“Upstart has an opportunity to become one of the largest and most impactful fintech companies in the years to come. You will see us move beyond auto and consumer loans but we are so excited about the opportunities within these two categories that our near term focus is there.” — Co-Founder & CEO Dave Girouard

a. Demand

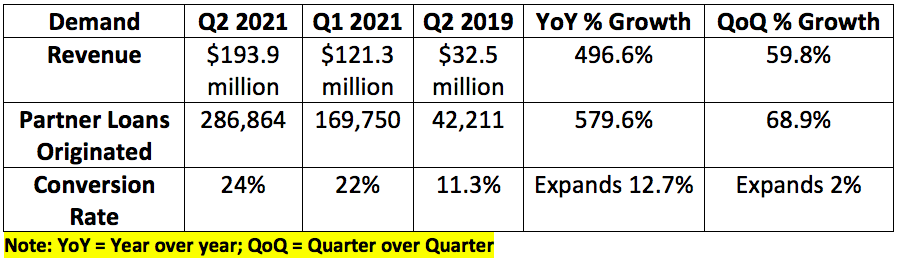

Upstart guided to $150 - $160 million in revenue for the quarter. Analysts were expecting $157.7 million in revenue. The company posted $193.9 million in revenue thus beating the high end of its internal guide by 21.8% and analyst estimates by 22.9%.

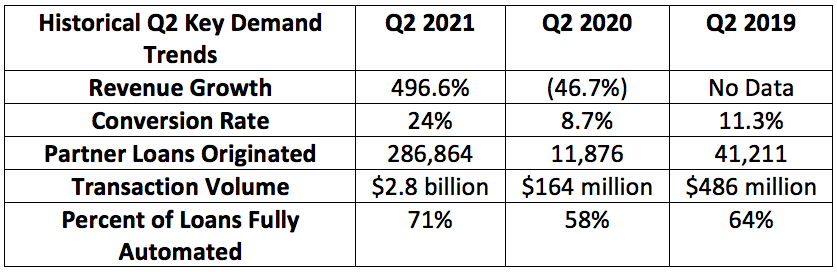

Note that demand for loans collapsed in Q2 2020 as a result of the pandemic halting economic activity. This made the year over year revenue comparison uniquely easy for Upstart. Because of this, I compared Q2 2021 results to Q2 2019 instead. The growth was still remarkable.

b. Profitability

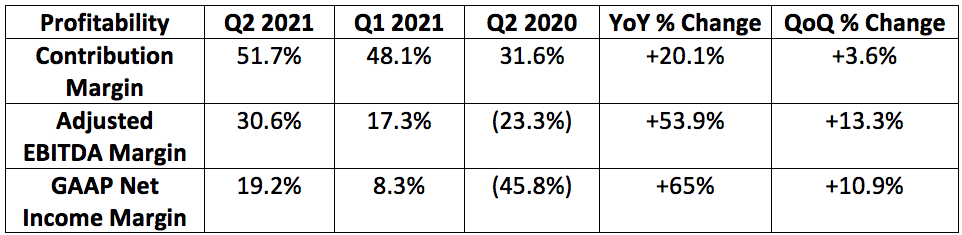

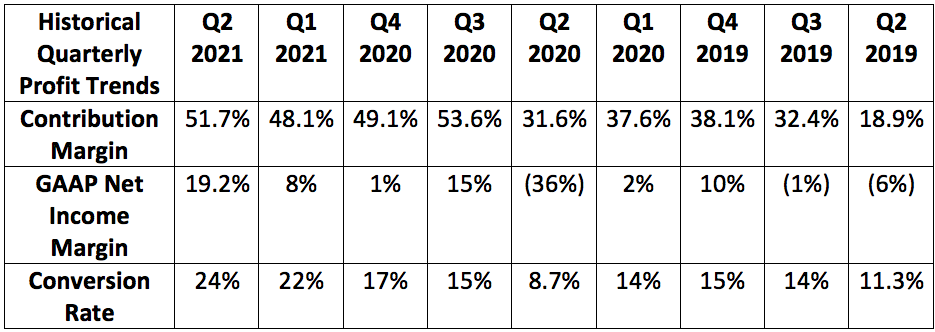

Upstart guided to a 44% contribution margin. It posted a 51.7% contribution margin thus posting results 7.7% above consensus.

