The Hims Review in section 2 of this article (after the Palantir review) is for paid readers. Upgrade below to read that, 40+ other reviews from this season, my current holdings & consistently thorough news/insight.

Table of Contents

- Meta Earnings Review.

- Alphabet Earnings Review.

- Apple, ServiceNow & Starbucks Earnings Reviews.

- Amazon & Mercado Libre Earnings Reviews.

- PayPal Earnings Review.

- Tesla Earnings Review.

- SoFi Earnings Review.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- My current portfolio & performance vs. the S&P 500.

1. Palantir (PLTR) – Earnings Review

a. Palantir 101

Palantir is a software company that helps customers get the most out of their structured and unstructured data. Like many others, it pulls from years of AI/ML work to automate insight-gleaning. It utilizes complex neural networks to power anomaly detection, trend forecasting and natural language processing… all with the aim of making enterprises more successful in cultivating customer relationships, making informed decisions and driving financial success. With Palantir, clients gain conjoined access to any data they need, and the tools to fully unleash that asset’s value. It gives customers a bird's-eye view of their operations, with detailed suggestions to help optimize products and uncover patterns. This all happens in a zero-risk environment via a process called ontology. Ontology enables clients to freely test massive digital twins to actually observe what works and what doesn’t. It’s like split-testing on steroids.

Revenue is neatly split into two buckets – “government” and “commercial.” Government clients predominantly use its Gotham product platform, while commercial clients mainly use its Foundry product platform. With Gotham, Palantir builds custom use cases for individual government clients. Foundry was built to be more malleable, with far more pre-built app integrations and developer kits available. That diminishes the need to conduct custom builds for every single enterprise. Still, it does materially more custom building than a typical B2B software firm will. It’s expensive, but also great for client stickiness and up-selling. It also seamlessly leverages the commercial platform to cater to industry-specific needs. By-industry models are intuitively named “micro-models.” These boast sector-specific use cases with granular, relevant regulatory compliance help. A financial services model from Palantir, for example, may specialize in assessing credit risk or fraud detection.

Palantir Apollo provides continuous integration and continuous delivery (CI/CD) to automate software package building and deployment. It’s a foundational piece of the firm’s ability to collect, utilize and drive value from broad data ingestion. This is a foundational piece of why Gotham and Apollo are so good at creating better outcomes.

AIP 101:

In the realm of GenAI and Agentic AI, Palantir is not playing the game of building the biggest model or buying the most GPUs to have the largest infrastructure footprint. It gives clients the ability to tap into whatever 3rd-party tools they want, while building granular use cases on top of them to finally extract ROI-fostering value from these assets. The app layer of AI is where this firm shines.

Its most exciting product is called Artificial Intelligence Platform (AIP) for highly automated app-building. The company compares AIP to what public cloud vendors did for compute and workload modernization. AWS, Azure, Google and Oracle provided the environment, tools, storage, security and maintenance needed to grow compute capacity without managing it yourself. This made migrations and adoption the rational decision. AIP attempts to do the same thing in terms of pushing enterprises to build and use GenAI applications. They fully manage all of the annoying and tricky pieces of embracing AI, allowing companies to more easily and confidently build (with Palantir’s help). AIP directly integrates with Foundry and Gotham, unlocking an ability to build powerful agents and apps with those products and an ability to extract more value from models. Considering the lack of finite and structured end products stemming from AIP, I think it helps to hear about some examples of what clients are doing with it:

- Turning inbound emails into automated inventory decisions.

- Automating healthcare documentation for claims.

- The Department of Defense (DoD) is using it to shrink app creation time from hours to seconds.

- Lowe’s cut its overdue task rate by 75% with it; General Mills saves$14M/year with it.

AIP is where jumbled data, processes and ideas turn into the operationalized, actionable creation of GenAI products. Initial go-to-market for AIP has been its “bootcamps” where it hosts events to provide hands-on support and “get clients from 0 to use case in 5 days. It has more recently begun to build out an external sales team (slow ramp) to support this segment’s momentum. AIP progress is most noticeable in its impressive U.S. Commercial results.

More AIP Tools:

- AI Forward Deployed Engineer (AI FDE) provides customers with an AI-based equivalent of a highly-skilled engineer to manage and guide more of the app creation process. This is “accelerating the already eye watering time to value for customers” by managing ontology, data migration, code debugging and other tasks. In turn, this greatly reduces resources needed to deploy AIP.

