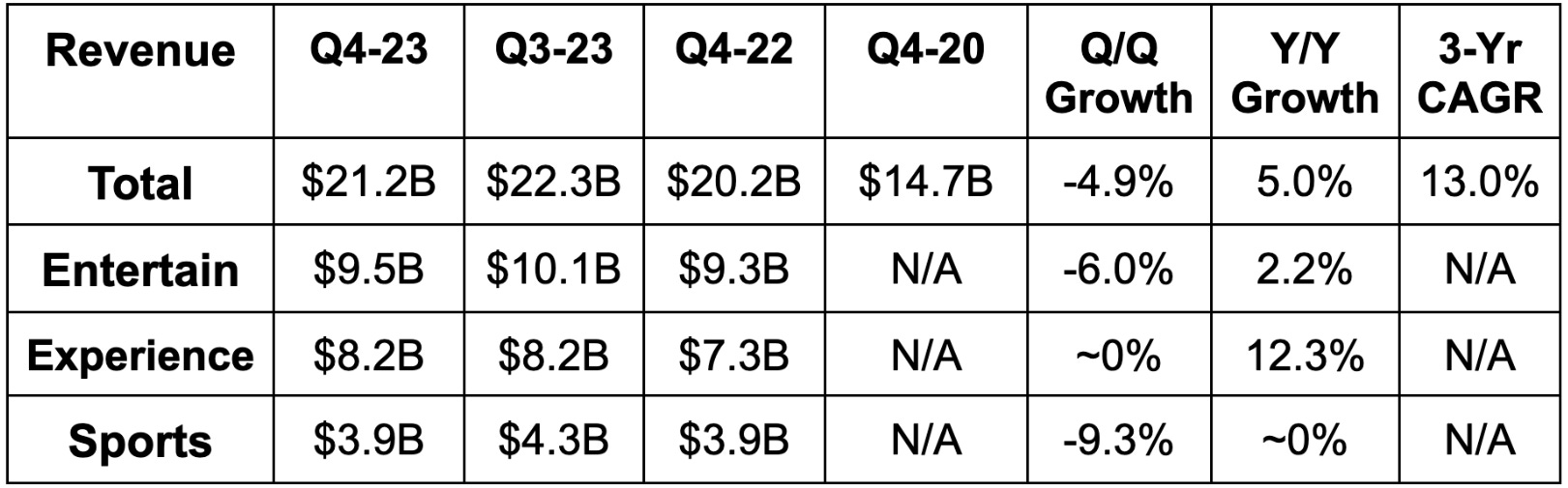

As a reminder, this is Disney’s first quarter under new reporting segments. The segments are:

“Entertainment”

“Sports”

“Experiences”

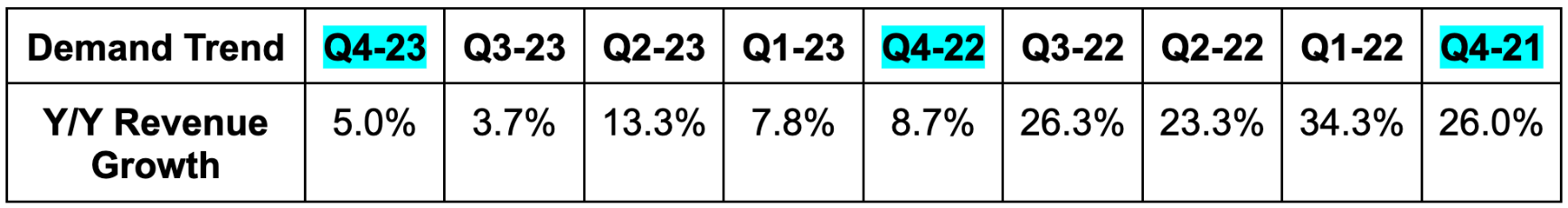

1. Demand

Disney missed revenue estimates by 0.7%. Sports and Experiences met revenue expectations while Entertainment slightly lagged.

Perhaps more importantly, it crushed Disney+ subscriber estimates of 2.7 million adds. It added 7 million.

Revenue rose 7% Y/Y for the full year.

Demand Highlights:

Within entertainment, linear revenue fell by 9% as the secular decline there continues. Affiliate and advertising revenue remain highly challenged within this bucket. Streaming revenue rose by 12% Y/Y. Disney+ subscribers rose 7% Q/Q, Hulu was flat and ESPN+ rose by 3% Q/Q. Disney+ revenue per user rose by 2% Q/Q thanks to “higher advertising revenue.” This is direct evidence of ad-supported tiers having higher value for Disney. Price hikes will boost revenue per user in the coming quarters as they went live after October 1st.

For experiences, rapid international park growth and its thriving resorts and cruises powered the success. Walt Disney World was the weak spot once again. More later.

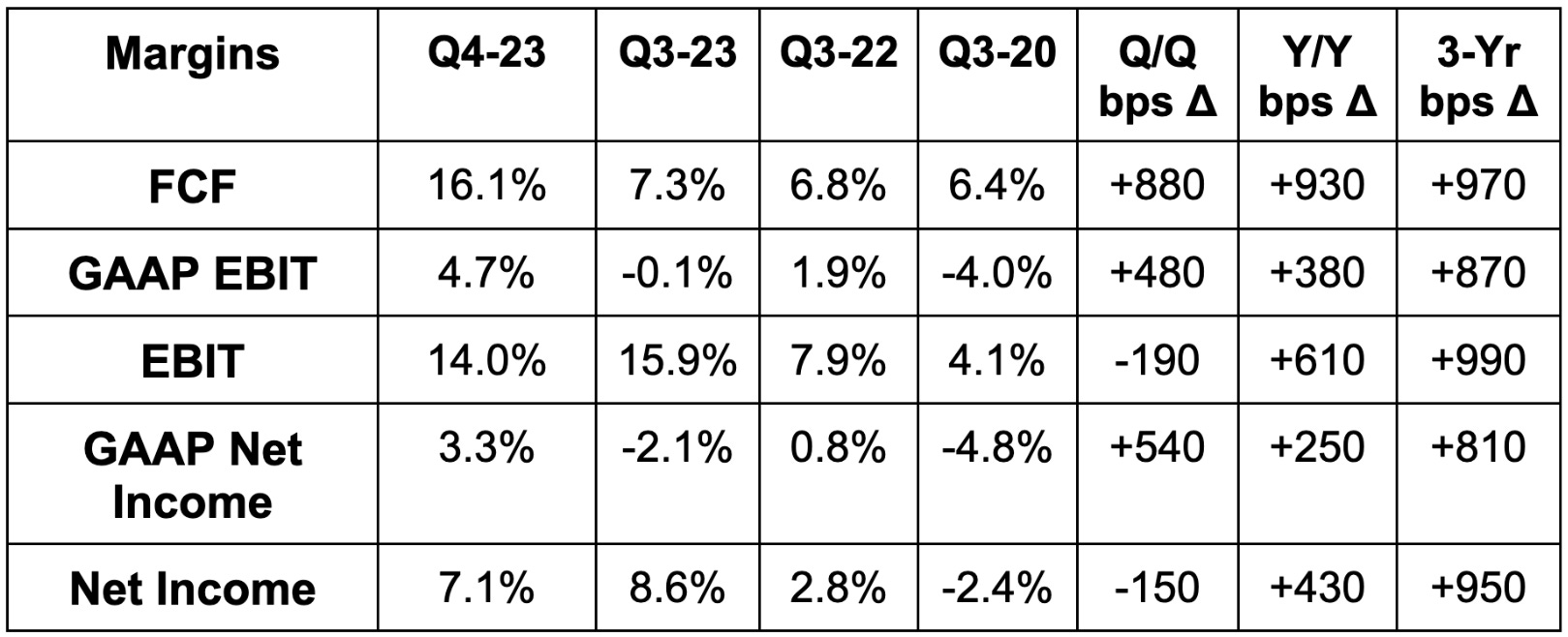

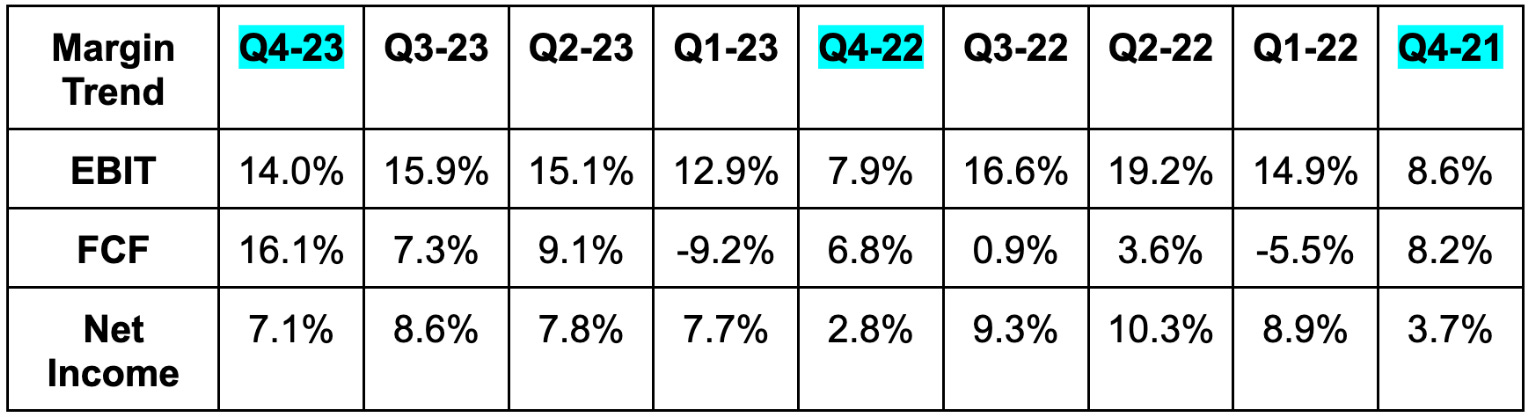

2. Profitability

Disney beat EBIT estimates by 5.9%, beat free cash flow (FCF) estimates by 19.4% and beat $0.71 earnings per share (EPS) estimates by $0.11.

Margin Highlights:

Earnings per share rose from $0.30 to $0.82 Y/Y. For the full year, earnings rose by 7% Y/Y while GAAP earnings fell by 26% Y/Y. This fall is entirely related to restructuring and content impairment charges. These charges are excluded from non-GAAP metrics. There was another roughly $1 billion in restructuring for this quarter. As restructuring charges won’t recur, I think it’s better to focus on non-GAAP performance at this time for Disney.

Full year FCF grew by nearly 5x from $1.06 billion to $4.9 billion. Based on the guide, more explosive growth is coming.

By segment:

2.5% Entertainment EBIT margin vs. -6.5% Y/Y.

This was powered by lower streaming losses and linear cost cutting.

25.1% Sports EBIT margin vs. 22.1% Y/Y.

This was helped by the absence of Big Ten Football rights, but ESPN+ subscriber growth was healthy regardless.

21.6% Experiences EBIT margin vs. 18.5% Y/Y.

This was helped by strong reopening tailwinds at its international parks.

EBIT margin expanded domestically despite some temporary Walt Disney World challenges.

Streaming EBIT margin was -8.3% vs. -31.1% Y/Y as Disney reiterated its path to positive streaming EBIT by Q4 2024. This improvement is not being propped up by the change in segment reporting. Under the old reporting structure, streaming losses improved by $1 billion Y/Y and $125 million Q/Q. Nothing shady here.

3. Balance Sheet

$14.2 billion in cash & equivalents.

$46 billion in debt ($4 billion is current).

Will restart the dividend by the end of the calendar year.

Share count is roughly flat Y/Y

4. Guidance

Disney didn’t offer much color on 2024 guidance. It told us that cash content spend will fall from $27 billion to $25 billion. It also said that capital expenditures (CapEx) will rise from $5 billion to $6 billion. What it did tell us about high profile metrics was wildly encouraging. The firm guided to $8 billion in 2024 free cash flow which is 18% better than expected. This is the investment case coming to fruition.

