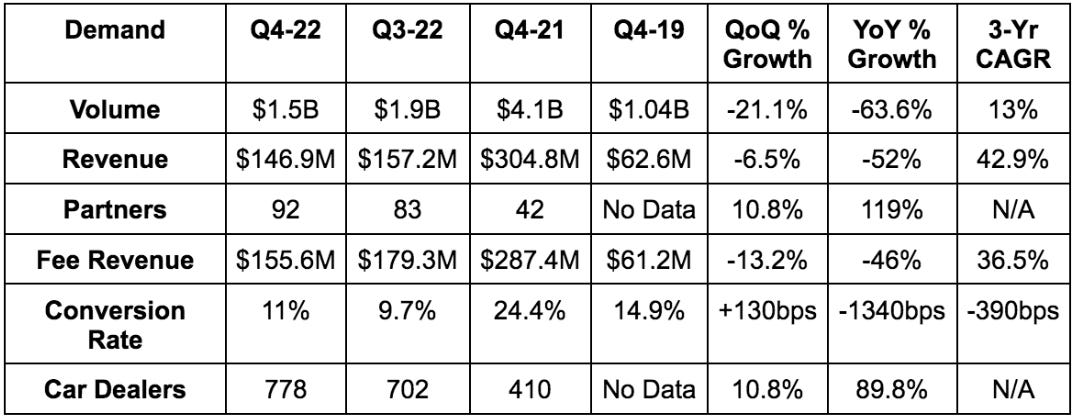

1. Demand

Beat revenue estimates by 10.7% & beat its guide by 8.8%.

More Demand Context:

Upstart’s demand was roughly in line with estimates. The beat was via holding more loans on the balance sheet than expected due to no suitors to sell the loans to. So it collected more interest income.

Revenue fell 1% in 2022 as a whole vs. 2021.

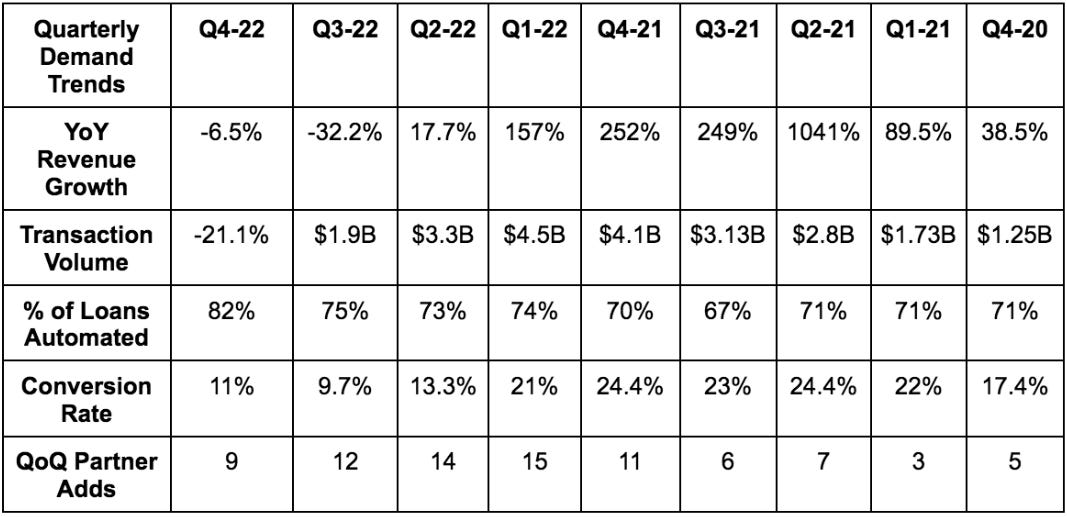

82% of Upstart’s loans were fully automated vs. 75% YoY.

Upstart continues to routinely turn down borrowers due to lack of supply. This is why conversion rate is plummeting.