- AI Workbench provides a safe environment for testing and iterating on AIP work. It’s a developer playground for building and testing agents and setting up data workflows, with slick tools for checking work and debugging issues.

- ontology-as-Code, integrates with a developer’s familiar tools and allows them to build ontologies with more guidance and guardrails.

All of these products reduce friction associated with using AIP and Palantir’s software by adding support for 3rd-party services, expediting and managing product creation and offering a secure environment (with compelling automation) to do all of this work.

More Products to Know:

- Operation Warp Speed is a modern industrial operating system (OS) that equips companies and governments with cutting-edge enterprise resource planning (ERP), product lifecycle management (PLM) and a manufacturing execution system (MES). It’s a fully managed way to rapidly allow manufacturers to fix how they build things. This is how Palantir plans to help “reindustrialize” the United States and ensure we build everything we need here. Good timing, considering tariff uncertainty continues to rage.

- FedStart is Palantir’s accreditation program for FedRAMP certifications needed to sell software to the government. It shrinks the time and cost it takes securing this status and makes Palantir more of an ally vs. an enemy for other software companies.

- Maven is PLTR’s Department of Defense AI and data analytics platform.

b. Key Points

- Another large beat and raise quarter powered by U.S. Commercial.

- Operation Warp Speed is off to a great start.

- Several more customer case studies highlighting why AIP is winning.

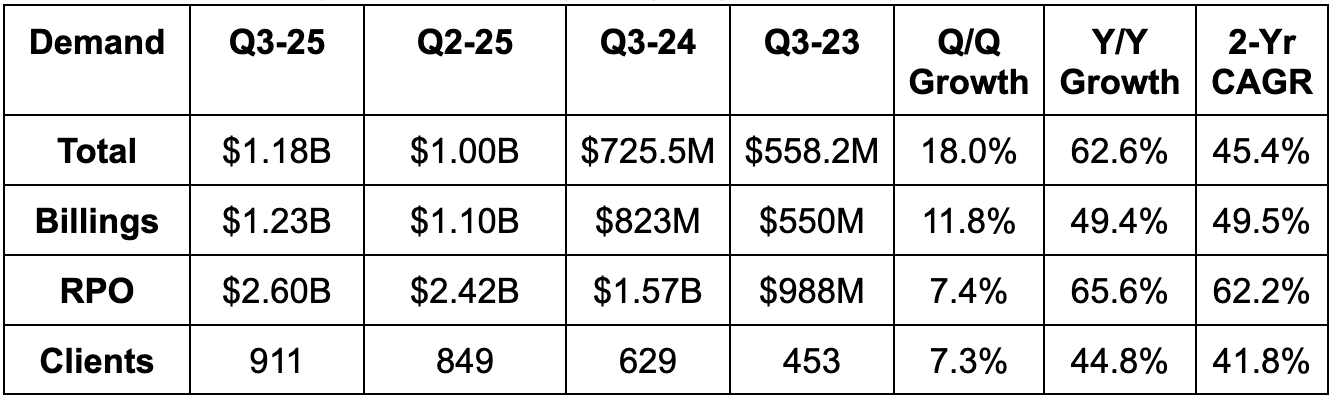

c. Demand

- Beat revenue estimate by 8.2% & beat guidance by 8.7%.

