Table of Contents

1. Hims (HIMS) — Earnings Review

Hims is an online healthcare marketplace that conveniently connects patients and providers. Its specialties include sexual health, dermatology, mental health and weight loss.

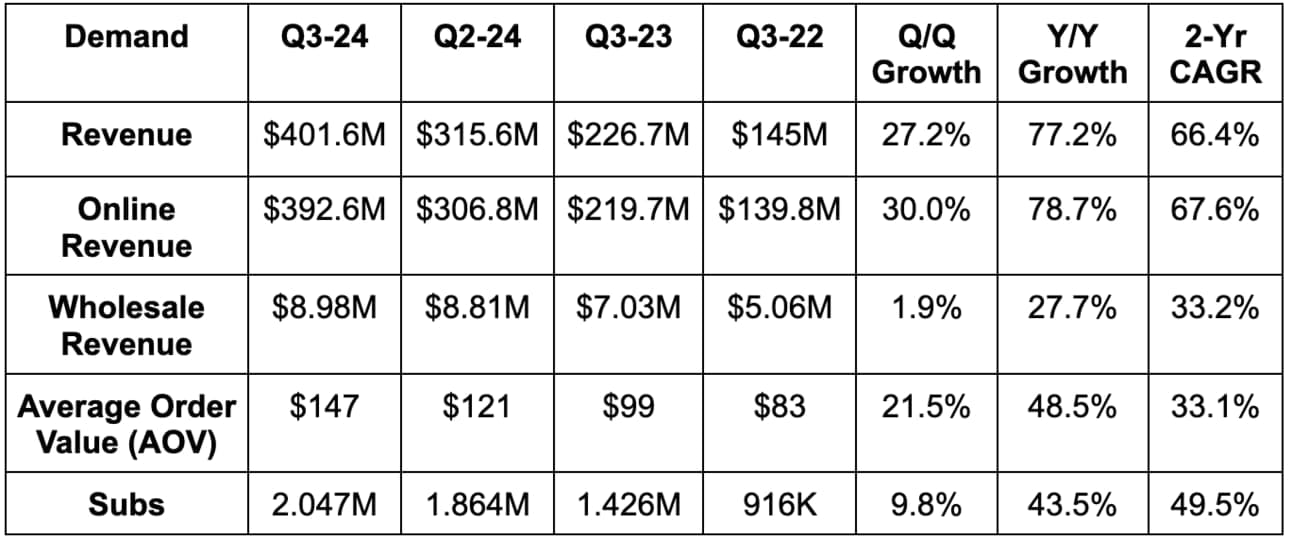

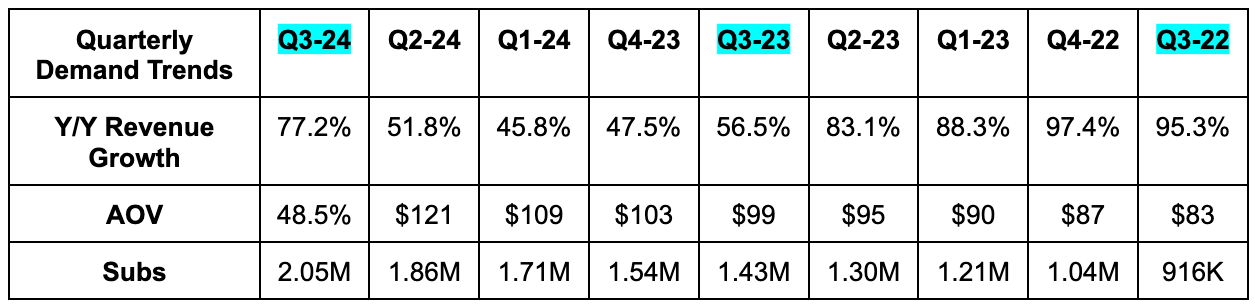

a. Demand

- Beat revenue estimates by 4.9%. Its 66.4% 2-year revenue compounded annual growth rate (CAGR) compares to 66.7% Q/Q and 65.7% 2 quarters ago.

- Paid subscribers slightly, slightly missed estimates. You could call it a rounding error.

- Average Order Value (AOV) beat estimates by 16%.

