“These results demonstrate that Uber continues to drive profitable growth at scale. This is why we believe we’re well positioned for the journey ahead, in good or bad macro environments.” – CEO Dara Khosrowshahi

1. Demand

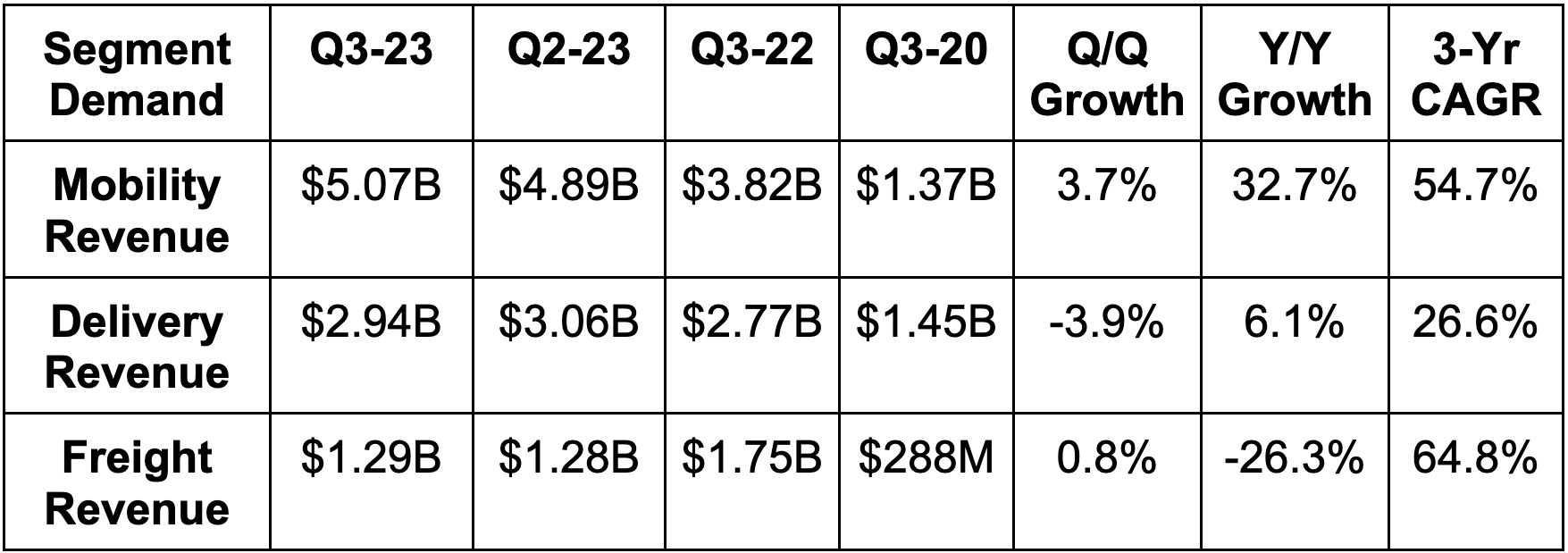

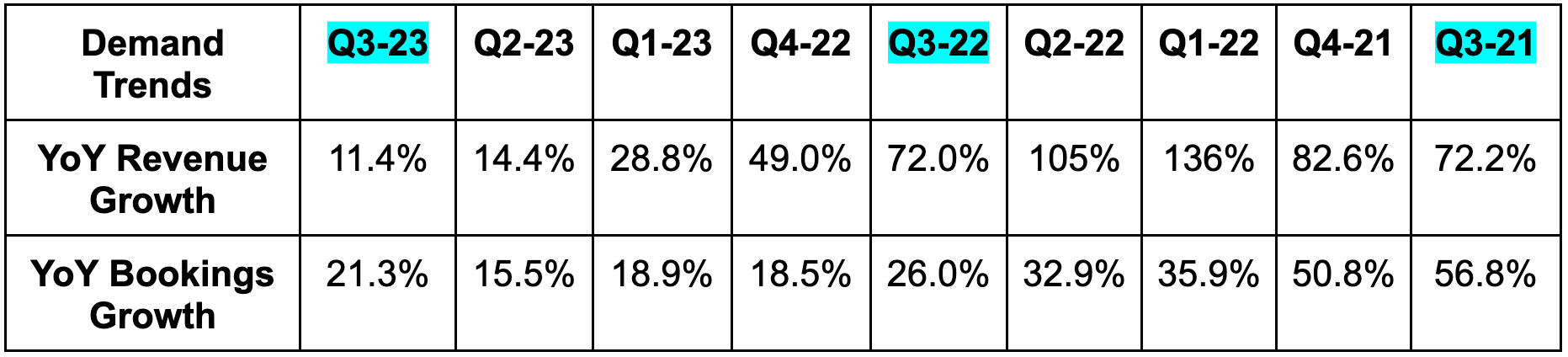

Uber beat bookings estimates by 2.3% and beat its identical bookings guidance by 2.3%. It actually missed revenue estimates by 2.5%. This was due to a $520 million hit from an accounting change. For business model compliance in nations like the U.K., it had to reclassify some sales & marketing expenses as a contra (AKA negative) revenue item. The impact was harshest in the delivery segment where promotional activity is the most intense.

Revenue was 4% ahead of consensus and Y/Y growth was about 19.4% without this headwind. Growth comps will normalize next year.

25% Y/Y trip growth comfortably beat guidance of at least 20% growth.

Monthly active platform consumers (MAPCs) reached another all time high. That’s what I expect for a growth company.

