“Solimar and progress within areas such as Connected TV (CTV), identity and retail data all enabled us to gain more share of the data-driven advertising market. Major advertisers around the world are embracing our open internet vision as the market races to a $1 trillion TAM. I am convinced that we will continue to outperform as more of these advertisers are gravitating to our platform.” — Co-Founder/CEO Jeff Green

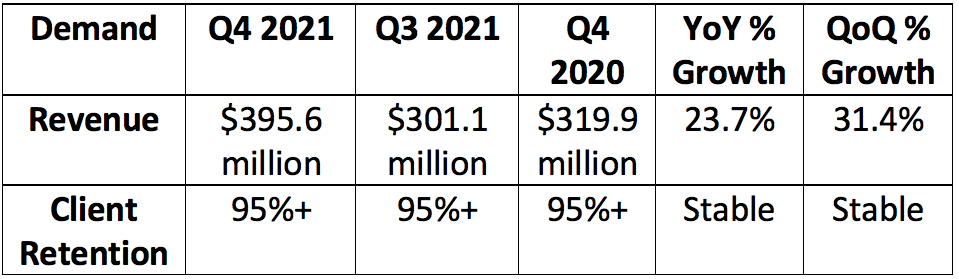

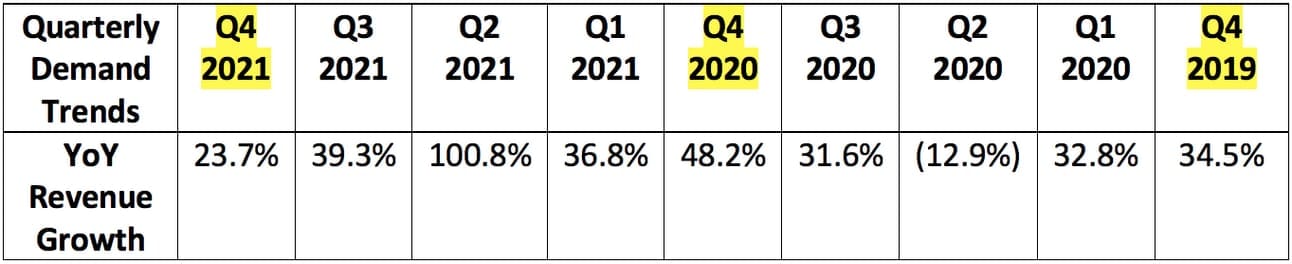

1. Demand

The Trade Desk guided to “at least” $388 million in quarterly revenue and analysts were looking for $389.7 million. It posted $395.6 million, beating its expectations by 2.0% and analyst estimates by 1.5%.

Note that Q4 2020 benefitted from political ad spend not enjoyed during this period. Without this year over year (YoY) comparison headwind, growth would have been roughly 36% YoY — marking an acceleration over the company’s 2019, pre-pandemic Q4.

