1. Demand

The company guided to “at least” $282 million in sales with mean estimates calling for $283.9 million in sales. The Trade Desk posted $301.1 million which beat expectations by 6.1%.

Note that revenue growth when excluding the political election impact from 2020 was 47%.

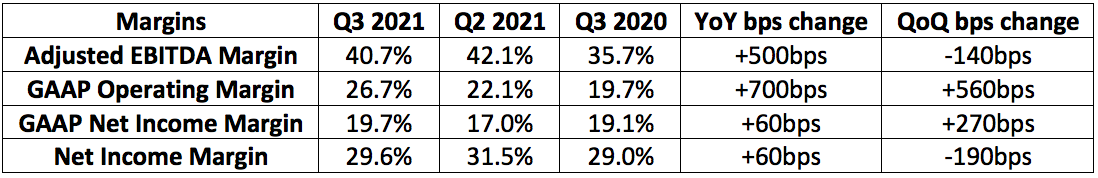

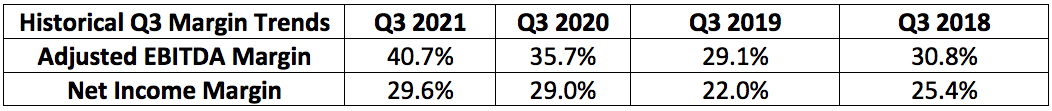

2. Profitability

The company guided to “at least” $100 million in Adjusted EBITDA with mean estimates of $101.8 million in Adjusted EBITDA. The Trade Desk posted $122.7 million which beat expectations by 20.5%.

Forecasts were for The Trade Desk to earn $0.15 per share during the quarter. The Trade Desk earned $0.18 which beat expectations by $0.03.

3. The Guide

Analysts were expecting $390 million in sales for the 4th quarter. The Trade Desk guided to “at least” $388 million for 21% growth at a minimum or 33% excluding political spend.

Analysts were expecting $165.9 million in Adjusted EBITDA for the 4th quarter. The Trade Desk guided to “at least” $175 million.

4. Co-Founder/CEO Jeff Green Conference Call Notes

“We are building a far better internet than what has been built by walled gardens holding the internet hostage.”

On supply chains:

“We see no material impact on our business from supply chains”

This is wildly encouraging considering some other players in the industry blamed supply chain obstacles for poor results.

On Walmart:

The Walmart DSP is live. Pepsi & several other behemoth brands are already active on it.

“Walmart is clearly a pioneer here by unleashing their first party data and closing the marketing loop. If a company runs an ad, data will allow them to know how well it worked. We are working with many other major retailers in the United States… it’s not just Walmart.”

“Walmart has gone first and now retailers around the world are wanting to execute the same playbook; we have aligned the interests of retailers and advertisers. We are talking to dozens of retailers and that is one of the most bullish things we are working on.”

On Google, Apple & UID2:

“iOS changes have had no material impact on our business and we expect that to continue to be the case.”

“I expect Google will take steps to make the market fairer given the scrutiny it’s under (anti-trust news). While this would help The Trade Desk, we expect to continue to do very well regardless… Google needs us more than ever and we will succeed regardless of any policy decisions Google makes.”

“Walled gardens are even beginning to adopt encrypted versions of UID2.”

Green on Connected TV (CTV):

Volkswagen and Colgate in an interview with a TTD executive (without prompting) stated they believe that most television advertising will be done through streaming and not linear within the next 3 years.

“All advertising will be digital and programmatic. As those shifts happen our commitment to the open internet merely intensifies to create a better internet. We have a level of support from the advertising world that is unprecedented. We never expected so many companies would share our vision for the internet.”

Green sees live sports as the last domino to fall in the pivot from linear to CTV. With 88% of the most watched shows in the United States being live sporting events, I wholeheartedly agree. Some live sports highlights that Green mentioned included:

Adding Turner Sports’ NBA package to its inventory.

Growing NFL ad-impressions by 6X year over year.

Adding Peacock (and its vast live sports content rights) to its inventory.

Peacock has rights to the NFL, NHL and The Olympics,

This digital audience is stickiest for live sports with 60 million digital sports viewers expected to rise to 90 million in 3 years.

On innovation and global traction:

On innovation:

“UID2 daily usage is reaching new all-time highs every week. UID2 is allowing advertisers to use 1st party data better than they ever could with cookies.”

“We are innovating within the supply chain to reduce duplications of ad inventory as publishers use multiple SSPs… there’s overwhelming support for this approach.”

Solimar introduced predictive pricing to give advertisers a sense of the maximum that each impression is worth to keep bids below that ceiling. This has already saved clients “tens of millions of dollars” for those activating the feature.

Green highlighted the “Made In” Case study that The Trade Desk recently published as concrete evidence of Solimar creating better outcomes for advertisers.

On global traction:

“The CTV progress in Europe is incredibly bullish.”

China remains its fastest growing geography.

Green eluded to The Trade Desk’s scale and balance sheet giving it the flexibility to invest in Europe and globally more aggressively than its competitors. It expects this to drive sustainable share gains.

General notes:

AVoD inventory continues to rapidly grow which is placing The Trade Desk in a better position to run more profitable auctions for its advertisers through CTV.

The historical supply constraint is slowly turning into a glut which favors the buy side and The Trade Desk.

The majority of The Trade Desk impressions auction will be through Solimar by early next year.

Green highlighted Gartner naming The Trade Desk a leader in ad-tech — as previously announced:

5. CFO Blake Grayson Conference Call Notes

Video (including CTV) grew from a “high 30% revenue contribution” last quarter to “roughly 40%” this quarter. Mobile fell from a “low 40% revenue contribution” last quarter to also “roughly 40%” this quarter. This shift makes The Trade Desk even less reliant on Apple and its privacy moves.

6. My Take

Supply chain issues and targeting headwinds have plagued many in the advertising industry this quarter — The Trade Desk overcame these issues and then some. The company’s unparalleled network of partners and first party data access puts it in control of its own destiny; Jeff Green knows exactly how to shape that destiny. UID2 and Solimar adoption both remain wildly encouraging. The company’s financial progress remains elite.

Excellent recap! Thank you for sharing!