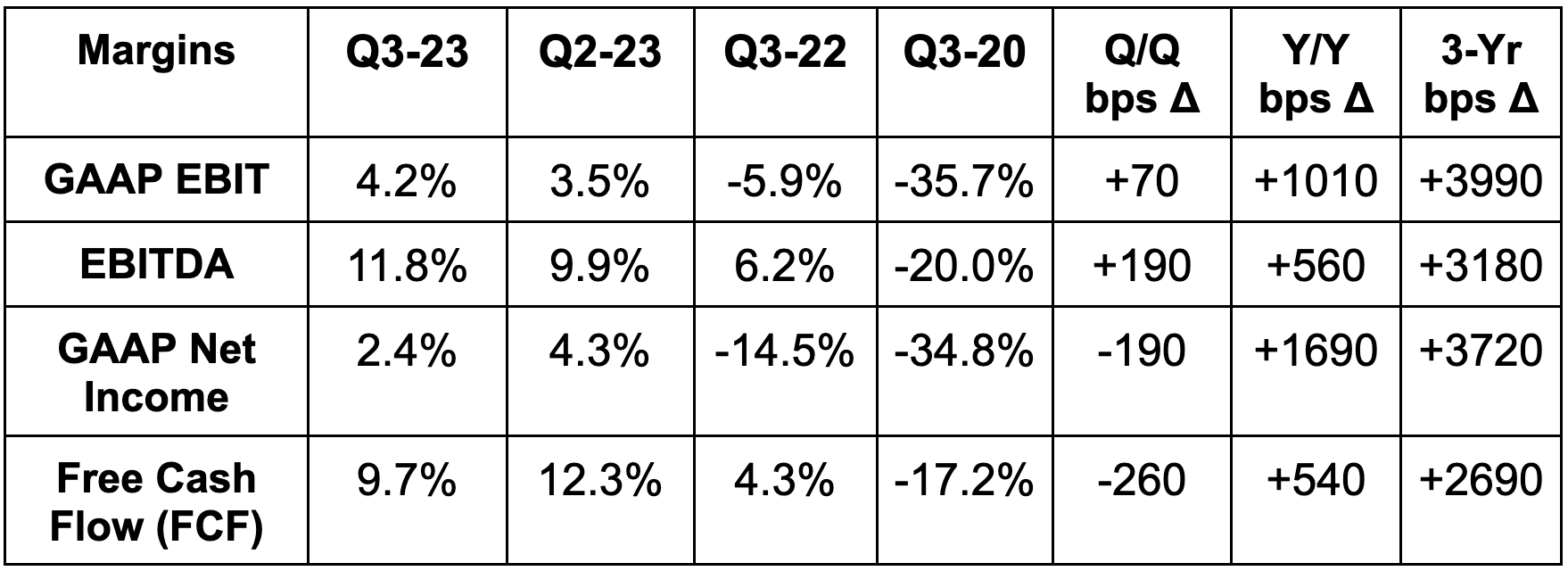

2. Profitability

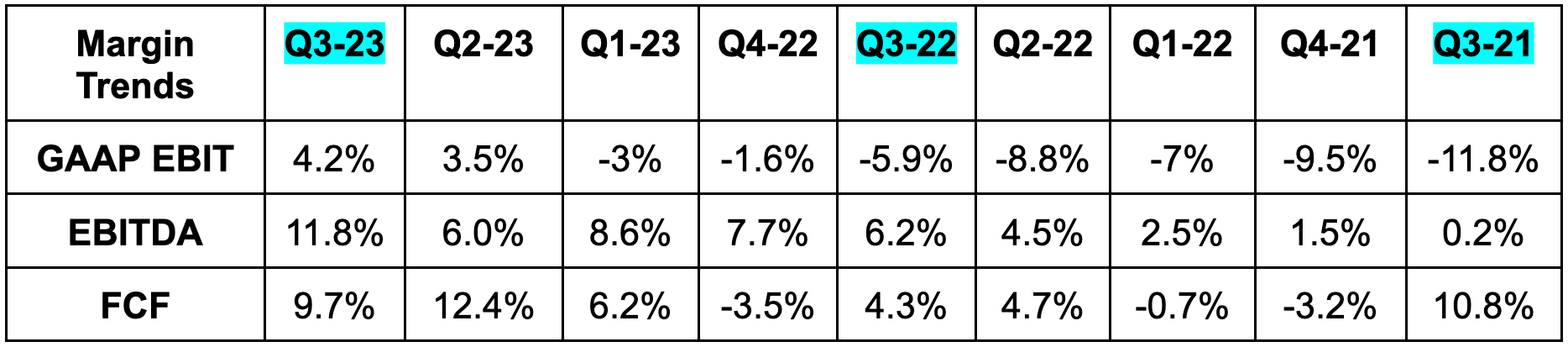

Uber beat EBITDA estimates by 6.9% and beat its EBITDA guidance by 9.0%. It beat GAAP EBIT estimates by 29.0% and missed $0.12 GAAP earnings per share (EPS) estimates by a penny.

As a reminder, GAAP EPS is heavily influenced by mark to market equity valuation swings. If Uber owns a stake in a company that saw its stock fall during the quarter, Uber’s net income suffers and vice versa. That’s not at all related to the unit economics of this business and is why I prefer GAAP EBIT. It’s less noisy.

Uber continues to tightly control costs. GAAP operating expenses as a percent of volume fell for all buckets Y/Y. The same is true for non-GAAP cost buckets as well. Headcount fell 1% Y/Y and the firm doesn’t expect much headcount growth in the near future.

Finally, it paid $622 million in non-recurring taxes to the U.K.’s tax authority (their IRS) during the quarter.

3. Guidance

Next quarter guidance was ahead on bookings by 1.6% and ahead on EBITDA by 5.2%. Demand on its platform “remains healthy” into November as it just wrapped up a new monthly record for volume in October. It also guided to flat freight volumes Q/Q. This puts the company on track to exceed $4 billion in 2023 EBITDA. At the start of the year, analysts were expecting $3.25 billion in 2023 EBITDA.

Outgoing CFO Nelson Chai told us the capital return update we’ve been expecting will come next quarter. It sounds like the firm is gearing up to add a new buyback. Its superior margins, scale and liquidity give it a clear path to the lowest cost of capital in the space. It sees this serving as a growingly “significant competitive edge” as it often does. I’d argue that edge here is even more significant than it usually is given the low margin nature of this sector.

