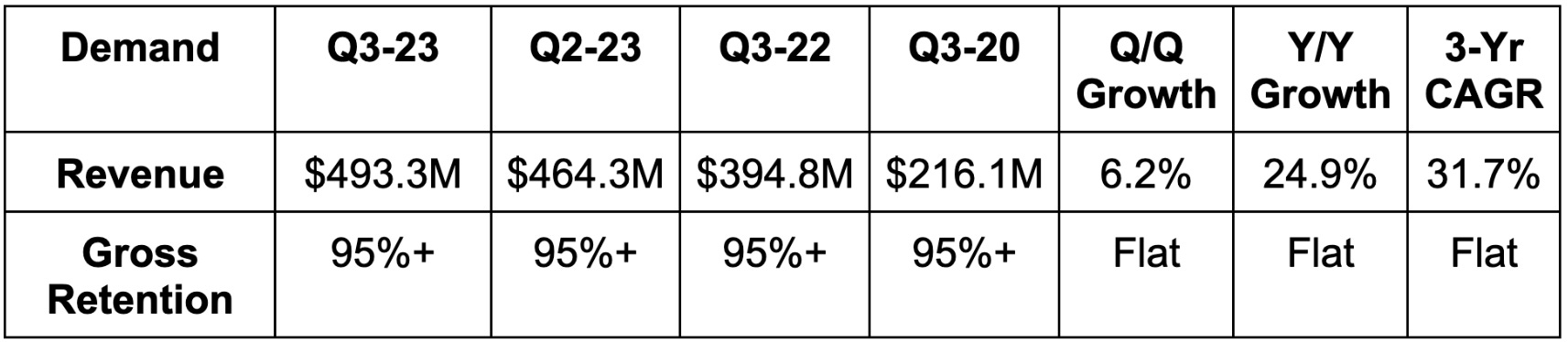

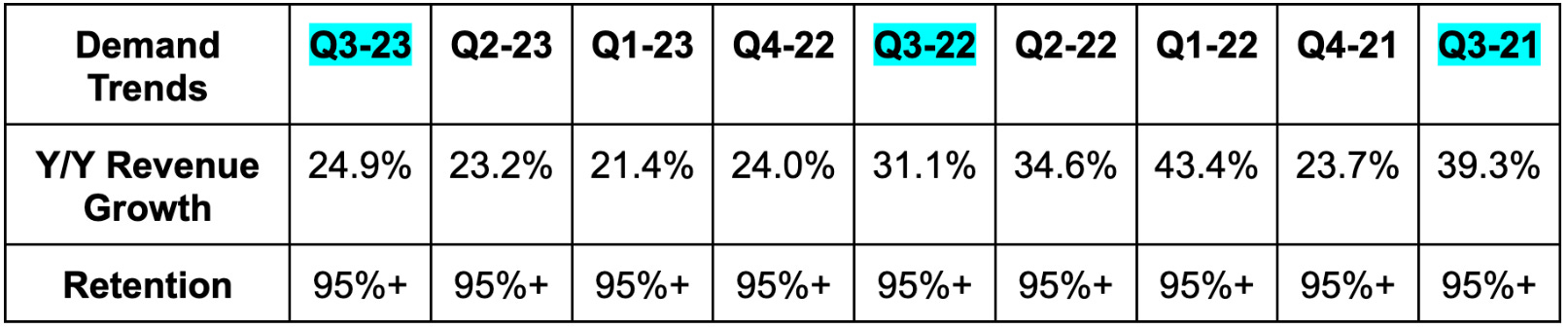

1. Demand

The Trade Desk beat revenue estimates by 1.2% and beat its guidance by 1.6%. Gross retention has been over 95% since it went public in 2016.