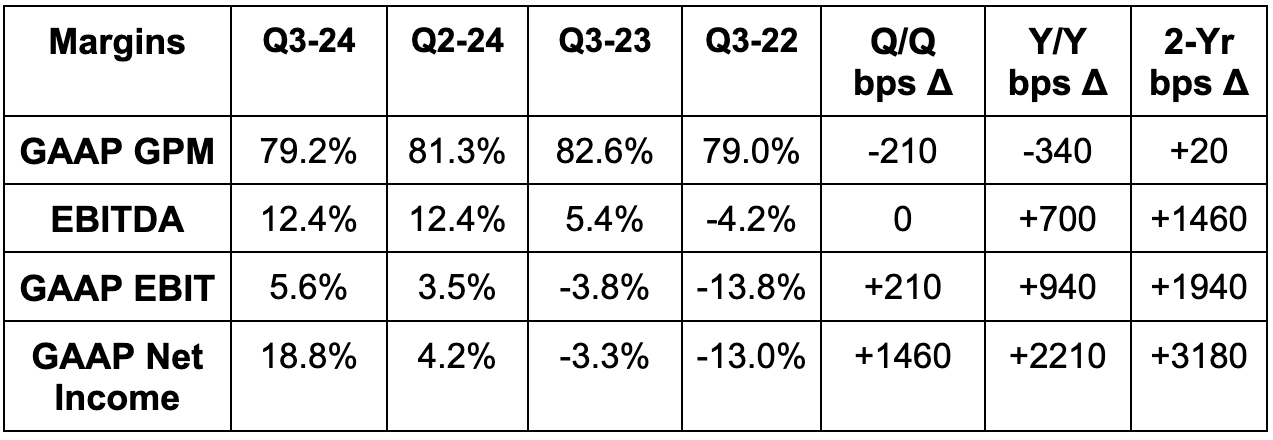

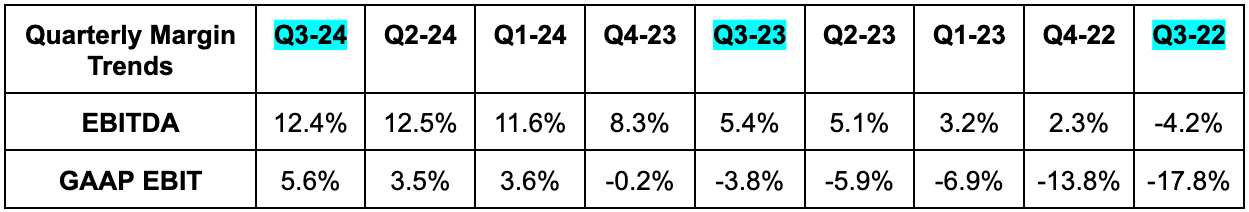

b. Profits & Margins

- Its 79.2% gross margin beat 79.0% estimates by 20 basis points (bps; 1 basis point = 0.01%). GPM fell Y/Y due to investments in its newer weight loss business as expected.

- Beat $9M GAAP EBIT estimates by $19M.

- Beat $0.05 GAAP EPS estimates by $0.27. This includes a $52 million tax benefit. Excluding this help, it beat $0.05 GAAP EPS estimates by $0.05. Still very good, but that must be considered. I saw several major outlets forgo this needed context.

- Beat EBITDA estimates by 31% and beat guidance by 36%.

c. Balance Sheet

- $255 million in cash & equivalents; $49 million in inventory vs. $22 million at the start of 2024.

- No debt.

- Diluted share count +12% Y/Y; basic share count +3% Y/Y.

d. Guidance & Valuation

- Q4 revenue guidance crushed estimates by 11%.

- Q4 EBITDA guidance beat estimates by 30%.

- Reiterated its path to 20%+ EBITDA margins by 2030. Looks like they’re going to comfortably beat that schedule.

- CapEx is going to pick up a bit to support capacity expansion and facility automation.

Hims trades for 32x forward earnings and more likely closer to 27x-28x following this report. EPS is expected to grow by 156% Y/Y this year and by 41% Y/Y next year.

e. Call & Release

The Company Foundation:

For several quarters, the theme of Hims investor materials has been the power of “personalization.” From the company’s beginning, it set out to create a “proprietary” electronic medical record (EMR) that enabled it to unleash its growing database and innovate with faster velocity. This core can ingest, organize and leverage all structured data to build customer data profiles, personalize touch-points and ensure higher quality care. Whether it’s adding vitamins into prescriptions that a consumer is deficient in, combining prescriptions into single pills, customizing dosing and titration schedules or selecting substitute drugs based on side-effect profiles, data and personalization help a lot. This becomes more true and more precise with scale.