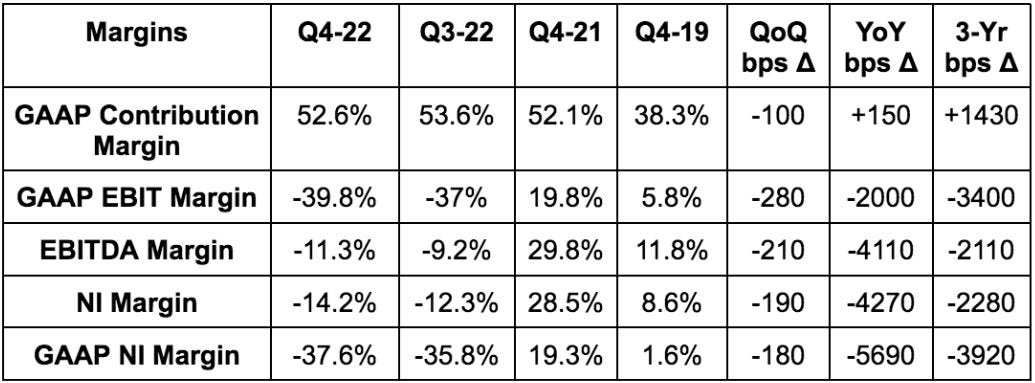

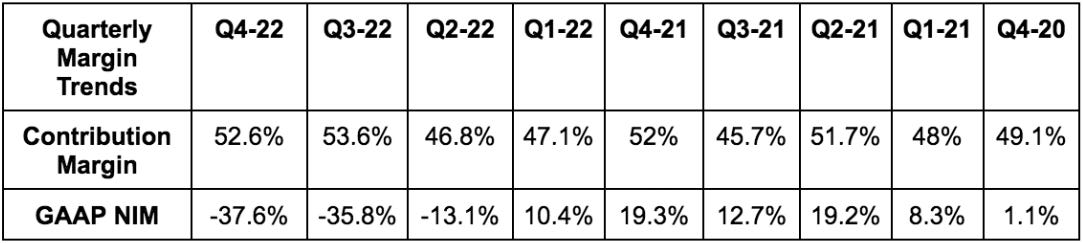

2. Profitability

Beat EBITDA estimates by 54% & beat its guide by 53%.

Beat GAAP EBIT estimates by 30.8%.

Beat -$0.97 GAAP EPS estimates by $0.30 & beat -$0.45 EPS estimates by $0.20.

Missed its contribution margin guide of 54% by 160 basis points (bps; 1 bp = 0.01%)

More Margin Context:

Contribution margin expansion is via higher take rates and more efficient marketing spend.

Sales & marketing fell 56% YoY.

EBIT fell from $141 million in 2021 to -$113.9M in 2022.

3. Balance Sheet

Upstart added $310 million in loans to its balance sheet. This was more than 4X the number it guided to. Yuck.

Most of this $310 million was core personal loans that it could not match with affordable external funding supply. As of now, its has $492 million in testing loans on the balance sheet for R&D purposes and $518 million in core personal loans. This company should be in survival mode right now and should not be adding loans for R&D purposes in my view.

On the bright side, operating cash burn of $674 million for 2022 was a matter of adding these loans to its balance sheet. So? it can revert the cash burn by not continuing to add loans like it hinted at being the plan in 2023. Some argue that the loans are valuable assets that can be liquidated if need be. They argue this makes the balance sheet fragility less concerning. It’s a fair point, but at the same time, its cash position falling from $986 million to $422 million YoY significantly crunches the timeframe of that outcome needed to come to fruition. It has about a 4-5 quarter runway of GAAP cash burn (ex-restructuring charges) which is far from comfortable despite cost control efforts.

It no longer has the luxury of time on its side. It needs credit markets to ease in a timely manner to stay solvent. If pundits like Michael Burry are correct, a resurgence of inflation and credit markets becoming even more conservative could force this company into an expensive capital raise to stay afloat.

It has $986 million in borrowings vs. $695 million YoY.

Partners retained about 30% of Upstart’s loans in 2022 vs. 26.3% in 2021. This is encouraging progress and must continue. Partner retention is inherently more durable and less sensitive to credit market cycles than capital market participants. A higher % here means a higher quality book of business.

It bought back another $28 million in shares which slightly accelerated QoQ. This is silly to me and borders on irresponsible. Capital preservation at the moment is far more pressing than buybacks. Preserve the dollars. Stop buying back shares. I’d prefer dilution today over being forced into a debt or equity raise with likely poor terms tomorrow.

Stock comp was 23% of revenue vs. 9% YoY. Stock comp dollars fell YoY, but revenue fell more sharply.

4. First Quarter 2023 Guidance

Upstart’s revenue guidance of $100 million missed estimates by a whopping 36%. The guide includes $110 million in fee revenue and a net interest loss of $10 million due to fair value adjustments on its loans. This is largely a factor of Upstart not being willing to use its balance sheet to fund more loans until it can find suitable partners to sell existing balance sheet loans. There aren’t any right now. And there’s also very little capital market and partner funding appetite. So? The large revenue miss is a matter of supply drying up. To a lesser extent, rising borrower interest rates are diminishing demand a tad, but this is almost entirely a supply-based issue. Demand remains “strong.”

While this was laughably embarrassing, it’s still better than continuing to unsustainably use the balance sheet. Again, liquidity is more important today than next quarter’s revenue number. As an aside, Q1 is always seasonally weaker than Q4 which amplified the implied sequential revenue contraction.

