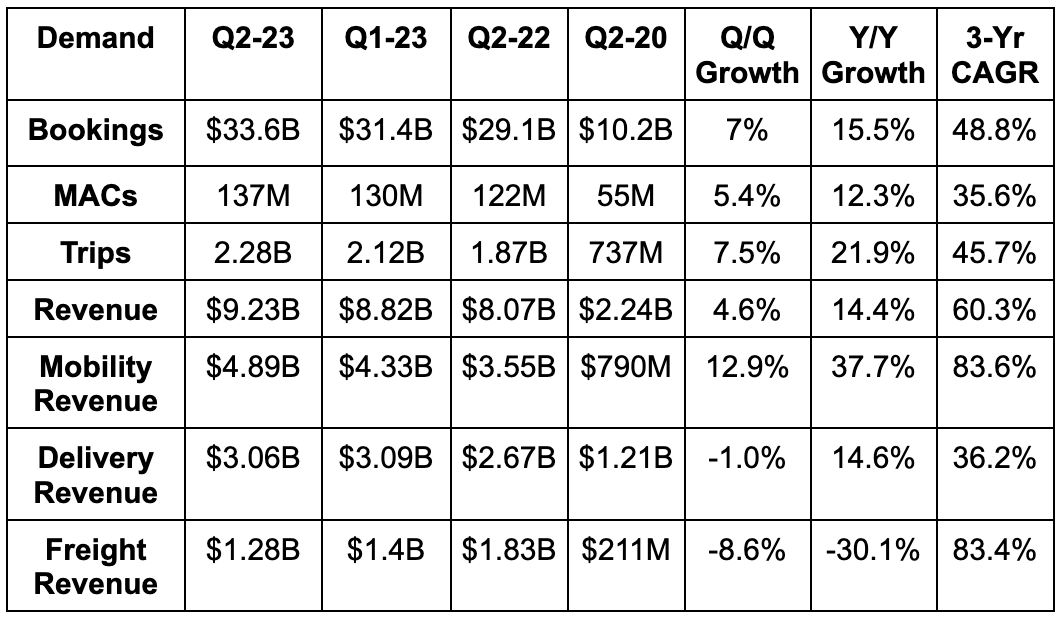

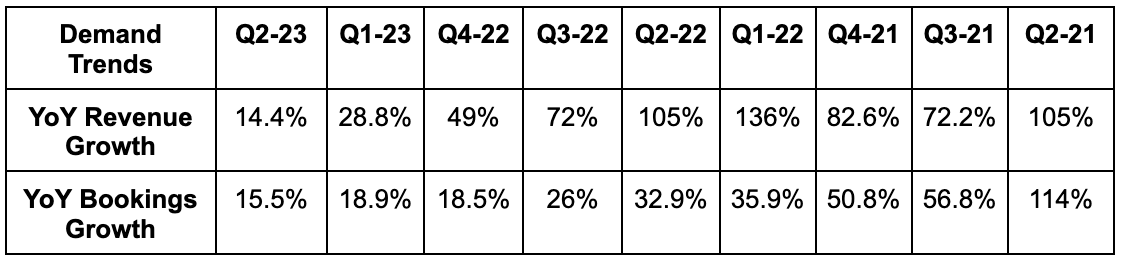

1. Demand

- Beat bookings estimates by 1% and beat its bookings guidance by 0.3%.

- Missed revenue estimates by 1.1%.

- Met 20%+ Y/Y trip growth guidance with 21.9% Y/Y growth.

Demand Context:

- Mobility take rate was 26.6% vs. 28.9% Q/Q (seasonality) & 29.3% Y/Y.

- Delivery take rate was 19.6% vs. 20.6% Q/Q (seasonality) & 19.6% Y/Y.

- Bookings growth was 18% Y/Y FX neutral (FXN).

- Mobility bookings up 25% Y/Y (28% FXN).

- Delivery bookings up 12% Y/Y (14% FXN).

- Freight bookings down 30% Y/Y. Revenue per load and volume headwinds hitting the sector and segment for Uber.

- Revenue rose 17% Y/Y FXN.

- Mobility revenue up 38% Y/Y (40% FXN).

- Delivery revenue up 14% Y/Y (17% FXN).

- North America revenue up 4% Y/Y, LatAm up 30% Y/Y, Europe up 31% Y/Y, APAC up 31% Y/Y.

- Trips per active platform consumer of 5.6 rose 9% Y/Y.

