The company announced a $400 million share re-purchase program. It’s quite rare to see a company growing this rapidly also buying back shares. Profitability and a strong balance sheet are wonderful things.

In the annual filing, Upstart will disclose concentration risk from Credit Karma and its originating conduits. That filing will be published later this week and I will include the information in the News of the Week post.

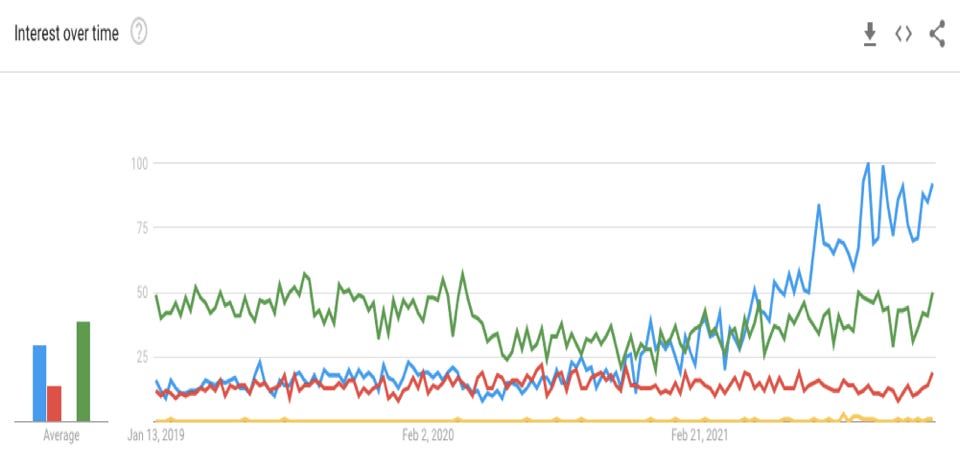

1. Demand

Upstart guided to a midpoint of $260 million in revenue and analysts were looking for $262 million in revenue. Upstart posted $304.8 million in revenue, beating its expectations by 17.2% and analyst estimates by 16.3%.

Upstart now has “over 150” institutional partners to fund its loans via capital markets vs. “over 100” a year ago. It had 6 total in 2016.

Over the first 9 months of 2021, Upstart’s proportional capital market reliance was at 76.7%. That falling to 74.1% for 2021 as a whole (including the 9 months at 76.7%) marks meaningful progress in eroding Upstart’s capital market needs. For this quarter specifically, Upstart’s capital market reliance fell to 69.3% of total volume. I was not expecting this improvement to come until further into 2022 (as deposit levels and savings rates normalized) — so this was a pleasant surprise. In 2022, I will be looking for proportional capital market reliance to fall further as that would make delivering profitable loan pools easier and more sustainable for Upstart.

After the company’s fraud incident a quarter ago, it’s good to see conversion and automation rates bounce back. These are two key performance indicators (KPIs) for growth. A few quarters ago, CFO Sanjay Datta told us that Upstart wants conversion rates around 20% and that anything above 20% signals to the company that it can spend more aggressively on growth — so it can spend more aggressively on growth.

When looking at competition like Lending Club, its recent transaction volume growth essentially brought it back to its own pre-pandemic levels. Conversely, Upstart has now more than tripled its own pre-pandemic volumes. Upstart is taking meaningful share.

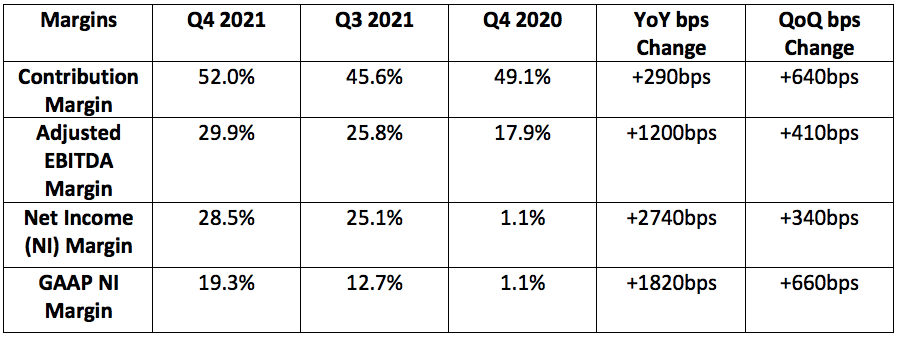

2. Profitability

Upstart guided to:

$52 million in adjusted EBITDA with analysts also expecting $52 million. It posted $91 million beating expectations by 75%.

A 47% contribution margin (CM). It posted a 52% CM, beating its expectations by 500bps.

A 6.9% GAAP Net Income (NI) margin. It posted a 19.3% GAAP NI margin beating its expectations by 1240bps.

An 18.8% net income margin. It posted a 28.5% net income margin beating its expectations by 970bps.

Analysts were looking for earnings per share of $0.51. Upstart posted $0.89 in earnings per share beating expectations by 74.5%

3. Guidance

Q1 2022:

Analysts were expecting $258.3 million in Q1 2022 revenue. Upstart guided to $300 million, beating expectations by 16.1%

Analysts were expecting $56.1 million in Q1 2022 EBITDA. Upstart guided to $57 million beating expectations by 1.6%.

Upstart’s net income guidance implies earnings per share guidance of $0.61 which beat analyst expectations by $0.13 or 27.0%.

2022:

Analysts were looking for $1.21 billion in revenue. Upstart guided to $1.4 billion, beating expectations by 15.7%

Analysts were looking for $261.9 million in EBITDA. Upstart guided to $237 million, missing expectations by 9.5%.

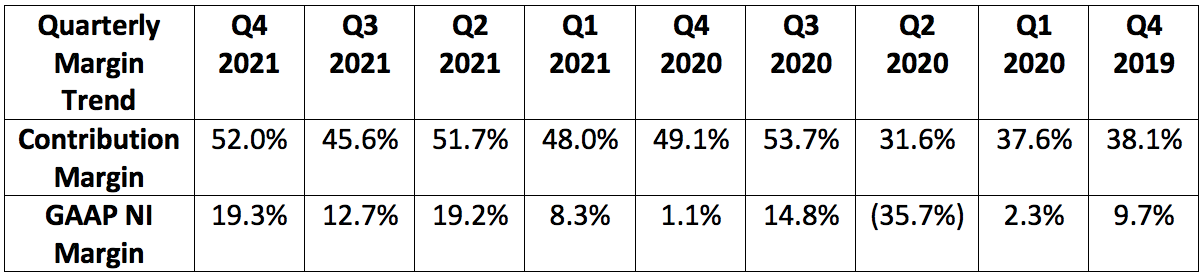

The expected decrease in 2022 EBITDA margin is intentional and controllable. It’s a function of the ramp up in auto lending which will reduce margins until it achieves meaningful scale. Rapid hiring is also leading to this expectation as Upstart looks to continue to exponentially grow its labor force. This will all foster a 5% hit to contribution margin for Q1 2022 which is why the guide was for a 47% contribution margin vs. 52% sequentially.

It also issued auto transaction volume guidance of $1.5 billion which is a strong sign of how much traction this new product is quickly gaining.

I want to reiterate: Upstart will be spending more heavily in 2022 than in 2021 to take more market share and develop growth projects. This will weigh on short term margins but is the correct decision (in my view) considering the opportunities ahead for the quickly-moving organization.

4. Notes from Co-Founder/CEO Dave Girouard

On sentiment, success and macro:

“We’re in a multi-decade mission to put affordable credit in the reach of every American. Price of credit equals price of opportunity and mobility.”

“We are confident that our market and economy in transition will play to our strengths. We’ve never been in a stronger competitive position.”