The modern, data-fueled EMR offers more benefits to its ecosystem. Per Hims, the foundation “reduces administrative burden” by automating customer appointment summaries and helping with paperwork. Furthermore, this approach has enabled Hims to debut two additional products to augment the personalization value that it provides:

First, MedMatch is essentially the firm’s automated insight hunter and gatherer. It utilizes GenAI and machine learning algorithms to uncover valuable pieces of information to nudge best provider practices. Whether it’s understanding polypharmacy or other drug interaction issues, comorbidity concerns or something else, the added context makes them more informed and better at their jobs. This tool has been available for about a year, but is only now expanding to weight loss.

The newest tool to support its care personalization aim is called Clever Routing. One of the main value propositions that Hims provides is compelling drug pricing and easier, more convenient access. One of the ways that it can position itself to provide more savings and unique value over time is by making sure its own operations are as efficient and profitable as possible. That’s really where this tool comes into play. Clever Routing pulls from data profiles to route customer journeys based on specific needs. If a patient requires more expensive, real-time access to a provider, it will guide them accordingly. If a patient needs a response to an administrative message sometime in the next week, perhaps a cheaper customer service interaction will be sufficient. Clever Routing knows.

Access & Adherence:

Let's stick with driving greater access and “democratizing” prescriptions for a moment. Hims allows providers to greatly expand their patient networks with modest incremental effort. And again, it gives them impactful data tools to use for their own care quality. This makes it doable for providers to interact with Hims patients a lot more than a traditional primary care physician relationship would allow. For context, patients routinely have text-level access to these providers. This is especially valuable for disciplines like mental health, where consistent interaction is needed. Weight loss is another area where this has a profound impact. Per Blue Health Intelligence, just 42% of GLP-1 patients are still taking the weight loss injectables after 12 weeks. On Hims, it’s 70%.

More on Personalization Traction & Impact:

For the first time, 50%+ of Hims subscribers are now on personalized subscriptions while 65% of all new subscribers went with personalized plans too. These customers boast higher retention and higher lifetime value for Hims, making it clear why this shift is being pursued. And while success here is great, leadership will readily tell you that it’s “very early.” Much more to do across new specialties and combining medications for prescriptions across multiple specialties.

“In some subspecialties of women's dermatology, we are seeing annual retention increase by more than 20 points year over year. The mix of those utilizing a personalized solution increased 40 points year over year to approximately 70%.”

Hims CFO Yemi Okupe

Weight Loss:

The regulatory environment for GLP-1 drugs remains volatile and fluid. As a reminder, when drugs are on shortage lists, the FDA relaxes rules on compounding substitutes to sell to the public. Popular generic compounds (Dulaglutide, Liraglutide and Semaglutide) are all on that shortage list, which is good for companies like Hims. There is growing concern that supply chains are recovering (especially for Semaglutide) and that shortage designations will be short-lived. That could create new risk for this firm’s ability to sell GLP-1s. Notably, it doesn’t see these shortages being resolved in the near term. It called out 80,000 customers reporting inability to secure access recently and doesn’t see that list shrinking at all. It’s actually growing. Leadership also hinted at thinking it will be allowed to sell GLP-1s following shortage list removal, thanks specifically to the personalization approach it has taken:

“The Food & Drug Administration has long recognized the critical role that compounding plays in meeting the clinical needs of patients. Compounding meds that are not essentially copies of commercially available drugs existed prior to and will continue regardless of the shortage status… The compounding exemption has always allowed for the personalization when clinically necessary… There's very well documented and outlined abstracts of the compounding exemption. We believe that dosing specifically for this type of treatment to mitigate side effects right down the center of what that compound exemption is built for. “

CEO Andrew Dudum

“And we're seeing the number of consumers voicing their frustration increase, not decrease in recent weeks. In fact, on a single day last week, we saw nearly 2,000 indications from individuals that have been unable to obtain name brand GLP-1s.”

CEO Andrew Dudum

There are many rich companies lobbying to get the FDA to clamp down on Hims and others selling copy-cat versions of their branded GLP-1s. Technically, these companies are supposed to have exclusivity windows before generics can compete. This protects their R&D dollars so that biotech discovery isn’t quite as risky. We’ll see how this shakes out.

Regardless of what happens, Hims is still delivering 40% Y/Y subscriber growth excluding weight loss, so it’s not like growth relies solely on this channel.

More weight loss news: