Introduction:

Responsible access to affordable credit is a key ingredient for economic prosperity and quality of life. Without it, monumentally important decisions like buying a car, a home or even a medical procedure become cost prohibitive for many.

Despite the high stakes, loan decisions are still largely based on a 40-year-old credit scoring system with anywhere from 8 to 30 basic variables mixed in for good measure. This largely acts as a static series of if/then functions and lacks any form of flexibility or context. The overarching result is costly inefficiencies and poor outcomes for borrowers, lenders and institutions. There’s a reason why the loan industry gets the “predatory” classification it so frequently receives.

The antiquated underwriting system only provides prime credit access to 48% of Americans despite 80% of the U.S’s borrowers never having defaulted on a loan. That missing 32% of our population is often called the “hidden prime” and is a main focus for many next-generation lenders. If an entity can uncover who in that 32% is truly worthy of prime credit, it can offer huge incremental volume and profitability with virtually no added risk.

This is exactly where Upstart is focused.

In light of the credit issues that plague our society, Dave Girouard took his experiences building software with Google and in 2012 founded Upstart (UPST) “to increase access to credit and lower the cost of borrowing for millions.” To do so, the company developed Machine Learning (ML) algorithms which inject convenience-fostering automation and data science into the loan process to unlock a more granular, true sense of risk. Nearly ten years into its journey, Upstart has seen fantastic financial and outcome-based success and I believe it’s just getting started. Let’s begin.

1. The Problem with Legacy Credit Underwriting and Credit in General

Legacy credit models are typically based on a “FICO+” system that calculates a 3-digit credit score to arrive at an “Approved/Rejected” decision. This three digit credit score is based on five weighted variables — 35% payment history, 30% debt, 15% length of credit history, 10% new credit and 10% credit mix. While our world has dramatically evolved since the score was invented in 1989, this primary analysis tool for underwriting has not followed suit.

- FICO Score = Fair Isaac Corporation Score. Fair Isaac Corporation is a 70-year-old company that has become a ubiquitous player in measuring credit risk.

FICO+’s entirely rigid and rules-based system lacks appropriate usage of alternative data to improve the risk calculation process — this creates significant issues. Worthy borrowers are frequently rejected or charged in excess of the prime rate for which they should rightfully qualify. Unworthy borrowers are often approved (which sets these individuals and the lenders up for failure) while traditional prime borrowers pay more in interest to subsidize the losses from misguided approvals. So? All of this translates into loan books that are both smaller and less profitable than they could be with better credit analysis. To put it plainly: Banks and credit unions can economically reach more customers and make more money.

It’s also interesting to point out that 50% of the FICO score is calculated based on the amount of repayments that we’ve made. This inherently discriminates against new immigrants as well as younger borrowers (both without established credit histories) and again leads to a less-than-efficient credit decision for millions of Americans. Partially as a result of all this, the average American is $29,800 in debt (per Northwestern Mutual) with 16% of Americans paying more than half of their income on debt servicing.

“Essentially anyone who isn’t born in the U.S. with money has a hard time getting access to credit before building up a long and rich credit history which limits availability when most needed.” — Co-Founder/Chief Product Officer Paul Gu

To combat these issues, lenders require new ways to enhance access and affordability — they need a risk model upgrade built for today’s consumer. Some entities — really just Bank of America, J.P. Morgan and the other banking giants — have the internal research and development (R&D) teams and budgets in place to try and build these systems internally. Most do not.

“Chase — our primary competitor in New York — has an R&D budget the size of our entire asset base… we don’t have the budget to invest in technology like that.” — Chief Retail Banking Officer at Apple Bank Jim Matera

Enter Upstart.

2. About Upstart

a) The Basics

The core attributes of Upstart are enhanced automation and AI/ML-powered risk underwriting built into the legacy loan process. Especially within lending, proper assessment of risk requires several layers of extensive data extraction, analysis and correlation that’s not being broadly practiced today. Upstart makes utilizing these tools exponentially easier and more profitable for banks and credit unions.

Before we dive into its produce-suite, there are some quick basics to cover.

Upstart is not a bank and it has indicated that it will never be a bank. It has no interest in originating loans or in retaining a large portion of the loans it sources on its balance sheet. So what does it do? Upstart is an unsecured personal loan demand aggregator. It drives traffic to its site — Upstart.com — and re-directs that traffic to a lending partner or to capital market institutions and associated investors. Importantly, loan offers from banks and credit unions are always partner-branded to ensure appropriate data sharing and brand building.

“The ability to integrate our brand and logo earlier on in the process so that new members recognize us was big.” — Abound Credit Union Chief Lending Officer Chuck Eads

Upstart-sourced loans — most of which are for consumer debt consolidation and re-financing other expensive debt — typically range from $1,000-$50,000 in size with 3-5 year terms and annual percentage rates (APRs) of 6.5%-35.99%. The company doesn’t target the largest 4-5 banks in the nation, but instead the smaller lenders who have much more to gain from Upstart’s efficiency-elevating solutions.

Why help lenders instead of trying to displace these incumbents? Banks have two key advantages over non-banks — lower cost of capital and generally better consumer trust, relationships and data. Upstart uses this member data to feed its ML engines and the lower cost of capital to enhance margins and demand. The firm enjoys a 15% higher conversion rate every time it lowers an APR offer by 1% — banks and credit unions are a contributing piece of this puzzle.

“We’re don’t have the same skills as banks but we’re very good at building technology and supporting our partners.” — Co-Founder/Chief Product Officer Paul Gu

By making the explicit choice to align with its partners rather than to compete & displace them, Upstart is able to merge a set of advantages not often enjoyed in tandem within financial technology. It gets the lower cost of capital and the treasure chest of first party consumer data that its partners, in aggregation, provide which brings a better way to leverage these assets.

b) The Market

Per TransUnion — there is roughly $4.2 trillion outstanding in total American credit. Unsecured personal loans — Upstart’s primary niche — is the fastest expanding piece of consumer lending with growth rates of 8% in the 12 months leading into the pandemic. Standard & Poor’s expects this market to double from 2021 to 2024 representing an accelerated 26% CAGR over that period. Today, the market sits at $118 billion in size and — assuming Upstart does roughly $12 billion in 2021 originations — the company commands a (quickly growing) 10% market share position. As its share continues to rise, growth could become more difficult to realize — so it’s actively expanding into other areas.

Auto lending will be the next area of focus for Upstart. There are early signs of encouragement here, but it remains a nascent endeavor. This market sports a TAM of $625 billion meaning if (big if) Upstart’s entrance is successful, its opportunity grows by more than 5X.

“A few months back, we could count on one hand the dealers using us — now we have sales members closing five dealerships within weeks of joining. Upstart auto retail is on track to repeat or exceed the funnel gains and value-add that the unsecured personal loan product delivered… the software creates a connecting front-end to the unpleasant car buying experience that we call the Shopify of the auto-retail market.” — Co-Founder/CEO Dave Girouard

Beyond auto, Upstart is actively developing products to serve credit card originations ($363 billion TAM), mortgage originations ($2.5 trillion TAM) and more. Two things are true: Upstart’s unsecured personal market is large and the market could become exponentially larger if the company’s new segments can find traction.

3. Upstart’s Products

The main ingredient of Upstart’s product suite is its ability to uncover the aforementioned Hidden Prime borrower more effectively than others are able to. It does so through use of traditional and alternative data that is amassed, organized and contextualized via its data science capabilities. This Hidden Prime represents a massive opportunity of up to 32% of Americans who have never defaulted on a loan, yet can’t access prime credit rates. The company’s raison d’etre is identifying these non-traditionally-worthy borrowers to grow bank volumes without raising loss ratios and to boost equal access in the lending space for consumers.

To accomplish this, Upstart has created a series of ML models capable of digesting vast amounts of data and automating and/or augmenting every piece of the loan decision process. In aggregation, these models form Upstart’s proprietary AI platform and the bulk of its value proposition.

a. The Credit Underwriting ML Model

The company built an ML model that uses and effectively correlates more than 1600 variables on a borrower. This includes things like alternative data on transactions, macroeconomic signals, educational performance and occupational information which aren’t being commonly used by competition — but can greatly improve risk assessment accuracy. This credit model can be accessed by lending partners directly through Upstart.com or can be licensed and integrated directly into their apps and websites with Upstart’s white-label product version.

One may question how imperative the 1598th and 1599th variables actually are to the credit decision — and that skepticism would be well placed. No single variable is all that important in isolation — you can remove any one of your choice (including the FICO score) and have the same level of predictability within Upstart’s software. The real progress comes from the difficult process of teasing out and relating 1600 variables in tandem, in real time and with seamless scale. That’s what this ML model does and how Upstart has approached uncovering America’s large Hidden Prime cohort.

According to the SVP of Business Development Jeff Keltner, “you have to eclipse the effective use of 100 variables to realize half of the explanatory power of our model” — more sophisticated legacy underwriting models struggle to assign meaning to less than half of that variable benchmark. This is where the edge forms around Upstart’s technology.

When transforming the risk-calculation mosaic from 30 inputs to 1600, borrowers eligible for prime rates that have been previously rejected magically start to appear — but not with commensurately higher loss rates. Unsurprisingly, more data here leads to improved decision-making just like it does in every other industry.

The company has taken a slow and calculated approach to folding relevant variables into its risk assessment. Eight years ago, Upstart was tracking 23 variables but had no first party training data — so was entirely reliant on 3rd party data vendors. Back then, legacy versions of its AI model were predominately based on logistic regression and solely predicted defaults in a binary fashion.

This modeling technique featured many of the same shortcomings of incumbent alternatives — rigid, rules-based and lacking needed flexibility. Since then, the company has aggregated 10.5 million repayment events to train its underwriting system and has added far more sophisticated modeling techniques. Specifically, it now leans more heavily on stochastic gradient boosting, root mean square deviation (RMSD) and even neural networks thanks to its swiftly growing data scale (which this method requires).

- Stochastic Gradient Boosting definition: This modeling technique combines individual models to form a single, more predictive model. The simple models are referred to as weak models/learners that are strengthened via model combination and collaboration.

- RMSD definition: Assesses the variation between sample values by calculating the standard deviation of how much these data points differ from a regression line.

- Neural Network definition: An algorithm model attempting to emulate the complexities of the human brain and nervous system.

Upstart has upgraded its binary default capabilities to time-delineated default (probability of each individual payment being received). It integrated a host of other utility-building expertise like loan-stacking prediction and fee optimization to enhance partner and investor unit economics further.

- Loan Stacking definition: Taking out several loans over a short period of time before lenders can adjust terms to reflect the new loans.

“In 2016, we had a human-specified, rules-based system wrapped around some ML models — that’s it. Since then, we’ve iteratively gone to each part of the human-designed system and transformed it from rules-based to first an individual ML model and then proprietary AI. We’ve replaced most human specifications and assumptions and now have a stack of ML models feeding each other with each layer powered by our proprietary AI system.” — Co-founder/Chief Product Officer Paul Gu

For partners, Upstart’s platform is cloud native to ensure broad integrations with disparate bank and credit union technology stacks. This allows partners with franchise locations using different vendors to offer a uniform user interface (UI).