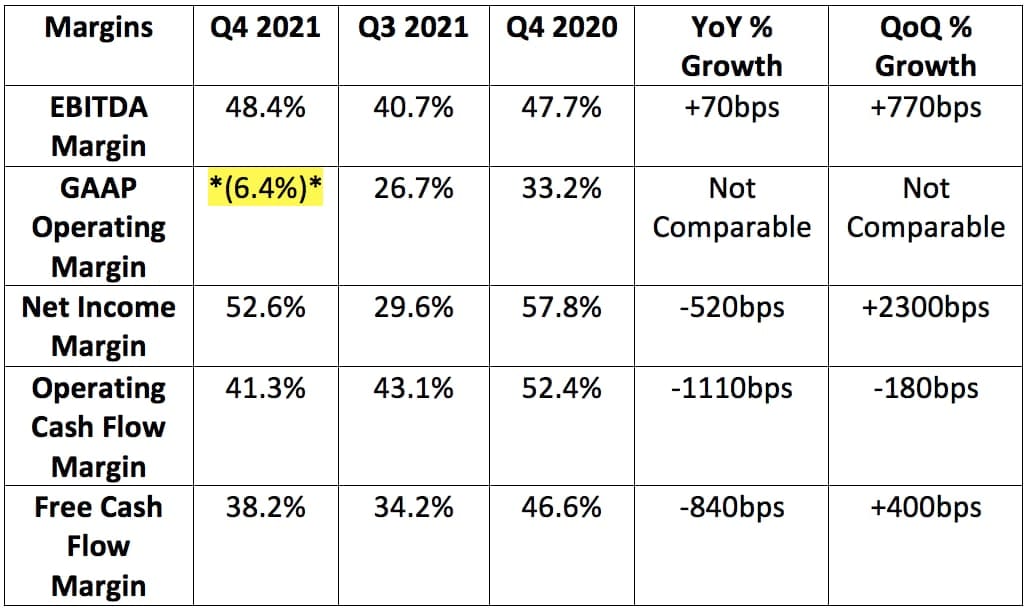

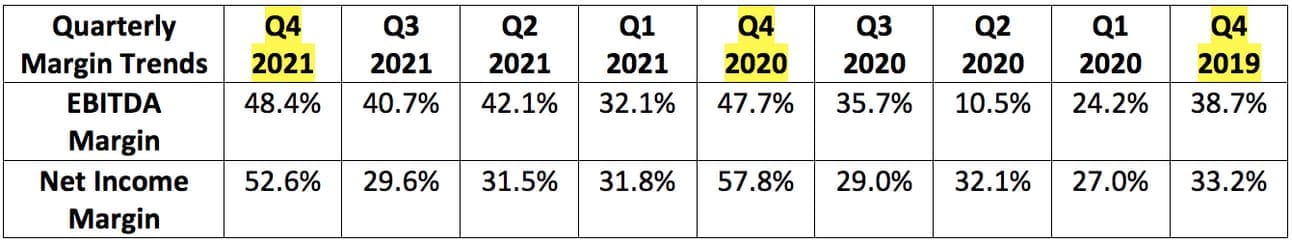

2. Profitability

The Trade Desk guided to “at least” $175 million in adjusted EBITDA for an implied margin of 45.1%. Analysts were looking for $178.3 million in adjusted EBITDA for an implied margin of 45.7%. The company posted $191.5 million in adjusted EBITDA beating its expectations by 9.4% (or 330bps) and analyst estimates by 7.4% (or 270bps).

*GAAP Operating Margin was hit by stock based compensation incurred during the period. This equated to $158 million and was paid out to CEO Jeff Green in connection with performance benchmarks being met. Without this charge, GAAP operating margin would have been 33.6%. There is another $616 million left in this package that will vest over the next 4 years. This will hit GAAP margins when the lumpy charges are incurred. Adjusted margins account for this.*

Q4 2020 margins greatly benefitted from political ad spend. When the company enjoys revenue outperformance (like it did in Q4 2020) it strongly flows down the income statement as we’re seeing here.

3. Guidance

Q1 2022:

- Analysts were looking for $287.6 million in Q1 2022 sales. The Trade Desk guided to at least $303 million, beating expectations by at least 5.3%. This would represent 38% YoY growth.

- Analysts were looking for $81.7 million in EBITDA. The Trade Desk guided to approximately $91 million, beating expectations by 11.4%.

4. OpenPath & Google

This week, The Trade Desk announced new tools for publishers to help erode their extreme reliance on Google. This launch marks another step from the company towards the supply side part of the industry as it will allow publishers to field offers from advertisers without any intermediaries like Google. While this will tighten the firm’s relationships with publishers — it is not entering the supply side of programmatic advertising. It will continue to be singularly focused on serving the demand side (advertisers) but does see ways to uplift publishers and to create more value for all parties. That’s the goal of this product.

To prove its lack of desire to compete with the supply side, OpenPath will not provide any core supply-side platform (SSP) tools like yield management. Instead, what this new product does is functionally deepens the integration capabilities to connect advertisers and publishers in a more intimate and valuable manner. Interestingly, the company will look to sell this offering at cost (breakeven profits) to juice inventory and appeal for the demand-side advertisers it represents. This is another clear sign that it does not want to compete with SSPs.

The Trade Desk will also now stop purchasing impressions for its client’s through Google’s Open Bidding program. It will continue offering Google’s slots to advertisers elsewhere.

“There’s substantial appetite to go away from Google.” — Co-Founder/CEO Jeff Green