“As the operating environment adjusts to a period of tighter capital availability and higher rates, we are poised to improve our competitive position… Put simply, we remain committed to best-of-breed cash flow growth, irrespective of the demand environment. The Uber platform has never been stronger and our expectations have never been higher.” -- CEO Dara Khosrowshahi

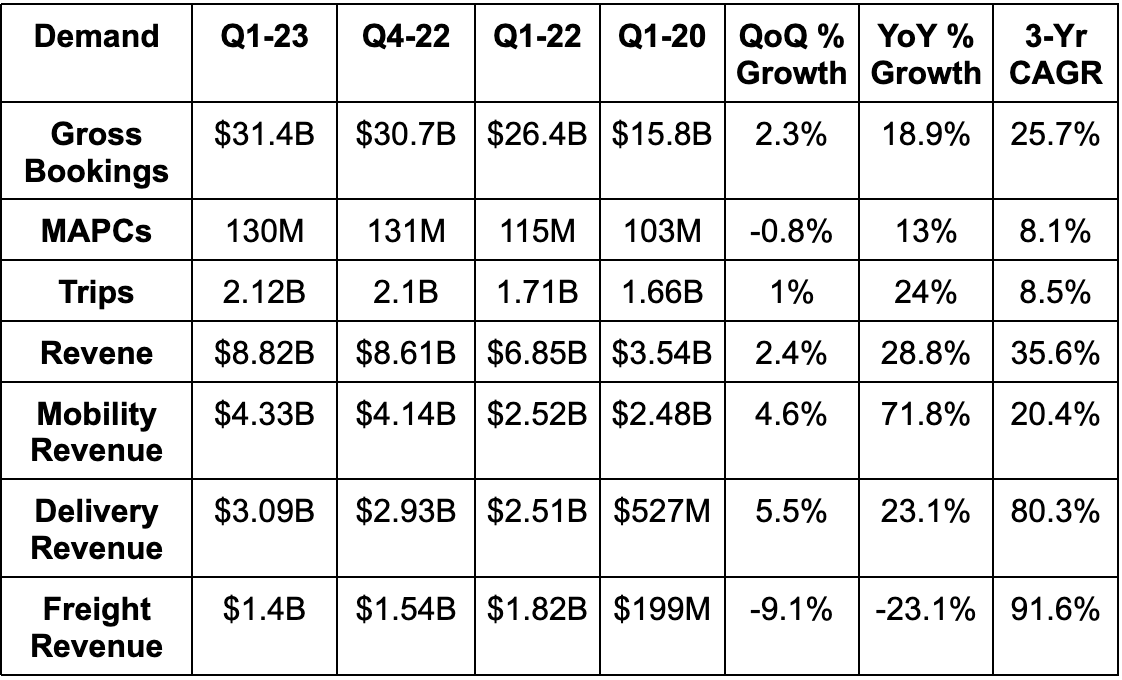

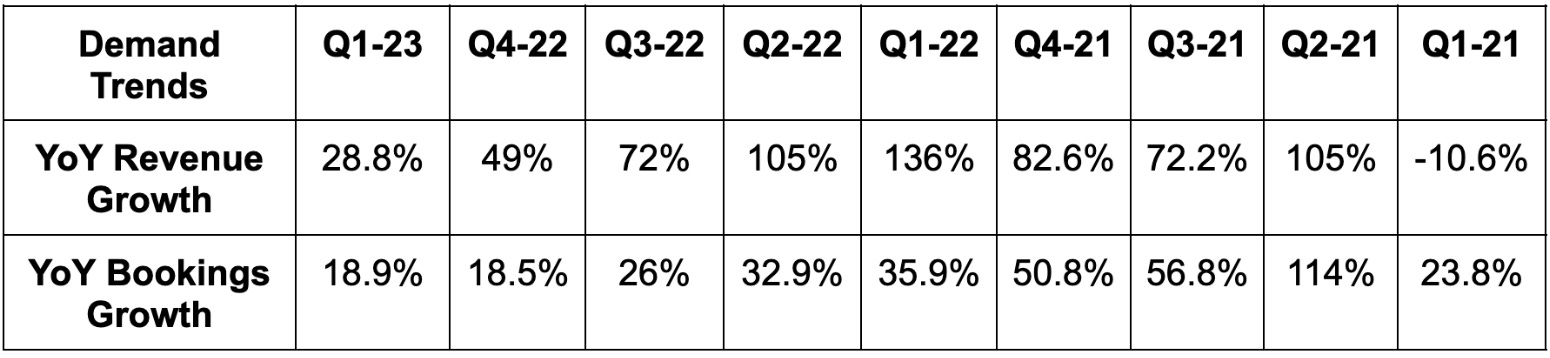

1. Demand

Uber beat revenue estimates by 1.3% and slightly missed the midpoint of its gross bookings guidance by 0.3%. Trips growth of 24% YoY met or beat estimates of at least 20% growth.