This credit underwriting model is the first and core product that the rest of Upstart’s platform is built upon.

b) More ML Models to Support Speed and Automation

Better risk assessment can work wonders in growing loan volumes without raising loss ratios — but that’s only one piece of the puzzle. Upstart also wants speed and automation wherever possible — not just within data collection. Accordingly, the platform merges the strengths of wildly sophisticated data science with a slick, intuitive consumer-facing interface. But this interface isn’t just pretty: It’s astonishingly utilitarian as well.

Upstart created a purpose-built ML model for powering instant verification of applicants and for uncovering fraudulent requests — this is embedded directly in the company’s underwriting product and helps to support more accurate pricing. A primary concern for lenders shifting their loan operations online is the rising rates of fraud and verification difficulties that inherently coincide. By creating a machine-based platform to automate this process, Upstart not only alleviates this fear but also fosters a more convenient borrowing process for the customer and therefore higher rates of conversion.

- Conversion rate definition: Offers accepted / rates quoted

This results in the best of both worlds: convenience-boosting digital automation and lower loss and fraud rates. What a wonderful win-win. Specifically, Upstart’s average rate of fraud sits at a low 0.3% of applications. It spiked in Q4-2021 due to an isolated incident that has since been resolved.

Thanks to the verification model, to get a quote and funding, borrowers need only to enter in the most basic of information. Upstart then automates the collection and entering of the rest of the needed data using its bank partners and agencies like TransUnion. These are the main 3rd party sources of data for the organization.

Upstart also offers a white-label servicing portal. By using another ML model to select the perfect payment date based on borrower liquidity, this product has been able to automate more than 90% of the repayments for Upstart-sourced and serviced loans. That help actively cuts operating and collection costs for the firm’s partners and investors.

Upstart’s servicing mission is to raise collection rates via determining which borrowers are at risk of impairment and to manage those losses through collection agencies. Servicing loans is a time-intensive process. For lenders without massive teams of people to do the tedious work, Upstart is becoming an ally in enabling input-cost-free servicing.

But wait, there’s more. The company offers a seamless, accessible reporting Application Programming Interface (API) that allows partners to track and tweak their Upstart-sourced loan budgets and performance. This also enables pre-filling of application data for current bank members to erode friction.

- Application Programming Interface (API) definition: APIs are blocks of code that enable software to perform various tasks. An API acts as the language that empowers access to data services, operating systems and other applications to create an end-product. A user interface (UI) is what the consumer sees and APIs are what the enterprise uses to build the UI and user experience (UX). Each model function that Upstart has built is an API.

Yet another Upstart model is built to optimize customer acquisition and lead generation. This allows for the reduction of variable costs and justifies more market share spending. As more partners license Upstart’s white-label credit API — and assume more marketing duties as a result — this product should become more popular.

Upstart has all relevant regulatory approval materials packaged and ready to go for any new partner in order to streamline on-boarding. Considering the intense regulations these institutions must adhere to, any help here is always appreciated. The company really aims to help lenders eliminate friction wherever possible.

In summary, Upstart is providing a full-service, end-to-end digital lending platform equipped with invaluable abilities. Here are the three core attributes I see for Upstart’s business:

- Optimizes the borrower acquisition process to limit input costs.

- Automates the application, credit decision, verification and closing processes to transform a days-long process into a minutes-long process without more fraud (also cutting input costs further).

- Offers superior credit underwriting to enhance access for consumers and profits for partners simultaneously.

d) The Evolution and Makeup of Upstart — Always Improving

One of the benefits of Upstart’s platform, like others leveraging AI/ML, is that it constantly gets better and more intelligent on its own. Thus far, the models have been trained by 10.5 million unique payment events used to help drive incremental improvements and efficiencies. Each new datapoint leads to model augmentation and new events are added by the minute.

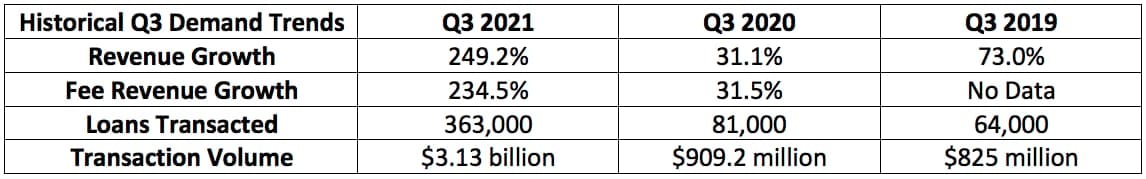

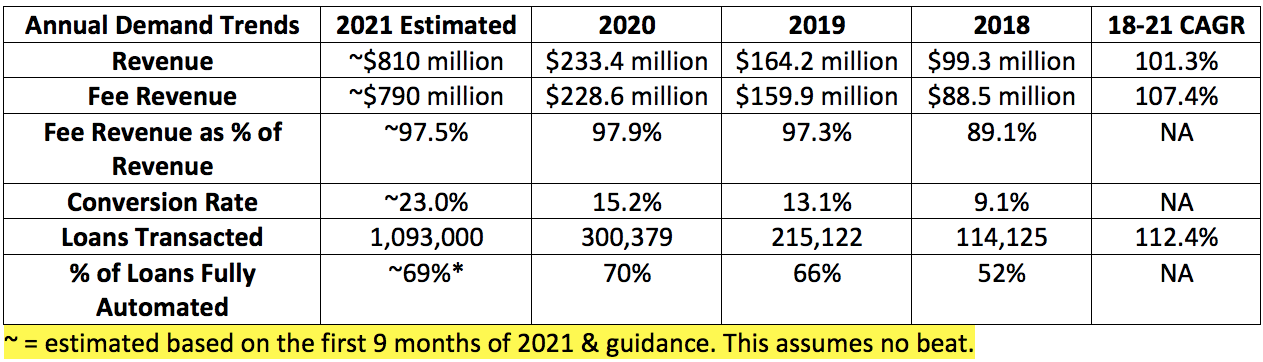

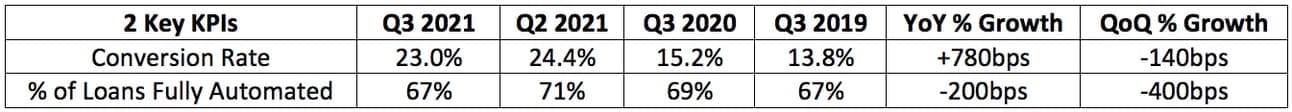

Evidence of this improvement is that Upstart’s conversion rate (a central Key Performance Indicator (KPI)) has improved by a factor of 10X over the last nine years. This positive momentum is powered by both lower APRs and more automation which are both direct effects of model seasoning and upgrades. Higher conversion rates justify more spending on growth thanks to that spending being met with more success. While the company has been able to precipitously raise the quality of its ML models and AI system, there remains ample opportunity for additional improvement:

“For an example of a model improvement, we used to have multiple ML models used in the loan decision but essentially just averaged outputs together. Now, it’s not human-specified logic but instead learning from the data directly to arrive at weighting to remove any human input. I won’t pretend that every corner of the code base is run intelligently, but it can and should be.” — Co-Founder/Chief Product Officer Paul Gu

We are just six years removed from the first Upstart-sourced loan powered solely by its models — this endeavor is like a promising elementary school student chock full of potential.

Upstart’s original base of models led to siloed data outputs requiring human assessment and a manual re-feed back into other ML models. Human involvement of any kind invariably paves the way for bias-carrying assumptions that will compromise the purity of the prediction. Most companies calling themselves “AI-based” feature dozens of these human-based controls. Not Upstart. Importantly, the company created its models in a way that allows its team to freely conduct rounds of trial and error for testing model improvements — with no disruption to the platform or day-to-day operations.

e) Why Bank and Credit Unions Don’t Build a Model Internally

While Upstart has a long head start on model maturity, one common question is why partners don’t simply decide to build a substitute to Upstart’s platform — rather than paying for its services? For the vast majority of these business, that notion is far easier said than done.

The three core pieces of any AI/ML model are training data (rows), variables (columns) and learning algorithms. These three pieces MUST be worked on in tandem to avoid one becoming a limiting factor for the other two. Data is worthless without an algorithm capable of contextualizing it and algorithms can’t uplift decision-making without an ample supply of data to tease out.

For banks boasting valuable first party data sets and lower cost of capital — yet little variable or model know-how — this is tough to pull off to say the least. According to co-founder (and model artist) Paul Gu — “institutionally it becomes difficult to manage improvements at a similar pace across all needed building blocks at the same time where no single block bottlenecks the progress of the rest. Doing so while showing proof points to justify the large financial investment required is even more difficult.”

One of the issues competitors face in trying to work on all three pieces in tandem is what has been termed a “kick-start” challenge. This arises from vast sources of third party alternative data not being readily available. This alternative data is vital to fostering what is known as feature engineering which essentially means taking two columns of variables and combining them to create another data column that is more predictive.

All loan operators do some form of this feature engineering, like dividing debt by income to get a debt-to-income ratio, but ample access to alternative AND traditional data frees firms to practice unique feature engineering that can actually differentiate an underwriting product via new, relevant correlations.

“There’s so much we can do to enrich our training data by feature engineering new columns.” — SVP of Business Development Jeff Keltner

Banks and credit unions are somewhat limited to their first party alternative data as customized, relevant third party sources aren’t all that common outside of Upstart. This is quite the challenge for model maturity and improvement — but Upstart’s rapidly growing network removes the bulk of this bottleneck.

To actually build internally, most banks and credit unions would need to hire large, expensive teams of data scientists to build from scratch with no guarantee the end product will be worth anything. The reality is, Upstart has a decade of crafting, training and refining its models and has demonstrated remarkably consistent success in doing so. Sure, you can try and build it from scratch, but with a lower probability of success and the large up-front costs, why do so? It is cheaper and easier for the vast majority of this industry to outsource the expertise.

“We don’t have a lot of ability to grow new products and services ourselves — we don’t have a deep technology bench or well-defined communications and lead generation strategies. We needed Upstart’s turnkey credit opportunity rather than building any of it ourselves on time and under budget… The start-up costs were extremely low.” — First Federal Bank of Kansas City Chief Sales Officer Barry Cooper

Upstart allows these partners to forgo the costs of building and maintaining an internal system and also opens them up to a few other key benefits. These participants gain from the marketing dollars Upstart spends on directing traffic to its own site. This traffic brings low-cost volume and often brand new customers to cross-sell for the referred partner. Furthermore, partners gain access to Upstart’s ecosystem of now 33+ total lenders. Each can tap into all of the available data from these participants and create an environment where smaller banks and credit unions are stronger together.

“We strongly believe that AI will rely on aggregation and scale. It does not make sense for every business in our industry to be developing their own AI engines and tools. It will not be scaled enough to be effective. We aim to be the common technology builder.” — Co-Founder/Chief Product Officer Paul Gu

The smallest 99% of lending institutions do not have the resources or inclination to take this risk — and with Upstart they don’t need to. Specifically, outside of the four largest consumer banks there are 5,200 FDIC-insured banks (with $8 trillion in total deposits) and another 5,195 federally insured credit unions (with $1.28 trillion in total deposits). These 10,600 entities are Upstart’s target market. There have been rumors from certain CNBC TV hosts of Upstart and Wells Fargo partnering — but I will believe it when I see it.