“We generated more cash in 2021 than our total cash burn as a public company up to 2021. We looked for another company in markets with our scale, growth and profits. We can’t find one.”

“Both the Spanish product and Upstart moving up the credit spectrum are quickly bringing new borrowers into the mix.

This is unlocking new marketing initiatives as Upstart’s audience widens.

7 lending partners have now dropped all FICO minimums for Upstart-sourced loans. Six months ago, just one partner had made this decision. Clearly, banks and credit unions are becoming more confident in Upstart’s risk underwriting.

On Auto:

“The auto refi funnel performance is now in line with our personal loan funnel as of 2019.”

Considering how monumentally successful the personal loan product has been, this is encouraging to me.

Upstart expects take rate and margin contribution for the auto segment to be roughly in-line with its unsecured personal loan business in the coming years. This was another pleasant surprise to me as I expected take rate to be lower.

10 total partners have signed up for Upstart Auto Retail vs. 7 sequentially.

“Scaling the auto business from here is no simple task. Even so, the good news is that we are in a class by ourselves with a unique and proprietary auto product and with far less competition than we face in personal lending. We are confident auto is a category we can grow into for years to come.”

“We expect to accelerate rooftop adoption throughout the year.”

The revenue mix from auto will be more heavily weighted to interest income vs. fee revenue. Considering this, as auto briskly proliferates, fees as a % of total revenue should fall.

On 2022:

The small dollar and small business loan products will debut in 2022. The mortgage product will come in 2023. These products will take 2 years to test. The plan is for Upstart to have a new product ready to scale in markets in each of the next 3 years.

On the path:

“Choosing not to become a bank was the right decision. A successful bank will serve a particular slice of America very well; we believe we can serve ALL Americans through our hundreds if not thousands of partners in the future.”

“Lending is cyclical and always will be. We expect our growth to vary considerably from Q to Q but we represent a secular change that is inevitable and durable. AI lending will rapidly gain market share and we are in a prime position to benefit. Economic volatility only demonstrates our value more.”

5. Notes from CFO Sanjay Datta

On the buyback:

“We have not run out of things to do. This is not a capital structure decision but rather us being opportunistic. Knowing what we know about our business, we feel the stock is undervalued.”

“We see attractive buying opportunities which our profitability puts us in a position to take advantage of.”

On defaults:

Datta told us that Upstart’s rising default rates are a product of a shift towards riskier loans as lending partners become more confident in Upstart’s underwriting. He also reminded us that the company has been predicting rising defaults for a year as we exit this unique stimulus and rent/eviction moratorium period.

“As we have anticipated, default rates have risen and our loans have been priced accordingly. We expect no adverse default rate impact on our volume or economics. Rising defaults are solely a product of change in customer mix. Rising absolute default rates correctly predicted is not a bug, but a feature of our platform.”

Mic drop from Datta.

On the balance sheet:

Upstart has $1.2 billion in cash and restricted cash on the balance sheet.

Other notes:

Engineering cost growth led the way in terms of sequential line item expense increases.

“Our view is that a moderate increase in rates will have no impact on our business. Any decrease in loan demand at the margin reacting to rising interest rates will be more than offset by growing demand as stimulus fades as evidenced by rising credit card balances.” — Datta

Upstart is expecting negative sequential growth next quarter.

“Proving that our teams can successfully create a 2nd product gives us confidence and the ability to to continue building credibility with partners and institutional investors.” — Girouard

6. My Take

This was a great quarter. Enough said.

Click here for my Upstart Deep Dive.

Hey. Great review thanks.

Can you please explain what is the contribution margin please? 🙃

Hi Brad,

I very much appreciated your Deep Dive. It was very timely, with the uptick in defaults raising questions at this time. I went into earning with a greater allocation because, at least in part, due to your analysis.

As you’ve said here, this was a great quarter.

Long Upstart now 12.2% of portfolio

Thanks,

Jason