5. Call & Release Highlights

Turning a Corner & Asset Reshuffling:

The call theme was highlighting the progress that Disney has made to restructure itself over the last year. Bob Iger covered efficiency gains and spoke about re-embracing content windowing, sports gambling and more content licensing. It finds itself on far better footing than a year ago (see the earnings and FCF bounce-backs) and is ready to shift from “fixing to building.”

That “building” includes Disney’s planned purchase of the rest of Hulu from NBC Universal. Recall that the 33% stake will cost Disney $8.3 billion with its cash position sitting at $14.2 billion. That’s not comfortable especially given its debt load. I don’t want to see this capital structure levered up any more… and it likely won’t be. Along these same “turning a corner” lines, Disney is rationally reorganizing its asset base. Iger again told us that a majority sale of its India business is in the works (wants to remain a minority partner). He hinted at linear asset sales coming. Finally, he all but told us that ESPN will partner with mega-cap tech as it moves to streaming. It’s behaving rationally.

These sales would fund the Hulu purchase and make Disney’s asset base less antiquated. The ESPN deal would make sports content bidding more feasible too. Disney can’t compete with Google, Apple and Amazon for expensive live sports rights. But? Disney has THE iconic sports brand they all want a piece of. It’s the most followed brand OVERALL on TikTok, for example. So? Partner. Merge your strengths.

Leaner & Meaner:

Disney’s initial cost savings goal under Iger was $5.5 billion annually. It then told us that it would do “better than $5.5 billion.” This quarter, it updated the cost savings target to $7.5 billion. It expects to save $4.5 billion annually on entertainment content spend, vs. $3 billion previously, as it cuts back on general entertainment. Based on the robust Disney+ subscriber adds, these cuts are not impacting demand. Lower costs without lower revenue is always nice.