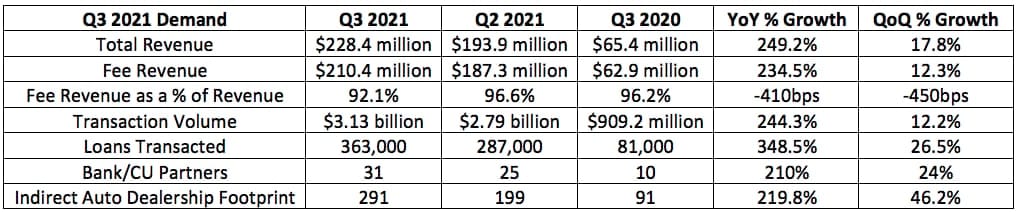

4. Upstart’s Revenue Model

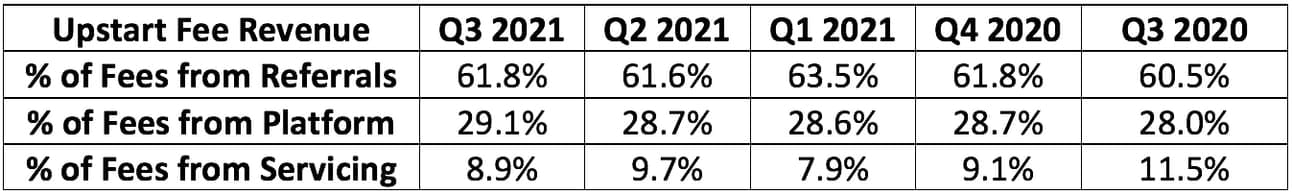

Upstart has three core revenue segments and a 4th — less important — channel. The vast majority of its revenue comes from referral, platform and servicing fees. All credit deals it offers through its site are on-behalf of a bank or credit union partner. Upstart does not offer loans on its own.

The company collects a one-time referral fee of 3%-4% of loan principal which is paid by lenders in exchange for the incremental volume. Referral fees are only collected when Upstart refers a loan from Upstart.com to a partner — not through white-label transactions.

Upstart charges 2% of loan principal for platform fees. This cost is incurred for usage of Upstart’s ML models for underwriting, fraud detection, verification etc. and is collected regardless of whether a loan is sourced through Upstart.com or the white-label credit underwriting product. Together, platform and referral fees equated to 90.9% of total sales in the company’s most recent quarter.

Upstart collects servicing fees in the amount of 0.5%-1% of the remaining loan principal. This fee compensates Upstart for the collection, processing, payment dispersal, reporting and customer support. Virtually all Upstart loan holders across all funding sources are serviced by the firm. This revenue segment has been growing as a piece of the overall pie in recent years and is the firm’s most recurring, visible line of business.

The contracts that Upstart signs are non-exclusive and generally last 12 months with automatic renewals thereafter. With Cross River Bank (CRB) specifically (an originating partner covered below), Upstart signs multi-year contracts with the most recent agreement set to expire this year.

The last revenue segment is net interest income and any changes in fair value adjustments of certain assets held on the balance sheet. This is the least compelling business line of the 4. I’m focused on fee revenue growth.

5. Upstart’s Approach to Growth — Prove Itself in Capital Markets

It’s quite difficult to convince banks and credit unions that the underwriting models they’ve relied on for decades are antiquated and ineffective. This created a Catch-22: Upstart needed to prove the model to lenders but couldn’t do that without a cooperative leap of faith from these lenders (good luck with that). At the beginning of Upstart’s journey, it could have waited and hoped for partners to trust its intimidating value proposition enough to retain loans — but instead Upstart chose a different (and I think better) path.

Capital market participants like hedge funds are generally less conservative and less regulated than federally insured institutions. These players also have a unique ability to absorb and distribute risk to other parties in a more seamless way than a bank or credit union. Knowing this, Upstart sought to grow and build a base of evidence using capital markets to fund its loans with less resistance. Doing so allowed it to embark on the processes of proving its value proposition and refining its models.

This has not only enabled fantastic revenue growth over the last several quarters, but also gave Upstart tangible data to take to current and prospective retaining partners. It’s one thing to ask for faith — it’s much more meaningful to demonstrate real success.

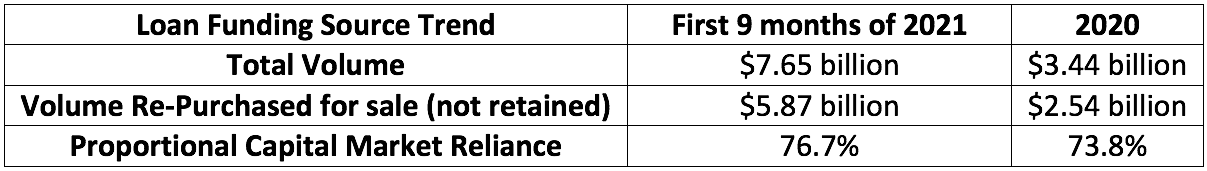

This process is still actively playing out. As a result, Upstart still leans heavily on these capital markets to fund the lion’s share of the loan volume it’s sourcing. Specifically, in the company’s latest full year of results — 77% of its loan volume ended up flowing through capital markets rather than being retained by a partner. We have not been updated since, but we will be on February 15th and the trend below depicts upward momentum of capital market reliance as of last quarter:

Ideally, I’d like to see this trend moving the other way — but the upward pressure from 2020-2021 is an effect of the pandemic’s impact on consumer loans fading away. This fostered a demand uncoiling for Upstart and triple digit revenue growth. That abrupt expansion was simply faster than partner retention adoption which prompted Upstart to seek out more funding from capital markets. The alternative would have been turning away up to 77% of its business.

The company fully expects this proportion of volume not retained to fall over time as it on-boards new banks and credit unions and as these partners become more confident in Upstart’s underwriting abilities. But this shift will take time and for now there are additional risks to consider when utilizing capital markets. I will discuss this in detail in sections 6 and 7. I expect upward pressure on capital market usage to revert in 2022 (not in Q4 2021) thanks to revenue growth normalization giving Upstart more time to find lenders for its newly sourced loans.

Revenue passing through capital markets is collected as fees for the company, but it can also be considered gain on sale revenue — this means revenue collected from sale of an asset above its holding value.

6. Where These Loans Go and Why That Matters

I’ve written a lot about Upstart loans either being retained by banks or sold through capital markets. Here, we’ll explore what that capital market process looks like, how Upstart’s reliance on these markets has trended, and why bank retention matters.

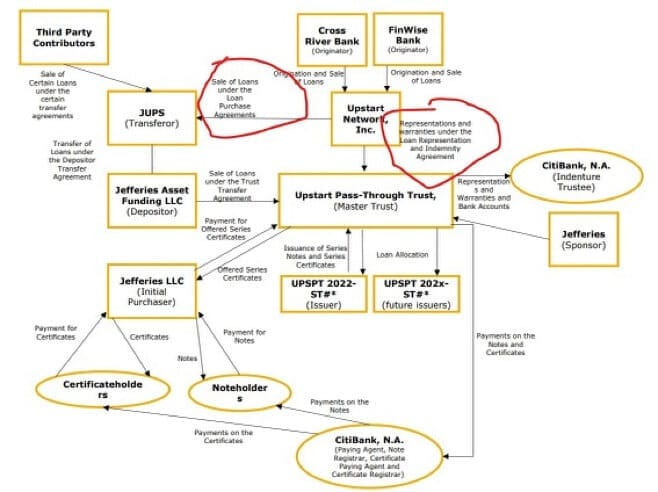

a) Capital Market Process

The origination of Upstart-sourced loans that are sold into capital markets is done by Cross River Bank (CRB), FinWise Bank (FB) and occasionally Customer’s Bank. CRB was Upstart’s first and only partner for the first four years of its existence while the start-up built large enough scale to effectively season its ML models. Since then, CRB and FB have split most of the origination duties for these capital market loan funding programs. CRB and FB are paid a loan premium fee and monthly trailing fees for serving as origination conduits. These fees are deducted from Upstart’s gross referral fees to arrive at net referral fees.

Days after origination, the loans are sold back to what’s called a Warehouse Trust Special Purpose Entity (SPE) created by Upstart and financed by its own warehouse credit facility borrowings. This vehicle exists to ensure immediate liquidity and then to expediently re-sell the pools of loans to institutions through capital markets. All in all, Upstart works with over 100 institutions to distribute its credit risk vs. just six in 2015.

Upstart re-buys these loans with purchase agreements already in place among institutional investors. These initial capital market transactions are called Whole Loan Purchases and are supported by subsequent payments from the correlated loan pool. After the assets are purchased by an institution, they are then distributed to its clients with Upstart continuing to service the loans for a fee. At this point, the loans are legally owned by the purchasing institution but Upstart must stay involved to guarantee certain warranties and representations relating to the transaction. This is mainly to shield institutions from risk of excessive holder claims via these 3rd party-sourced loans.

- Whole loan purchases definition: Directly buying large pools of loans.

Two main purchasers of these whole-loan pools are Jefferies and Goldman Sachs. The institutions often group the pools of whole loans into different tranches of risk — usually class A, B and C — to be securitized and made available to investors via Asset-Backed Security (ABS) transactions or Pass-Through certificate transactions. These two securitization transactions function very similarly to each other. Class A is the most senior tranche and has first claim on borrower payments. Once all three classes are compensated, any left over cash flow goes to the residual holder which is usually initially Goldman Sachs — but it will sell off as much of this residual exposure as possible.

- ABS and Pass-Through Transactions: These both offer a proportional, secured interest in a tranche of risk within an underlying pool of loans.

Whole loans are extremely illiquid and difficult to transact — this capital market process fixes that issue by creating liquid securities that can be freely traded. Again, Upstart remains involved throughout this entire process to service the loans and to continue providing assurances on loan information accuracy and representations.

Up until 2019, Upstart was doing all of this on its own (it was serving as the primary sponsor, master trust, depositor trust, issuer trust and grantor trust). This was to jump-start the capital market demand engine before it had enough data and proof of efficacy that its loans were priced for consistent profitability. Since then, Goldman Sachs and Jefferies have assumed the roles of primary sponsor and depositor trust for these securitization transactions with Upstart being required to maintain its co-sponsor status and master trust roles. Importantly, Goldman Sachs also assumed risk retention duties as part of the evolution thus freeing Upstart from balance sheet risk. By rule, the primary sponsor of these transactions must retain at least 5% of the overall credit risk — now Upstart no longer needs to do so.

For securitization transactions, Upstart creates a variable interest entity (VIE) to shield institutions (and itself) from excessive risk. A VIE is similar to a Limited Liability Company (LLC). These entities serve to split sets of liabilities and assets into each individual securitization transaction bucket so that only assets from those transactions can be used to cover those specific liabilities. VIE holders have zero direct recourse to the rest of the parent company’s assets. Third party interests in these consolidated VIEs show up as “non-controlling interests” on the company’s balance sheet.

- Variable Interest Entity (VIE) definition: An organizational structure in which an investor enjoys controlling interest but without the >50% of voting power. These vehicles generally need outside funding to support ongoing operations and are used as a means to protect the creating company from creditor claims on assets outside of the securitization transaction. If the company is deemed to be the primary beneficiary and primary value driver of this VIE — it must be consolidated and included on the full balance sheet.