Demand Context:

Trips growth accelerated from 19% last quarter to 24% this quarter.

By region, USA + Canada (UCAN) saw 12% YoY growth, LatAm saw 31% YoY growth, EMEA enjoyed 86% YoY growth & APAC 41% YoY growth.

Foreign Exchange (FX) hit bookings growth by 320 basis points (bps) which met expectations.

Trips per MAPC rose 10% YoY.

Uber continues to take share in most markets despite materially lowering driver and rider incentives from 2022. Its scale, product breadth (for more cross-selling) and operational tweaks to improve the experience for drivers and riders are working wonders. It sees this combination as the explanation for rising share, engagement and profitability.

The newer the consumer cohort, the more frequent the engagement with Uber’s platform. This is direct evidence of new products working.

The sequential rise in Uber’s take rate was mainly driven by typical seasonality.

Revenue growth greatly outpaced volume growth because of a revenue recognition change in the UK. That change led to Uber recognizing all fares charged for trips in that country as revenue. Uber used to function as a middle man that merely facilitated the transference of some fees without recognizing the revenue. This change boosted revenue growth, didn’t impact volume growth and hit margins due to dividing by a larger denominator. It made this model tweak to comply with new regulations… not to shadily juice revenue.

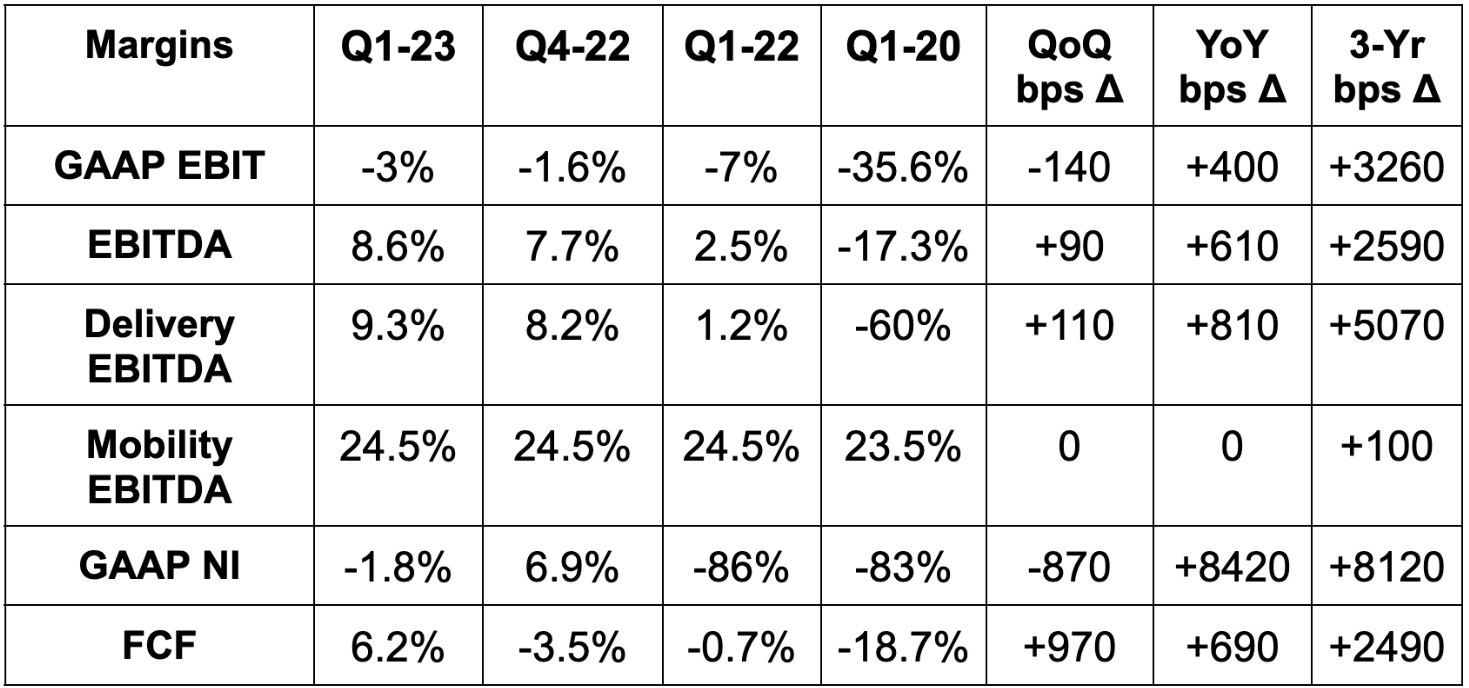

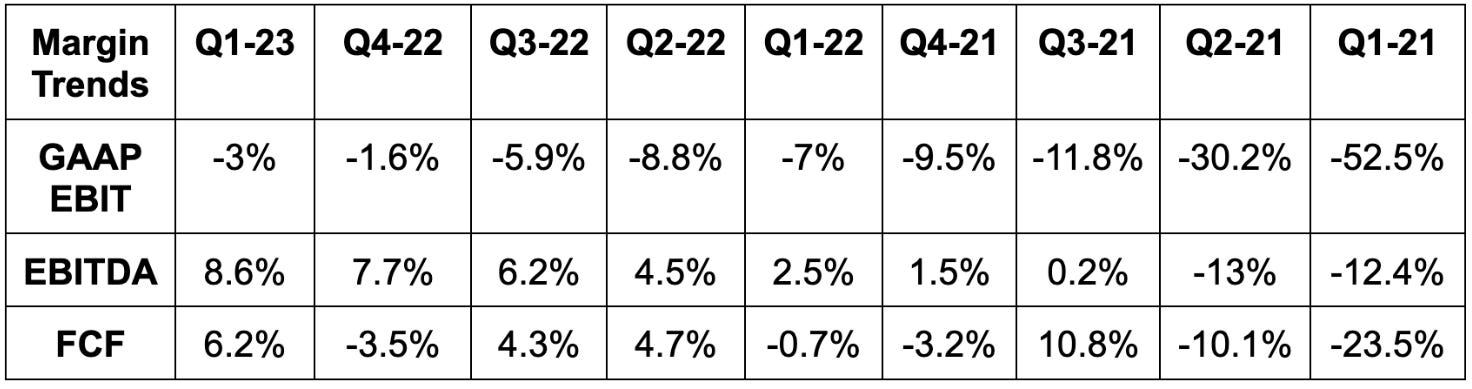

2. Margins

Uber beat EBITDA estimates by 12.5% and beat its EBITDA guidance by 11.9%. It also barely beat estimates of -$0.09 in earnings per share by a penny.

Margin Context:

Uber saw modest operating leverage in every single cost bucket besides R&D which was stable at 1.5% of bookings YoY.

Leadership thinks “free cash flow will ramp in the coming quarters.”

Its incremental EBITDA margin was 12% of gross bookings vs. its operational goal of 7%.

3. Balance Sheet

$4.05 billion in cash and equivalents. It sold about $1.1 billion worth of equity investment stakes after the Q1 period ended. This cash will be added to the balance sheet next quarter.

