong unit economics, but the regulatory fog continues to keep tight handcuffs on these fundamentally thriving firms.

Here, we will explore the cannabis regulatory path. I’ll cover the key pieces of possible future legislation, and what the passing of each would mean for American cannabis investors.

Let’s begin.

1. Most Likely Regulation

More states legalizing

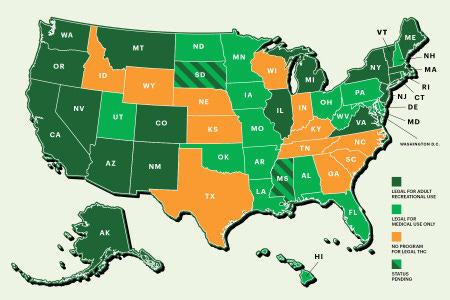

Today, 36 states offer medical-use cannabis and 17 support adult-use. When I was born in 1997, just over 25% of Americans supported legalization and now, that number sits at an overwhelming 68% according to Gallup.

With deeply-conservative states such as South Dakota and Mississippi passing cannabis reform, it’s safe to say a bipartisan legalization train has long left the station. Even the Governor of Texas — the most high-profile state hold-out — is now voicing his support for cannabis use by veterans to help with PTSD. America wants legal cannabis.

Beyond public approval, the COVID-19 pandemic up-ended state budgets and legalizing cannabis is the least disruptive way to create new tax revenue streams. Raising existing income taxes will only create more economic headwinds as we exit this daunting crisis. A state legalizing cannabis would continue to move consumption from the black market to legal channels and boost tax revenues without sacrificing economic prosperity.

To give states even more reason to pass reform, the presence of cannabis dispensaries contributes to a 21% decline in opioid related deaths according to the British Medical Journal. In my view, more states legalizing cannabis is not just possible, it’s inevitable.

2. Somewhat Likely Regulation

a) The Secure and Fair Enforcement Banking Act of 2021 (SAFE Banking Act)

States can legalize marijuana, but that doesn’t change the issue of federal prohibition creating added business costs and complications for operators. The SAFE Banking Act is a piece of legislation designed to offer creditors protection against the current federal ban on cannabis. With it, banks and credit unions would gain immunity from the punishments associated with supplying capital to a company selling cannabis.

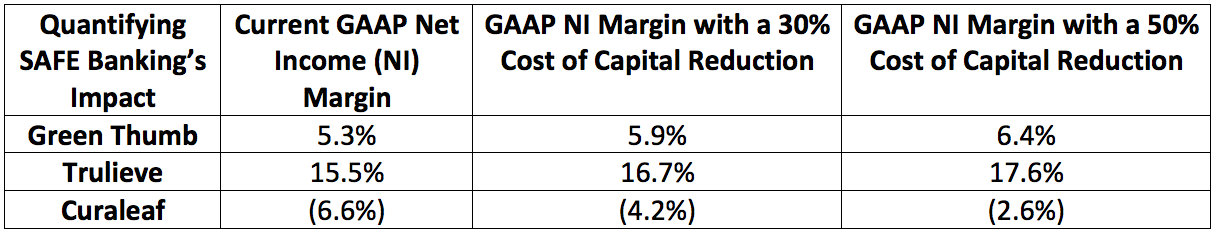

Safe and secure banking legislation should be something all MSO investors are rooting for. It would greatly reduce the lofty cost of capital that growers currently pay. It would also allow these companies to gain more complete business insurance coverage offsetting some of the unique risks associated with American cannabis involvement. Green Thumb — a company with one of the strongest balance sheets in the space — rightfully celebrated paying 7% on their most recent debt issuance. This is still quite elevated and has ample room to come down.

Lower cost of capital would allow MSOs to more aggressively pursue growth while boosting underlying profitability as well: An immediate win-win.

This is one of the more likely pieces of legislation to be passed. In 2018 and 2019, the act was struck down by a republican-controlled Congress. It has since been re-introduced this year with broad, bipartisan support and passed the House of Representatives easily. It’s still waiting for a Senate vote and while getting to 60 votes is far from a guarantee, we will see what happens.

Senate Majority Leader Chuck Schumer is also of the opinion that the SAFE Banking Act doesn’t quite go far enough. He advocates for including things like sentencing and social equity reform which offers a new layer of doubt for compromise being made.

Even if it doesn’t pass this time around, we are slowly progressing as the two parties have every incentive to continue working on getting something done. Not only are the public and state budgets calling for reform, but one of the most conservative Supreme Court Justices — Justice Clarence Thomas — is now suggesting comprehensive federal reform. He refers to the current laws as “contradictory” and “unstable.”