There are a lot of moving pieces within Upstart’s capital market value chain that all need to effectively profit from these transactions. Residual cash flows simply must be consistently present — the gain on sale fee that Upstart collects relies on this being a reality.

b) Why Funding Source Matters

To reiterate, loan retention on partner balance sheets means that there is only one other entity profiting from Upstart-initiated transactions. This equates to more potential profits for both parties and, again, enables downward pressure on Upstart’s APRs — fueling higher conversion and more growth. Banks and credit unions also generally feature more consistent consumer loan demand across macroeconomic environments vs. capital market investors which represents another perk.

Shifting from capital market reliance to partner reliance will foster a lucrative network effect and more durable operations, but this transition has not yet happened. Over the last two years, Upstart’s capital market usage has actually grown — but again that was powered by the aforementioned demand backlog unwind fostering absurd growth.

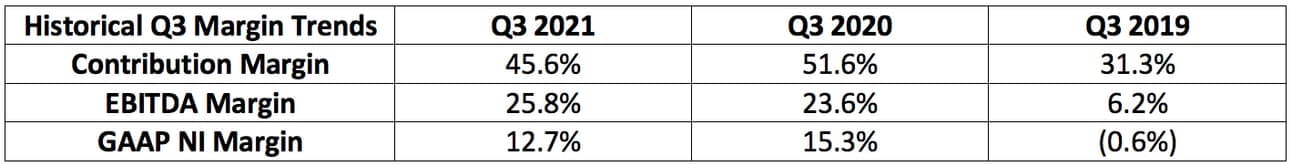

Upstart’s growth and fundamental success going forward depends on its ability to expand the volume that it sources while maintaining (or even growing) its take rate. As of this last quarter, the take rate (total fees/origination volume) sat at a hefty 6.1%. This take rate is objectively more defensible and sustainable when loans are being retained by bank balance sheets vs. sold through capital markets. Why?

First, the lower cost of capital that chartered banks and credit unions have access to makes Upstart-sourced loans inherently more profitable for a lending partner than a capital market investor. This reality helps defend and justify the 6.1% of volume Upstart is charging overall.

Second, there are simply more pieces of the value chain commanding a chunk of the profits when capital markets are utilized. The ultimate holder of any residual cash flow claims and every previous piece of the chain all need to realize profits that outpace the costs to participate. If this wasn’t the case, the capital market demand train would slow or Upstart’s take rate would compress. Delivering appropriate cash flows becomes more and more difficult as the value chain lengthens. Consider:

- Parties needing to profit when loans are sold through capital markets

- Originating bank

- Institutional Investors in whole-loan purchases

- Institutional sponsors creating tranches for pass-through and ABS transactions from those whole-loan pools.

- Class A, B and C Investors in pass-through certificates and ABS transactions.

- Residual cash flow holders.

- Upstart

- Parties needing to profit when loans are retained by banks

- Originating/retaining bank

- Upstart

It’s far easier for Upstart to satisfy profit requirements for one third party vs. five of them. With the macroeconomic backdrop is tightening — discussed in sections 8 and 10 — more bank retainment is not just preferred, but likely necessary for Upstart to continue commanding such favorable fees and rapid top line expansion.

More defaults (which Upstart is expecting as stimulus fades and has priced into its guidance) would dampen profits for capital market investors and retaining partners which could place pressure on Upstart’s financial performance. Rising defaults can certainly be combatted with higher interest requirements — but this would slow growth and conversion for the firm. Consistently delivering acceptable loan profits to all associated parties will be the key to keeping Upstart’s growth engine humming and the take rate handsome. That’s more doable when partners are retaining the loans but for now institutions are doing the bulk of the funding.

As an encouraging aside, capital market demand for Upstart-sourced loans has been a consistent theme over the last several years. Scarcity is a wonderful tool for take rate preservation and demand.

7. Quantifying Upstart’s Value Proposition

In the company’s value chain, there are three key stakeholders.

a. Consumer Value Proposition

First — and most importantly — is the end consumer. The loan industry is dauntingly competitive and largely commoditized at this point in time. The only ways a single lender can differentiate itself amid a sea of similar competition is via more approvals at lower APRs and more automation to speed time and minimize effort to funding.

“There is a powerful trade-off between more user work required and lower conversion. If we have to ask for a document, we can expect that roughly 20% fewer people make it through the process. There’s an efficient frontier of trade-offs between information gathered and work required. The real magic of our AI system is that we can choose between much better combinations on a better frontier for the consumer.” — Co-Founder/Chief Product Officer Paul Gu

Most loan disruptors and augmenters will say they’re better than the field — every single leadership team is incentivized to skew toward optimism. Luckily for Upstart, we have 3rd party data pointing to its edge. The Consumer Financial Protection Bureau (CFPB) released a study (utilizing its own grading techniques) on how Upstart loans perform for consumers vs. a high quality FICO-based model. The results were staggering.

On an apples-to-apples basis, Upstart fosters a 27% boost in approval rates for prospective borrowers while lowering their average APR by a full 16%. Unlike internal executive teams, CFPB has no financial incentive to say Upstart or anyone else is better within these categories, meaning we can take these conclusions very seriously.

Upstart borrowers refinancing credit card debt also enjoy an average FICO score boost of 43 points which actively lowers cost of borrowing for future loans. CFPB and other 3rd parties conduct quarterly studies of its rates and other KPIs vs. six close competitors — and Upstart’s leads have consistently grown over time.

“Over time, our ability to offer lower rates than our competitors has improved significantly.” — Co-Founder/CEO Dave Girouard

Seasoning its data science capabilities with more information and upgrading the modeling architecture are the two primary ways Upstart is able to pull this off.

According to management, they’re just “scratching the surface” of what its core ML engine can be. For example, two quarters ago it removed a limiting step function from its underwriting model and enjoyed an immediate boost to approvals with no impairment or loss rate impacts. There’s a long road of enrichment ahead even considering how far the platform has already come.

Beyond these apparent differentiators, Upstart also appeals to potential customers through more digital automation. The process of filling out an application took me less than two minutes. I filled out the form, and immediately got my rate and verification with an acceptance offer delivered to my phone. The offer — which I only requested for research purposes — was a soft credit pull, meaning it did not impact my credit score in the least.

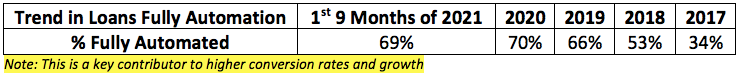

Perhaps as a result, more than half of Upstart-sourced loans are applied for through a smartphone and two-thirds of Upstart loans are fully automated (vs. 0% in 2016) — meaning no document uploads or manual controls needed. Paul Gu sees the fully automated ceiling at 99.7% of loans.

Complete automation boosts conversion rates by 2.5X without sustainably material impacts on fraud rates (there will be episodes). The company’s verification model is the crucial ingredient driving this momentum — it cultivates less friction, less abandoned applications and happier consumers.

Finally, customers enjoy zero pre-payment penalties and so can side-step future interest payments if they can afford to re-pay the loan at any point. A lot of these pre-payments are to re-finance debt in falling rate environments — the opposite of what we are in currently.

b. Partner Value Proposition

Moving Upstart-sourced volume from capital markets to partner balance sheet retention has required a significant amount of proof, and will continue to do so. Luckily, there’s abundant evidence pointing to the uniqueness of Upstart’s platform.

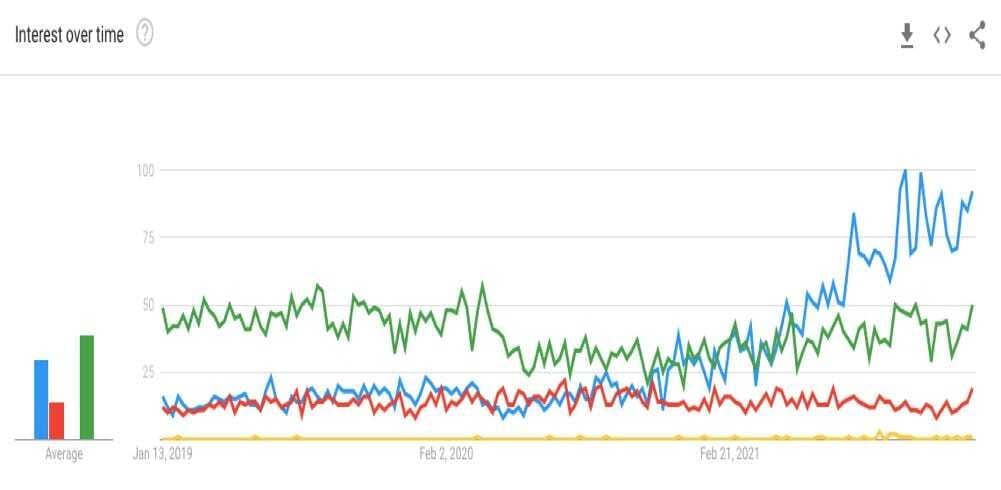

Upstart.com traffic has enjoyed precipitous growth in recent years and partners tapping into this demand aggregation channel immediately open themselves up to a wonderfully new customer base for up-selling more products. As Upstart management likes to put it, the company allows banks and credit unions to “lead with lending” when they’ve had to rely on lower value depository accounts to do so in the past.

For several of Upstart’s partners, this digital revolution has allowed them to expand their state footprint and to begin serving more Americans — again, all without being forced to absorb the higher rates of fraud common with other digital transformations. Beyond geographic expansion, many of Upstart’s newly on-boarded lenders did not previously have any unsecured personal loan business before Upstart — so this relationship fosters product suite fortification and also risk diversification.

Rather than the partners fronting the preliminary costs, growing pains and risks associated with building a brand new product internally, Upstart facilitates low-cost growth with a documented higher likelihood of successful results for most lenders. Especially within unsecured personal lending, where rates and margins are better but risk is far greater, this is a compelling proposition.

“We had no unsecured credit product until the Upstart partnership. Having chosen Upstart has allowed us to launch a new line of business” — Chief Retail Banking Officer at Apple Bank Jim Matera

“One of the reasons so many banks have not entered unsecured lending is due to the high costs of underwriting. Upstart helps avoid asking for document uploads and needing to find information which lowers costs… When you can reduce those costs, you can make it really economical. — CEO of Customers Bank ($18 billion AUM) Sam Sidhu

Again, if Upstart can identify which of these borrowers are truly credit worthy — its primary skill — there’s ample value to be created. Specifically, Upstart’s risk underwriting allows bank partners to juice their approvals by 2.7X without impacting their loss rate. But that’s not the only option for banks — far from it. The company’s risk assessment process offers a new layer of autonomy and flexibility allowing banks to customize and tweak their desired risk parameters and outcomes. Banks and credit unions can choose that 2.7X boost to approvals or they can choose stable approvals with a 75% lower loss rate… or something in-between. It’s entirely up to them thanks to the superior accuracy and intelligence of Upstart’s credit decisioning.

With financial institutions exhibiting an extremely wide range of risk preferences, this configurability is important. And again, forgoing the need to internally build means this new line of business comes with essentially zero fixed costs.

Overtime, bank partners have generally started with more conservative requirements and have lowered these requirements as Upstart’s performance proved the platform’s worth. The company has enjoyed near-zero partner churn to date.

