This piece contains a brief Hims earnings snapshot, a Mercado Libre earnings review & a Palantir earnings review. The Hims review (with far more detail) will come tomorrow with a Lemonade review. At first glance, the Hims quarter looks like a weaker performance than they’ve delivered in a while. Not terrible and also not as good as we’ve grown to expect from them. As most of you know, I’m not a bull here, but I need to read the transcript and letter before commenting further. Stay tuned.

In case you missed it:

- Amazon & Microsoft Earnings Reviews

- Meta & Robinhood Earnings Reviews

- SoFi & PayPal Earnings Reviews

- Alphabet & Tesla Earnings Reviews.

- Chipotle Earnings Review.

- ServiceNow Earnings Review.

- Netflix & Taiwan Semi Earnings Reviews.

- Starbucks & Apple Earnings Reviews.

- Current Nerd Portfolio & Performance.

Table of Contents

- 1. Hims (HIMS) — Earnings Snapshot

- 2. Mercado Libre (MELI) — Earnings Review

- 3. Palantir (PLTR) — Earnings Review

1. Hims (HIMS) — Earnings Snapshot

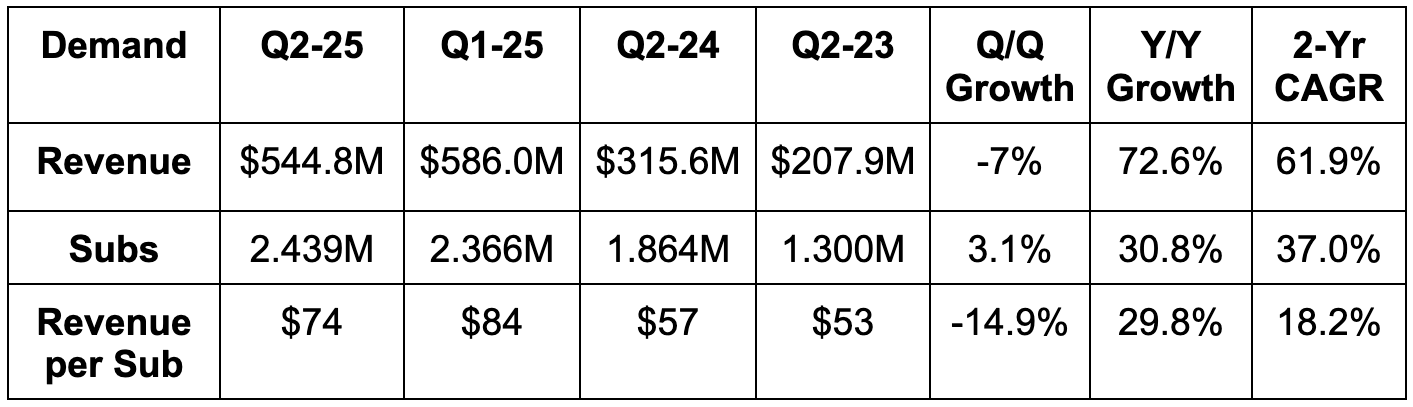

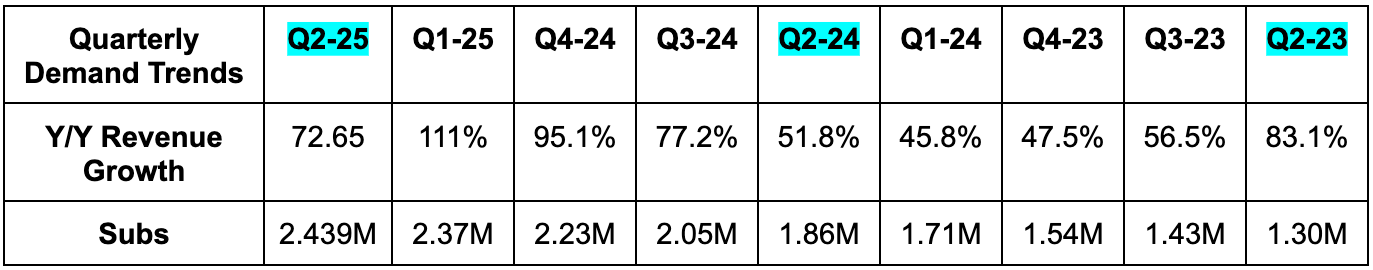

a. Demand

- Missed revenue estimates by 1.3% but beat guidance by 0.9%.

- Missed subscriber estimates by 2.5%.

- Missed revenue per subscriber estimates by 1.4%.

