Upstart Q3 2022 Earnings Review

A dive into this struggling credit innovator's expectedly poor results.

Today’s Piece is Powered by SavvyTrader:

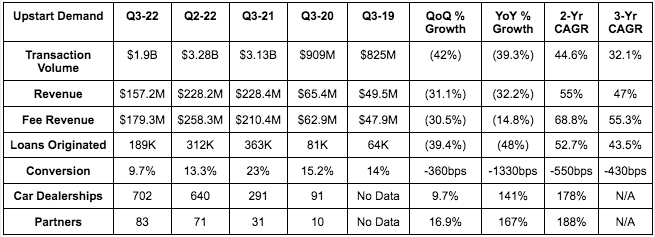

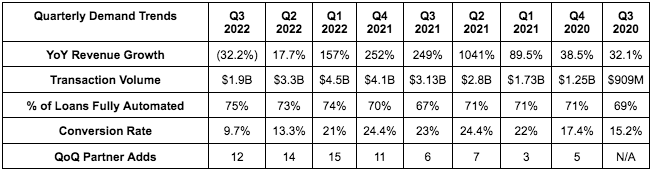

1. Demand

Upstart missed its revenue guide by 7.5% and analyst estimates by 7.3%.

More Context on Demand:

The proportion of loan volume retained by partners so far in 2022 is 27.2% vs. 24% YoY. This source of funding is far more durable than institutional investor funding.

Falling conversion rate is via 2 headwinds:

Upstart loans are 800bps more expensive for borrowers than the same loans YoY. Especially for its less affluent demographic, this is a massive incremental cost burden.

Funding supply from investors remains severely challenged. While Upstart continues to lean on capital markets for funding, it is intimately connected to these volatile sources of funding. The fast money hedge funds that were scooping up all of its volume in 2021 have since abruptly vanished. That’s why shifting to longer term funding supply and more partner retention is so vital. It hasn’t made enough progress yet to weather this large headwind.

Upstart added more new lenders to the platform this quarter than in all of 2021.

New Products:

Small dollar loans sourced quadrupled QoQ to 9,000. All of these borrowers would have been previously rejected without the product.

Borrowers now save $5,800 per Upstart Auto Refi vs. $4,800 QoQ.

Upstart has sourced $10M in small business loans vs. $1M QoQ.

Upstart Auto Retail added 3 more dealer groups this quarter to reach 22.

⅓ of Upstart Auto Retail applicants are now automatically verified vs. ⅙ QoQ.

The negative fair value adjustments to the loans on its balance sheet amid rising rates as well as some loan sale losses led to fee revenue being greater than total revenue. At some point, this headwind will swing back to a tailwind and prop up growth in the future.

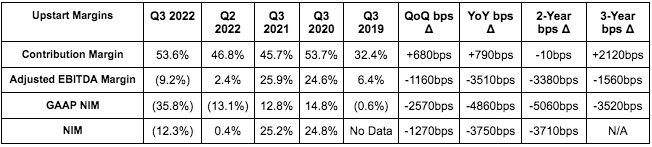

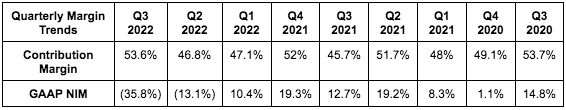

2. Profitability

Upstart missed its EPS guide of -$0.10 by $0.14 & analyst estimates of -$0.08 by $0.16.

Upstart missed its GAAP EPS estimates of -$0.48 by $0.21.

Upstart missed its 59% contribution margin guide by 540bps.

Upstart missed its breakeven EBITDA guide (analysts expected the same) by $14.4M.

More Context on Margins:

Upstart has been cutting marketing (by 46% QoQ) & headcount costs to stay profitable through all of the turmoil.

Upstart’s pricing power has allowed it to continue increasing its take rate which is why contribution margin expanded QoQ and YoY.

3. Balance Sheet

Upstart has $830M in cash on the balance sheet. Its worst case scenario quarterly burn rate at this point is $30M. Insolvency is NOT a concern here. This is not Carvana or Opendoor.

Upstart greatly slowed the pace of its buyback from $125M last quarter to $25M this quarter. I don’t think it should be buying back any shares right now.

Still, shares outstanding grew by 2.9% YoY as the buyback was outpaced by stock comp expenses realized.

Upstart has $700M in loans on the balance sheet vs. $624M QoQ & $252M YoY as it plugs funding supply gaps with its own cash.

64.3% of that $700M is for R&D purposes vs. 77.5% QoQ.

It expects to add another $70-$80 million in loans to the balance sheet this quarter.

“We don’t see any need to raise additional capital… we don’t see a scenario where we have to raise cash… With a healthy balance sheet, unit economics and strong pricing power, we’re well positioned to navigate an extended period of economic uncertainty.” – Co-Founder/CEO Dave Girouard

Savvy Trader is the only place where readers can view my current, complete holdings. It allows me to seamlessly re-create my portfolio, alert subscribers of transactions with real-time SMS and email notifications, include context-rich comments explaining why each transaction took place AND track my performance vs. benchmarks. Simply put: It elevates my transparency in a way that’s wildly convenient for me and you. What’s not to like?