“We tested four similar platforms but with Upstart’s, things just clicked. Our risk, compliance and legal teams got very deep into Upstart and were impressed with the structure and configurability of the program.” — Abound Credit Union CFO Jake Darabos

To point to more confidence in Upstart’s capabilities, bank partners are now even beginning to drop the minimum FICO requirements they’ve had in place for decades in favor of Upstart’s models. Two quarters ago zero partners had made this decision — six months later, four of them now have.

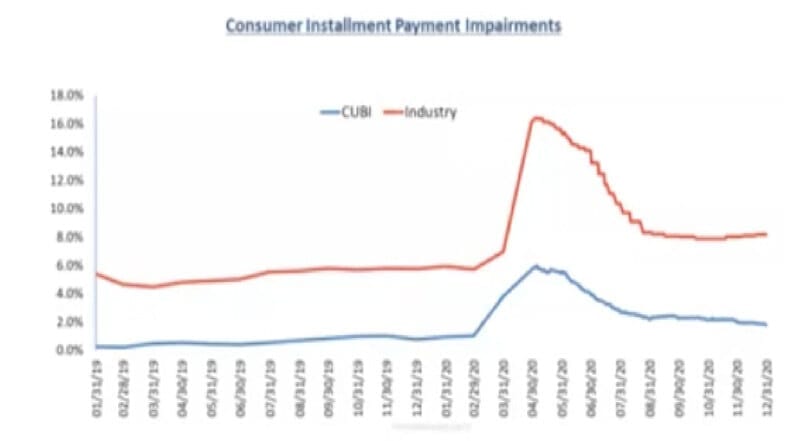

For a more specific case study, we have great data from Customers Bank depicting its own impairment rates vs. the industry during the pandemic. According to the bank’s CEO — Sam Sidhu — “if you were to pull out Upstart from the blue line (seen below) you would see that our relationship with Upstart did even better than the rest of our portfolio.” During this period, Customer Bank’s forbearance remained less than half of that of its competitors and it has since raised its Upstart loan budget multiple times.

- Impairment definition per the OCC: A loan is impaired when — based on current information and events — it is probable that an institution will be unable to collect all amounts due according to the original terms.

The incremental automation that Upstart infuses into the loan process doesn’t just appeal to customers, but partners and investors as well. This automation unlocks a lower borrower acquisition cost compared to direct channels — referral partners don’t even have to market their brand to enjoy the incremental business Upstart generates.

“Upstart’s model was able to deliver better returns, lower defaults and reduce fraud. We’ve grown the program to full-scale and it has continued to meet and exceed our expectations.” — Customers Bank CEO ($18 billion in AUM) Sam Sidhu

This expedited process also lends itself to Upstart-sourced loans carrying a net promotor score (NPS) of +81 which has risen from +79 when the company went public. The metric compares quite favorably to a mean of +30 for our nation’s largest banks offering competing products. For an individual example within a First National Bank of Omaha (FNBO) pilot run, Upstart-sourced loans carried an NPS of +83 while approval and loss rates both handsomely exceeded FNBO’s expectations.

Like several other partners, the company has now shifted from a small pilot program to using Upstart nation-wide. This is a top 100 bank in the U.S. and offers an anecdotal example of a consistent theme of Upstart over-delivering on its promises. For even more evidence of happy borrowers, with 25,000+ reviews on Trustpilot, Upstart sports an average rating of 4.9 stars out of 5.

Superior customer satisfaction inherently leads to more loyal customers and thus a higher likelihood of partners cross-selling other products. Upstart’s average borrower is also 28 years old and brand new to borrowing, meaning these loyal customers can contribute to bank success for decades, not years. This is also why it’s important to me that Upstart isn’t trying to be a bank — it doesn’t compete with partners for this cross-selling opportunity but instead uses its intrigue to bolster the value that it can provide to the ecosystem. If lenders want all of this technology and utility licensed for their own sites, Upstart’s white-label credit model is available for purchase as a stand-alone product.

And again, partners benefit from Upstart’s servicing model automating a large portion of collections as well as its lead-generation model lowering borrower acquisition cost.

“We’re letting you do the servicing so there was really very little investment up-front to get into this line of business. We did not have the servicing capabilities to launch this ourselves.” — Chief Retail Banking Officer at Apple Bank Jim Matera

The perks continue. Strict regulations that banks and credit unions must adhere to include a law called the Community Reinvestment Act (CRA). This law requires that certain financial institutions make minimum levels of geography-based investments — including in low and moderate income (LMI) communities. According to Nat Hoopes (Upstart’s VP of Public Policy), lenders commonly fulfill CRA requirements via purchasing loans from other institutions that have already met minimums in a certain area. Originating a CRA-qualifying loan directly is far more profitable for institutions than doing so through another organization — and Upstart can help create the needed direct demand to avoid this indirect scenario. How?

Upstart’s platform reaches underserved communities at a rate of 28% while traditional credit vendors do so at a rate of 16% — 59% of the firm’s loans are also to protected classes which is well above the national mean. It fosters large APR reductions and approval spikes for every single one of these protected classes. Expanding access and simultaneously boosting margins — that is the essence of Upstart.

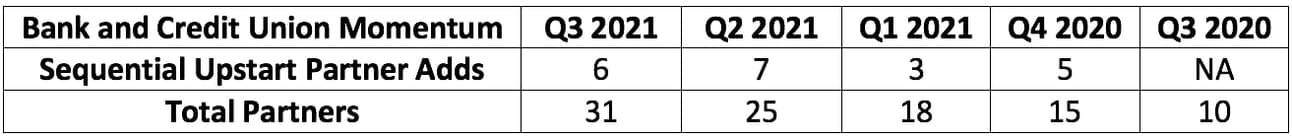

All of this incremental value has translated into rapid growth of Upstart’s partner roster. At the time of its IPO in late 2020, the company had 10 total banks and credit unions signed on. As of its last quarter, it had 31 and has since added two more credit unions to its referral network. There have likely been several more adds this quarter, but Upstart generally doesn’t announce new partnerships until several months after they begin. Founder/CEO Dave Girouard wants to eclipse 100 by 2023 and told the Twitter World in December that Upstart would “shock the world again in 2022” — talk about ambitious!

The turbulent pandemic times did hit Upstart’s business hard in the short term — in the 2nd quarter of 2020 originations fell 86% year over year (YoY). It was still able to deliver 40% origination growth for 2020 vs. 2019 as a whole — but the pandemic undeniably (and temporarily) halted much of Upstart’s business. Over the longer term, the young company’s relative success amid chaos (covered next) should serve as valuable evidence of its talents and should push more lenders to sign on and to originate more Upstart-sourced loans.

“I’m a former school teacher who graded very strictly and I am generally very skeptical. This Upstart program has exceeded our expectations. It just works. Even in a crazy pandemic period when we were expecting losses and needing to pivot with our Upstart program, that was not the case. The risks we thought we’d see did not manifest just like Upstart told us. The performance throughout was outstanding and prompted us to double our Upstart budget. I’d anticipate we’ll continue to grow here considerably.” — First Federal Bank of Kansas City Chief Sales Officer Barry Cooper

“We had the luxury of seeing how your model worked through the stress of the pandemic. It survived very well and convinced us that there was something here. It was a great test and Upstart passed the test with flying colors. — Chief Retail Banking Officer at Apple Bank Jim Matera

On-boarding these partners is also getting much more seamless. Upstart was able to integrate its latest bank partner in just 45 days vs. what had been taking it 6-15 months when it publicly debuted in 2020. The vast majority of that 6-15 months was spent receiving approvals from executives boards and relevant regulatory bodies. This is generally not considered part of the on-boarding process but Upstart does consider it as such. More expedient on-boarding is a sign that reviewers are becoming more comfortable with what the firm is selling. It also diminishes incremental friction for prospective partners who want to sign on.