EBITDA guidance of -$45 million missed estimates by more than 200%.

It expects to lose about $0.85 per share vs. estimates of losing $0.18 per share. Not great.

We were told that “with some modest economic cooperation” the company would return to sequential (not YoY) revenue growth this year. In the Q&A, leadership added this was a real possibility starting in Q2. Still, the guidance assumes poor macro will last through Q1 2023 with no improvements despite some green shoots beginning to form.

While leadership has had their fair share of blunders, they described this quarter’s guide the same way they did last quarter’s. Hopefully this means they’ve effectively recalibrated how they model forward expectations considering the large Q4 beat.

5. Notes from the Presentation & Call

On the Balance Sheet & Liquidity:

“Our balance sheet is at the local maximum now.” -- CFO Sanjay Datta

Datta told us “they remain comfortable with the liquidity position today.” I guess that makes one of us.

The company is determined to return to profitability as soon as possible. The previously announced layoffs and product expansion pauses will save it $71 million in OpEx in 2023.

If demand for its loan pools return, cash flow would turn positive immediately considering liquidated loans contribute to that metric. But capital market demand has to actually return for this to happen.

On Effective Underwriting:

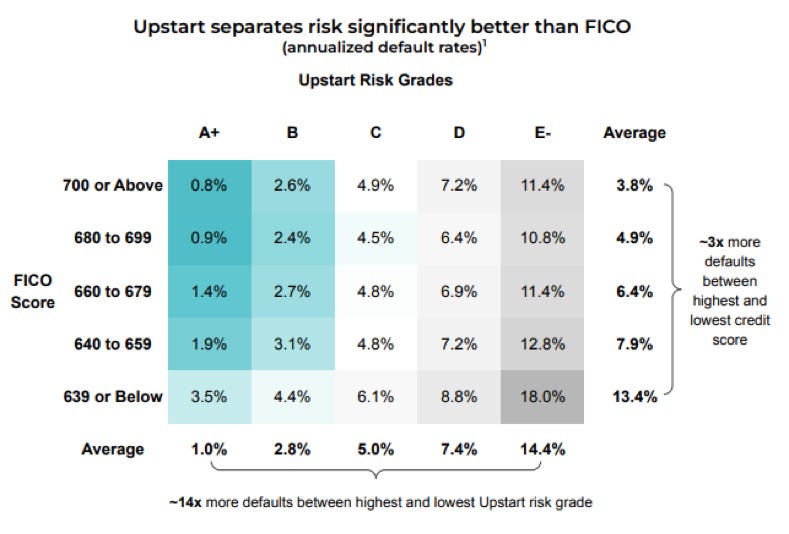

The following image shows Upstart’s continued ability to siphon credit quality tiers far more effectively than a FICO score — this is the best part of the report:

Upstart’s expected cash flows have begun to recover and converge towards target cash flows as macro starts to show preliminary signs of improvement.

Upstart’s partner loan retention program has consistently outperformed target cash flows since inception. That has not changed.

Out of Upstart’s 19 credit market vintages, 13 have outperformed and 6 have underperformed. In aggregate, these loan pools are delivering a 9.7% gross annualized return. This sounds robust, but it needs to be robust due to the elevated perceived risk associated with Upstart’s less affluent borrower demographic.

“We made more progress with our tech in 2022 than any year in our history. As capital markets and the overall economy normalize, this will become obvious to you all.” – Founder/CEO Dave Girouard

On Funding Sources:

The firm is in late stage discussions with multiple partners to secure committed, longer term capital market funding. Upstart will inevitably need to concede some of its margin in order to secure this funding. But that’s the right decision. Its margins were incredible during 2020-2021 and investors should be eager to accept a lower margin ceiling in exchange for less volatile revenue growth. I know I am. It hopes to have more news to share here soon.

On Macro:

“Last year was a perfect storm for us. The end of stimulus disproportionately harmed our borrowers and rates were hiked at the fastest rate in decades to leave lenders & capital markets concerned about the economy. Out of an abundance of caution, many lenders cut or paused originations despite Upstart loans meeting or exceeding expectations since inception in 2018.” -- Founder/CEO Dave Girouard

“Macro exceeded our most wildly bearish expectations.” -- CFO Sanjay Datta

The quote above should never come out of the mouth of a public CFO working in credit markets.

New bank and credit union retention partners are ramping volumes more slowly with Upstart than they had in the past. They are still on-boarding the tech partner at a rapid clip, but are waiting to lean into originations until macro improves.