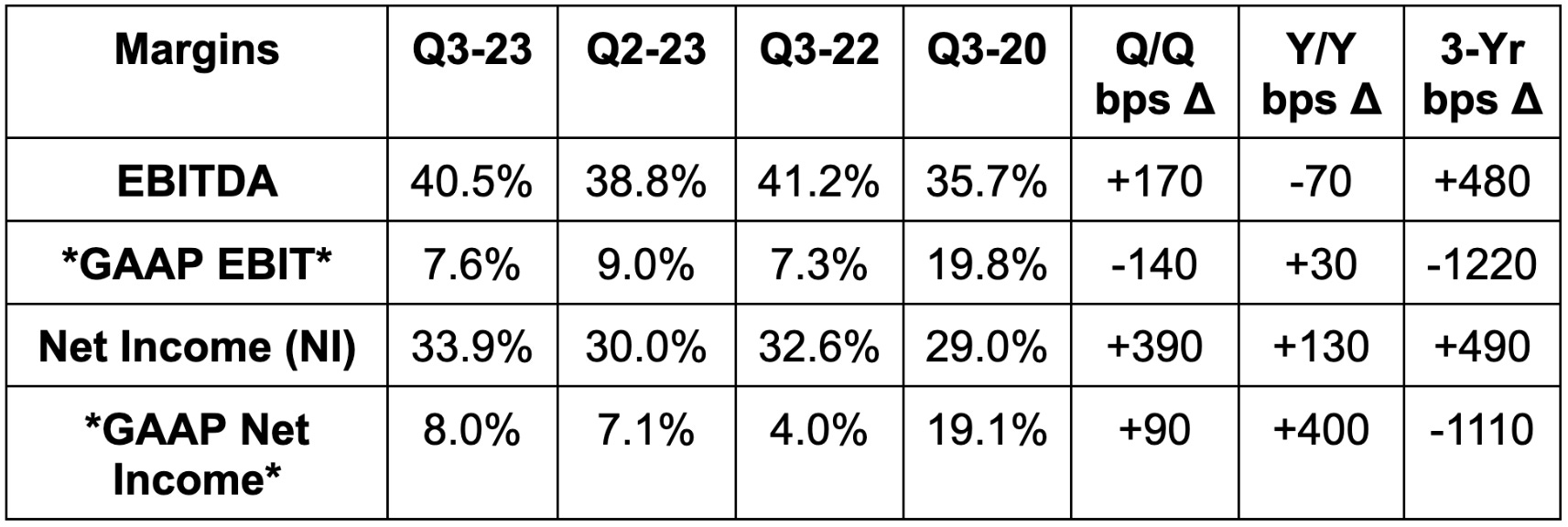

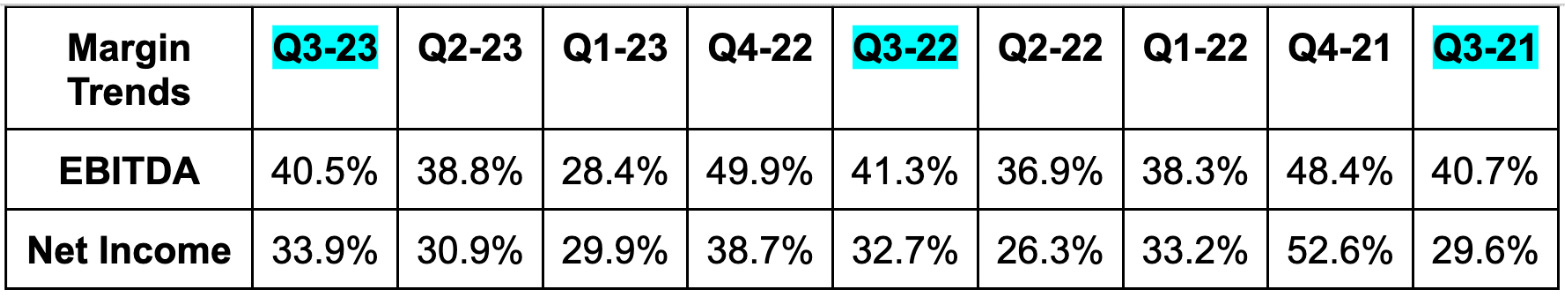

2. Profitability

Beat EBITDA estimates by 6.0% & beat guidance by 8.1%.