c. Capital Market Value Proposition

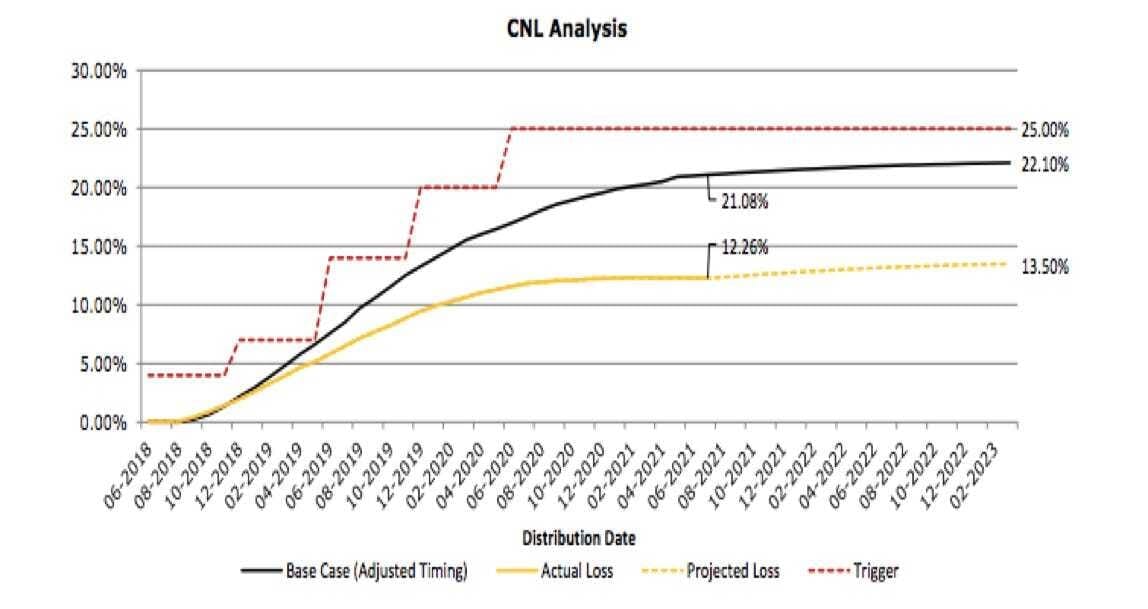

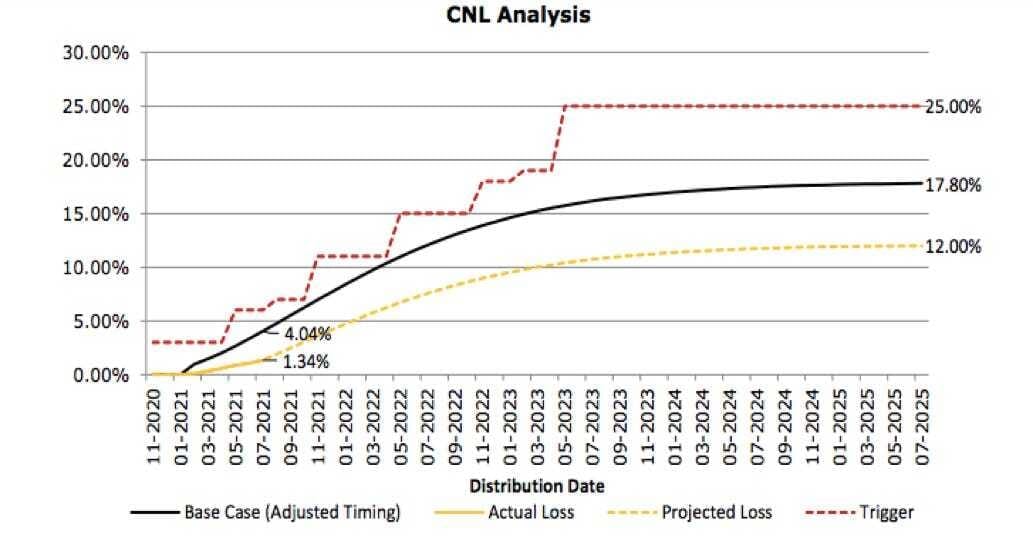

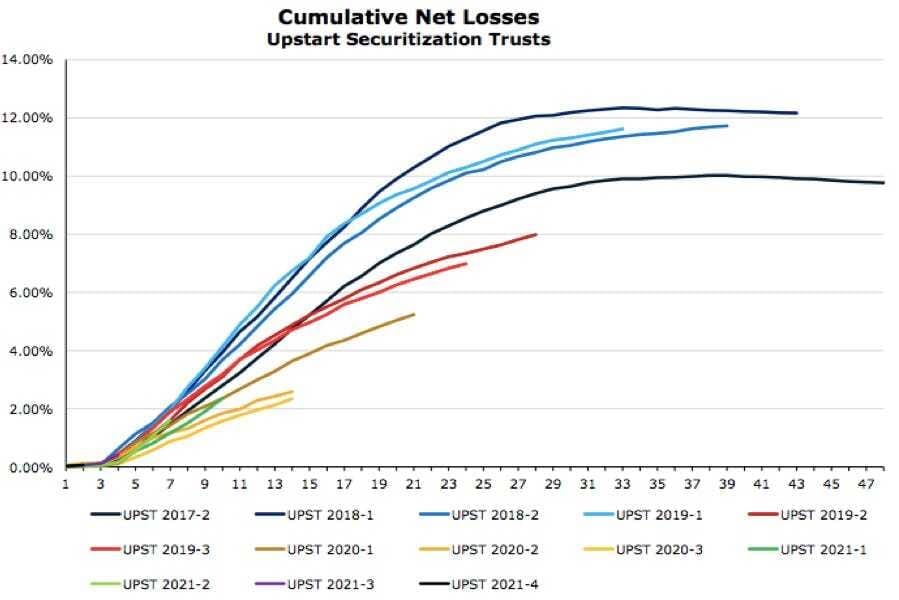

Upstart’s choice to heavily lean on capital markets for early growth and proof-of-concept has naturally led to a lot of its current business coming from this channel. Kroll Bond Rating Agency (KBRA) released a credit surveillance report in July of 2021 to gauge and publish the performance of Upstart-sourced loans passing through credit markets via securitization and pass-through trusts.

Encouragingly, each trust vehicle has seen its time adjusted cumulative net loss (CNL) rate handsomely outperform expectations by anywhere between 256-813 basis points (2.56-8.13%).

- CNL definition per Law Insider: A fraction where the numerator equals the sum of total liquidation losses and cram down (loan principal reduction) losses and the denominator equals the original loan pool balance.

Every single trust has also seen CNL outperformance precipitously expand as the transactions become more and more seasoned. Below are two examples via KBRA of the consistent theme:

It’s nice that Upstart’s loans continue to see loss rate results outperform at a healthy clip — but we have to remember that the macroeconomic backdrop has been extremely favorable as stimulus checks aided loss and impairment rates for all creditors. Those checks ended in 2021.

The Covid-19 pandemic certainly wasn’t a full credit cycle, but it was a stressful credit shock that surely tested the legitimacy of Upstart’s various ML models. During these tough times, the company was able shine on a relative basis vs. the competition benefitting from the same stimulus-induced help.

“As terrible as 2020 was for humanity, a silver lining for us is we get a proof point to see how our models performed through a huge economic dislocation. From an absolute sense, there was no harm at all to the returns (it did undoubtedly hit volumes) on the credit portfolios of our bank partners — it was as if the pandemic didn’t happen. Some of this may be due to government stimulus but we have clear evidence that our models performed dramatically better than traditional systems.” — Co-Founder/CEO Dave Girouard

“We were able to find the right people to lend to throughout the pandemic.” — Co-Founder/Chief Product Officer Paul Gu

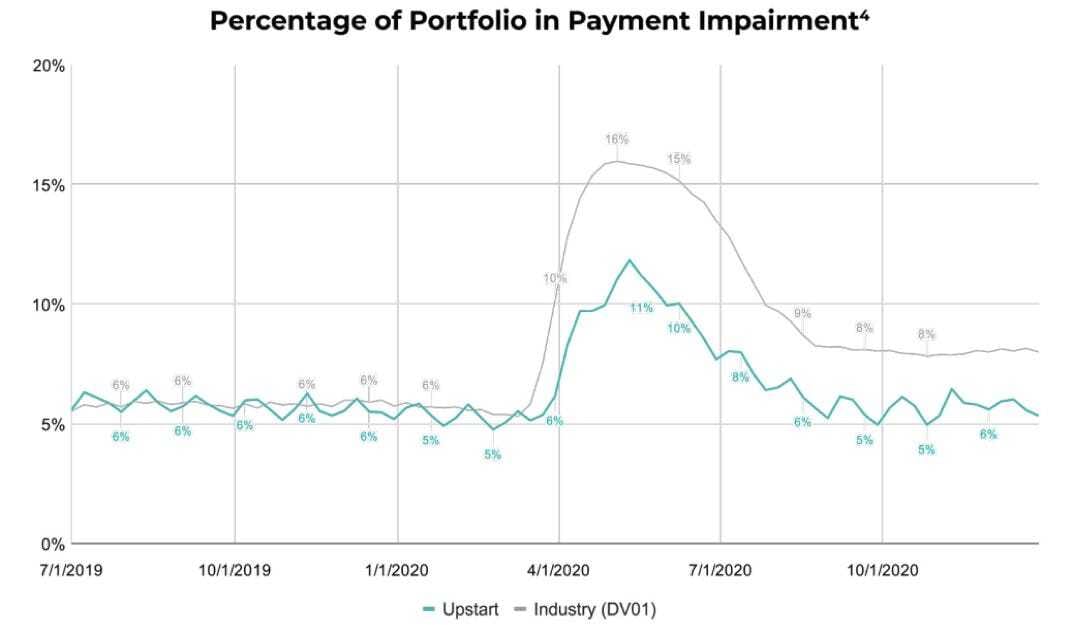

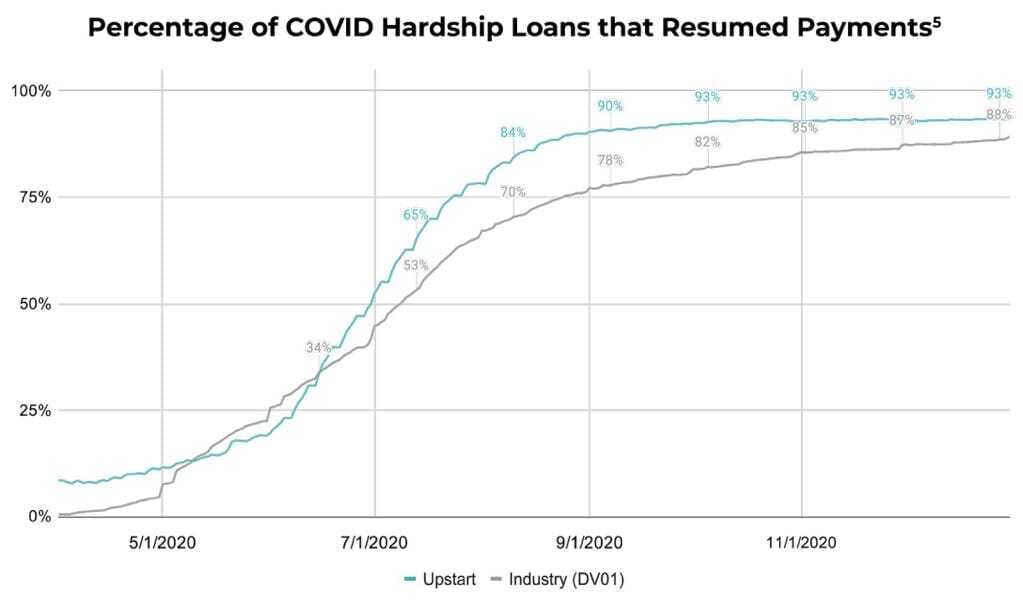

Per data collected by DV01 (an independent research agency), amid peak pandemic pain, Upstart’s impairment rate rose by nearly 600 basis points from roughly 5% to around 11% of its outstanding loan volume. Conversely, the industry as a whole saw its mean impairment rate rise from 6% to 16%.

- Impairment rate definition = Percent of portfolio of loans not current on payments due to hardship program participation or delinquency

This outperformance directly hints at Upstart’s models being more capable of handling macroeconomic turbulence than legacy underwriting mechanisms. It’s important to point out that Upstart’s loan customers feature an average credit score 25 points below the industry average meaning its impairment rates being roughly equal to the industry pre-pandemic is evidence of relative outperformance in that environment as well.

Across the industry, spikes in impairment were all but solely driven by rising hardship program participation. Not only did Upstart experience a smaller spike in impairment rates but more of its borrowers entering hardship programs resumed normal payments vs. the industry as a whole.

Most capital market investors (and bank partners) did severely pull back on volume when Covid-19 began, but as Upstart’s loans continued to perform, partners resumed their loan programs with most now having much larger monthly Upstart origination budgets than pre-pandemic.

“Our growth from the third fintech platform in unsecured loans to number one by volume was driven by our pandemic performance. Through the pandemic, our credit held up and so things like capital market appetite are just astronomical.” — Upstart VP of Public Policy Nat Hoopes

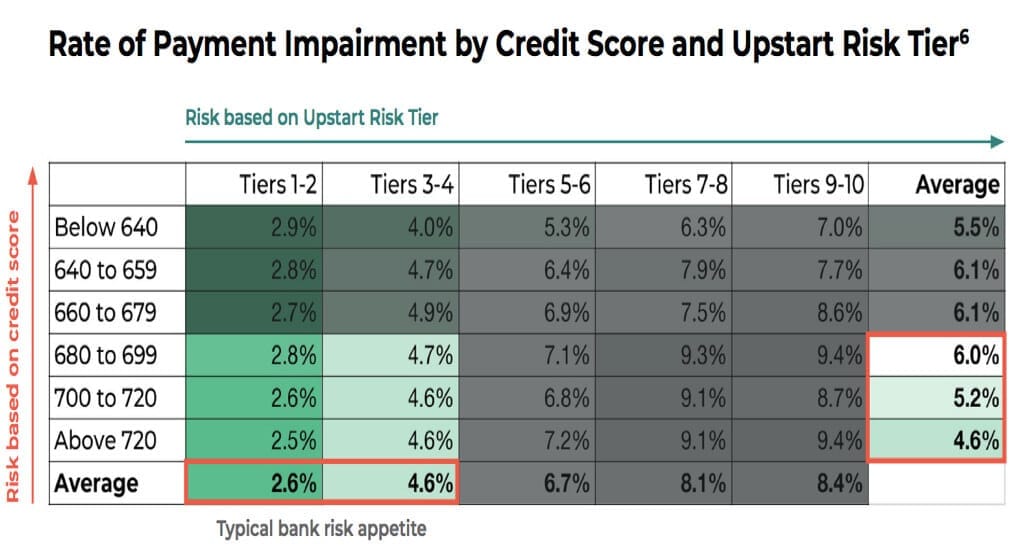

In May 2020, Upstart ran a study comparing the accuracy of its risk tiers to comparable credit bands by measuring impairment rates by band and tier. Upstart has 10 risk tiers — bank and credit union partners generally lend to tiers 1-4. Amid the pandemic-induced turmoil, Upstart impairment rates were far more uniform across its risk tiers vs. legacy credit bands.