Despite poor macro (or perhaps partially because of it), borrower demand remains “very strong.” It continues to raise its take rate due to this strong demand as evidenced by 2022 volume falling 14% YoY yet contribution profit rising 13% YoY.

CFO Sanjay Datta spoke on Upstart being early to call out delinquency trends in Q4 2021. They did subtly mention it, but this company was also one of the last to continue claiming “macro immunity” through credit cycles. Leadership didn’t handle this cycle well.

Upstart was actually able to place a loan pool through Asset-Backed Securitization (ABS) markets in January. It sees senior tranche demand (meaning first claim on residual cash flows) beginning to recover. Junior tranche demand has not yet but should eventually follow.

Leadership thinks credit performance for subprime bottomed at the start of 2022 with prime credit performance bottoming end of 2022. Capital market supply will come back first for prime loan pools. So? This prime performance bottoming is a necessary step towards Upstart’s funding supply returning.

Upstart’s Macro Index (UMI), which reflects delinquency rate expectations, worsened sequentially in Q4 vs. Q3. The rate of that worsening encouragingly slowed and even stabilized thus far in 2023 with savings rates rising for 3 straight months. As macro improves, loan performance expectations improve, required annual percent rates (APRs) fall and approval rates rise. This combination is generally a precursor to capital market funding supply returning. Upstart would also entertain resuming approval of lower credit quality bands if UMI keeps improving and funding supply recovers. This could (or could not) provide incremental upside to demand growth.

New Products:

24,000 small dollar loans originated for 2022 with half in Q4 alone. 86% of these are fully automated.

Upstart Auto Retail is now beta testing its underwriting model with 27 dealers. Among these dealers, Upstart offers have a 42% share of loan originations.

Upstart Auto Refinance customers are saving $5,581 on average over the life of a loan.

Auto rose to 3.7% of origination volume vs. 3.0% QoQ.

33% of auto loans were fully automated vs. 25% YoY.

Interestingly, leadership talked about a 2023 priority being “improving its ability to severe primary borrowers more competitively.” It sees this as making its transaction volume less sensitive to economic cycles. They’re right, but this is an exponentially more competitive demographic to try to compete in vs. its subprime niche.

Expanding Credit Access:

Upstart’s credit models approve 43% more black borrowers at 24% lower APR vs. a traditional model. It also approves 46% more hispanic borrowers at a 25% lower APR than traditional models.

6. My Take

2022 featured about as many exogenous headwinds for this company as one could imagine. Its failure to guide through the chaos and its constant flip flopping on balance sheet usage did not help. Macro hit this company hard, but its micro-level execution did too.

All of this led to the poor results we’ve seen over the last few quarters. STILL, Upstart’s underwriting quality continues to be a clear upgrade to legacy FICO models, it’s still signing new partners (who will hopefully eventually originate some volume) and its auto product is still starting strong.

Unfortunately, the balance sheet with the added $310 million in loans QoQ now looks fragile compared to where it was a year ago. It’s encouraging to hear that it doesn’t plan to use it more in Q1, but that means demand will be severely challenged until macro improves. And again, the time it has for this improvement to come is more finite than ever before.

Upstart has become a wildly speculative and wildly binary investment. Either it survives this cycle and funding appetite returns amid improving macro, or the exogenous backdrop remains poor for longer and it struggles to stay solvent. It may not go bankrupt if macro does indeed stay poor for longer, but it will surely have to aggressively dilute or lever up to stay afloat. Burn rates could also lighten with improving macro conditions and cost controls, but if the last year+ has taught us anything, it’s that relying on macro trends is never ideal.

The firm unfortunately had not built enough trust with retention partners to motivate continued funding as macro turned sour. HOWEVER, its partner pools consistently outperforming since 2018 (with no blemishes) should help build that trust for the next cycle. It’s really just a matter of getting to that next cycle which is somewhat likely but becoming less so by the quarter.

If this company has built partner trust, if it can stay liquid through the cycle and if it has truly invented a way to expand borrower access without ruining loan books for partners, the upside is immense. But there’s a lot of “if” there. Signs of its underwriting prowess do exist, but they’re not unanimous considering the 6 underperforming capital market vintages in 2022.

While this has 20-30X potential if everything goes well, the probability of things going well continues to tank. So? With all of this said, I sold 50% of my position after the spike this morning. A tiny piece is all investors need today if this investment works out. In my view, anything beyond that is taking too much risk.

Good write up. I do think, however, that you’re succumbing to the typical panic selling. If you’ve already made a small allocation then what’s selling 50% going to do? You’ve locked in a small loss and will miss out on a LOT of they survive—which is probably much more likely than you think.

Good analysis, thanks. I still cannot understand why the stock popped yesterday