Upstart guided to $21 to $25 million in net income. It posted $58.5 million thus beating the high point of expectations by 134%.

Upstart guided to $23 to $27 million in adjusted EBITDA. It posted $59.5 million thus beating the high point of expectations by 120.4%

Analysts expected Upstart to earn $0.25 per share. It earned $0.62 thus beating expectations by 148%.

Upstart expects its 51.7% contribution margin to fall slightly in the coming quarters as it continues to accelerate spend. Still, CFO Sanjay Datta explicitly told investors during the call that elevated margins are a more durable trend than the company originally thought.

R&d remains the spend priority here, rising 66% year over year.

Last quarter, Sanjay Datta told investors a 22% conversion rate was higher than the company wanted it to be. He said he was taking this as a clear sign for Upstart to lean even more aggressively into growth and marketing. It can afford to see conversion rates well below 22% in exchange for even more growth. The conversion rate rising further to 24% this quarter means Upstart has more productive dollars to spend on growth — even after a 50% sequential boost to marketing spend.

It’s exciting to think where this company can be as it rightfully spends more and more on market share.

c. Guidance

For the third quarter:

$205 to $215 million in revenue vs. $161.6 million expected by analysts

45% contribution margin

$28 to $32 million in net income

$30 to $34 million in adjusted EBITDA

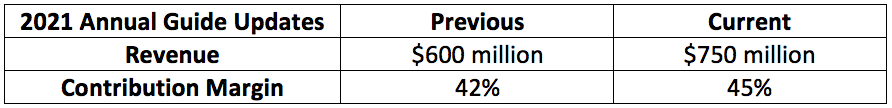

Current 2021 guidance:

It’s important to note that just 3 quarters ago, Upstart was expected to generate roughly $350 million for 2021. It has now raised that guide by 114% while also seeing very positive contribution margin momentum. To be candid, I have never seen such a rapid and dramatic rise to revenue estimates for a company of this size.

d. Management Commentary

CEO & Co-Founder Dave Girouard

Upstart now has 25 banking and credit union partners vs. 18 sequentially and 10 at the time of its IPO less than a year ago. It also now boasts 150 institutions as pooled loan buyers.

The company added 0 incremental balance sheet risk in the period as all loans were funded by banking partners and institutions.

Upstart saw another incremental rise in its approval rate during the quarter due to removing a limiting step-function that was causing friction in its algorithm.

The company’s repeat-customer loan volume doubled sequentially.

“For the first time, one of our bank partners decided to eliminate any minimum FICO requirement. This demonstrates a shift to more inclusive lending and more confidence in Upstart’s algorithm. We are hopeful a second bank partner will soon follow suit.” — Girouard

The company officially debuted a Spanish language version of its product. This is a first of its kind in the space.

“We continue to have a number of model upgrades coming to further improve rates, approvals and friction.” — Girouard

Auto lending updates:

In January Upstart offered auto loan refinancing in 1 state. It’s now in 47 states or 95% of the USA population.

Upstart auto saw a 100% improvement to its conversion rate since the beginning of the year.

Upstart now has 5 bank and credit union partners signed up for auto lending.

Prodigy has doubled its dealership footprint since the beginning of the year.

Upstart plans to offer its first secured auto loan product by year’s end. It’s predominately doing refinancing at this point in time.

“Upstart has a robust and growing list of lenders in the pipeline for the second half of 2021.” — Girouard

“We have built a very strong core with which we plan to launch several new products and services in the years to come.” — Girouard

These results are despite a macro loan demand headwind coming from stimulus checks and rising savings levels. That headwind should fade going forward.

CFO Sanjay Datta

“We continue to see our strongest growth in direct to Upstart channels. Client concentrations continue to decline across the board.” — Datta

There is still more institutional supply for pooled Upstart loans than the company can provide in demand.

Upstart’s guide does not consider any more improvement to economic activity throughout the rest of the year.

e. My Take

This was another remarkable quarter from Girouard, Datta and the Upstart team. There is absolutely nothing negative to pick at. It cannot be overstated how impressive raising its 2021 revenue guide from $350 million to $750 million in three quarters truly is. To see that complemented by a precipitously rising margin outlook is simply icing on the cake.

I know it went well when every single analyst question began with a congratulations to the company’s leadership. I have no interest in doing anything but adding to my position going forward.

Thank you for reading!

How much % does their largest customer contribute to their revenue?