In Case You Missed It:

- SoFi Earnings Review.

- Microsoft Earnings Review.

- Meta & ServiceNow Earnings Reviews.

- Starbucks Earnings Review.

- Apple & Tesla Earnings Reviews.

- Netflix Earnings Review.

- Taiwan Semi Earnings Review.

- Axon Deep Dive.

- My Current Portfolio & Performance (I cut a position last week).

Table of Contents

a. Palantir 101

Palantir is a software and AI company that helps customers get the most out of their structured and unstructured data. Like many others, it pulls from years of AI/ML work to automate insight-gleaning. It utilizes complex neural networks to power anomaly detection, trend forecasting and natural language processing… all with the aim of making enterprises better at cultivating customer relationships, making informed decisions and driving financial success. With Palantir, clients gain conjoined access to any data they need, and the tools to fully unleash that asset’s value. It gives customers a bird's-eye view of their operations, with detailed suggestions to help optimize products and uncover patterns. This all happens in a zero-risk environment via a process called Ontology. Ontology enables clients to freely test massive digital twins to actually observe what works and what doesn’t. It’s like split-testing on steroids.

Revenue is neatly split into two buckets – “government” and “commercial.” Government clients predominantly use its Gotham product platform, while commercial clients mainly use its Foundry product platform. With Gotham, Palantir builds custom use cases for individual government clients. Foundry was built to be more malleable, with far more pre-built app integrations and developer kits available. That diminishes the need to conduct custom builds for every single enterprise. Still, it does materially more custom building than a typical B2B software firm will. It’s expensive, but also great for client stickiness and up-selling. It also seamlessly leverages the commercial platform to cater to industry-specific needs.

Palantir Apollo provides continuous integration and continuous delivery (CI/CD) to automate software package building and deployment. It’s a foundational piece of the firm’s ability to collect, utilize and drive value from broad data ingestion. This is a foundational piece of why Gotham and Apollo are so good at creating better outcomes.

AIP 101:

In the realm of GenAI and Agentic AI, Palantir is not playing the game of building the biggest model or buying the most GPUs to have the largest infrastructure footprint. It gives clients the ability to tap into whatever 3rd-party tools they want, while building granular use cases on top of them to finally extract ROI-fostering value from these assets. The app layer of AI is where this firm shines.

Its most exciting AI suite is called Artificial Intelligence Platform (AIP) for highly automated app-building. The company compares AIP to what public cloud vendors did for compute and workload modernization. AWS, Azure, Google and Oracle provided the environment, tools, storage, security and maintenance needed to grow compute capacity without managing it yourself. This made migrations and adoption the rational decision. AIP attempts to do the same thing in terms of pushing enterprises to build and use GenAI applications. They fully manage all of the annoying and tricky pieces of embracing AI, allowing companies to more easily and confidently build (with Palantir’s help). AIP directly integrates with Foundry and Gotham, unlocking an ability to build powerful agents and apps with those products and an ability to extract more value from models. Considering the lack of finite and structured end products stemming from AIP, I think it helps to hear about some examples of what clients are doing with it:

- Turning inbound emails into automated inventory decisions.

- Automating healthcare documentation for claims.

- The Department of Defense (DoD) is using it to shrink app creation time from hours to seconds.

- Lowe’s cut its overdue task rate by 75% with it; General Mills saves $14M/year with it.

AIP is where jumbled data, processes and ideas turn into the operationalized, actionable creation of GenAI products. Initial go-to-market for AIP has been its “bootcamps” where it hosts events to provide hands-on support and “get clients from 0 to use case in 5 days. It has more recently begun to build out an external sales team (slow ramp) to support this segment’s momentum. AIP progress is most noticeable in its impressive U.S. Commercial results.

More AIP Tools:

- AI Forward Deployed Engineer (AI FDE) provides customers with an AI-based equivalent of a highly-skilled engineer to manage and guide more of the app creation process. This is “accelerating the already mouth-watering time-to-value for customers” by managing ontology, data migration, code debugging and other tasks. In turn, this greatly reduces resources needed to deploy AIP.

- AI Workbench provides a safe environment for testing and iterating on AIP work. It’s a developer playground for building and testing agents and setting up data workflows, with slick tools for checking work and debugging issues.

- Ontology-as-Code integrates with a developer’s familiar tools and allows them to build ontologies with more guidance and guardrails.

- Edge Ontology is a slimmed-down version that enables running Palantir’s software and building with its platform on a mobile device.

- Multimodal Data Plane provides data storage with a high degree of data modality flexibility and full storage location control. It lets companies use whatever structured query language (SQL) they’d like and essentially any model as well.