For example, the borrowers in the riskiest credit band and safest Upstart risk tier featured an impairment rate of 2.9%. Conversely, the borrowers in the safest legacy credit bank but riskiest Upstart risk tier carried impairment rates of an underwhelming 9.4%. All in all, Upstart’s tiers were 34% more predictive of true risk vs. credit bands. A full breakdown can be found in the following chart:

This offers direct confirmation of Upstart’s loan-decisioning abilities being far superior to credit bands — even (and perhaps especially) with a hectic macroeconomic backdrop. That reality does two things: keeps capital market demand humming and also motivates more partners to retain more loans.

8. KBRA’s Most Recent Upstart New Issuance Report (Macro Risk)

a) The Data

The liquidity and savings of a typical American consumer is quickly reverting to pre-pandemic levels. Add to that things like interest rate hikes and the inevitable Federal Reserve balance sheet reduction — and the macroeconomic backdrop has dramatically shifted in recent months. Less liquidity sloshing around institutional balance sheets means less demand for Upstart’s pooled loans.

Considering this, less liquidity should mean we inch closer to a supply/demand equilibrium — vs. the capital market demand surplus Upstart currently enjoys — which could impact take rates and demand until traditional lenders are retaining more loans. Knowing all of this, Upstart has assumed rising levels of default, delinquency and impairment rates in its forward guidance heading into this year. It is important to note, that ALL lenders are making the same assumptions and the key for Upstart’s business model is not that these metrics stay flat, but that they still exhibit relative outperformance vs. legacy origination models in an apples to apples risk analysis. I believe they will.

- Delinquency definition: When a borrower misses any loan payment

Since Upstart caters to less credit worthy borrowers than most of its competition, it’s safe to say the end of stimulus checks and eviction moratoriums will put more pressure on Upstart’s borrower cohort than others — this merely raises the bar for its underwriting performance. On the last earnings call, CFO Sanjay Datta explained this evolution to us:

“In terms of macro outlook, we are seeing the early signs of a return to the pre-Covid consumer profile with personal savings rates in the economy having fallen to pre-Covid levels and credit balances edging up to within 90% of pre-Covid levels. We expect the continuation of this trend to eventually lead to an increase in consumer default rates consistent with pre-Covid levels and we believe that any issuer who has not priced this in is likely to experience a deterioration in their returns.” — CFO Sanjay Datta

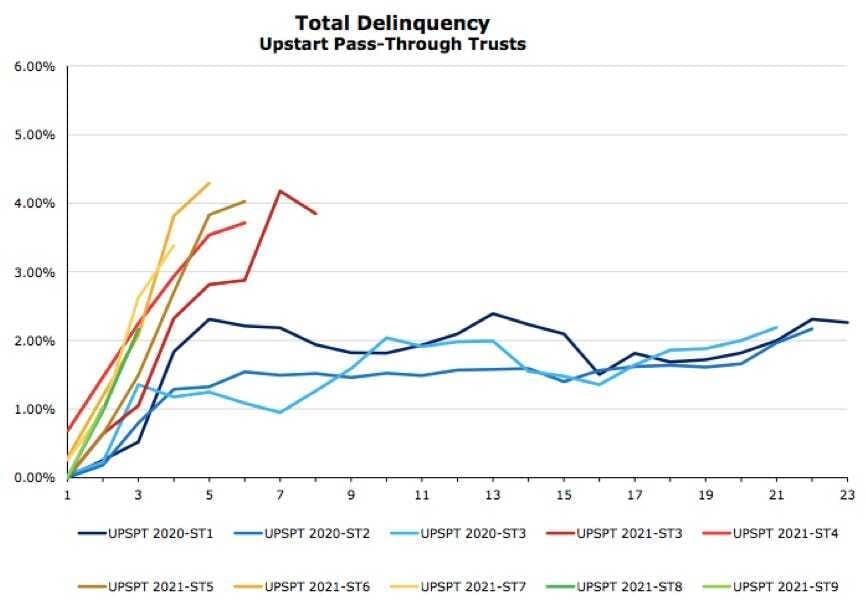

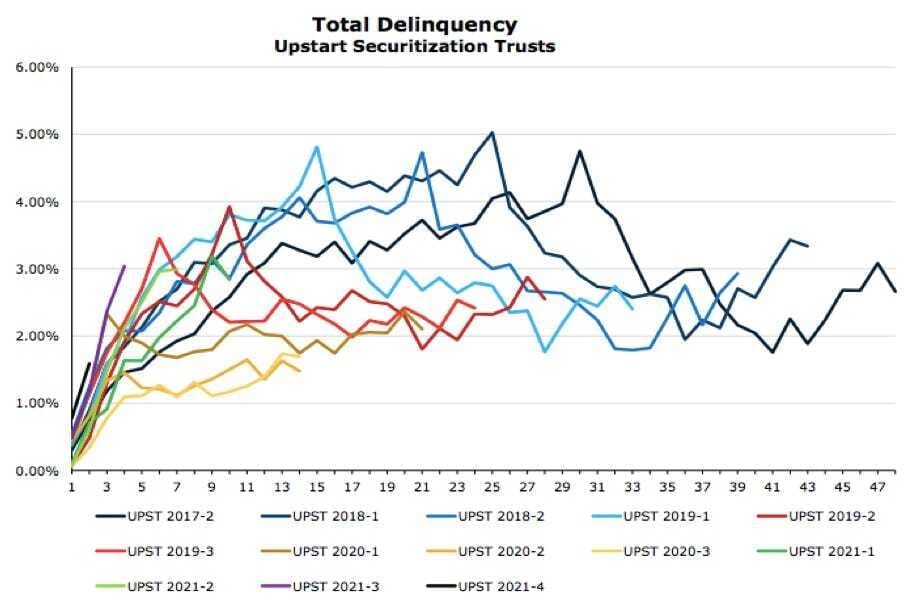

KBRA’s most recent new issue report showed early signs of rising delinquency and CNL rates beginning to play out. From a delinquency rate perspective, Upstart’s newest pass-through trust transactions had been rising until “UPST 2021-ST7” (the name for the 7th Upstart pass-through trust in 2021) but encouragingly began to fall back to historical means in its two most recent transactions:

Conversely, delinquency rate trends for its securitization trust transactions look more encouraging with some of the newer transactions overshooting the historical mean and some undershooting it:

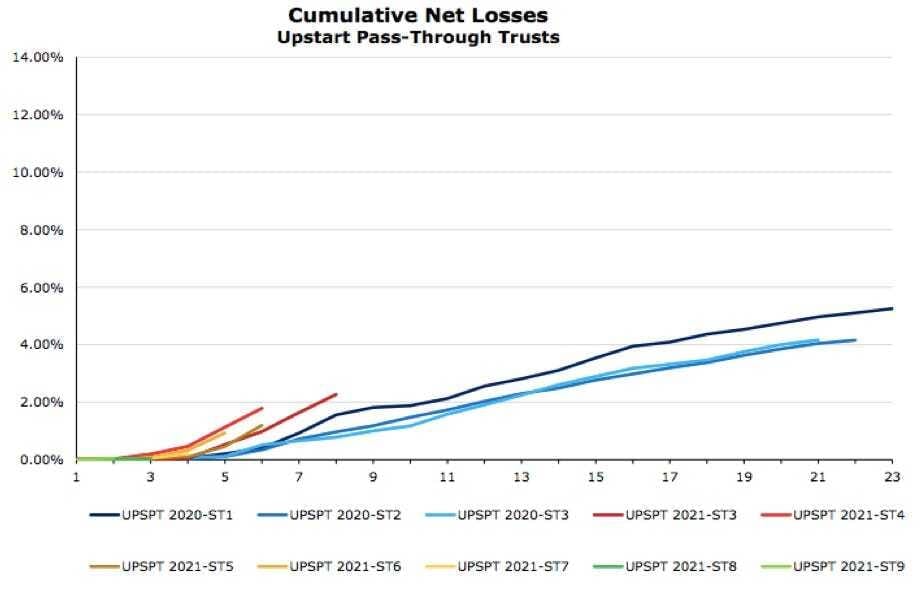

CNL rates — a more complete assessment of loan pool losses — boast a similar, albeit more encouraging, pattern. For pass-throughs, Upstart’s newest transactions had been trending higher for CNL but began to show signs of an encouraging reversion in its two most recent dealings:

Finally, CNL rates for securitization transactions are strong:

Rising rates of delinquency are to be expected as we re-pivot back to a more normal world and monetary environment — and this is fine. Again, Upstart’s success will depend on the relative performance in its CNL and delinquency rates being better than the alternatives. Based on Datta telling us that default rates would be “consistent with pre-Covid levels” and Upstart’s outperformance long before the pandemic began, I’m comfortable taking this risk.

Timely interest distributions have been made for all Upstart trusts to date with rising levels of credit support and falling static gross loss levels. Both are important metrics for preserving Upstart’s capital market demand and take rate in the years to come.

I’m eager to hear more detail related to this on the company’s earnings call next month. As the firm is in its quiet period, I cannot reach out for direct comment but I will after the report. This is not a red flag to me, but it is something I will closely monitor going forward.

b) More Context

It’s important to reiterate that management has already guided to a reality of rising defaults — this performance headwind will not come as a surprise in its future quarterly reports. The lack of uniformity of the actual rises in delinquencies and CNLs thus far, I believe, should be taken as a positive. Management expected the upward pressure to be more consistent across its portfolio of loans — it did not guide to only pass-throughs enduring worsening loss rates.

Furthermore, one of its closest competitors — Pagaya — has experienced some of the same trends on its most recent securitization transactions, pointing to this blip being unique to the segment and not Upstart.

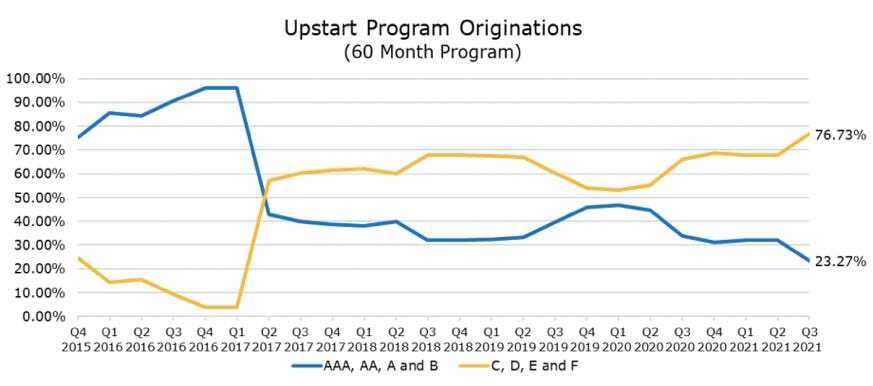

A bi-product of Upstart’s maturation is growing confidence in the platform’s capabilities. The conviction prompts more partners and capital market investors to lower credit restrictions for Upstart-sourced loans which is leading to a larger portion of these loans being issued to riskier classes.