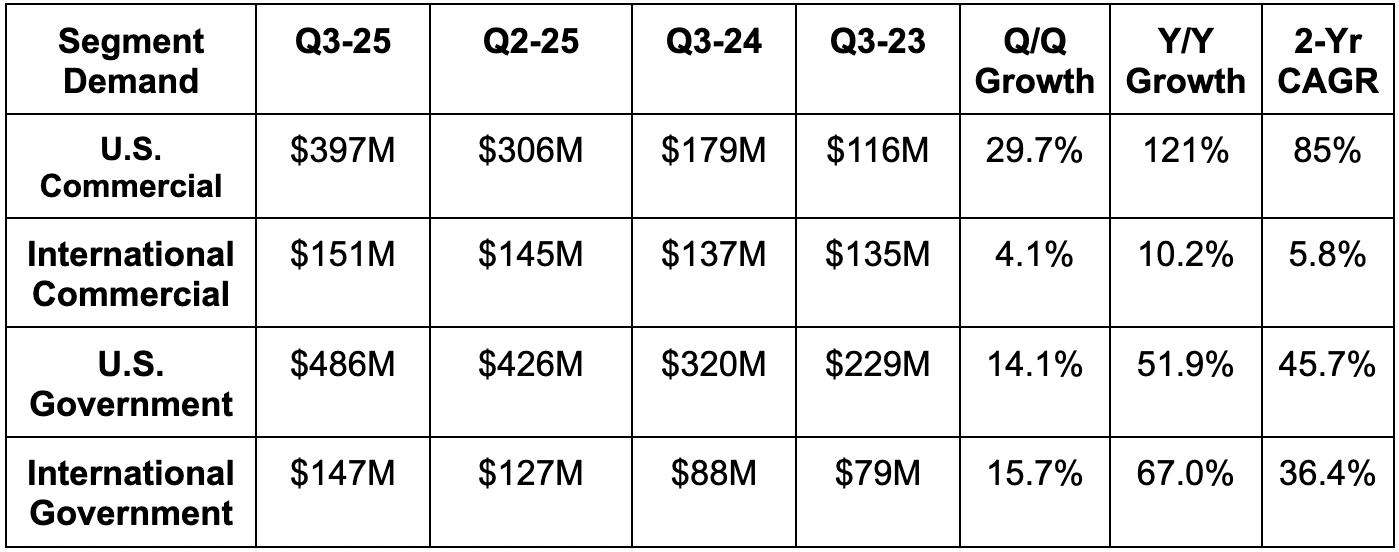

- U.S. commercial revenue beat estimates by 16% (thank you, AIP).

- International commercial revenue beat estimates by 4.5%.

- U.S. government revenue beat estimates by 3.5%.

- International government revenue beat estimates by 16.1%.

- Beat billings estimates by 7.9%.

- Beat remaining performance obligation (RPO) estimates by 40%.

d. Profits & Margins

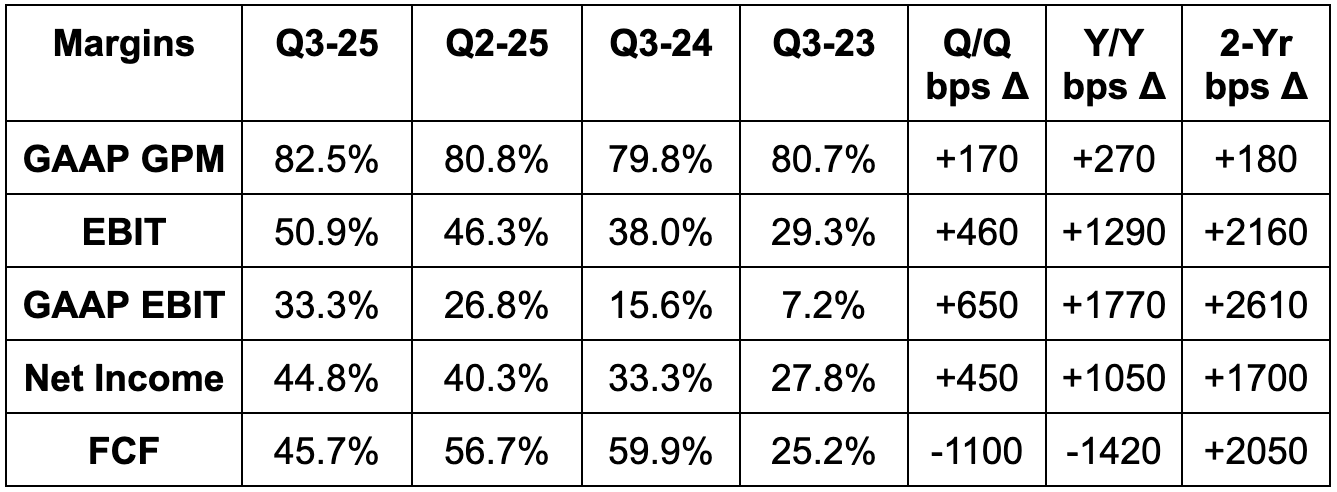

- Beat 81.1% GPM estimate by 140 basis points (bps; 1 basis point = 0.01%).

- Beat EBIT estimate by 20% & beat guide by 21%.

- Amid rapid and accelerating growth, expenses rose by 29% Y/Y – less than half the rate of revenue.