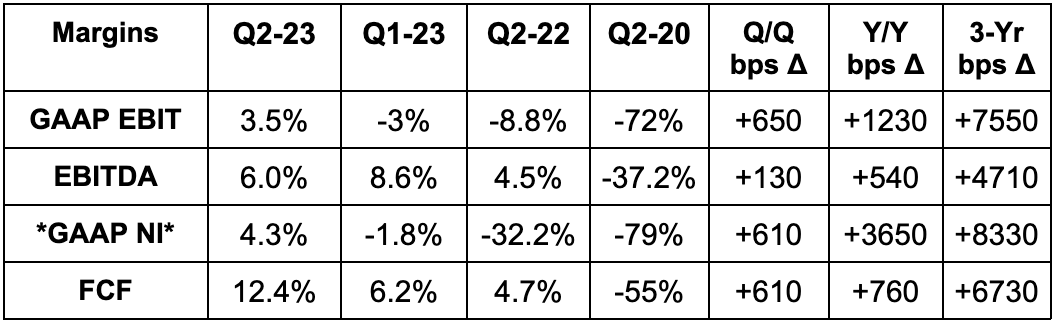

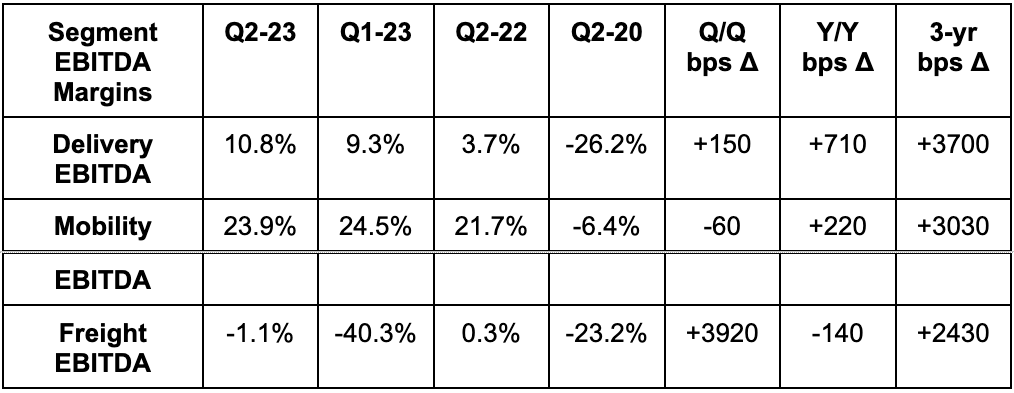

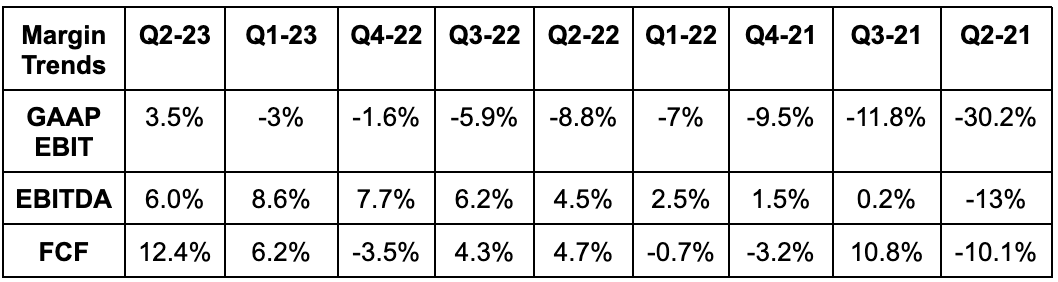

2. Margins

- Beat EBITDA estimates by 8.5% and beat its EBITDA guidance by 11.3%.

- Beat GAAP EBIT estimates by a whopping 165%.

- Beat FCF estimates (limited sample size) by 86%.

- Beat -$0.01 GAAP EPS estimate by $0.19.

Margin Context:

- *GAAP net income was helped by equity investment gains and hurt by equity investment losses in the Y/Y period. GAAP net income was still positive without the equity investment help this quarter.*

- FCF for this business is somewhat lumpy.

- Incremental EBITDA margin as a percent of gross bookings (not as a % of revenue which would make it look much better) was 12.2%.

- Corporate G&A + Platform R&D fell 10 bps as a % of bookings.

3. Next Quarter Guidance

- EBITDA guidance beat estimates by 8.3%.

- Bookings guidance beat estimates by 1.5%.

- Freight bookings to reverse negative Q/Q trend with growth set to be 0%.

Cash flow next quarter to be hit by a more than $400 million one time tax payment to the U.K. Tax Authority due to its business model change in that country. As a reminder, these changes included:

- Charging riders directly vs. previously charging drivers a service fee as the U.K. determined drivers were employees and not contractors.

- Began collecting tax on its fees charged. This direct tax collection role had the impact of reducing driver earnings and raising Uber’s take rate.

“We expect to demonstrate further operating leverage in the coming quarters.” -- Outgoing CFO Nelson Chai