This inherently leads to rising CNL and delinquencies which partners and investors are compensated for in the form of higher payment inflows. As long as Upstart can assess the risk correctly, partners and investors can still make money in a higher default environment through proper loan pricing. The company expects CNL and delinquency rates to vary somewhat widely in the short term, while slowly falling over the long term.

Also consider that an end to federal aid will provide a meaningful consumer demand tailwind as borrowers must seek out other forms of funding aside from federal checks and as their own liquidity levels normalize. This demand tailwind is entirely ahead of the company.

“We expect macro dynamics to ultimately lead to an increase in borrower loan demand — although this has yet to manifest in our results and remains upside to our forecast.” — CFO Sanjay Datta

9. Regulatory Traction

When infusing newer concepts like machine learning into a hyper-conservative, hyper-regulated industry like banking, regulatory scrutiny will invariably follow. Upstart must continuously make sure it provides loan products that augment equal and affordable access to credit through all model upgrades/tweaks — rather than precluding it. The firm is keenly focused here.

Several years ago — when Upstart was still in the R&D stage — the company began working closely with the Consumer Financial Protection Bureau (CFPB). The two entities were interested in determining if the usage of alternative variables and machine learning discriminated against protected classes. The result of this inquiry was CFPB issuing Upstart a no-action letter in 2017. This meant that the agency had no intention of recommending enforcement action on Upstart’s platform pertaining to the Equal Credit Opportunity Act (ECOA). The letter expired in 2020 and was renewed through the end of next year; there are no other competitors that have received this same letter.

“We have added more rigor and additional testing and have agreed to allow CFPB to test bias whenever our models are upgraded. I feel confident in saying our testing for bias is industry-leading.” — Co-Founder/CEO Dave Girouard

AI/ML-induced discrimination — especially within the riskier niche of unsecured lending — will continue to be a hot regulatory topic in the years to come. This letter gives me and Upstart’s partners an added layer of confidence in the company behaving in a way that is appropriate to and supported by regulators.

“Upstart’s no-action letter granted from the CFPB was an important factor to our risk team.” — KEMBA Chief Credit Officer Brent McCoy

In 2019, the FDIC, OCC and CFPB also released a co-published report in support of the usage of alternative data in lending. Clearly, these bodies of government see the value in using this disruptive technology. Upstart’s decision to test its models with federal agencies to ensure continued bias-less improvement provides lenders a sense of comfort that is largely absent with its competitors.

10. Risks

The main risk surrounding Upstart is that its core competency involves AI/ML engines. We can read all we want about the modeling techniques and variables that go into these platforms — but we will never know the ins and outs of what truly makes these models tick. Leadership teams with proprietary, value-building AI have no incentive to tell the public how it actually works. That would be like a pitcher telling the batter what he’s about to throw before the pitch.

As a result, this is and will continue to be a black box and we will continue to rely on the talent within Upstart to foster success — this is quite the abstract reliance. Fortunately, all of the data from federal and credit agencies shared above (as well as the make-up of management) gives me comfort in this dependency.

a) Macro Help

For a firm exposed to exogenous factors like monetary policy and capital market demand, macroeconomic risk is especially important.

The question is how much of Upstart’s pandemic success was due to the company and how much was due to the backdrop? If its KPI leads are durable, the rest will take care of itself. If the macroeconomic climate in 2020-2021 proves to be the primary contributor to Upstart’s outperformance, then things like interest rate hikes and less economic liquidity will surely dampen its progress. That perceived risk could also lead to investors in Upstart-sourced loans having to pay more in cost of capital to fund the loans or push partners to require higher APRs on these loans. This unfortunate reality would slow Upstart’s demand and/or cut into its take rate.

The only reason Upstart can get away with charging so much on its volume is the immense incremental value it’s providing. To be a successful long-term investment, that incremental value cannot be unique to a certain macro environment but must continue through all phases of the business cycle and must mainly be the result of Upstart’s unique skill-set. Much of the data above points to Upstart’s relative outperformance vs. both legacy credit models, as well as other competitors operating in the same business environment. It’s a great sign.

Even if Upstart proves itself to be capable of delivering success in any period, economic turmoil or economic contraction could lead to partners and capital markets pulling back on origination volumes to shield risk. The vast majority of Upstart’s revenue is not recurring — so that would lead to short term volatility in its revenue stream. The company’s growth is more correlated with credit shocks and cycles than many comparable software organizations — that must be contemplated.

Again however, Upstart’s proof of concept through the chaos of Covid-19 and other crises should offer wildly valuable evidence to drive more demand. Lending cycles are generally dictated by the overall health of the economy. This causes lenders to reduce lending at a time when consumers need the service the most. The reality is that while default rates vary by 2x based on macroeconomic health, these rates vary by 10x for two borrowers with identical credit.

“What about recessions? Lenders should put away their crystal balls and focus on predicting which borrowers can pay in ANY environment.” — Co-Founder/CEO Dave Girouard

“This fascination with economic cycles is a symptom of an approach to lending that is neither robust nor predictive. It means lenders are not able to predict an individual consumer’s risk all that well. It’s almost like just throwing paint against a wall. Even in the toughest economic climates, most low-risk borrowers still re-pay their loans. We focus most on which individuals are in those low risk buckets and not which period of the economic cycle we are in.” — Co-Founder/Chief Product Officer Paul Gu

Upstart’s approach assesses risk on a person-by-person basis rather than population-by-population. This is how it delivers larger loan books without added risk and allowed the company to profitably lend through the pandemic while others stopped lending activity altogether. Maybe this is why its partner roster tripled in size during 2021.

b) Concentration Risk

Upstart’s concentration risk is multi-pronged — present within the company’s origination volumes and also from where it sources traffic.

Origination Volume Concentration Via CRB and FB Loan Funding Programs:

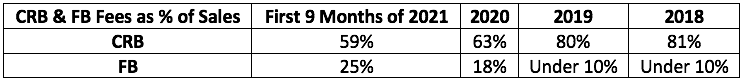

Solely using CRB for the first four years of its existence has naturally led to that partner originating a large (but falling) percentage of Upstart-sourced loans. FB has since stepped in to assume some of the volume and below is a chart depicting the trend in revenue concentration from CRB and more recently FB:

CRB and FB are in the business of collecting revenue to move assets. Neither of these banks will ever retain a high percentage of Upstart-sourced loans on their balance sheets so moving loans from capital market funding to lending partners will require different partners assuming more volume. It fully expects this trend to play out, but time will tell.

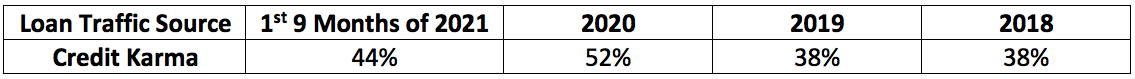

Traffic Concentration via Credit Karma (and so Intuit):

Upstart also has concentration risk pertaining to the source of Upstart.com traffic. It has 30 of these traffic-generating partners overall, yet one is far more important than the rest. Credit Karma is the largest contributor, but has diminished in percentage through 2021.

While customer concentration is a concern, it appears to be yet another bi-product of the Covid-19 pandemic. Many fintech companies halted loan businesses altogether in 2020 — but Upstart and Credit Karma continued their operations. This cut into the number of Upstart traffic partners and led to the rise. According to CFO Sanjay Datta — “direct to Upstart growth channels are outpacing others” meaning this concentration risk should erode more going forward.

Intuit’s purchase of Credit Karma now makes the relationship more delicate. Intuit’s decades-long track record of success and its fortress balance sheet gives it the ability to try and build something internally should it want to. There’s no indication of Intuit’s plans to do so.

In 2020 Credit Karma debuted a new customer traffic program that Upstart chose not to participate in. This led to a reduction in Credit Karma sourced traffic in November 2020 that Upstart grew through regardless.

Finally, Upstart generates about 10% of its origination demand from direct mail. An ability to leverage its data science to target a more curated list of borrowers (with pre-verified credit data) makes this a wildly efficient growth mechanism for the firm.

c) Competition

Platforms like SoFi, PayPal’s Venmo, Block’s Cash App and countless others are quickly pursuing a “super app” path (AKA one stop shop for all things finance including consumer loans). Successfully doing so would open these players up to greater cross-selling abilities thus elevating the lifetime value (LTV) ceiling that each customer can produce. The boost could free these competitors to profitably undercut Upstart.com’s APRs because they are able to make up the rest of the variable profit elsewhere. Upstart will continue to round out its product suite with features that are all credit and loan focused without other consumer banking applications.

The LendingClubs and SoFis of the world generally cater to more affluent borrowers vs. Upstart but — as I’ll cover in section 12 — Upstart is now moving further up the credit spectrum to serve a larger cohort of borrowers. As this plays out, the competitive overlap will increase.

As briefly mentioned, Pagaya is a direct Upstart competitor going public via SPAC at an $8.5 billion enterprise valuation (EV). Interestingly, Upstart is more profitable, larger and growing just as quickly as Pagaya — yet claims an EV of $7.2 billion. Other smaller substitutes include Zest AI and Amount. Financial services are and will continue to be strikingly competitive. It will be up to Upstart’s team and product quality to continue standing out in the large pack.

“There’s the perception of commoditization within the usage of machine learning with any model being able to tell us the same thing. That is not at all the case. Just like for an athlete, it takes hard work, dedication and significant time to get good at this. We’ve been doing this for a decade yet we have a long, long way to go. It’s really hard to do this well.” — SVP of Business Development Jeff Keltner

d) State Usury Law Exemption, Sustainability and More Regulatory Risk

Multiple State Attorneys General have inquired into the Upstart value chain over the years. The primary criticism has centered on non-banks receiving bank exemptions from certain taxation and state regulation without having a charter. Upstart using bank partners for origination certainly falls under this umbrella of what has been termed “renting a charter.”

In May 2020, the OCC issued a formal confirmation that when chartered institutions sell or transfer a loan — the allowable interest pre-transfer is allowed post-transfer. It also announced that interest-related requirements could be exported from a bank to a non-bank. This ruling directly supports the legality of Upstart’s operations. One month later, the FDIC finalized a proposal determining essentially the same thing — loan interest rates are to be unaffected by future sales and transfers.

If this regulatory path were to pivot, that would spell trouble for Upstart’s operations. Delivering acceptable profit margins to all relevant parties becomes more difficult without these taxation and cost of capital exemptions in place.

Since these decisions, seven AGs have challenged the ruling with the Federal Government showing next to no interest in re-visiting these topics. Also in 2020, five Senators sent a letter to Upstart about claims of discrimination stemming from an activist organization. Upstart responded and then three of those senators asked CFPB to review use of educational variables more closely and to stop issuing ECOA no-action letters.

In response, Upstart entered into partnerships with the NAACP’s Legal Defense and Education Fund (LDF) and the Student Borrower Protection Center (SBPC). The arrangements call for Upstart to frequently partake in fair lending reviews of its ML powered underwriting model including the review of educational variables. Upstart has agreed to adhere to any recommendations to promote equality that do not sacrifice the quality of its risk assessment.