$9.27 billion in debt.

Uber refinanced its 2025 and 2027 term loans to 2030 maturities. The new terms come with credit spreads that are 75 bps more favorable than previously thanks to improving balance sheet health.

Headcount fell QoQ after it reallocated some talent away from lower priority projects. This will drive more fixed cost operating leverage in the coming quarters.

Uber’s credit rating was upgraded by S&P and Moody’s this quarter with both giving it a positive credit outlook. It’s committed to getting to investment grade debt.

“Over the next few quarters, we will evaluate returning excess capital to shareholders as our cash flows ramp, and with any potential further monetization of our equity stakes over the long term.” -- CFO Nelson Chai

4. Q2 2023 Guidance

$33.5 billion in gross bookings for 17% constant currency growth.

Trip growth to exceed 20% again.

EBITDA beat estimates by a robust 22%.

Uber told investors to expect consistent operating leverage in the coming quarters with a GAAP EBIT improvement next quarter. It reiterated plans to reach GAAP EBIT positive this year.

Stock comp is expected to be 5.4% of revenue. Stock comp dollars to approach $2 billion this year and fall YoY in 2024.

Chai further added that Uber’s long term guidance targets are meant to be “exceeded on the bottom line.” Under promise, over deliver.

5. Call & Release Highlights

Mobility:

Fee surges fell significantly QoQ as Uber attracted more driver supply and a better marketplace balance. The added supply also cut wait times for riders. That was given credit for outperforming engagement and results overall.

More supply also has meant lower fees for riders. These fees are down 7% from the Q2 2022 peak.

In places like Brazil, trips per consumer set a new record at 7.7 per month.

Uber Taxi launched in countries across Europe and South America. This is a wonderful top of funnel for bringing new supply and demand into the platform to juice cross selling. 100% of New York City’s taxi supply is now plugged into Uber. It wants every cab in the world on its network over the long haul.