- Beat $0.11 GAAP EPS estimates by $0.07.

- Beat FCF estimate by 24%.

e. Balance Sheet

- $6.4B in cash & equivalents.

- Untapped $500M credit revolver.

- No traditional debt.

- 4.5% Y/Y share count dilution.

f. Guidance & Valuation

- Raised Q4 revenue guide by 13.3%, which beat estimates by 8.9%.

- Raised Q4 EBIT guide by 21%, which beat estimates by 20%.

- Raised annual U.S. commerce growth guide from 85%+ to 104%+

- Raised annual FCF guide by 5.3%, which beat estimates by 3.1%.

PLTR trades for 97x… yes 97x forward sales. It also trades for 280x forward EPS, as the sky-high sales multiples is a bit offset by sky-high margins. Those margins depend on differentiation-based pricing power that looks quite strong for Palantir right now. Estimates will sharply rise following this report, which will lower the forward multiple a bit too. It’ll still be extremely elevated, but worth noting. EPS is expected to grow by 58% this year and by 35% over 2026-2027 (pre-revisions).

g. Call & Presentation

Short call (44 minutes) as always.

Taking a Moment to Appreciate These Numbers:

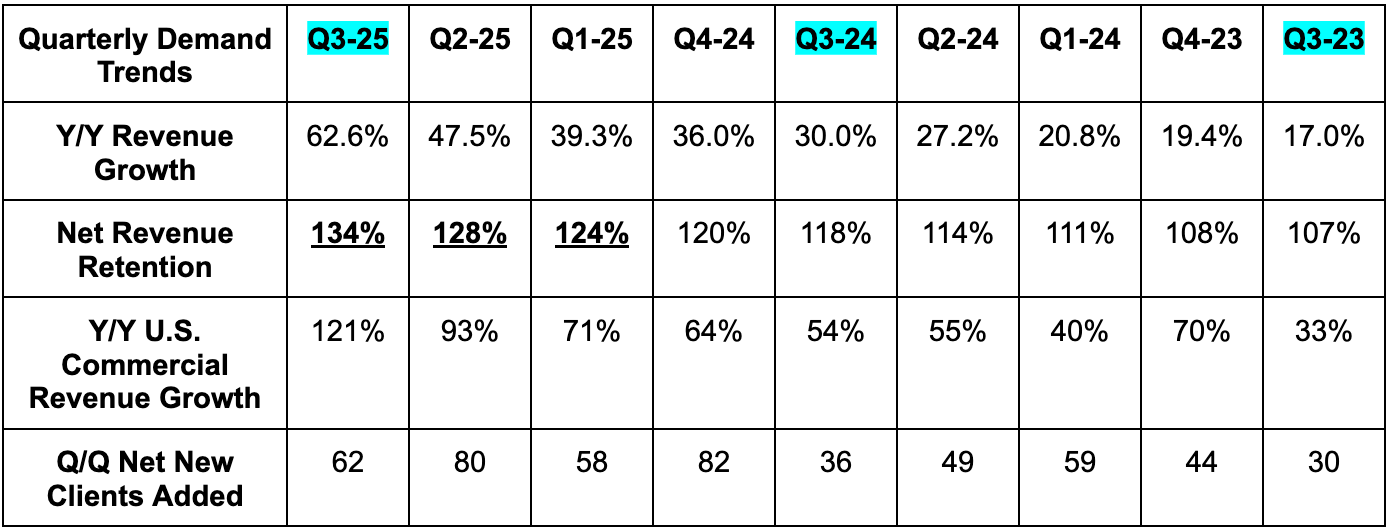

These numbers are ridiculously good… again. $1M+ deals doubled Y/Y while $5M+ deals 5Xed. Total Contract Value (TCV) bookings rose by 151% to $2.8B, eclipsing last quarter’s record by a full 18%. U.S. Commercial TCV bookings rose 342% Y/Y, crushing previous quarterly records. Revenue from its top 20 customers rose 38% Y/Y to $83M, while overall customer growth modestly surpassed expectations once more. Remaining Deal Value (RDV) rose by 91% Y/Y (U.S. commercial +199% Y/Y), pointing to demand remaining overwhelmingly strong for this company going forward. And while net dollar retention continues ramping to a now elite 134%, they think that’s going higher. Any metric we look at here will make your jaw drop like it has for the last year. This is the company monetizing the app layer of the AI opportunity better than anyone else on the planet. And it is not particularly close, either. To do all of this while also delivering 10+ points of Y/Y operating leverage is truly bonkers.