Motivation to create a layer of protection from the federal government for the cannabis industry is not new. In 2013, the Obama Administration sent out what’s known as the “Cole Memorandum” to discourage the enforcement of federal cannabis law for people in compliance with state law.

In 2018 AG Jeff Sessions effectively threw out this memo and threatened to crack down on cannabis enforcement. This turned out to be all bark and no bite. It did, however, more recently prompt lawmakers to introduce legislation like the States Act and the Sensible Enforcement of Cannabis Act to re-incorporate similar protections. SAFE Banking is a compromise born from both of these acts.

b) Uplisting

It’s widely expected that the SAFE Banking Act is the final hurdle obstructing MSOs from uplisting to major U.S. stock exchanges. Enacting this would mean MSOs can move to the New York Stock Exchange (NYSE) from The Canadian Securities Exchange (CSE) and U.S. OTC markets where they currently reside. It seems many MSOs are expecting this to be a when, not if as Trulieve, Ayr Wellness and many more have already converted to GAAP accounting to comply with American exchange regulations.

Uplisting would help lower cost of capital just like with safe and secure banking, but it also helps in another way.

Uplisting would open the door for institutional dollars to finally flood into MSOs. Today, things such as regulation, illiquidity fostered by not being listed on a major exchange and not being able to obtain appropriate insurance all prevent many institutions from investing here — regardless of the momentum.

With institutional demand making up such a large portion of overall stock market volume, unlocking this buying power would be a very powerful multiple expansion event for MSOs. For evidence, look no further than the discrepancy in performance and valuation between an MSO like Green Thumb and a Canadian LP like Canopy Growth in their most recent quarters.

Green Thumb:

Revenues rose 89.5% year over year to $194.4 million

57% gross profit margin

34.2% EBITDA margin

5.3% net income margin

$6.5 billion enterprise value

Canopy Growth:

Revenues rose 37.5% year over year to $148.4 million

7% gross profit margin

(63.5%) EBITDA margin

(416%) net income margin

$6.8 billion enterprise value

Green Thumb enjoys far faster growth, better margins, a larger market opportunity and yet a smaller enterprise value. What gives? This is likely the effect of Canadian cannabis growers being able to list on major exchanges in the United States to garner that coveted institutional demand.

Translation? Whenever uplisting does come these MSOs like Green Thumb should finally trade more in line with their true intrinsic value. Today, the companies are thriving in every sense of the imagination offering me confidence that when this day comes, institutions will be ready to pounce.

Just like with the SAFE Banking act, uplisting is an objectively positive event for American cannabis investors.

c) 280E Reform

280E is a tax provision preventing companies that sell federally illegal goods from deducting ordinary business expenses from their tax bills. The result of this is an effective tax rate nearly doubled for any company selling cannabis in the U.S.

280E being thrown out would vastly boost free cash flow (FCF) and net income (NI) margins for all MSOs overnight. With it, companies would be able to get far more aggressive in pursuing growth just like with SAFE Banking. This would be a big positive.

The Biden Administration doesn’t seem eager to get this antiquated piece of law fixed. In February, his Department of Justice released a comprehensive report empowering the IRS to investigate American cannabis operations. This only ingrained the power of 280E over cannabis more deeply into our taxation system. Hopefully 280E will be a thing of the past at some point, but that may take a while.

Any broad-based federal legalization would exempt cannabis growers from 280E.

3. Less Likely Regulation

a) Interstate commerce reform

Interstate commerce reform is another piece of relevant potential legislation to consider. I do not see this getting passed before SAFE Banking, uplisting or 280E reform, but once those dominos fall this could be in play.

As of today, transporting THC-bearing cannabis across state lines remains a federal crime. This has created an environment where each legalized state operates as their own island of production which has fostered some significant price inefficiencies.

The national average for an ounce of premium cannabis is $326, but varies widely depending on where you go. California, Oregon, Washington and Colorado are the 4 most mature cannabis markets in the United States. Over the years, competition has gotten more and more fierce and growers have gotten more and more efficient. The result is an ounce of high-quality cannabis in these Western states costs anywhere between $211 and $257 depending on your zip code.

When looking across the nation, the outlier is District of Columbia which charges $597.88 per ounce. Still, there are several other notable discrepancies with the Midwest, Southeast and East Coast all boasting far higher prices than their Western counterparts.

Interstate commerce would invariably smooth out some of these inefficiencies and prevent places like D.C. from charging such alarming amounts for the same quality of product. This change would have a negative impact of gross profit margins (GPM) across the board, especially for growers more heavily focused on states with higher selling prices. While this is less likely to be a reality in the coming years, it bears watching.

