The Trade Desk Q3 2022 Earnings Review

Exploring the impressive results of this advertising disruptor.

Today’s piece is powered by The Investor’s Podcast Network:

“Over the first 9 months of the year, we have gained more market share than at any point in our history.” – Co-Founder/CEO Jeff Green

1. Demand

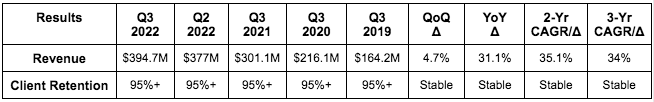

The Trade Desk beat its at least revenue guide by 2.5% and analyst estimates by 2.3%.

More Context on Demand:

The 34% 3 year CAGR compares to 33.1% last Q & 37.6% 2 Qs ago.

Client retention has been over 95% for 8 years.

Video (includes Connected TV (CTV)) represents a low 40% of the company’s revenue which is stable QoQ.

Disney+ launching ads next month (and Netflix) will fuel the CTV fire more.

Mobile remains in the high 30% range in terms of revenue contribution.

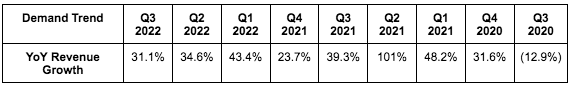

Q3 2022 is comping vs. nearly 40% growth in Q3 2021 — significantly ahead of The Trade Desk’s run rate growth. It still managed to boast over 31% growth. Impressive.

2. Profitability

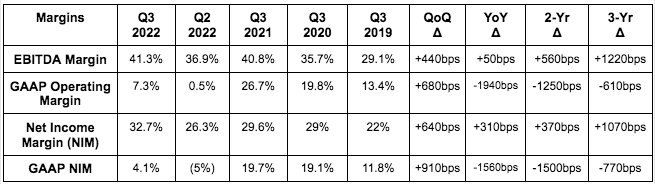

The Trade Desk beat its EBITDA guide by 16.5% and analyst estimates by 15.6%.

The Trade Desk beat analyst earnings per share (EPS) estimates of $0.20 by $0.03 or 15%.

More Context on Margins:

Founder awards in connection with meeting several performance goals began vesting in 2021. That’s the source of the large difference between GAAP and non-GAAP margins. Most of the $600 million package is expected to finish vesting next year when GAAP margins will normalize. A small chunk will vest early 2024.

CFO Blake Grayson told us that YoY stock comp growth would turn negative next quarter as we have lapped most of these awards.

The Trade Desk’s trailing 12 month FCF generation is up 53% YoY.

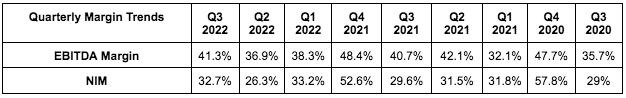

The sequential margin expansion was a positive surprise. Last quarter the company told us it would lean into operating expense growth starting this quarter and that, that would weigh on margins. Unit economics improved regardless.

3. Balance Sheet

The Trade Desk’s balance sheet is simply beautiful. It has $1.31B in cash & equivalents and added about $100 million to that pile sequentially thanks to consistently elite profitability. It has no debt.

Diluted shares grew by 2% sequentially in connection with the founder awards. That growth must briskly slow and is expected to in the coming quarters as YoY stock comp growth should turn negative.

“There are a lot of companies out there that may have more resources than us that are pausing or even cutting their resources because they potentially invested too aggressively. We didn't get ahead of ourselves the last couple of years like some of these companies did, and that's paying off for us.” – CFO Blake Grayson

For years on the show “We Study Billionaires”, The Investor’s Podcast Network has made a habit of chatting with the world’s best investors, like Ray Dalio, Joel Greenblatt, Howard Marks, and many more. With 100+ million downloads, they make podcasts by investors, for investors.

Now, they’re joining the newsletter space. Read The Investor’s Podcast Network’s full daily commentary and expert insights in the “We Study Markets” newsletter.