4. Balance Sheet

$5.2 billion in cash & equivalents.

$5.1 billion in investments.

$9.3 billion in debt with a $2.5 billion credit revolver.

Share count rose by 3.3% Y/Y. This needs to slow and should with the lack of headcount growth. Stock compensation dollars also started an encouraging negative growth trend this quarter.

5. Call & Release Highlights

Demand:

Demand and engagement remain rock solid. Y/Y trip growth accelerated to 25% vs. 22% last quarter and trips per monthly active matched an all time high. Overall, volume growth for mobility and delivery was strong at 31% Y/Y and 18% Y/Y respectively. Importantly, this “robust activity” has continued quarter-to-date -- hence the strong guide.

Mobility:

Strength across products and geographies was consistently broad. Still, there were some standouts. Asia Pacific and Latin America boasted the strongest quarterly accelerations for Uber.

This was credited to better product fit in markets like Japan where it was added to that nation’s taxi association. In that country, taxis are a highly important part of transportation. Uber is actually only allowed to acquire Japanese customers through this channel, which had been slowing traction. Now, it actually has the product and partnerships in place to grow there. And? It’s growing quickly.

While the summer travel season is now wrapping up, growth there is being readily replaced by strength related to the back-to-school season where its newer teen accounts are working wonders. Enterprise demand is also accelerating via “return to office” initiatives.” All in all, it’s “at or near all time highs” for market share in North America, the U.K. and India.

For its new mobility product bucket as a whole, bookings crossed $9 billion with rapid 80% Y/Y growth. New segments now represent 13% of total mobility volume. Its higher end Reserve product is working. Lower end UberX Share and Moto products (up 100% Y/Y) are working. Uber for Business? Working. It’s just all working. In newer geographies, a “fine tuning of the model” has unlocked penetration gains in Germany, Spain, Argentina, Japan, Korea and Turkey.

More Mobility Notes:

Teen Uber account engagement is similar to adults.

Pricing increases will likely resume in the coming quarters.

Launched Group Rides across 100 cities.

Launched taxi ride fulfillment in New York City.

Taxi drivers accepting Uber riders earn 24% more than those who don’t in San Francisco.

Uber Direct:

Uber Direct (private label delivery and mobility service) added JetBlue, White Castle, Incu, Ocado and Staples as key clients this quarter. It also integrated its network into Oracle’s retail cloud, which should accelerate momentum further.

Driver Supply:

Uber continues to briskly grow its driver supply. It reached 6.5 million total this quarter, which represents 30% Y/Y and 8.3% Q/Q growth. This means shorter wait times, lower consumer pricing and just a better experience overall.

Importantly, its supply dynamic is much healthier than it was a year ago. This has allowed it to cut incentives across the globe by more than 40% Y/Y. Still, these drivers are enjoying significant earnings growth of 24% Y/Y and are delivering 5% Y/Y engagement growth to Uber. Clearly, they feel well taken care of. This takes us back to a key investment case theme:

Uber is threading a highly important needle. It’s using its unmatched reach to scale lower margin businesses effectively. At the same time, it’s supporting drivers better than others can afford to, thus keeping the supply side of the equation strong. A strong supply side means a strong demand side due to the incremental service quality.

Uber One:

Uber One (loyalty program) entered 3 new countries this quarter to reach 18 in total. It now has over 15 million members vs. 12 million just 9 months ago. Customer behavior from these members has been consistently positive despite rapid growth. These users spend 4x more than non-members with 15% lower churn.

Most of Uber One’s perks today are based on monetary discounts. It sees this changing in the future with new tools like skipping the rider cue when waiting in line. Uber One mobility volume is just 15% of total vs. 40% of total volume for Delivery. This is how it expects to close that gap.

Scale:

Dara spoke in detail about why Uber’s scale matters so much. I talk about this constantly, but he included an idea that I haven’t spoken about as much.