- AI HiveMind, is Palantir’s agent organization product. This can group, guardrail and surgically unleash a “swarm” of agents to conduct complex workflows. The swarm is large, yet orderly in this case. HiveMind directly plugs into a company’s data and ontology engine so that these workflows can be further localized for specific requirements. This was first used for government agencies, but is showing real promise for commercial customers too. As leadership puts it, HiveMind “uncovers hidden opportunities” while Palantir’s platform actionably frees customers to turn those insights into implementations.

All of these products reduce friction associated with using AIP and Palantir’s software by adding support for 3rd-party services, expediting and managing product creation and offering a secure environment (with compelling automation) to do all of this work.

More Products to Know:

- Operation Warp Speed is a modern industrial operating system (OS) that equips companies and governments with cutting-edge enterprise resource planning (ERP), product lifecycle management (PLM) and a manufacturing execution system (MES). It’s a fully managed way to rapidly allow manufacturers to fix how they build things. This is how Palantir plans to help “reindustrialize” the United States and ensure we build everything we need here.

- FedStart is Palantir’s accreditation program for FedRAMP certifications needed to sell software to the government. It shrinks the time and cost it takes to secure this status and makes Palantir more of an ally vs. an enemy for other software companies.

- Maven is PLTR’s Department of Defense AI and data analytics platform.

b. Key Points

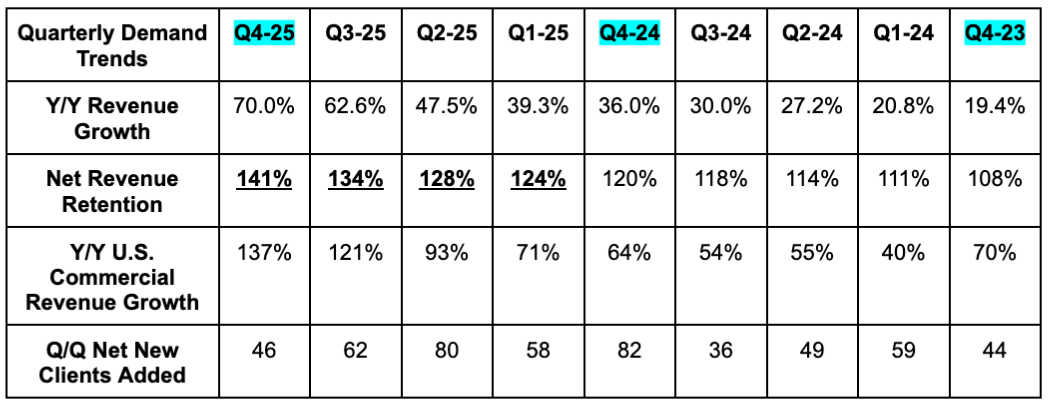

- AIP momentum keeps rolling.

- Existing large customers are growing revenue contributions at a 40%+ Y/Y clip.

- Margins keep briskly expanding.

- Palantir continues to lace more utility-rich features into AIP.

c. Demand

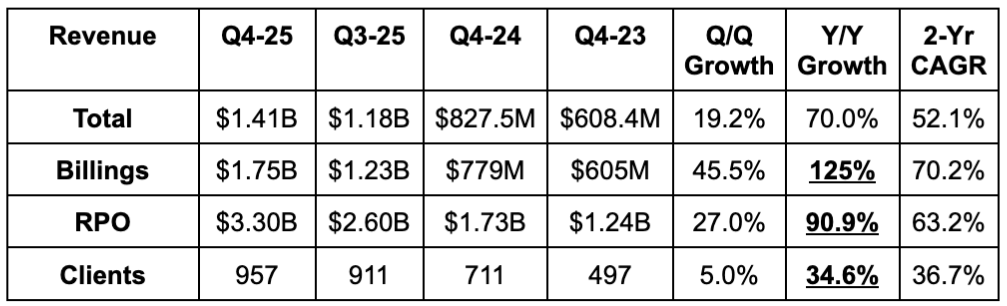

- Beat revenue estimates by 5.2% & beat guidance by 6%.