Uber Reserve (pre-book a ride) is now in 50+ countries. 20%+ of Reserve usage is for airport trips. Uber added walking ETAs for its Uber Reserve product in airports to make wait times and canceled trips less frequent.

Importantly, UCAN is seeing a needed acceleration in demand following a slower recovery vs. other regions in 2021 and 2022.

Uber held market share in UCAN despite materially reducing incentives by 42% YoY and 12% QoQ.

New mobility products are now at a $6 billion annual booking volume run rate -- up 100%+ YoY.

UberX Share (share a ride for lower cost but still high driver earnings) is “expected to be the newest billion dollar volume product.”

“Category position trends across most major markets are constructive… With global scale and deeper local density, we are increasingly separating from smaller regional competitors both on driver preference and Mobility breadth.” -- CEO Dara Khosrowshahi

Eats/Delivery:

Gained market share in 9 of its 10 largest countries of operation.

Added PetSmart in the USA, Coles in Australia (2nd largest grocer there), Benavides in Mexico and all locations under the regulation of the Liquid Control Board of Ontario to deliver alcohol.

Growth accelerated throughout the quarter and into April as Uber lapped Omicron variant comps.

Advertising and marketing/incentive cuts are fostering the rapid operating leverage for this segment.

The tweaks it made in UCAN to lower cost per trip in 2022 are now being rolled out globally.

Added a new workflow to cut order defects and refund and appeasement (R&A) charges. This is the largest source of customer churn; just a 10 bps improvement of R&A rates equates to another $15 million in pure profit.

Took a full 10% of new market share in Japan during the quarter. Wow. It also gained several percent in the UK.

Eats is now profitable in 15 of its 20 largest markets and at the company’s long term margin target in 6 of the 20 markets.

Freight:

Uber Freight continues to deal with macro headwinds that are leading to this segment’s underperformance. Supply chain issues that plagued the sector in 2021-2022 have now more than normalized and morphed into supply gluts. This is weighing on rates. Still, Uber “really believes in the segment” and did not hint at wanting to spin it off. It sees the freight industry at a “cycle low.”

Taking Care of Drivers:

Driver and courier earnings rose 26% YoY due to robust engagement growth and despite falling incentives. Driver engagement is up 15% vs. pre-pandemic levels and 10% YoY.

Uber has 5.7 million drivers and couriers on the platform vs. 5.4 million QoQ.

Leadership continues to see Uber as the “driver platform of choice” with its share of supply steadily rising in most major markets.

Driver churn fell “substantially.”

New app:

Uber’s newly updated app makes Eats and Mobility cross-selling all the more intuitive. This is how it now gets more Eats customers from Mobility cross-sales than all social marketing channels combined. This means lower customer acquisition cost and more efficient growth vs. mono-product competition.

Advertising:

Uber now has 345,000 advertisers in its network which is up 70% YoY.

Added a new car top ad product to augment driver earnings.

Added a post checkout ad format for non-restaurant merchants.

Journey ads continue to fetch premium cost per impression considering Uber’s young, affluent demographic.

Scale:

The main factor contributing to the firm’s outperformance is global scale giving it a data advantage to more precisely train its algorithms on stakeholder preferences. That paired with deeper product breadth to offer it more cross-selling potential vs. competition is turning into a delicious recipe for success.

Debuted a new neural network to more precisely predict estimated time of arrival (ETA).

Created a new vision algorithm to process driver documentation more quickly and so to cut onboarding time.

Lyft:

“The tradeoff between category position and profitability is a false one and I hope we’ve demonstrated that over the last 7 quarters… Lyft is a strong brand that isn’t going anywhere… they’re looking to price competitively with us. That sets us up to compete on brand, service, ETA and reliability. That’s constructive.” -- CEO Dara Khosrowshahi

Uber One (Subscription Program):

Uber One continues to set new membership records as expected. It will look to add “experiential benefits like priority dispatch” eventually to complement discount-based perks. Uber One users contribute 4x more revenue and churn 15% less frequently. Today, Uber One is 27% of Uber’s total bookings vs. 25% QoQ. It sees this getting over 50% in the coming years. This is the most exciting part of the investment case. Uber One clearly builds ample consumer loyalty to allow it to sidestep some of its previous marketing needs.

6. Our Take

This was Uber’s third excellent quarter in a row. Brisk core demand growth paired with successful product expansion and operating leverage is a wonderful concoction. It’s very convenient to be a verb and enjoy the organic virality that coincides. There are no weak spots to point out here, just highlights to celebrate. Leadership has transformed Uber from a bloated, lost enterprise into a lean, mean, share taking, profit inflecting machine. Great results.

Thoughts on valuation at current levels?

Great data layout and metrics!