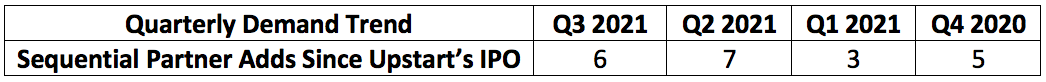

1. Demand

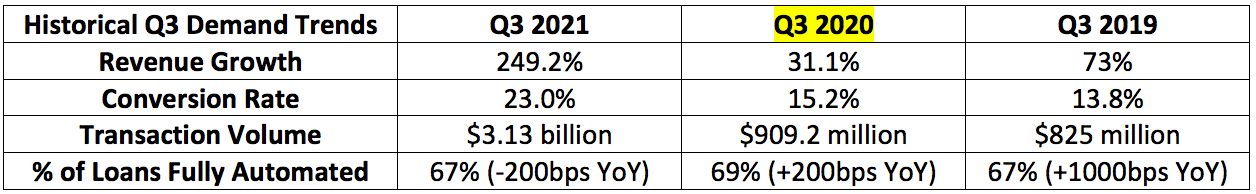

Upstart guided to $210 million in quarterly revenue at the midpoint. Analysts were expecting $214.9 million in revenue. It posted $228.4 million beating its expectations by 8.8% and analyst estimates by 6.3%.

Upstart discloses revenue concentrations in its 10Q which will be published later in the week. I will include that information (and anything else notable) in the News of the Week post on Saturday. As of last quarter, Cross River Bank was originating 60% of Upstart’s volume vs. 79% year over year and Credit Karma traffic accounted for 49% of Upstart fees. I’ll be looking for these percentages to continue to fall as the partner base grows.

Note: The pandemic represented a severe demand headwind for loan activity and Upstart specifically. As a result, these Q3 2021 comps are extremely easy which helped boost the revenue growth metric alongside healthy demand. Quarterly growth is more telling of continued momentum here and is also exceedingly strong -- again.

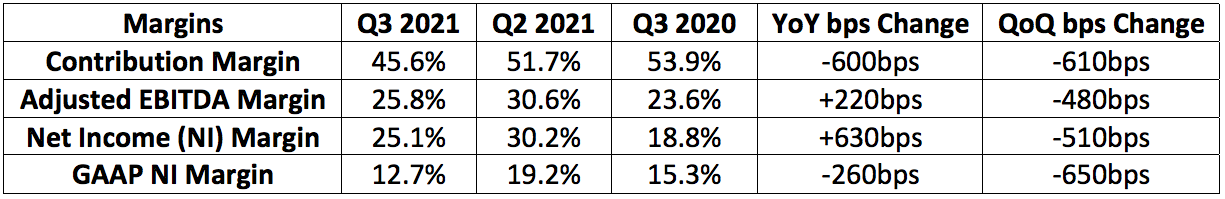

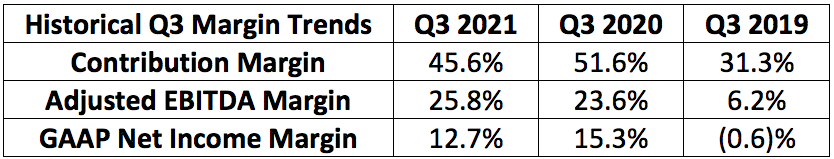

2. Profitability

Upstart was expected to earn $0.27 per share. It earned $0.60 which beat expectations by $0.33 or 122%.

Upstart guided to the following midpoints:

Roughly $94.5 million in contribution profit. It posted $95.9 million beating expectations by 1.5%.

$20 million in GAAP net income. It posted $29.1 million beating expectations by 45.5%.

$30 million in Non-GAAP net income. It posted $57.4 million beating expectations by 91.3%.

$32 million in adjusted EBITDA. It posted $59.1 million beating expectations by 84.7%.

3. Guidance

Upstart was expected to guide to the following for the 4th quarter:

$227.6 million in revenue. It guided to $255-$265 beating expectations by 14.2%. Girouard also called this guide “reasonably conservative” during the Q&A.

$25.1 million in adjusted EBITDA. It guided to $51-$53 million beating expectations by 107.2%.

4. Co-Founder/CEO Dave Girouard Conference Call Notes

On banking partner progress:

7 banking partners have now signed up for Upstart Auto Retail (formerly Prodigy) vs. 5 last quarter.

3 more partners eliminated any FICO requirements:

“Last quarter I told you that one partner eliminated any minimum FICO requirement. Four Upstart bank partners have now dropped their FICO requirement. In just a few months this has become a trend.”