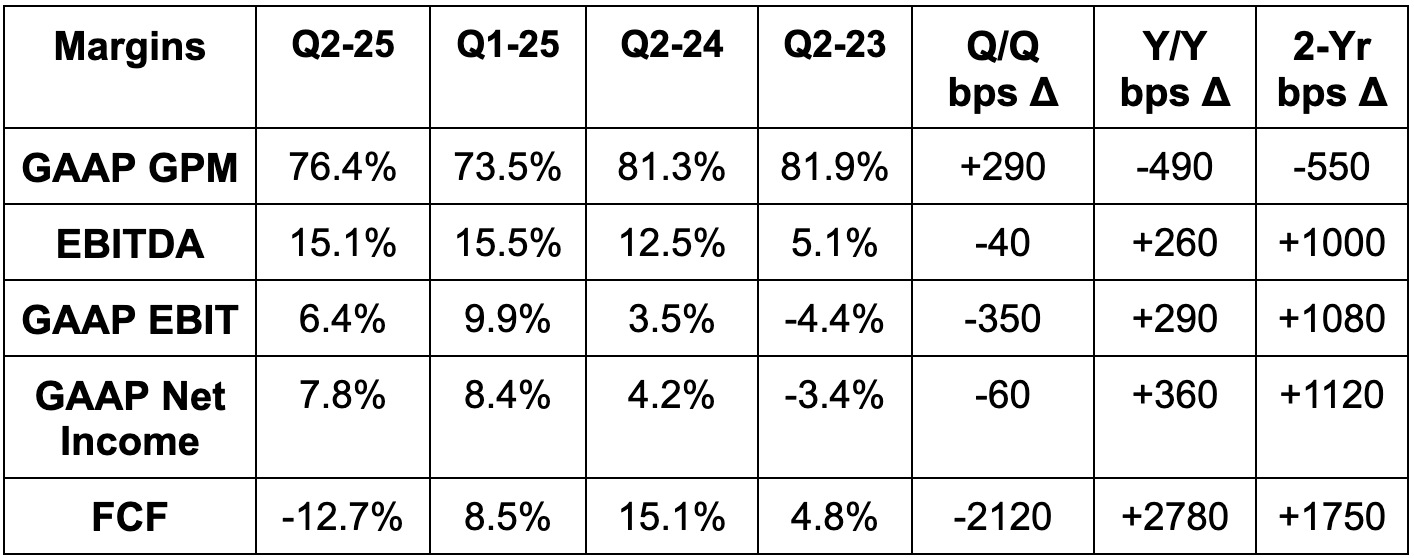

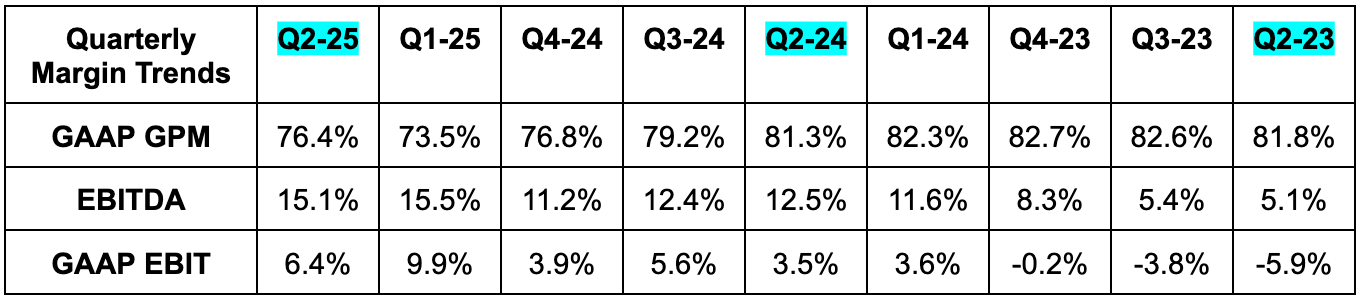

b. Profits & Margins

- Beat GAAP GPM estimates by 60 basis points (bps; 1 basis point = 0.01%).

- Beat EBITDA estimates by 14.1% & beat guidance by 17.4%.

- Beat $0.16 EPS estimates by a penny.

c. Balance Sheet

- $1.12B in cash & equivalents.

- $969M in senior notes.

- 9.3% Y/Y share dilution.

d. Guidance & Valuation

- Reiterated annual revenue guide, which met estimates.

- Reiterated annual EBITDA guide, which missed estimate by 1.3%.

- Q3 revenue guide slightly missed estimates.

- Q3 EBITDA guide missed estimates by 14.5%.

Hims trades for 58x forward EPS. EPS is expected to grow by 32% this year and by 43% next year. Estimates should be stable following the annual guidance reiteration.