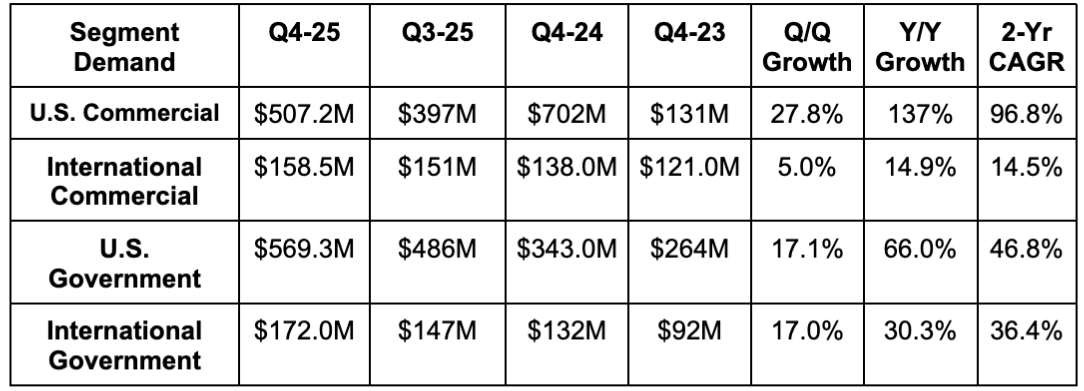

- Beat U.S. commercial revenue estimates by 5.8% & beat guidance by 6.7%.

- Beat International commercial revenue estimates by 4%.

- Beat U.S. government revenue estimates by 9.3%.

- Missed international government revenue estimates by 11%.

- Overall quarterly Y/Y revenue growth record for Palantir’s 5+ year public history.

- The U.S. business crossed $1B in quarterly revenue for the first time.

- Beat billings estimates by 16%.

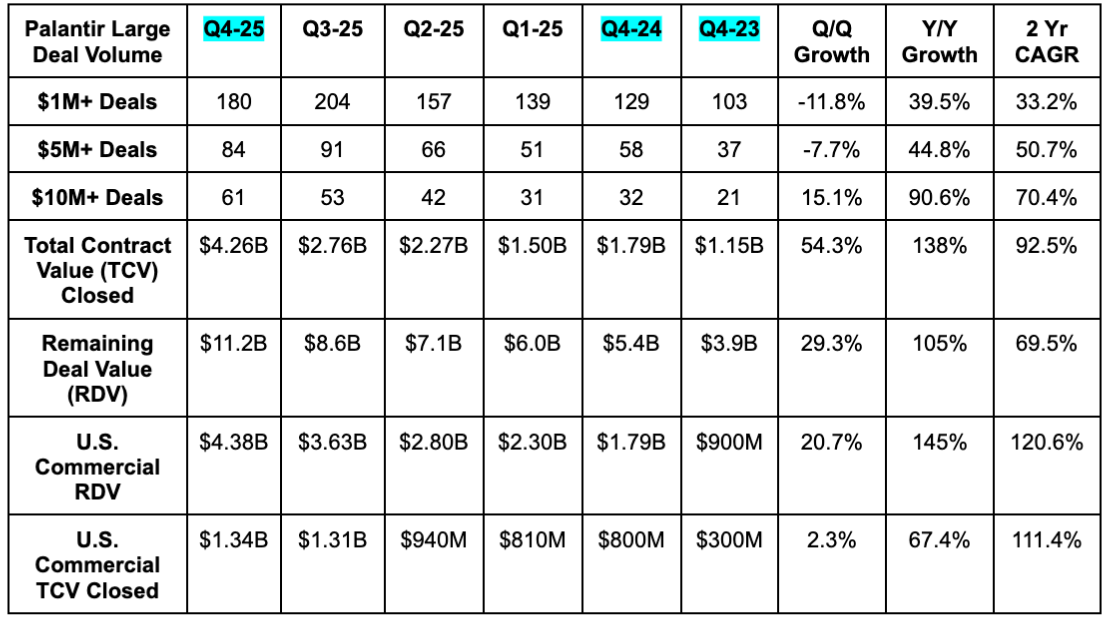

- 138 Y/Y Total Contract Value (TCV) booked growth compares to: 151% growth for Q3-25, 140% for Q2-25, 66% for Q1-25, 56% for Q4-24 and 192% for Q4-23.

- This quarter marked a new TCV record, which broke last quarter’s previous record by 54%.

- More impressive U.S. commercial segment stats:

- U.S. commercial remaining deal value (RDV) rose by 145% Y/Y and 21% Q/Q.

- U.S. commercial customer count rose by 49 Y/Y and 8% Q/Q. 8% Q/Q growth compares to 9% last quarter and 12% in each of the two quarters before that. So still great, but slowing a bit. On the other hand, a lot of Palantir growth is being driven by fantastic existing customer contract expansion. For context, its 20 largest customers grew revenue contribution by 45% Y/Y to $94M on average. 20% growth for this metric would be considered very good.

- RDV and TCV were both helped a bit this quarter by a few “significant long-term renewals with longstanding international customers.”