Beat $0.29 earnings per share (EPS) estimates by $0.04.

Met GAAP EPS estimates.

It has generated $600 million in free cash flow (FCF) over the last 12 months. This puts it around 40x trailing 12 month free cash flow and a likely mid-to-high 30s next 12 month FCF multiple. It’s amazing how a 30% stock price haircut can magically make valuation look far better in a hurry.

c. Guidance

“At least” revenue guidance was 5% below consensus (at most) with EBITDA about 7% worse than consensus. Revenue guidance represents 18% Y/Y growth and 22% Y/Y when excluding the impact of political spend in Q4 2022.

This is the first time in TTD’s public history that it missed on top and bottom line guidance. The weak guidance was due to cautious spending that started in the 2nd week of October. Hesitation was related to macro headwinds and industry strikes as well. That caution stabilized starting this month but led to the firm baking added prudence into the Q4 guidance. It said over and over again that it’s highly optimistic about Q4 and 2024 as a whole, but wanted to be overly conservative for this specific guide.

I’d be surprised if they didn’t handsomely beat next quarter. This feels like underpromising to overdeliver. If this quarter is an anomaly like I expect, this is not concerning to me. If it isn’t, this becomes much more concerning.

d. Balance Sheet

Share count rose by 0.3% Y/Y as it controls dilution with its small buyback. It repurchased $90 million in stock during the quarter.

$1.6 billion in cash & equivalents.

No debt.

e. Call & Release Highlights

Competitive Backdrop & More on the Guide:

The weak Q4 guide will naturally lead some to assume competitive pressures are building. That’s not the case. The Trade Desk continues to take more open internet market share at a faster and faster rate. It is entirely confident in these share gains continuing in Q4 and for 2024 as well. This truly is macro driven. The Trade Desk takes more share when times are tough and marketers flock to its higher return, more transparent platform. When times are good, it leads its sector’s growth re-acceleration. We have multiple examples of this playing out since it went public. I think the macro excuses here are actually legitimate for once.

Amplifying those issues were the auto strikes. Auto is an important vertical for the company. All of this led to the prudent Q4 guide. It’s adamant that this softness is highly temporary based on discussions with clients and what it’s now seeing.

“It’s better for our guidance to be cautious right now.” – CFO Laura Schenkein

Winning Big Deals:

The Trade Desk had a banner quarter for landing large joint business partnerships. These partnerships routinely entail $1 billion in multi-year spending. This merely adds to my confidence that this quarter is a one-off event. The revenue from these contracts will flow in over the coming years.

Connected TV (CTV) (Streaming):

The Trade Desk continues to win a larger portion of CTV advertising budgets. Notably, 3rd party research broadly concludes that revenue and value per user are higher for ad-supported tiers than ad free. This will be yet another important tailwind driving this sector’s multi-year growth. The Trade Desk is best positioned to benefit. If streamers want to fund expensive content creation, it’s becoming increasingly obvious that they’ll do so through ads. Not only will this mean more revenue for streamers, but a larger addressable market given the lower subscription price and finite consumer budgets.

Most recently, Disney+ (an existing close partner) added its European inventory to TTD’s platform.

As of now, a lot of the programmatic spend within CTV is under a format called “Programmatic Guaranteed.” This essentially functions like an upfront linear market, but with a bit more segmentation and campaign customization. The Trade Desk offers this as a bridge to the next iteration of CTV advertising: fully biddable impressions. This is what allows ad buyers to infuse all of their data into each impression decision. It’s what allows for full control over ad frequency, customer segmentation and constant identification. Old Navy embraced fully biddable programmatic advertising to enjoy a 70% reduction in cost of reach.