Market share scale means data scale. Because Uber has the largest dataset in transportation, it has the best machine learning algorithm seasoning capabilities in transportation. This helps everywhere with driver onboarding, customer support bots and better driver matching as key examples. The scale advantage also means more bargaining power as part of contracts with vendors like PayPal.

New York City Regulation:

Dara seemed encouraged by the Attorney General and Department of Labor in New York settling with Uber. He described the deal as one that effectively balances basic worker protections with desired flexibility. Uber sees this as the framework and where global regulation is heading; it thinks that bodes very well for its business model. Some worker protections are entirely fine for it as long as they’re not treated exactly as full time employees.

Even in some European markets where Uber must utilize drivers through their fleet networks, it has found a way to work profitably. Rates are just higher, volumes are lower and drivers don’t enjoy any flexibility. This is not a matter of market regulation allowing Uber to exist or not. It’s a matter of how profitable and large that existence will be. Recent developments are positive.

Macro & Geopolitics:

“We have been looking for pockets of consumer spending weakness. We haven’t found it. The U.S. Consumer is Incredibly Strong.” – CEO Dara Khosrowshahi

Dara credited the affordable nature of Uber vs. other luxuries as a reason for its relative insulation to poor macro. The shift back from goods demand to services demand also continues. This is helping Uber’s results too.

Uber doesn’t operate in Israel and has 2% of its overall bookings in the Middle East. It is seeing a little bit of weakness in countries like Egypt as part of ongoing war. That weakness has not been material as international business travel actually picked up since this started. Surprising to hear.

Advertising:

Uber’s ad suite to date has really only catered to smaller buyers. It’s now building out more sophisticated tech, like better segmentation, incremental reach measurement and more, for larger advertisers. This should lead to more explosive growth here as it marches to $1 billion in annual advertising revenue. This is materially enhancing operating leverage for Uber.

It expanded checkout ads across more core markets. It added in-car tablet ads to more U.S. cities.

Its 445,000 ad buyer base grew by 70% Y/Y.

Uber continues to deliver 700%-1000% return on ad spend.