59% of loan applicants approved by Upstart’s partners without any FICO requirement are minorities which is well ahead of the national mean. This offers direct evidence that Upstart’s claim of offering a more inclusive loan experience is accurate.

On a philosophy shift/broadening:

Upstart is focusing more on serving users across the entire credit spectrum as it realizes it can provide better loans for high-credit constituents as well. The company had originally anticipated its value proposition mainly expanding to the under-banked. That is now changing. This broader focus is expected to improve the company’s marketing efficiency making things like TV campaigns productive.

On Upstart auto:

“Upstart’s auto retail product is on track to repeat the funnel gains that the personal loan product has delivered.”

Considering how much success the personal lending product has enjoyed and how much bigger the auto loan TAM is vs. personal loans, I found this to be very encouraging.

“During the third quarter we reached adding 1 rooftop per day.”

That 365 rooftop-per-day pace should allow its 291 dealership footprint to continue to rapidly grow.

On new product plans:

Upstart is building a small loan product that will integrate with its partners and feature “bank-level APRs.” This will expedite the pace at which Upstart can include the under-banked in the financial services world. Girouard called interest in this product from partners “off the charts” and it will debut next year.

Upstart is also now building a small business installment loan product. Which is also “in high demand from our partners” according to Girouard. This will debut in 2022 as well.

Upstart plans to introduce a home mortgage product later in 2022. In 2001 compared to 2015, 1 million fewer mortgages were originated -- Girouard called this the “missing million” and plans to pursue this opportunity with a new product in the near future.

“We feel very confident that we can better underwrite mortgage applications for a large portion of consumers.”

On the partner pipeline:

Girouard was directly asked about prospects for new Upstart partners. Here’s what he had to say:

“We have very rapidly growing interest from banks. The returns we are providing to our partners has exceeded what we thought we’d provide and we feel very confident that we will continue to add bank and credit union partners at a rapid clip.”

5. CFO Sanjay Datta Conference Call Notes

On contribution margin:

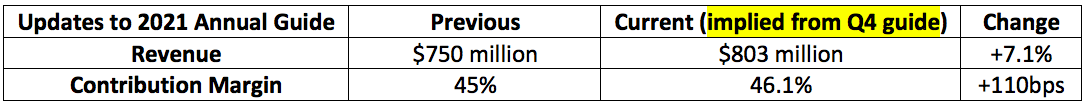

Contribution margin was expected to fall with more aggressive marketing spend and the proliferation of its auto business which will come with lower margins as the product matures and improves. This is still above its 45% long term target with its forward looking guide rising into the 47% range for the 4th quarter.

On a fraudulent loan attack and automated loans:

“We experienced a coordinated effort to obtain a large group of loans fraudulently through the platform. The company experienced no material impact. Upstart put in a series of controls that was responsible for the lowered % of loans fully automated.”

On an end to stimulus:

Datta is seeing signs of the consumer returning to more pre-pandemic liquidity levels. This trend should lead to a rise in default rates across the industry that Upstart has priced into its guidance. Upstart is also expecting the end of stimulus to serve as a demand tailwind in the coming quarters although “that has not yet manifested” according to Datta. This means the tailwind is entirely in front of the company.

On conversion rate:

Two quarters ago, Datta told us that a 22% conversion rate was too elevated and a sign for Upstart to lean more aggressively into growth. That conversion rate rose further to 24.4% last quarter again pointing to Upstart needing to get more aggressive in pursuing market share. A conversion rate of 23.0% remains too elevated and is still a sign Upstart can become more aggressive in pursuing market share. This is a very good thing.

6. My Take

This was another great quarter for Upstart. Demand and forward looking guidance exceeded all expectations and profit lines all crushed them as well. The share price action does not concern me as the business remains firing on all cylinders. To put its success into context, when it went public last year analysts expected the company to generate $350 million in 2021 sales. Its latest revenue guide is roughly 130% above that initial expectation with 2021 margin guidance also vastly improving since last year.

The most encouraging this I took from the report -- aside from the great numbers -- was the number of Upstart bank partners dropping minimum FICO requirements rising from 1 to 4 sequentially. Clearly, these partners think Upstart has created a sustainably better way to price loans.

Some will pick on the company’s revenue and profit beats being smaller than in its first three quarters -- but you can only shatter expectations so many times before estimates start to catch up. And still, the beats were impressive across the board. Great job Upstart.

I plan to add back a piece of the 10% of my Upstart stake that I sold a few weeks ago in the morning.

Thanks Brad, good summary!

Love the clarity of thought! Great work.