U.S. Commercial & AIP:

U.S. Commercial is leading the way as enterprise flocks to Palantir as their AI app innovation partner. AIP is dominating for the same reason it has dominated since inception. It’s created unmatched, proven value. Leadership is confident that their recipe of AI FDEs, ontology and Foundry is best-in-class. And they think the ability to use their software to actually extract useful applications from LLMs is unmatched. It’s very hard to disagree when looking at results. More customer case studies help provide a lot more evidence too:

- Lear saved $30M+ in OpEx over the first two quarters of 2025 with AIP.

- American Airlines has saved “tens of millions.”

- BP is enjoying a triple figure return on investment (ROI) with AIP.

- There are several examples like these offered every single quarter.

It’s quite simple. Palantir is delivering better outcomes than its competition at the moment. It’s packing all needed AI services into a highly compelling and well-crafted bundle and giving these customers everything they need to solve their most pressing problems. Thanks to fully leveraging a customer’s own data paired with PLTR’s cutting-edge tools, the solutions to these problems are better. As Karp puts it, they’re making their customers a ton of incremental money, and taking a small piece of that. No customer will ever have an issue with you spiking their profits more than anyone else can and taking a small cut. AIP is thriving because AIP is a better product. That’s how this product continues to accelerate despite very tough comps.

They’re also doing it while the sales team shrank Y/Y. How? The autonomous AI FDE army within AIP is rapidly getting customers to operational solutions in a far more autonomously managed manner. Less heavy customer lifting for better end-products and more support is a mix that sells itself. Generally speaking, Palantir slowly built a platform based on fixing very tough problems for a diverse set of industry leaders across different parts of the economy. That has made the platform so impactful and malleable, as they can easily learn from previous work and seamlessly tweak it to fit the mold of other needs.

- Two human FDE’s used Palantir’s AI-based FDE’s to migrate an entire legacy data warehouse in one business week. Per Palantir, this would have “taken system integrators up to two years.”

- Between AI FDE’s and how many of PLTR’s conversations now happen with CEOs rather than VPs, the sales cycle is shrinking and customers are moving more quickly from initial product adoption to full platform embrace.

More AIP Applications:

AI HiveMind, is Palantir’s new agent organization product. This can group, guardrail and surgically unleash a “swarm” of agents to conduct complex workflows. The swarm is large, yet orderly in this case. HiveMind directly plugs into a company’s data and ontology engine so that these workflows can be further localized for specific requirements. This was first used for government agencies, but is showing real promise for commercial customers too. As leadership puts it, HiveMind “uncovers hidden opportunities” while Palantir’s platform actionably frees customers to turn those insights into implementations.

Next, it introduced Edge Ontology. This is a slimmed-down version that enables running Palantir’s software and building with its platform on a mobile device.

Finally, Palantir announced the Multimodal Data Plane. This provides data storage with a high degree of data modality flexibility and full storage location control. It lets companies use whatever structured query language (SQL) they’d like and essentially any model as well. Model choice now includes Nvidia’s, which were recently made available on AIP through a new partnership. PLTR helps integrate these models with its own base of specialized AI models (k-LLMs).

- Recently, Snowflake and Palantir announced Snowflake’s AI Data Cloud will integrate with AIP, offering a more interoperable experience for shared customers.

Operation Warp Speed:

Warp Speed is enjoying broadening adoption. While initial users were “new defense entrants to meet production goals,” now “traditional defense companies” are joining the party. They’re pleased with this project, and even if it doesn’t directly deliver a ton of revenue, it’s worth it. They’re creating companies that are more capable of using Palantir products in useful ways. These companies are getting more educated about all of this potential gain. It should be a core business accelerant, while also helping the United States regain its manufacturing mojo. And along the lines of upskilling America, its 90-day training program (American Tech Fellowship) is attracting customer attention. They’re asking Palantir to create new programs for their workforces.

Government Business:

The U.S. Army sent a memo for all Army orgs to “consolidate and centralize on Vantage, which is its AIP and Foundry-based platform purpose built for the Army. This will accelerate the replacement of old systems and will unlock more budget for PLTR products. Across the pond, International government growth was again powered by the UK.