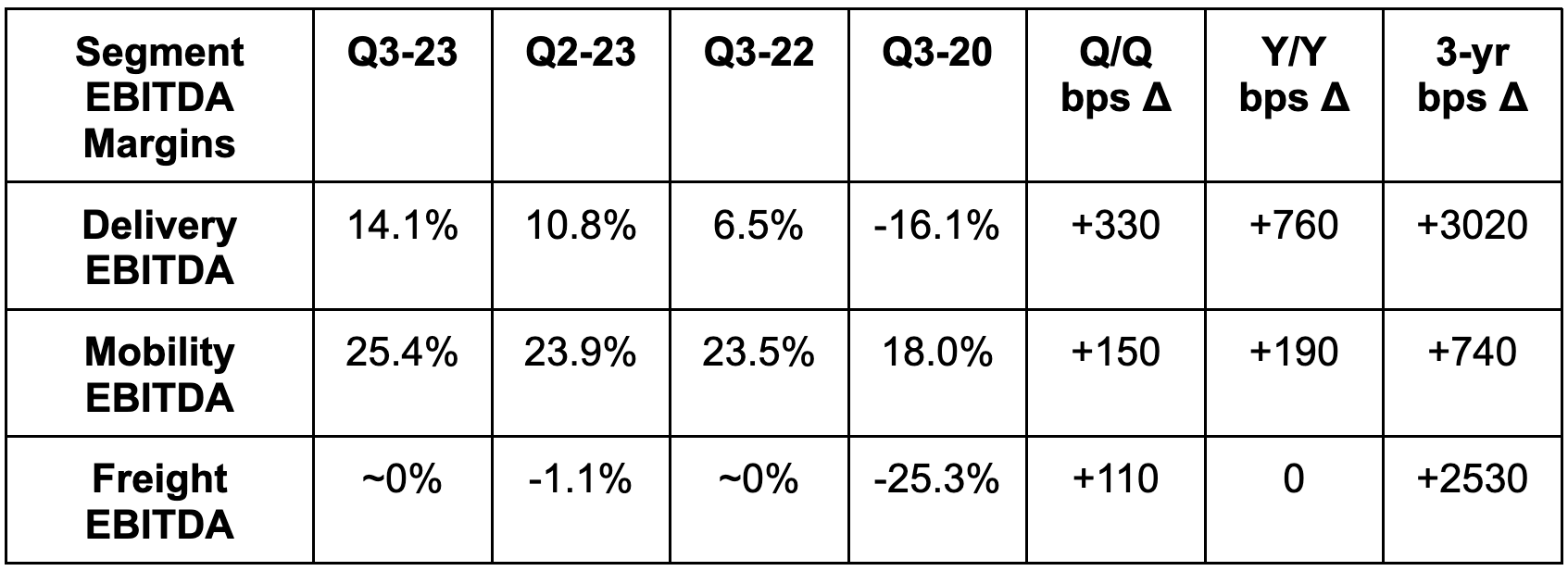

Delivery:

Uber set a 2 year record for Delivery trip growth this quarter with frequency also reaching an all time high. Growth accelerated across every region; it maintained market share in North America with record margins (no pricing wars here). It took market share across other core markets and set new share records in France, Mexico, Japan and Australia. Newer verticals like grocery (added 610 new locations this quarter), alcohol and convenience are also thriving with 46% Y/Y volume growth.

Time per delivery in the USA fell by 3 minutes (thanks to driver supply) while cost per delivery fell by 5% Y/Y to an all time low. These efficiency gains are a byproduct of Uber’s best in class margins and liquidity. The advantages give it the ability to aggressively invest in platform and tech enhancements. It expects “healthy margin expansion” for the segment to continue.

Some of these investments are also fostering a better customer experience. For example, its new chat bot matches queries with the best restaurant options and automates coupon discovery for grocery orders.

Freight:

Uber delivered flat Q/Q freight volumes as expected. Macro remains quite difficult for the segment as supply gluts hit pricing and weak demand hits volumes. Still, it thinks it is “weathering trends better than competition” as several others have closed operations in the past year. It continues to tightly manage costs and maintain near breakeven EBITDA while sector headwinds run rampant.

But despite cost controls in some areas, it’s remaining aggressive in product development to separate itself from the pack. It thinks its balance sheet and today’s backdrop create the perfect opportunity to do just that.

It debuted Insights AI this quarter as a Gen AI tool to “create and surface insights for customer planning.” It revamped its Freight Transportation Management System (TMS) to “enhance software usability” and bolster visibility. Broadly speaking, it’s transforming Uber Freight from a physical mover of goods to a full suite of physical AND software-based tools to drive end to end logistics.

Finally, it continues to develop its freight autonomous vehicle (AV) partnerships. Its new Waabi partnership will “deliver a turnkey autonomous service” for Uber Freight over the next 10 years. The two just launched their first route in Texas this quarter. Overall, Uber Freight just crossed 100,000 autonomous miles driven.

Final Notes:

It’s now eligible for the S&P 500 and well on its way to investment grade credit.

Waymo partnership now live in Phoenix as previously announced.

6. Take

This was a great quarter. The profit explosion continues via cost discipline, and growth is not suffering as a result. Market share leads are stable or improving, new products are rapidly gaining traction, hefty buybacks are poised to start and this company keeps on executing.

As I’ve said many, many times… Uber is a baby Amazon. The Uber One subscription reminds me very much of early Amazon Prime. It boasts the network and product breadth needed to operate more efficiently than others in a low margin segment. Its customer acquisition cost is better thanks to more cross-selling. Its scale is larger thanks to more cross-selling. Its service quality is sharper thanks to more cross-selling. Its churn is lower… thanks to more cross-selling. This is the formula to win in transportation and it clearly has the team in place to execute. Two thumbs up.