Click here to sign up (for free) today.

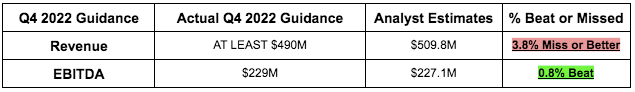

4. Guidance

5. Notes from the Call and Investor Materials:

Outperforming Everyone Else:

“We continue to gain share as advertisers embrace the precision of data driven advertising on the open market… especially in Q3, The Trade Desk has significantly outperformed all other forms of digital with a significant contrast to walled gardens in our ability to win advertising budgets.” – Co-Founder/CEO Jeff Green

This outperformance is REGARDLESS of what the macro looks like. The combination of The Trade Desk’s ability to target more granularly, offer real-time optimizations, candidly report results, avoid any conflict of interest and cut booking costs in half (reiterated today) is EVEN MORE coveted amid macro pain. No it is not immune from macro volatility, but yes it is relatively more insulated than its competition. That’s why it gains more share when times are tough, and why it continues to grow over 30% YoY profitability while others with similar revenue bases see their growth turn negative and their margins contract.

“Volatility pushes advertisers to seek out relevance & return on ad spend and that pushes them to programmatic advertising as they believe the open internet is the best place to create that value… we’re confident that we will continue to outperform.” – Co-Founder/CEO Jeff Green

Green spoke on The Trade Desk continuing to win more and more of the first dollars in ad budgets with an increasingly large portion of the leftovers going to walled gardens. This is the polar opposite of how things used to work.

So far in 2022, The Trade Desk has tripled the growth rates of its closest industry-wide benchmark.

On Tightening Supplier Relationships (OpenPath wasn’t talked about today):

“We’re developing closer relationships with the largest brands and agencies in the world… because of this, we are signing joint business plans with brands at a record pace. Some of the largest that we signed this year represent total spend of over a billion dollars in the future.” -- Co-Founder/CEO Jeff Green

In 2023, Green expects The Trade Desk to have “the best data marketplace the ecosystem has ever had and the best first party on-boarding that the company has ever had. This should help build stronger supply side relationships.

Some Positive Anecdotes:

Clarins enjoyed an 8% marketing conversion bump which drove “exponential growth” through The Trade Desk’s platform

Mercedes used The Trade Desk to raise brand awareness by 11% in key demos.

ViewSonic launched a new product with a CTV campaign through The Trade Desk which materially raised reach and lowered acquisition cost.

Lexus reached 15M new customers and 5Xed its web traffic with a 67% rise in purchase intent among the millennial buyers it targeted -- thanks to The Trade Desk.

Shopper Marketing Spend on the platform tripled sequentially (small base).

Unified ID 2.0 (UID2 AKA The Trade Desk’s multi-channel 3rd party cookies replacement)

The company expects 50% of its 2023 inventory to be UID2 tagged vs. about 5% in 2022.

Procter & Gamble added support and adoption for UID2 last month.

MediaMath and its 3,500 advertisers added UID2 this quarter.

FuboTV is thriving with UID2. Its revenue growth is outpacing impression growth by 113% and ad spend on Fubo rising 61% YoY for campaigns using UID2. That positively stands out vs. other smaller streamers.

UID2 just crossed 600 partners

6. My Take

Two things are true. First, this was a weaker quarter than The Trade Desk has reported in a while. And second, it was an impressive performance. Despite all of the aggressive macro headwinds raging on and intensifying, it continues to report a combination of growth, share gains and profit that is entirely unmatched in its space. It truly is outperforming all of its relevant comparisons. CTV + retail media give it two more exciting growth levers to pull, and considering how upbeat the forward commentary was on the call, it should be exciting to watch those areas play out. Great job again. It’s so easy to invest in Jeff Green.

Nice job Brad…. Bought some shares for a swing on this red day. $40 is not a bad price to start a LT position.

Thanks Brad for your input.

My inquiry was if you use the 3yr CAGR as a benchmark for comparing to current qtr growth?

Thanks again