Open Path is now being utilized in the CTV channel. As a reminder, Open Path connects publishers on the supply side directly to its inventory on the demand side. As the name indicates, it carves an open path. It doesn’t replace sell side platforms like Magnite, but it does allow publishers with in-house capabilities to supplant them. Considering how every CTV player has the internal talent to do their own yield management (which is what the supply side mainly provides), more are opting into this product.

Retail Media:

There are two pieces to this explosive retail growth story. First is getting retailers to partner with The Trade Desk to enhance the value they bring to ad buyers. Second is getting these same players to share their data with the rest of the ecosystem to create a compelling data scale network effect. The Trade Desk has won dozens of the largest retailers in the world as clients. Now the data sharing item is playing out. Albertsons, Walgreens and Dollar General were the trailblazers while Instacart joined the fold this quarter. As more opt into data sharing, The Trade Desk’s aggregated 3rd party data becomes a larger open internet differentiator.

NBC Universal is partnering with Walmart to deliver more relevant Peacock ads using Walmart’s shopper data. With Walmart, NBC has enjoyed a 30% boost to buyer reach. The Trade Desk runs Walmart’s ad buying platform.

Unified ID 2.0

As a refresher, UID2 stands for Unified ID 2.0. It’s The Trade Desk’s replacement (and upgrade) of 3rd party cookies. It doesn’t own this directly, but built it and opened it up to the entire internet. UID2 unlocks organized email tracking to ensure buyers know exactly who they’re marketing to. This also means sellers know exactly what impressions are worth. Unlike cookies, this does not just work in a web browser setting… but across all channels.

If better campaign management and open bidding is peanut butter, identity is jelly. The former ensures I know who I want to target and that I actually can granularly target those people. The latter ensures I’m actually reaching these desired individuals.

Leading streamers implementing UID2 are enjoying a 222% revenue spike under the biddable programmatic format while delivering a 900% boost to return on ad spend. This means publishers can charge more while buyers are happy to pay more. Win, win.

Warner Brothers and Discovery integrated with UID2 this quarter.

Bacardi, Kimberly-Clark and others integrated with UID2 in Europe during the quarter.

Walmart is using UID2 in its demand buying platform that The Trade Desk operates.

f. Take

This company is fundamentally stellar. I will lean on 8 years of elite execution to maintain that opinion. 32 quarters matter more to me than a weak single quarter guide that was called overly cautious amid poor macro and strikes.

TTD boasts an elite combination of growth and ample cash flow generation that lets it invest to stay ahead of the pack. It takes market share every quarter, but those share gains are currently being masked by broader advertising weakness within the open internet. It will keep taking more market share, and it will become utterly obvious how strong of a footing this company is on when the backdrop gets easier. I could be wrong, but I really don’t think that I am.

Having said all of that, it came into this report at wildly expensive valuation multiples. That price tag set the bar for perfection and this Q4 guidance was certainly not perfect. The margin of safety in this name had simply vanished with significant multiple expansion. That is why I’ve sold 41% of my shares over the last 9 months. It’s why I moved this from one of my largest holdings to one of my smallest this year. My portfolio is publicly visible for you to verify that I’m not talking out of my you know what.

At the risk of sounding insensitive, this is what needed to happen for me to finally lean back into accumulation. The quarter does nothing to deter my confidence in the long term story and the multiple got far more reasonable in a hurry. As a long term investor, that’s not only fine with me, but it is exactly what I yearn for. This company possesses an investment case that makes me want to have it as a large holding. Now, I’ve gotten the chance to make it a large holding once more.

Expect a sizable purchase from me tomorrow morning if the stock price opens up around these current levels. Expect more purchases as significant multiple contraction continues. I’m ready to lean in.

I hold TTD. It's currently dipping though but I'm optimistic of its future returns.

Thank you Brad for your thorough analysis and astute conclusions. i like the metrics on which you are focused and look forward to the Trade Desk and Jeff Green's team performing well as they expand their platform, customer base, and global and virtual footprint. Have a great day! , Best Kevin c