Interested in building your own portfolio? You can do so for free here. Creators can charge a fee for subscriber access or offer it for free like I do. This is objectively a value-creating product, and I’m sure you’ll agree.

There’s a reason why my up-to-date portfolio is only visible through this link.

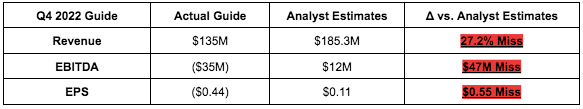

4. Guidance

“While we don’t make predictions, we’ve chosen to take a conservative position with respect to the direction of the economy in the coming quarters. We are assuming the worst is in front of us and will be pleasantly surprised if that turns out not to be the case.” – Founder/CEO Dave Girouard

5. Conference Call & Presentation Notes

On Lending Partner & Investor Appetite:

“Many of our lending partners have reduced their originations, raised their rates or both. This is generally out of an abundance of caution with respect to the economy and despite the fact that Upstart-powered loan portfolios have met or exceeded expectations since the program began in 2018.” – Co-Founder/CEO Dave Girouard

New lenders are understandably starting off more cautiously with Upstart than in 2021.

The brief reprieve from ABS market weakness late this summer quickly ended, unfortunately.

Securitization costs for ABS markets are up 500bps YoY – this has led to severe institutional funding pullbacks.

Conversations to secure longer term funding remain preliminary but “encouraging.”

On Upstart’s Less Affluent Niche:

Industry-wide impairment levels for Upstart’s core demographic are now 2X what they were pre-stimulus.

Upstart approves 43% more Black borrowers than a traditional model at 24% lower APR and also 46% more Hispanic at a 25% lower APR.

Upstart Macro Index:

Upstart created the Upstart Macro Index to model in period defaults. This reading is currently at 1.7, which means it’s experiencing 70% more defaults than it would in a normal period of macroeconomic stability. This is up from around 1.5 last quarter. Just a few quarters ago, Upstart gloated about its macro immunity. My, how things have changed.

On Upstart’s Underwriting Quality:

Model accuracy has improved as much in the last 4 months as the previous 2 years.

Upstart’s predicted per loan target cash flows are beginning to recover back to the long term target trend line… with still a lot more work to do.

Upstart’s Model continues to outperform legacy FICO default prediction accuracy by 5X as of October 2022:

6. My Take

As I’ve been saying for months, 2022 is going to stink for Upstart. It caters to the most economically vulnerable people in the U.S. and leans on volatile capital market funding during a time when both of those things simply will not work. 2021 was the sugar high with free money and negative real rates, and this is the hangover. That’s why I trimmed multiple times last year and why I have not been adding to my stake amid the turmoil like I have been with other holdings. This quarter was brutal, and that was entirely expected.

Silver linings:

Its balance sheet buys it a lot of time and new products are beginning to work. Furthermore, its loans have consistently outperformed loss expectations for lending partners from inception in 2018 all the way to today. That reality is far more important today than it was last year considering we’re now several quarters into a violent credit cycle.

Still, I need to see stronger signs of funding supply recovery before I resume adding to my small stake. When the cycle becomes a little less daunting for Upstart, I actually think it will be poised to materially benefit. And even if we want to cut its current 2023 profit estimates in half (which is appropriate), it now trades for 19X earnings & about 2X contribution profit. I’m not selling any shares after the call & my opinion on the company has not changed from before the report. This is a wildly speculative boom or bust, and should be treated as such. It does not deserve any more of my capital today. I hope that changes in the future.

This is a company that I was initially quite impressed with (many quarters ago). But they have continued to mess up with the execution and fiscal management....bad decision after bad decision...quarter after quarter.

As tech investors, we like investing in up and coming businesses who are trying to disrupt existing models and deliver for the consumer/customer/client. Upstart had that promise early on and who know, they might eventually get to the promised land.

Right now, they are at the bottom of the hill, a very long and tall hill, perhaps even a mountain...

Thanks again for the update and thoughts, Brad.

As a stock investment, this has been a horrible investment for, well, everyone.

As an investment in a business though, I plan to remain invested for the longterm (years) so long as Upstart:

1) keeps signing up new partners for the platform,

2) is more accurate in rating individual borrowers than FICO, and

3) develops a viable product for all types of consumer lending.

This quarter showed progress on two of these three areas for me.

Although you note that the quality of the AI model has improved, I know I have a problem with trying to assess the quality of the underwriting. I am no expert and have no access to the data necessary to make a determination. The data given to us by Upstart as to its accuracy is self-selected. And, as we have seen, even if the data indicating Upstart's model superiority is true, that superiority is not translating to revenue increases.

And, at least for me, exacerbating the problem of thinking about quality of the AI is the fact that the model is not static - it changes. That implies to me that only a much longer time horizon over a more diverse set of economic conditions and hindsight will really show whether Upstart built a better mousetrap.

So, I have looked to the adoption by banks/credit unions as a proxy that Upstart's AI is superior. At least to an extent. Do you think that Upstart's increase in the rate of signing up lenders is a validation of the accuracy of Upstart's rating ability? Or is the increase in adoption more a validation that Upstart can provide an automated lending platform for banks and credit unions who otherwise wouldn't develop one on their own?

T.