All of this paved the way for the aforementioned $8 billion in 2024 free cash flow guide. While free cash flow is being helped by current actor strikes (less content spend), it’s also being hurt by CapEx returning to pre-pandemic levels. Both of these items were surely already baked into consensus estimates. It comfortably beat those estimates.

Streaming:

Disney+ remains on track to be EBIT positive by the end of fiscal year 2024. I expect it to reach that target more quickly given the outperforming progress we’ve recently seen. Its refreshed approach to marketing and the reorganized team continue to bear fruit.

Ad-Supported Streaming:

The Disney+ ad supported tier keeps rapidly growing. 50% of new U.S. subscribers went with ads as the base grew from 3.2 million to 5.2 million sequentially.

Ad-supported subscribers are spending 30% more time on Disney+ than ad-free subscribers. This means more impressions to sell and more revenue.

Ad-supported subscribers are more valuable for Disney+ than non-ad-supported subscribers just like for Netflix (and Hulu). That’s why we see Disney hiking prices for ad-free plans. And again, ads are boosting revenue per user for explicit evidence of this being the case.

It thinks Hulu has the best ad-tech stack in the industry and is now actively bringing those tools to Disney+.

Along those same streaming unification lines, its unified streaming app is on track to launch in the coming months. It will beta test the bundle starting in December and expects the release to eventually juice engagement, retention and margins. Finally, the account sharing crackdown will be a 2024 event with that coinciding boost to subscribers being enjoyed in 2025.

Films and Streaming:

Disney’s theatrical releases continue to be some of its top streaming performers. Little Mermaid, Elemental and the new Guardians of the Galaxy film are all ranked near the top for watch hours. Why does this matter? Two reasons. Its core brands working in the world of streaming allow it to differentiate vs. other players. This means better pricing power and retention. No other streamer has its bench of IP. Secondly, this is allowing it to spend less on streaming series releases. This shift, per Iger, will boost Entertainment margins as successful films generally create more profit than a general entertainment series. The boost to Entertainment content savings is evidence of this playing out.

Iger continued to hammer home the “restore creativity to the center of the business” narrative. To me, this is his subtle way of saying Disney will focus on creating elite content vs. influencing polarizing cultural issues. Just tell great stories.

ESPN & Ad Demand Overall:

Aside from partnerships, there were a few other interesting ESPN notes. The ad sales continue to stabilize and even improve. ESPN continues to be by far the healthiest part of linear TV. Viewership for 18-49 year-olds set a 4 year record and it took more market share of viewing hours despite ramping competition. ESPN Bet will launch next week.

Notably, ESPN’s shift to streaming could coincide with leaning into local sports rights, per Iger. It won’t “take too much risk” here but will explore partnerships. Considering the financial struggles of local sports vendors like Bally’s, this could be promising.

While ESPN is the bright spot for linear ad demand, overall linear demand isn’t as bad as some think. Iger called it “stronger than expected”, but not where he wants it to be. It likely will never be where he wants it to be again considering the steady decline of cable. It’s all about extracting linear value while it can and buying enough time to let streaming mature to a point of replacing this business.

Experiences (Parks, Resorts and Cruises):

Walt Disney World continues to deal with tough comps related to lapping its 50th anniversary. Accelerated depreciation charges for its galactic starcruiser resort and unique wage inflation are also holding back this park’s performance. Tough comps specifically will continue next quarter. For evidence that this isn’t just a convenient excuse, bookings activity for Disneyland in California, its cruises and its international parks was called “exceptionally strong with no economic hangover.”

As reviewed at Disney’s investor day last month, returns at the parks continue to steadily rise. Return on Invested Capital is 100% higher than in 2019 at its domestic parks with large gains internationally too. This is why it’s doubling annual CapEx from $3 billion to $6 billion here. It’s pulling money from low return linear and general entertainment investments and adding it to this bread and butter. Cost savings will more than cover this extra $3 billion a year… but that isn’t necessary. The CapEx will be self-funded by the strong segment profits.

6. Take

This turnaround was supposed to be a long process. I was never expecting signs of life to be as clear as they are today. Well? They’re crystal clear. Disney is doing the things it needs to do to drive compelling demand and profit growth for the long term. It’s further along on the turnaround path than I hoped for, plain and simple.

It is hyper-focused on its high return, high differentiation businesses and turning away from projects that aren’t worth its time. It’s fixated on elite storytelling, omni-channel fan activation and taking care of shareholders rather than worrying about cultural issues. What a concept. There remains much more work to do to fix this company, but the fix has fully begun.

Nice read. Disney's turnaround is projected to take some years. Let's be optimistic