Prices in D.C. and elsewhere will normalize over time regardless of this happening. Interstate commerce, however, would greatly accelerate that process.

These are consumer packaged goods (CPG) companies at heart, so the 50%+ GPMs that most currently boast is comparatively elevated vs. a Heinz for example. This — along with all of the profit margin and cash flow tailwinds — makes some possible compression there more palatable. These can still be fantastic businesses with GPMs in the 30%-40% range.

And there’s more good news. Interstate commerce would also allow MSOs to create more centralized operations for growing and processing which would create profit synergies, thus counteracting the margin headwind.

b) Federal Legalization

Part 1) The MORE Act

The MORE (Marijuana Opportunity Reinvestment and Expungement) Act was a bill for federal cannabis legalization. It would have finally reclassified cannabis from a schedule one drug. For context, cannabis is still viewed in the exact same light as crystal meth by our federal government.

The bill was quite broad-based: It would have allowed for safe and secure banking, uplisting, and exemption from 280E.

Imperatively, the passage of the MORE Act also would have released thousands of non-violent criminals from prison for cannabis-related charges. This is a piece of legislation desperately needed in my view, but the likelihood of it passing is extremely low — regardless of behemoths like Amazon endorsing it.

A Republican-led Senate buried the bill for two consecutive years between 2018 and 2019. Today, with a left-wing controlled House of Representatives and Senate there’s still very little interest or momentum in getting it passed. Getting to 60 approving Senators seems like a pipe dream at this point with President Joe Biden recently voicing his opposition to federally legalizing recreational-use cannabis.

This is not necessarily a bad thing for American MSOs. Federal legalization could potentially open the border for international commerce, thus allowing the Canadian supply glut to find its way into the states. Like interstate commerce reform, this would be a large GPM headwind. Additionally, behemoths such as Curaleaf have already begun selling in other nations such as Israel: MSOs clearly don’t need federal legalization to sell abroad.

Part 2) The Cannabis Administration and Opportunity Act (CAOA)

The Cannabis Administration and Opportunity Act (CAOA) — spearheaded by Chuck Schumer — would tuck in a lot of the regulations we’ve already discussed just like the MORE Act did. This is essentially MORE Act 2.0 with some minor tweaks. It’s a wide-ranging draft of a bill to end federal prohibition while also featuring banking, sentencing, uplisting and taxation/280E reform.

Importantly, the legislation will not unlock interstate commerce and does not open international borders for trade. This means gross profit margins would not suffer with its passage as states would be able to continue enforcing their own, individual laws.

CAOA would open the door for a federal tax of up to 25%, but considering this would also mean 280E reform, that’s just fine. Finally, it would earmark new funds dedicated to cannabis research on a federal level.

The MORE act failed to cover the FDA’s involvement in regulation — it was simply too casual. This time CAOA explicitly names and defines the FDA’s role as the core regulatory body for manufacturing, processing and promotion of the product.

Furthermore, The Alcohol and Tobacco Tax and Trade Bureau would assume the responsibility of collecting tax dollars as well as tracking and tracing every single plant. Today, states are in charge of all of that meaning new federal compliance expectations would likely add a new layer of incremental cost to American grower operations.

“The Schumer bill is not perfect, it’s probably not going to get done, but think about two years ago when there was no proposal out of the Senate. So, I look at it as a positive.” — Ayr Wellness CEO Jon Sandelman

The draft is expected to be more of a place to re-start political negotiations rather than finish them. Again, it is somewhat similar to the MORE Act but executives and insiders are hopeful this time around that some of the disagreements preventing MORE’s passage have been solved. To be candid, some are also calling the legislation a politically motivated wish list but I still do think we are moving in the right direction.

For cannabis investors, this draft seems ideal compared to some of the other proposals we have seen floating around — but still it likely won’t be passed.

Today, passing regulation piece by piece is the most efficient way to move cannabis reform through Congress. An end to federal prohibition is still quite the intimidating idea for the majority of our politicians. Passing banking and taxation reform is the more realistic and palatable scenario at this point in time.

4. The take-away

None of these events are a sure thing, and that is entirely fine for American cannabis investors. Without the SAFE Banking act, uplisting, tax reform and more legalization, the companies are still in the early innings of a truly remarkable growth opportunity. Furthermore — as we briefly hit on before — the margins are already strong and continue to rapidly improve.

If status-quo remains for MSOs, the companies will be just fine.

Writer disclosures

Cresco Labs is my 8th largest position, Green Thumb Industries is my 9th largest position and Ayr Wellness is my 14th largest position. American cannabis is my largest portfolio sector weighting and I have no plans to do anything but accumulate more shares over time.

Thank you for reading!

Research Cited